P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

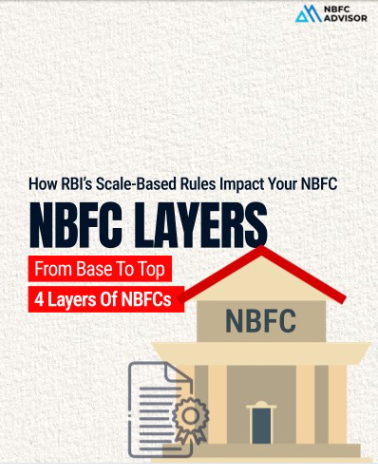

𝐍𝐨𝐭 𝐚𝐥𝐥 𝐍𝐁𝐅𝐂𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞.

RBI has divided NBFCs into 4 layers based on size, risk, and complexity.

The bigger your NBFC is, the stricter the rules.

✓ 𝐁𝐚𝐬𝐞 𝐋𝐚𝐲𝐞𝐫: Smallest NBFCs, lightest regulations

✓ 𝐌𝐢𝐝𝐝�...

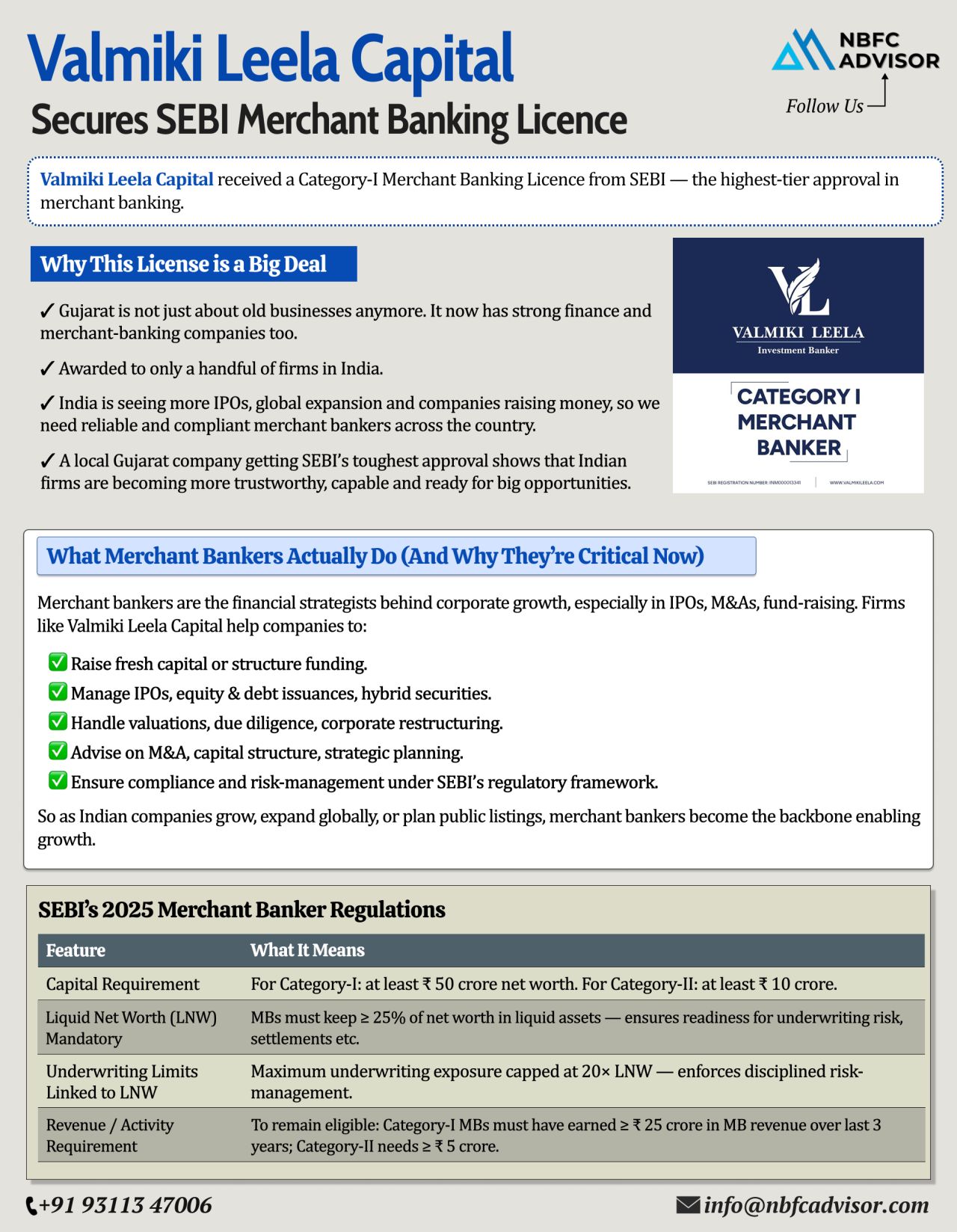

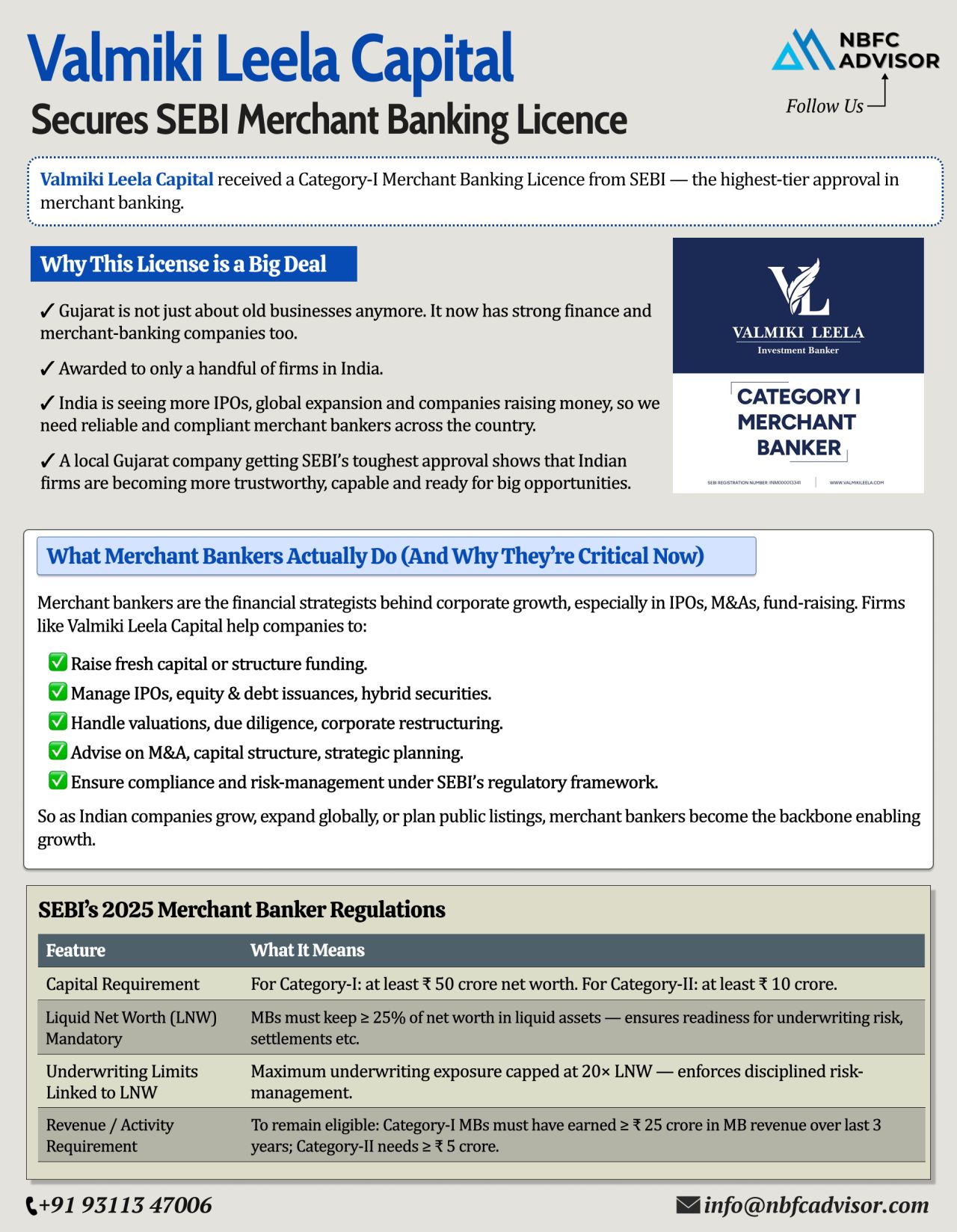

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

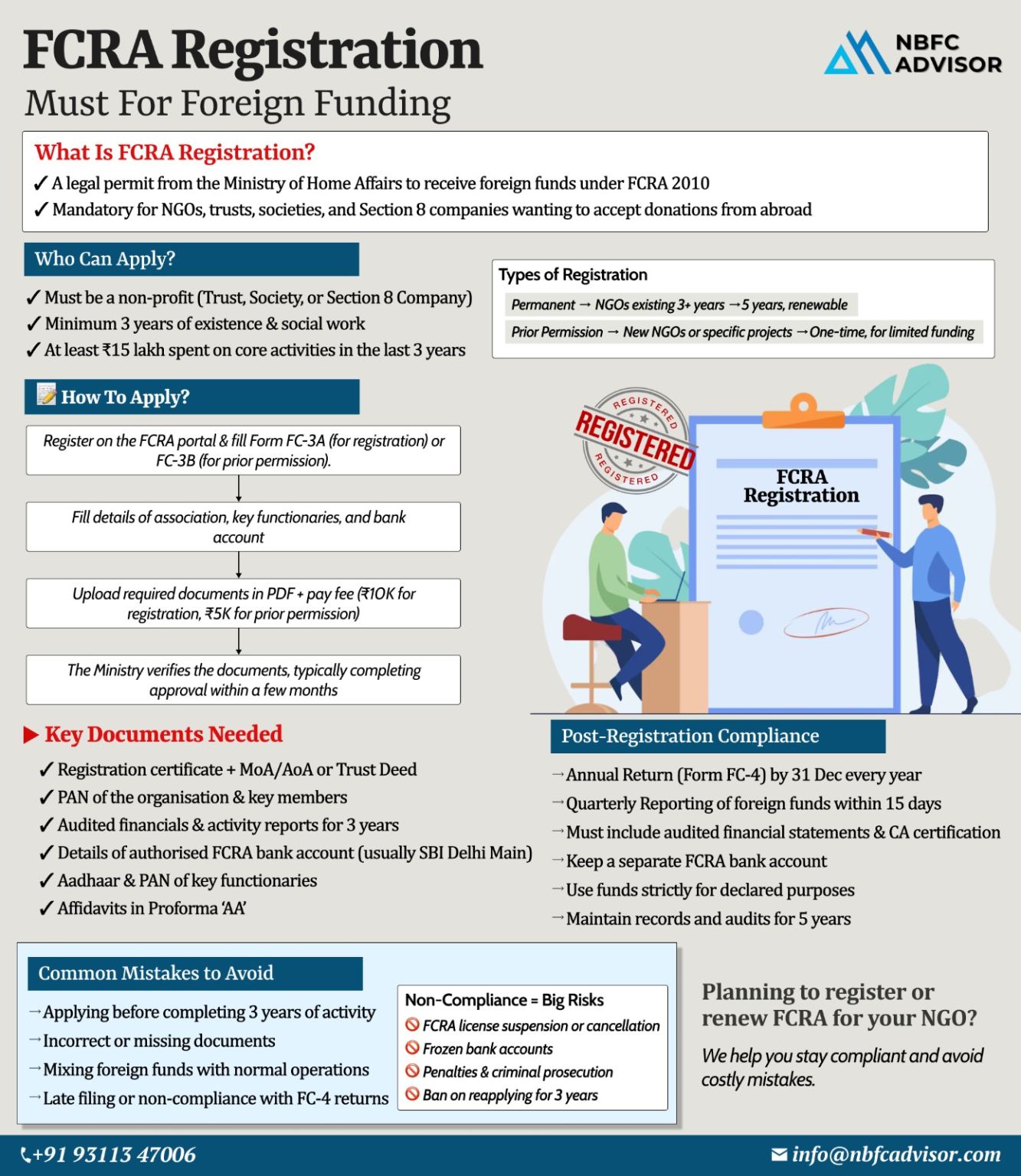

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

SEBI Just Reclassified REITs as Equity — And It Changes Everything

SEBI has officially reclassified Real Estate Investment Trusts (REITs) as equity investments — a landmark regulatory shift that will reshape how institutions and invest...

Gujarat Just Proved Everyone Wrong — And It’s a Big Win for India’s Financial Future

For decades, Gujarat has been known for its entrepreneurial spirit — but mostly in textiles, jewellery, and traditional family businesses....

