Regulatory Compliance Services – Protecting Your Business from Legal & Regulatory Risks

In an increasingly regulated business environment, regulatory compliance is the foundation of a stable, credible, and sustainable organization. Every...

NBFC Registration Services – Your Gateway to India’s Financial Services Sector

India’s financial ecosystem is expanding rapidly, creating strong opportunities for businesses in lending, investment, and asset financing. One of the...

Regulatory Compliance Services – Building a Legally Strong & Trusted Business

In today’s fast-evolving regulatory environment, regulatory compliance is no longer optional—it is essential for business continuity, credibility, ...

What Are Regulatory Compliance Services?

Regulatory compliance services ensure that a business adheres to all applicable laws, rules, guidelines, and regulations issued by government and regulatory bodies. These services cover ongoing legal, finan...

NBFC Registration Services in India – A Complete Guide

Starting a Non-Banking Financial Company (NBFC) in India is a powerful way to enter the financial services sector. NBFCs play a crucial role in providing loans, advances, asset financing...

Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

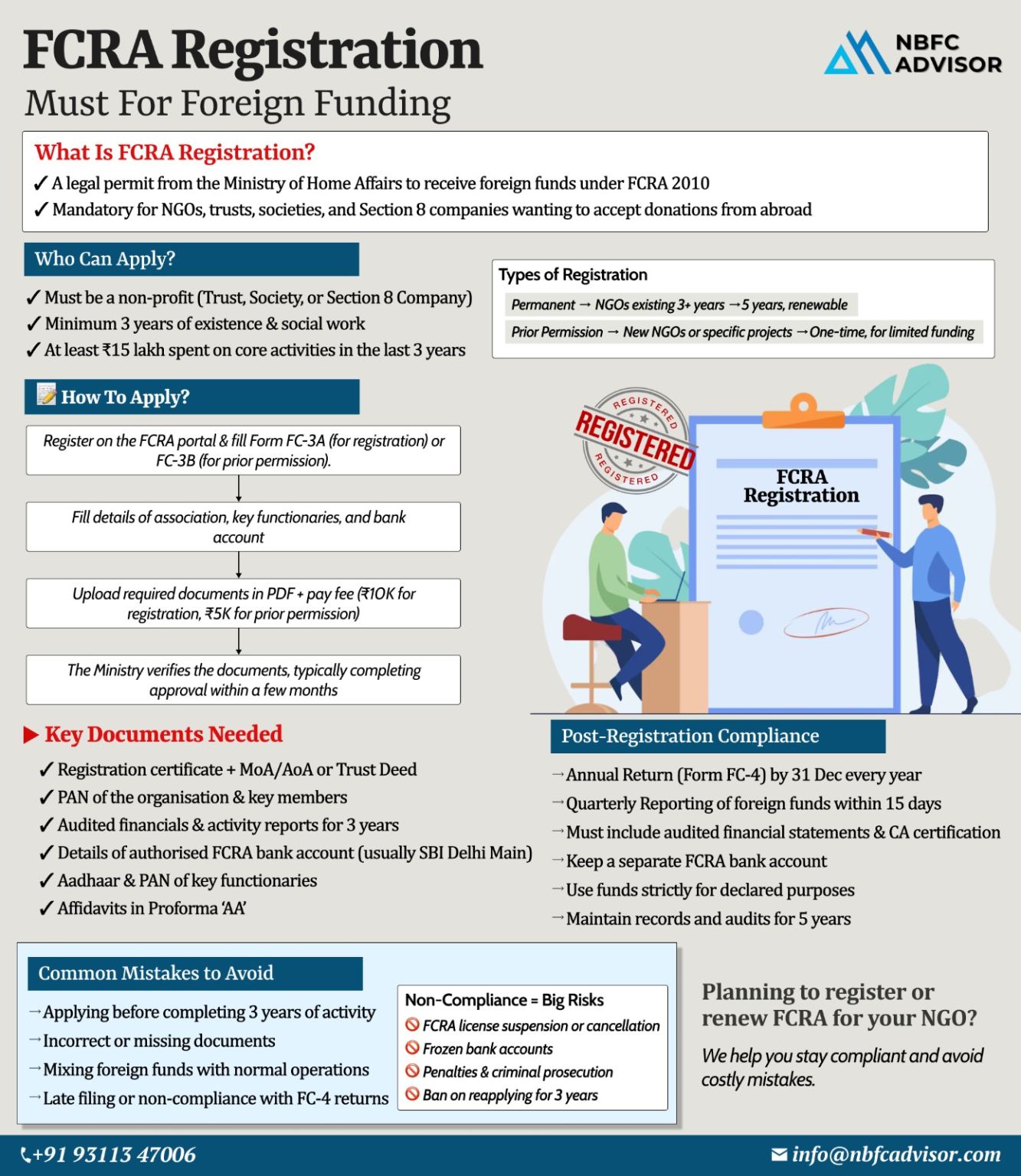

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

Compliance Gaps Can Break Your Business: Why NBFCs Must Stay Ahead of RBI Regulations

In today’s financial landscape, compliance is no longer optional.

