Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every Non-Banking Financial Company (NBFC).

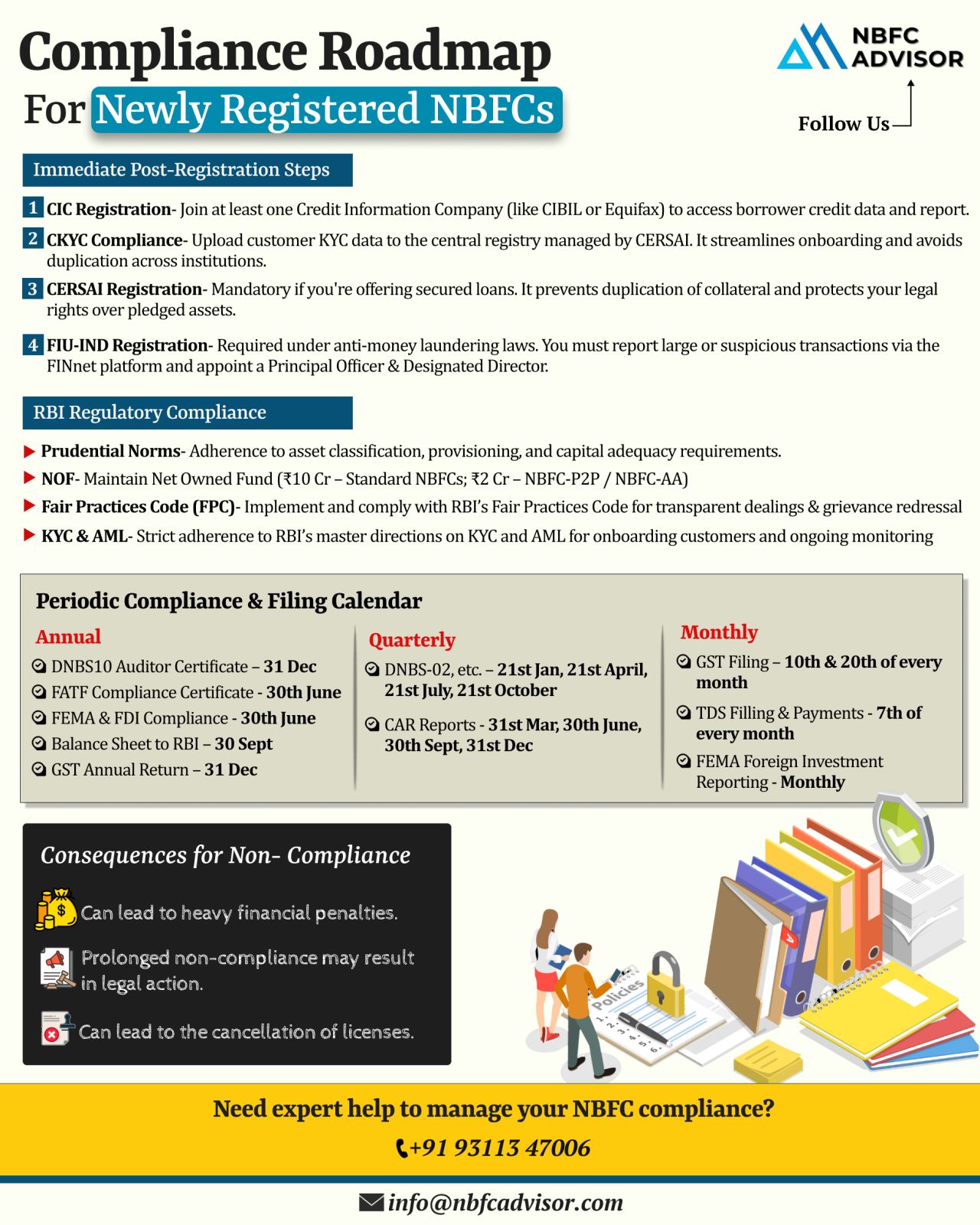

Key Compliance Requirements Right After Registration

Once your NBFC is incorporated, a few critical registrations and filings need your immediate attention:

- CIC Registration – To access borrower credit history from Credit Information Companies.

- CKYC Uploads – Mandatory submission of customer details to the Central KYC Registry.

- CERSAI Registration – Recording of secured assets to safeguard against fraud.

- FIU-IND Reporting – Regular reporting under Anti-Money Laundering (AML) laws to the Financial Intelligence Unit.

Ongoing Compliance Responsibilities

Compliance isn’t a one-time exercise; it’s a continuous process. Your NBFC must ensure:

- Strict adherence to prudential norms and the Fair Practices Code.

- Maintaining the prescribed Net Owned Funds (NOF).

- Strong KYC and AML procedures to detect and prevent fraud.

- Timely submission of all monthly, quarterly, and annual returns to RBI and other authorities.

The Risks of Non-Compliance

Failing to meet compliance standards can have serious consequences, such as:

- Monetary penalties

- Regulatory legal proceedings

- In extreme cases, revocation of your license

Why Partner With Us?

We simplify compliance for NBFCs—managing everything from registrations to routine filings—so you can focus on growing your business and serving customers without worrying about regulatory hurdles.

Book a free consultation today: +91 93113 47006

#NBFCAdvisor #Compliance #RBI #FinancialServices #RiskManagement #DigitalLending #NBFCRegistration #AMLCompliance #Fintech #NBFC