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

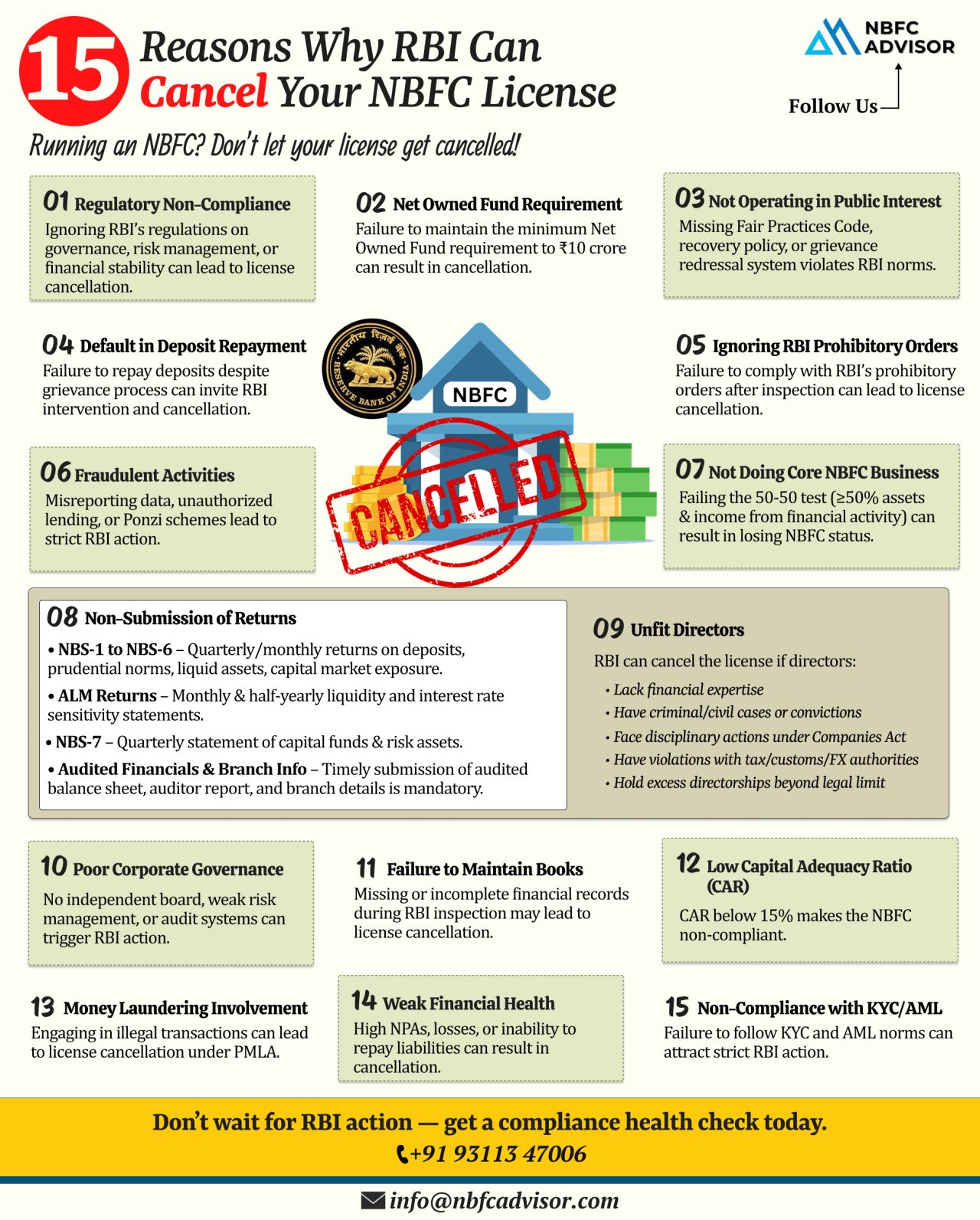

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

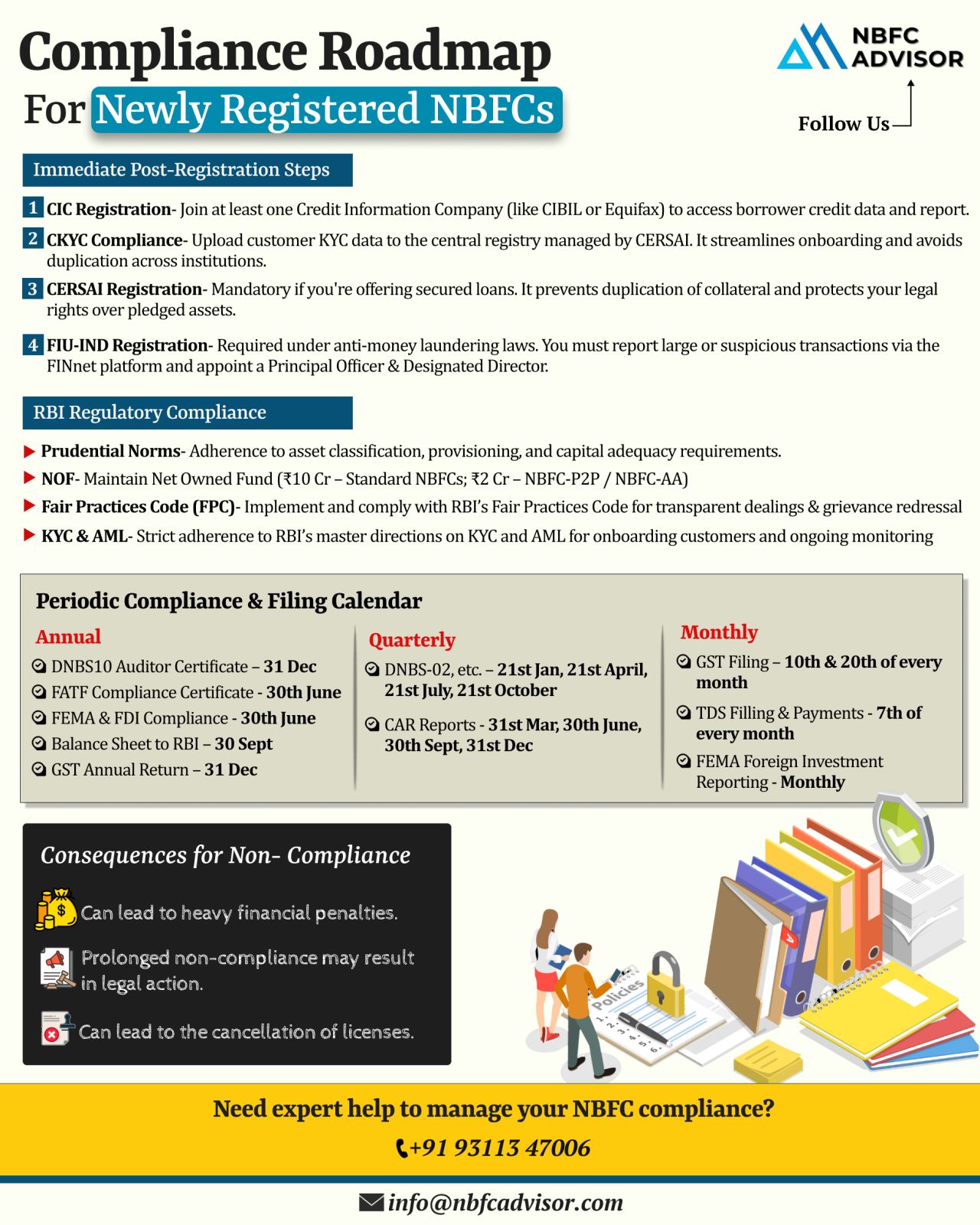

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

