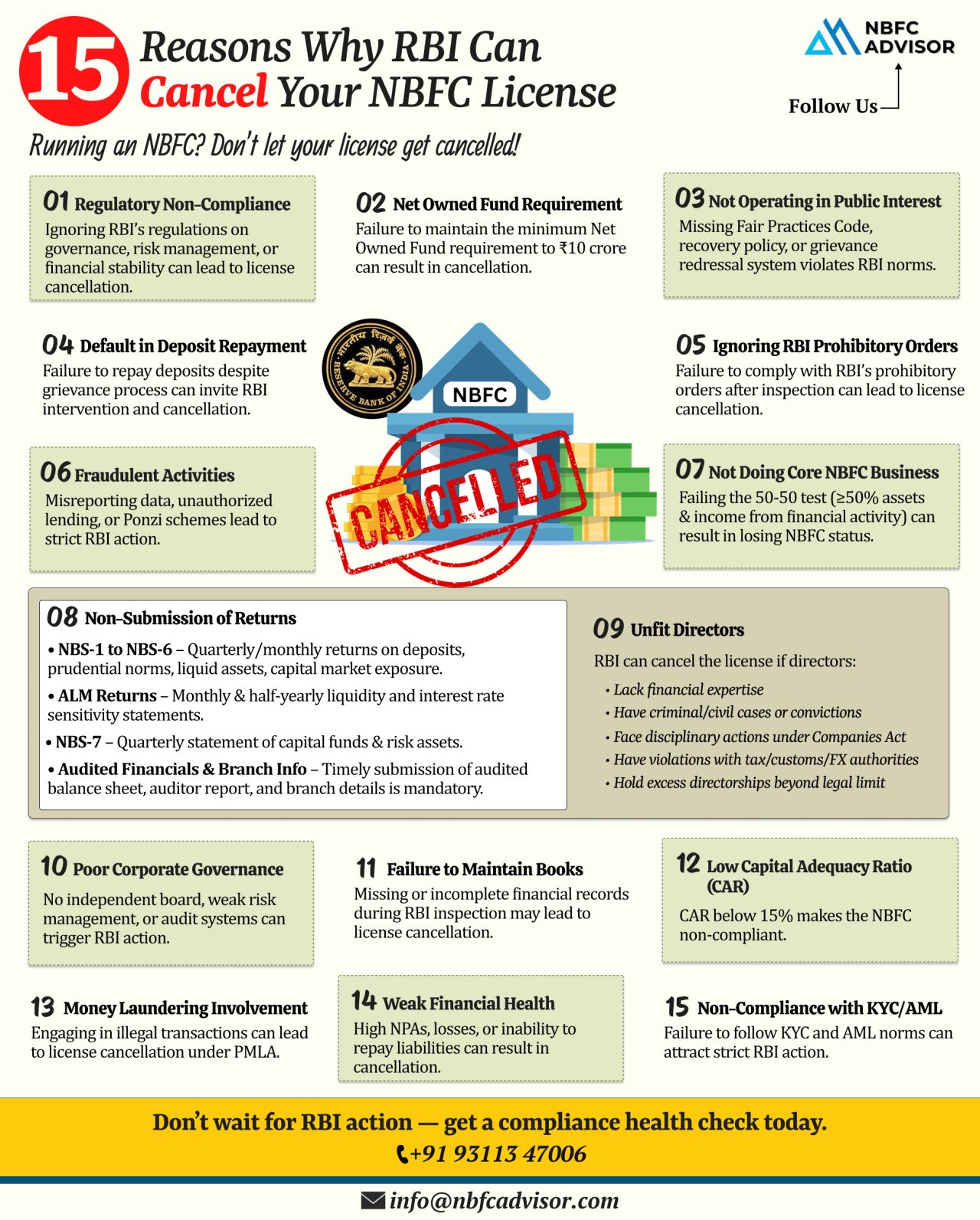

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, weak financial health, or failure to follow RBI directives.

If you operate an NBFC, it’s essential to regularly review your processes and ensure compliance. Here are 15 warning signs that could put your license at risk:

Common Triggers for NBFC License Cancellation

-

Non-Adherence to RBI Guidelines: Ignoring circulars, notifications, or instructions issued by the RBI.

-

Financial Weakness: Insufficient capitalization or poor net owned funds.

-

KYC & AML Violations: Failing to follow proper Know Your Customer (KYC) and Anti-Money Laundering (AML) protocols.

-

Delayed or Inaccurate Reporting: Submitting late or erroneous financial statements to the RBI.

-

High Non-Performing Assets (NPAs): Excessive bad loans without adequate provisioning.

-

Poor Governance: Weak board oversight or lack of internal controls.

-

Operational Risks: Inefficient risk management systems or technology failures.

-

Fraud or Mismanagement: Significant operational fraud or mismanagement issues.

-

Breach of Lending Norms: Violating interest rate limits, exposure caps, or loan disbursal rules.

-

Unclear Ownership Structure: Ambiguity around promoters, shareholders, or beneficial ownership.

-

Failure to Maintain Statutory Reserves: Not keeping required reserves or funds.

-

Ignoring RBI Inspections: Non-cooperation during audits or regulatory checks.

-

Unethical Practices: Misleading customers, investors, or stakeholders.

-

Outdated Policies: Not updating internal policies according to RBI or industry regulations.

-

Ignoring RBI Warnings: Delays in addressing issues or complying with regulatory directions.

Protect Your NBFC Through Compliance

Maintaining regulatory compliance is vital not only to protect your NBFC license, but also to gain trust from investors, clients, and stakeholders.

If you need assistance with NBFC compliance, KYC, AML, or regulatory reporting, our experts can guide you. Reach out for a free consultation and safeguard your business today.

📞 +91 93113 47006

Hashtags:

#NBFCAdvisor #RBICompliance #NOF #KYC #AML #NBFC #Fintech