𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘦𝘨𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘳𝘦 𝘌𝘷𝘰𝘭𝘷𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘗𝘳𝘦𝘱𝘢𝘳𝘦𝘥?

Starting July 2025, the rules governing Angel Funds in India are undergoing a major overhaul.

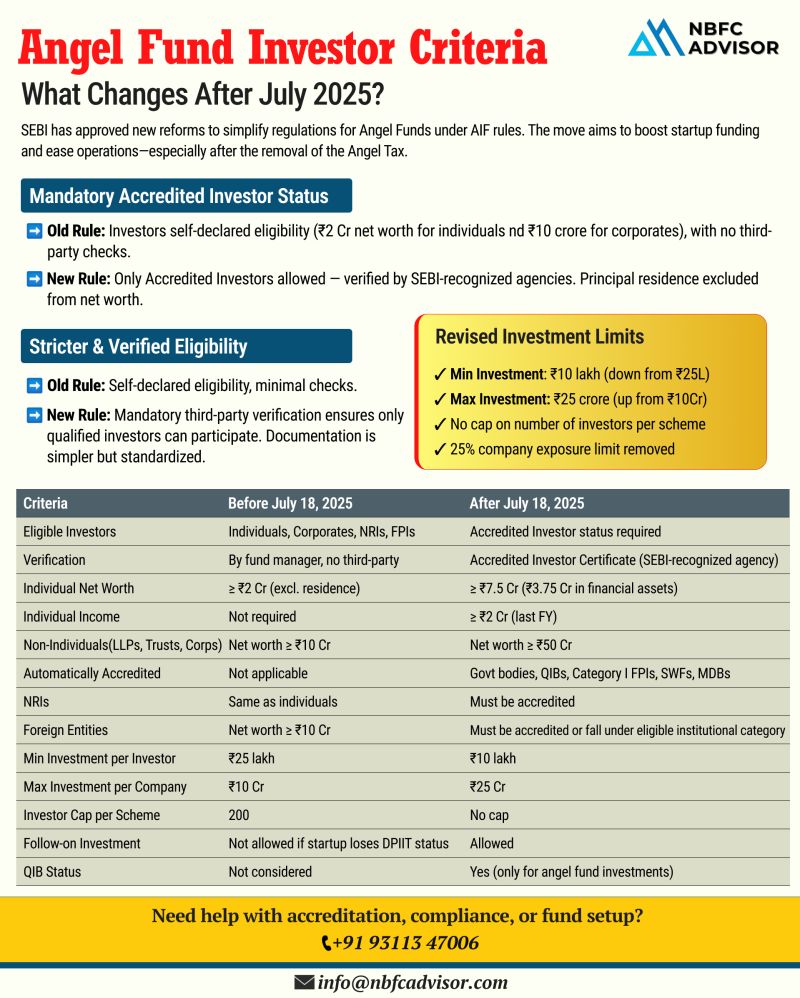

These fresh guidelines from SEBI aim to bring greater structure, credibility, and transparency into India’s early-stage investment ecosystem. One of the biggest takeaways? Only SEBI-accredited investors can participate going forward.

Here’s what this regulatory shift means for investors, fund managers, and startups.

🧭 What’s Changing in Angel Fund Norms?

🛡️ 1. Only Accredited Investors Can Invest

SEBI will now only allow formally Accredited Investors to participate in angel funds. This will:

-

Elevate the quality of investors

-

Filter out non-serious players

-

Strengthen overall trust in the system

📉 2. Lower Investment Threshold

The minimum investment size is being slashed from ₹25 lakh to ₹10 lakh, opening up access to a wider range of eligible investors.

📈 3. No Investor Cap per Scheme

The existing 200-investor ceiling per angel fund scheme will no longer apply.

This allows:

-

More investor participation in promising deals

-

Greater flexibility in fundraising

🔁 4. Follow-on Investments Now Allowed

Angel Funds can continue backing a startup even if it loses its DPIIT startup recognition, enabling longer-term support beyond early rounds.

⚖️ 5. Transparent Deal Sharing Required

All investment opportunities must now be shared with every investor in a scheme.

This fosters:

-

Greater fairness

-

Reduced insider bias

📋 6. Accredited Investors Treated as QIBs (for Angel Funds)

A big win for investors—accredited individuals will now be treated as Qualified Institutional Buyers (QIBs) when investing through angel funds.

📌 What This Means for You

Whether you’re:

-

A startup founder raising early capital,

-

An investor looking to diversify your portfolio, or

-

A fund manager running regulated schemes,

these changes are going to reshape the startup investment playbook in India.

🔍 Is Your Strategy Future-Ready?

Ask yourself:

-

✅ Are you already accredited or working toward it?

-

✅ Are your fund documents and operations SEBI-compliant?

-

✅ Is your structure ready for transparent deal allocation?

If you’re unsure, we’re here to guide you.

💼 How We Can Help

Our team helps you navigate the new Angel Fund rules with services like:

-

SEBI Investor Accreditation Support

-

Angel Fund registration & setup

-

QIB status advisory

-

Compliance management and reporting

📞 Book a FREE consultation today

+91 93113 47006

#NBFCAdvisor #SEBI #AngelFunds #AccreditedInvestor #VentureCapital #Startup #PrivateCapital #AngelInvestor #QIB #SEBIGuidelines