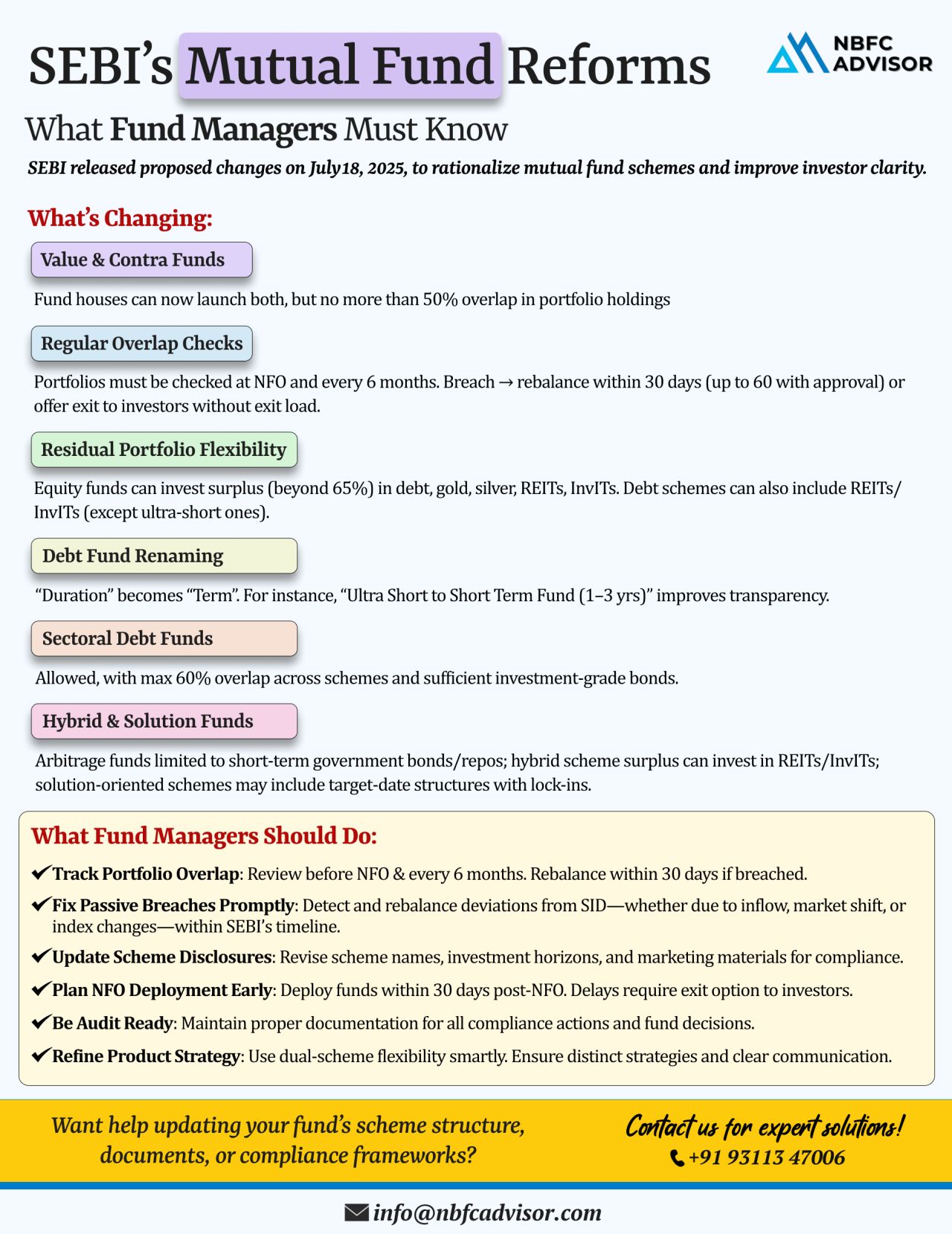

📰 SEBI’s Latest Mutual Fund Reforms: A Step Towards Clarity and Better Risk Management

The Securities and Exchange Board of India (SEBI) has introduced a series of proposed reforms to bring greater transparency, clarity, and structure to mu...