With the Reserve Bank of India (RBI) tightening its oversight, even well-managed NBFCs a...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

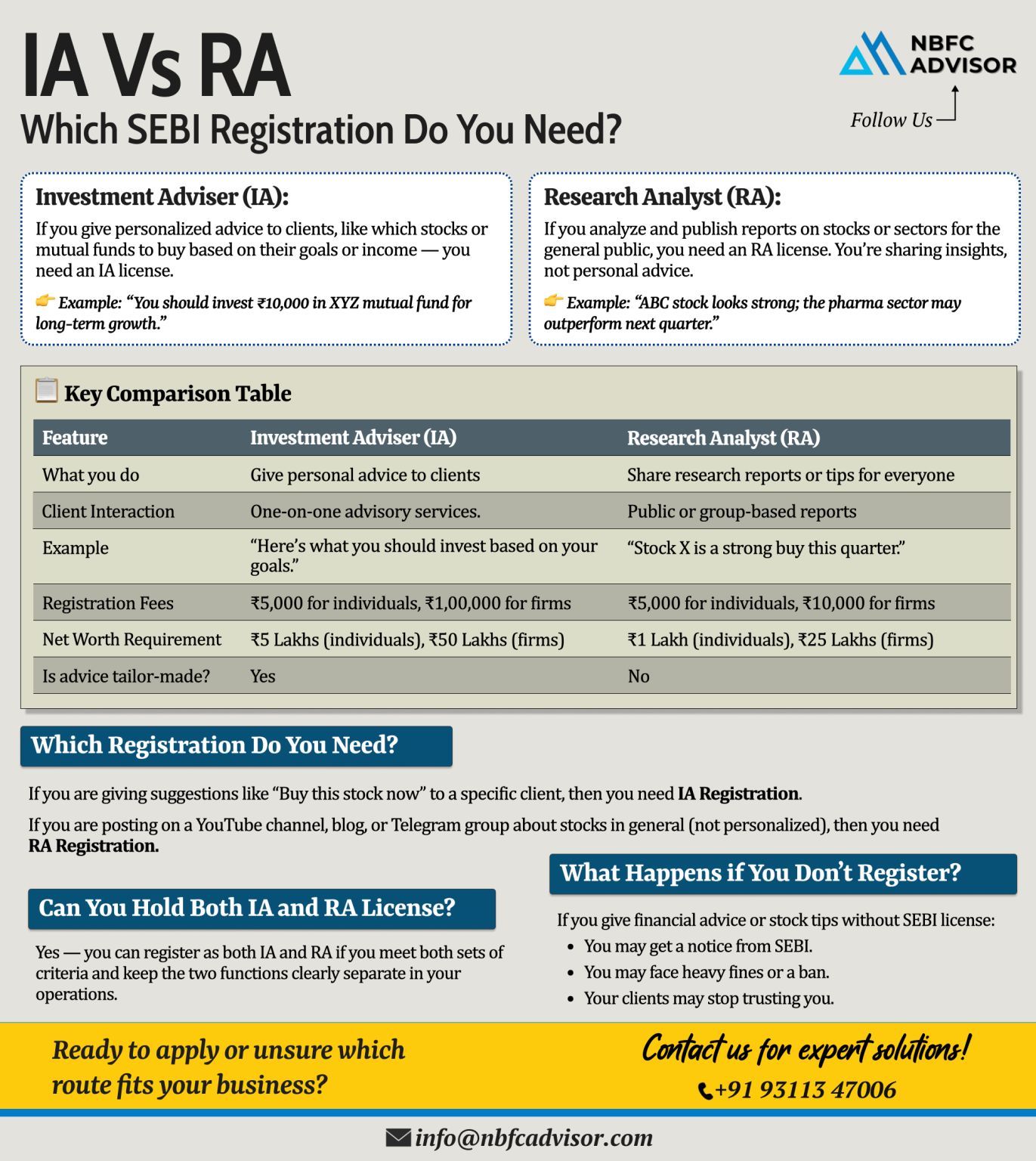

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

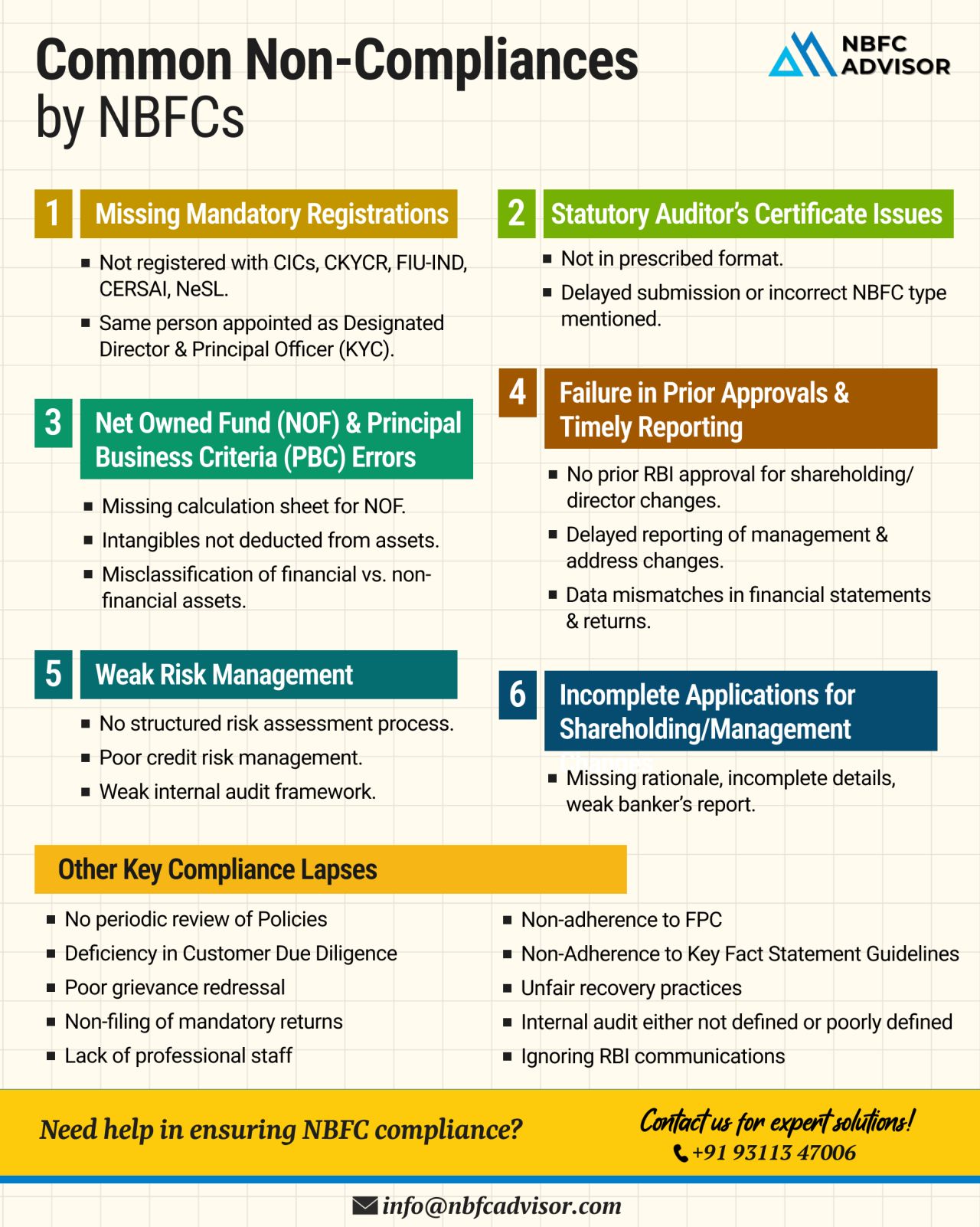

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Is Your NBFC Really Compliant? Here’s What You Need to Know

The Reserve Bank of India (RBI) has been tightening its regulatory framework around Non-Banking Financial Companies (NBFCs), and the impact is clear — several NBFCs have lost ...

