Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FCRA compliance requirement.

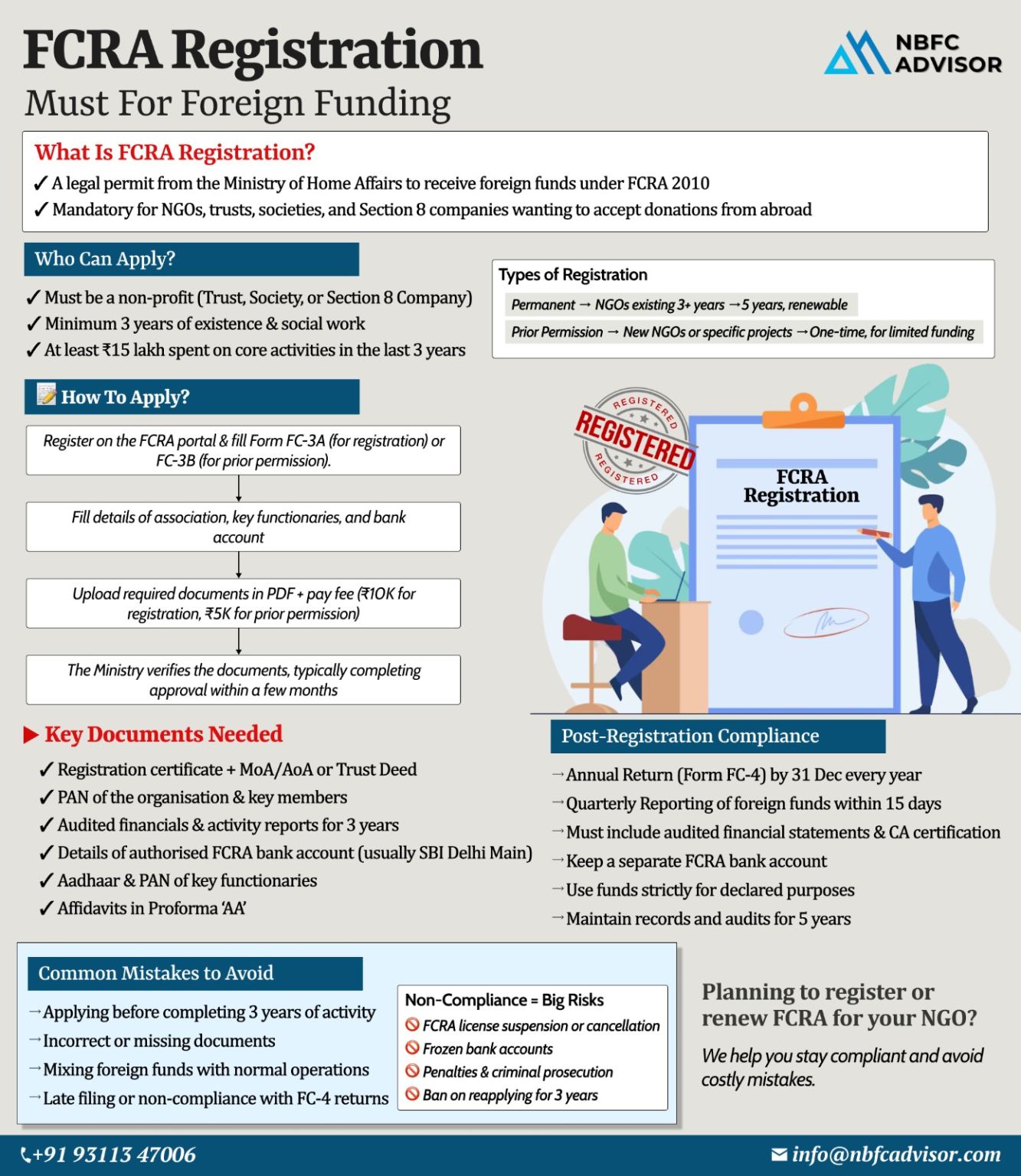

Under Indian law, FCRA registration is mandatory for any NGO that wants to receive foreign donations. Even a small oversight can lead to delays, frozen bank accounts, or cancellation of registration.

What Is FCRA and Why It Matters?

The Foreign Contribution (Regulation) Act, 2010 (FCRA) regulates how NGOs, trusts, and societies in India receive and utilise foreign funds. Its purpose is to ensure:

- Transparency in foreign donations

- Proper utilisation for social objectives

- National interest protection

Without valid FCRA registration or prior permission, receiving foreign funds is illegal.

Key Eligibility Requirements for FCRA Registration

Many NGOs face rejection simply because they overlook basic eligibility conditions.

1. Minimum 3 Years of Proven Social Work

Your organisation must have at least three years of genuine charitable activity, supported by audited financial statements and activity reports.

2. ₹15 Lakh Spent on Core Activities

The NGO must demonstrate minimum expenditure of ₹15 lakh over the last three financial years on its main charitable objectives—not administrative expenses.

3. Documentation Must Be Perfect

Even one incorrect or missing document—such as mismatched financials, incomplete activity reports, or errors in governing body details—can delay approval for months.

FCRA Approval Is Only the Beginning

Many NGOs believe the risk ends once registration is granted. In reality, post-registration compliance is equally critical.

Key ongoing obligations include:

- Annual FCRA returns (Form FC-4)

- Maintenance of a designated FCRA bank account

- Proper utilisation and disclosure of foreign funds

- Timely reporting of changes in office bearers or bank details

Non-compliance at this stage often triggers regulatory action.

How Small Lapses Lead to Big Consequences

Regulatory actions such as:

- Frozen bank accounts

- Suspension or cancellation of licences

- Investigations by authorities

often begin with minor compliance failures—late filings, incorrect disclosures, or misuse of funds.

Once scrutiny begins, operations and funding can come to a complete halt.

Planning FCRA Registration or Renewal?

Whether you’re applying for new FCRA registration or renewing an existing licence, expert guidance can help you:

- Assess eligibility before applying

- Prepare error-free documentation

- Avoid approval delays

- Stay compliant after registration

Get Expert FCRA Compliance Support

We assist NGOs with:

- FCRA registration and renewal

- Documentation and eligibility review

- Post-registration reporting and compliance

- Preventing fund freezes and licence risks

📩 DM us if you’re planning FCRA registration or renewal and want to avoid costly compliance mistakes.

Hashtags

#FCRA #NGOCompliance #ForeignFunding #FCRARegistration

#RegulatoryCompliance #NGOIndia #SocialImpact