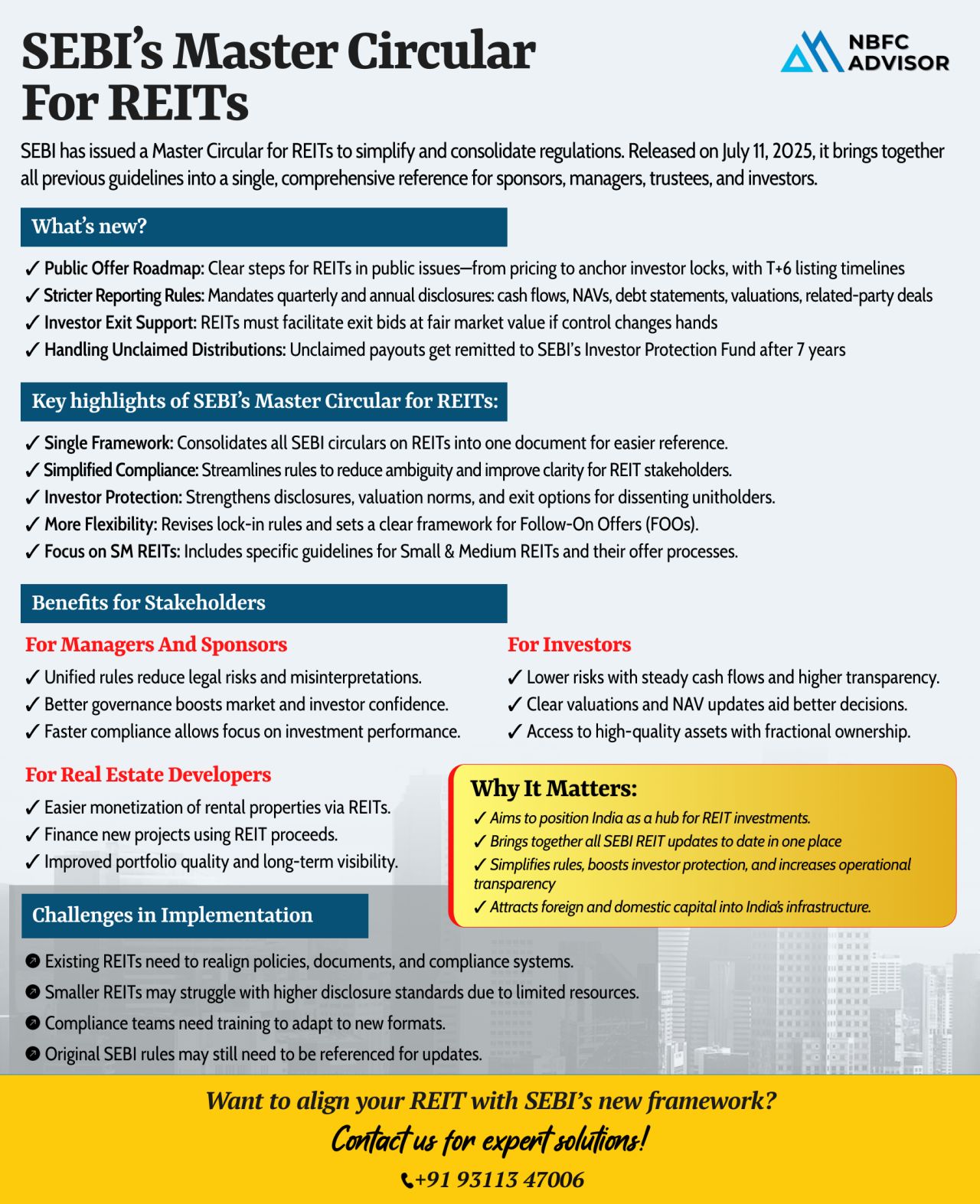

SEBI introduces a unified regulatory framework for REITs, enhancing transparency, investor protection, and ease of compliance. Discover how it transforms India’s real estate investment ecosystem.

SEBI’s New Master Circular: A Landmar...