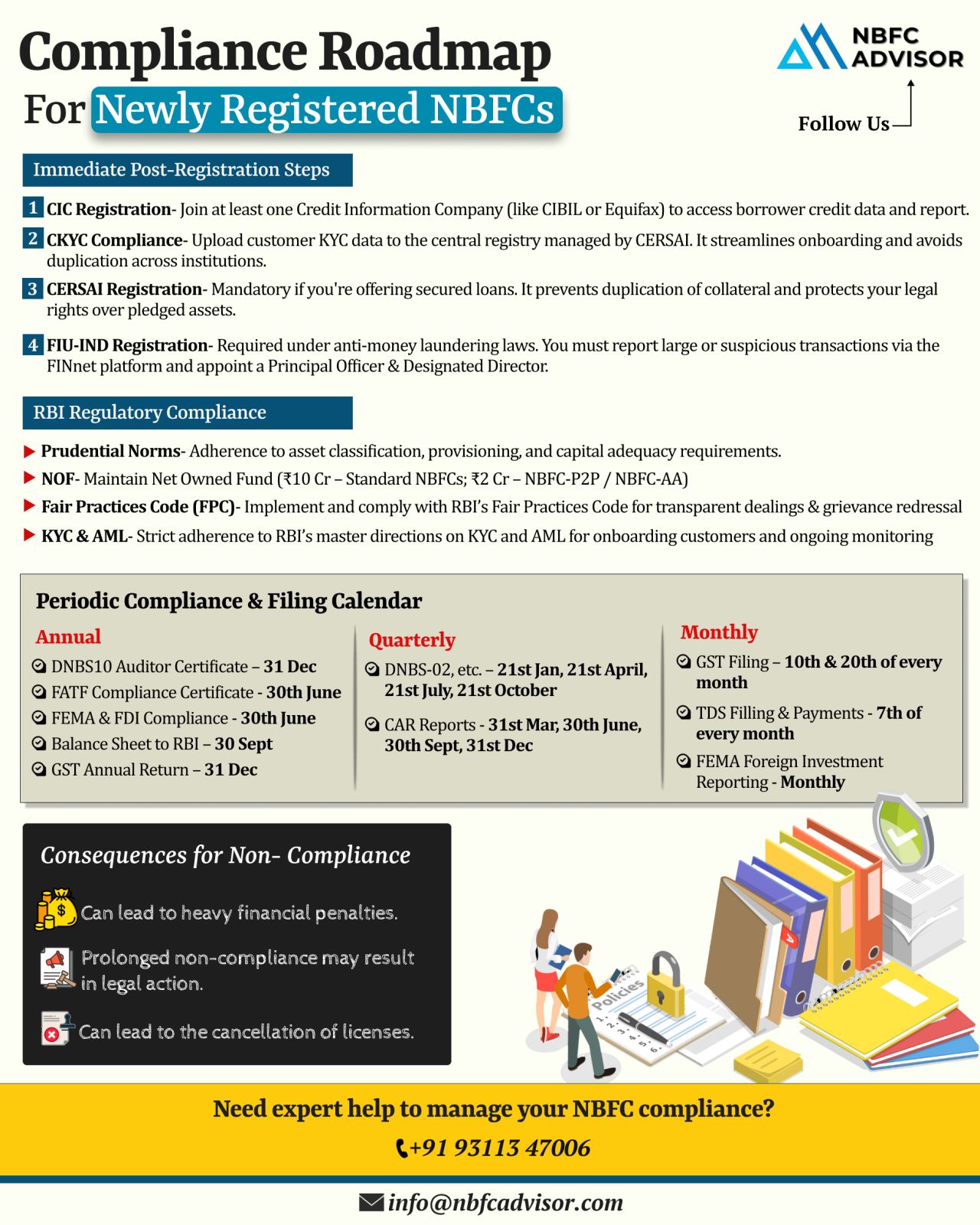

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

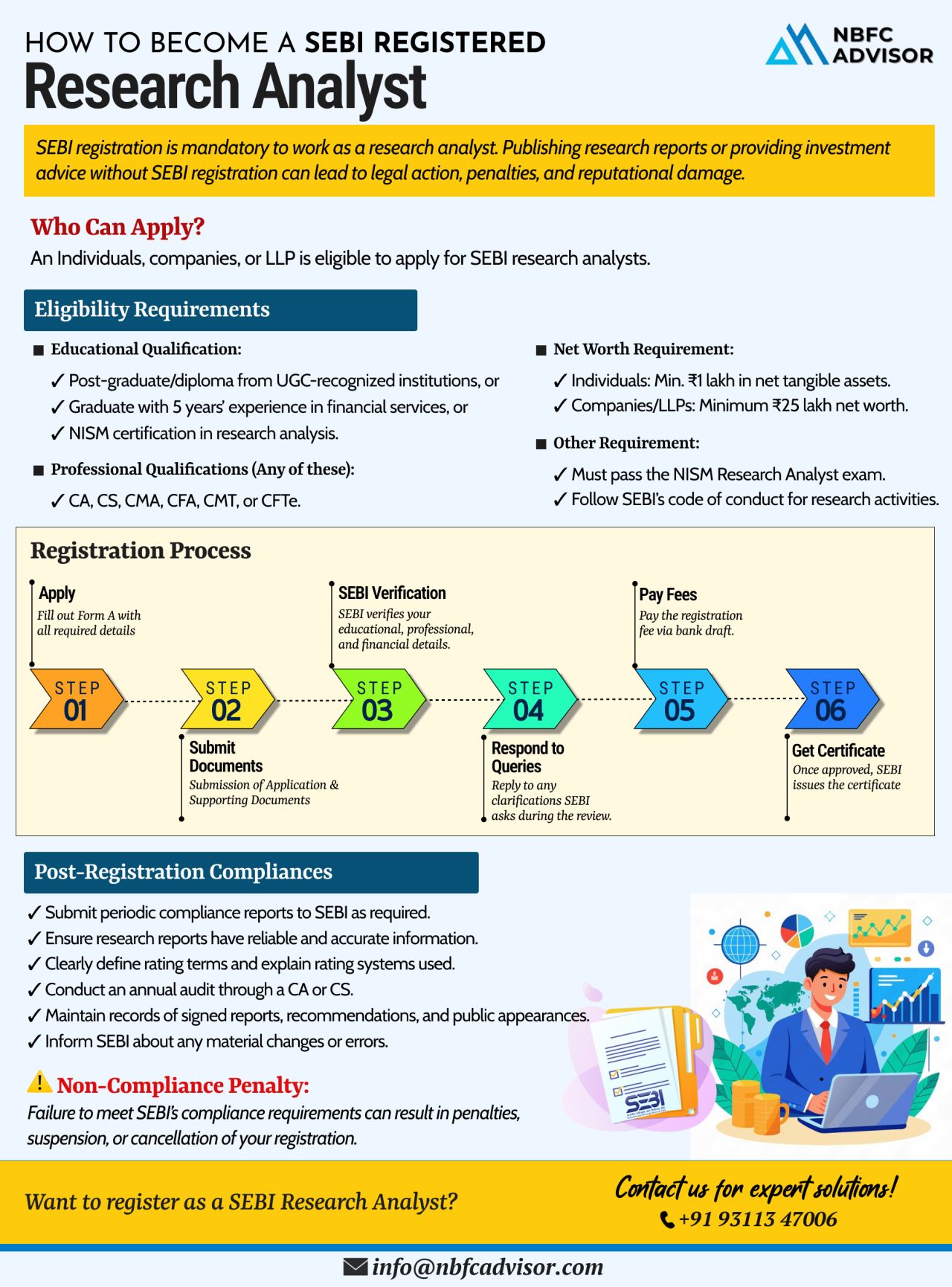

Are You Publishing Research Reports Without SEBI Registration?

That’s a fast track to penalties, suspension, and long-term reputational damage.

In today’s regulated financial ecosystem, SEBI registration is mandatory if you wish to wo...

⚠️ Is Your NBFC Vulnerable to RBI Action?

With increasing regulatory scrutiny, the Reserve Bank of India (RBI) is taking strict action against Non-Banking Financial Companies (NBFCs) that fail to comply with its guidelines. From financia...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘑𝘶𝘴𝘵 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Getting your NBFC license is a big milestone — but don’t relax just yet. Receiving RBI approval is only the first step in setting up your fin...

𝐃𝐨𝐞𝐬 𝐘𝐨𝐮𝐫 𝐀𝐈𝐅 𝐍𝐞𝐞𝐝 𝐆𝐒𝐓 𝐑𝐞𝐠𝐢𝐬𝐭𝐫𝐚𝐭𝐢𝐨𝐧? 🤔

Here’s what fund managers and AIFs need to know about GST compliance

Alternative Investment Funds (AIFs) are becoming a key pillar in India’s capital markets. B...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...