Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrative has officially changed.

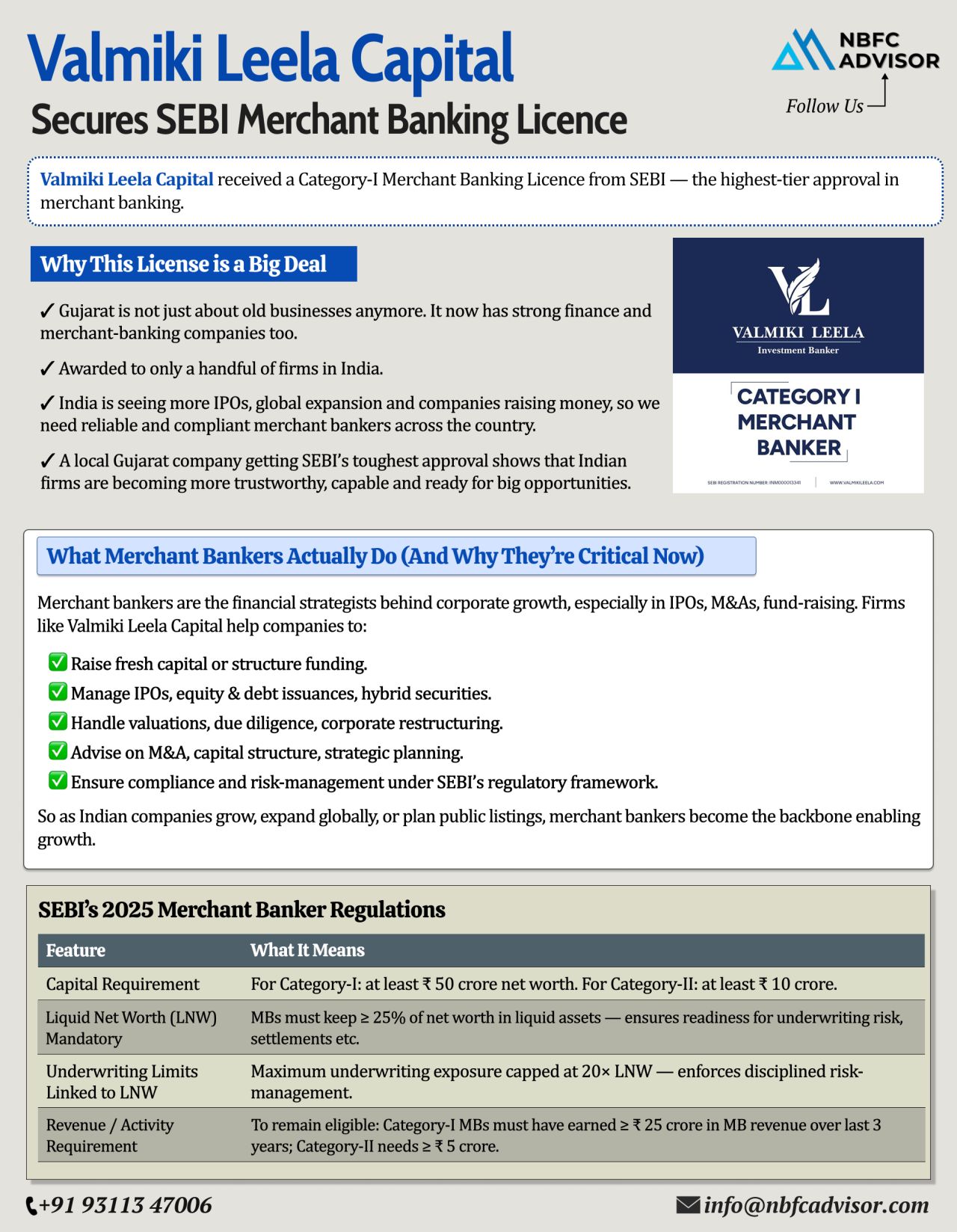

A Gujarat-based firm, Valmiki Leela Capital, has received a Category-I Merchant Banking License from SEBI—one of the most difficult and prestigious approvals in Indian finance.

This isn’t just a licence.

It’s a signal.

Why This Approval Matters

A Category-I Merchant Banking licence allows firms to manage:

-

IPOs and public issues

-

Mergers and acquisitions

-

Capital restructuring

-

Valuations and fund-raising advisory

SEBI grants this licence only after rigorous scrutiny of:

-

Capital adequacy

-

Governance and compliance systems

-

Professional competence

-

Risk management frameworks

Very few firms qualify. Fewer still are new entrants.

That a Gujarat-based firm has earned this trust speaks volumes about the state’s evolving financial ecosystem.

Gujarat’s Entry into Modern Finance

This milestone arrives at a critical moment.

Indian companies are:

-

Scaling faster than ever

-

Expanding into global markets

-

Raising private and public capital

-

Preparing for IPOs and strategic exits

To support this growth, India needs credible, compliant, and capable merchant bankers—not just in Mumbai or Delhi, but across emerging financial hubs.

Gujarat is clearly stepping into that role.

The Role of Merchant Bankers in India’s Growth Story

Merchant bankers are the backbone of capital markets. They help companies:

-

Raise capital efficiently

-

Structure deals and valuations

-

Navigate regulatory requirements

-

Execute IPOs and M&A transactions smoothly

As the number of listings and fund-raising events increases, trust in merchant bankers becomes non-negotiable.

A local firm securing a Category-I licence reflects both institutional maturity and regulatory confidence.

More Than a Single Licence

This approval is not an isolated success. It represents:

-

Strong professional talent emerging from Gujarat

-

Robust compliance culture beyond traditional hubs

-

Growing institutional depth in regional financial ecosystems

It also complements the broader rise of GIFT City, fintech growth, and capital market participation from the state.

Are We Entering India’s Strongest Decade for Capital Markets?

With:

-

A booming IPO pipeline

-

Retail and institutional participation rising

-

Global capital flowing into India

-

Strong regulatory oversight by SEBI

India’s public markets may be entering their most powerful decade yet.

And Gujarat’s emergence in merchant banking suggests that the next wave of financial leadership will be broader, more regional, and more inclusive.

The Big Takeaway

Gujarat is no longer just a manufacturing and trading powerhouse.

It is becoming a serious player in modern finance and capital markets.

And this shift has only just begun.

Do you think India is heading into its strongest decade for public markets?

Hashtags

#NBFCAdvisor #MerchantBanking #SEBI #Gujarat

#IPO #CapitalMarkets #Startups #FinancialServices