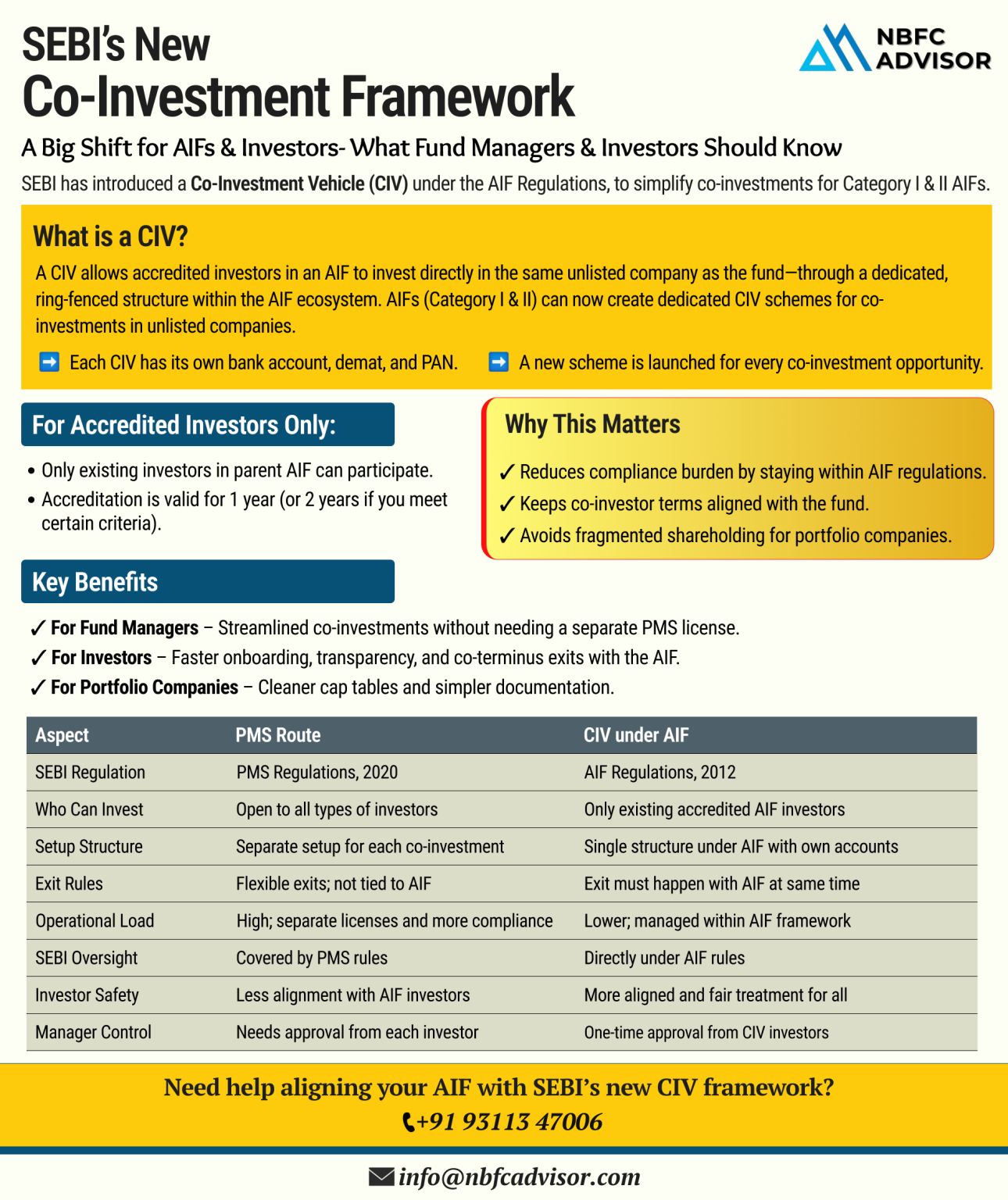

SEBI Rolls Out New Co-Investment Framework: A Big Win for India’s Private Market

India’s private capital landscape just received a significant boost.

In a major regulatory move, the Securities and Exchange Board of India (SEBI) has un...

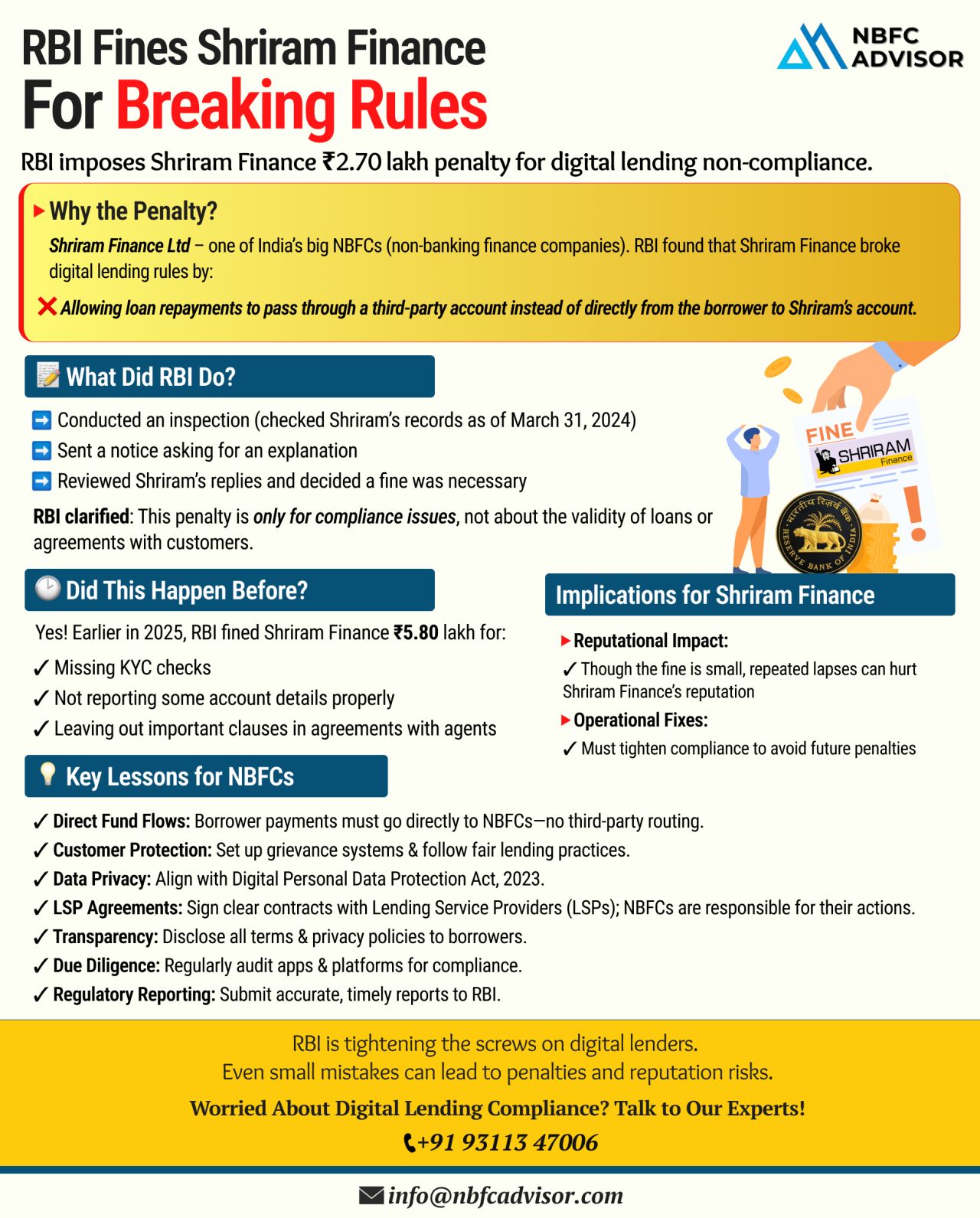

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘑𝘶𝘴𝘵 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Getting your NBFC license is a big milestone — but don’t relax just yet. Receiving RBI approval is only the first step in setting up your fin...

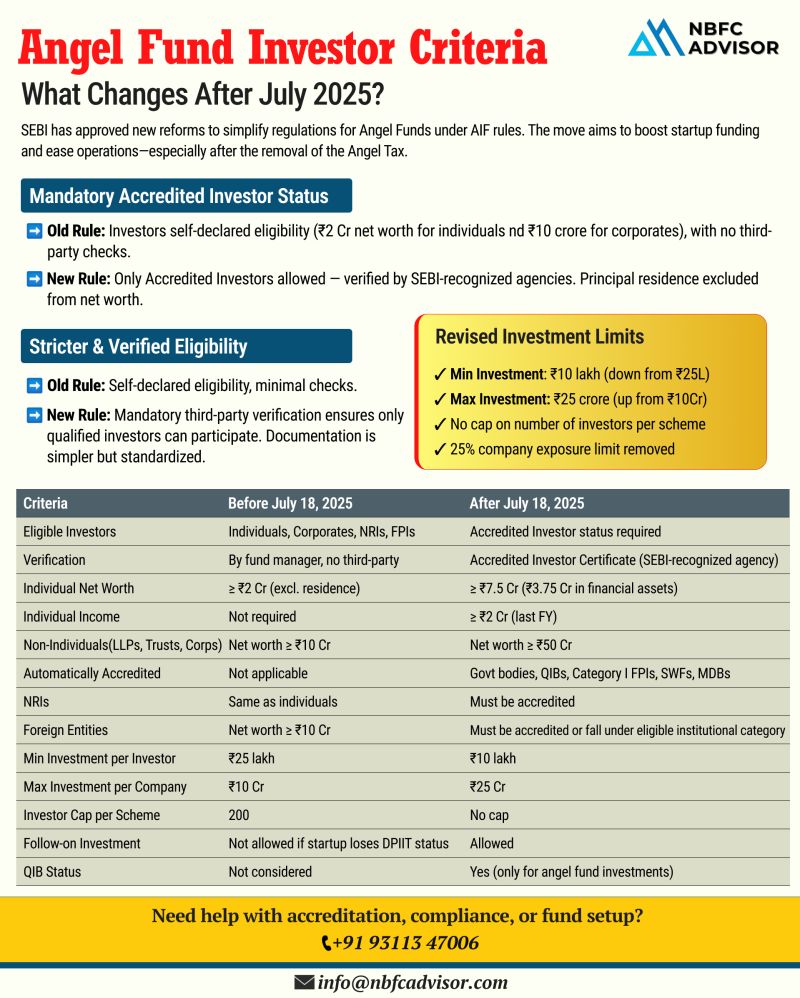

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘦𝘨𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘳𝘦 𝘌𝘷𝘰𝘭𝘷𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘗𝘳𝘦𝘱𝘢𝘳𝘦𝘥?

Starting July 2025, the rules governing Angel Funds in India are undergoing a major overhaul.

These fresh guidelines from SEBI aim to bri...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...