Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market advice, there’s a fine line between financial education and regulated investment advice — and crossing that line without proper authorization can attract serious penalties from SEBI (Securities and Exchange Board of India).

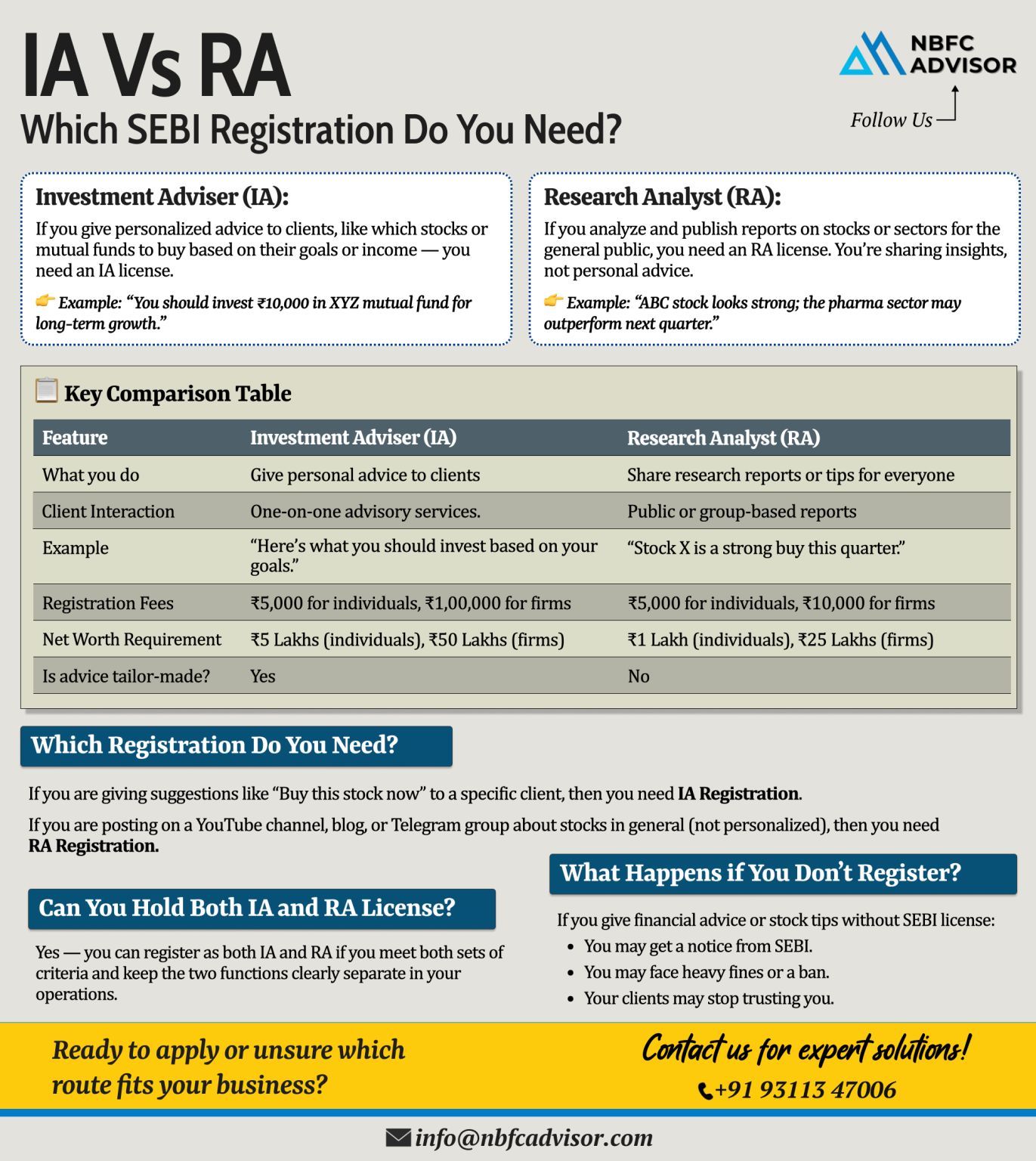

When You Need a SEBI Investment Adviser (IA) License

If you are advising individuals personally — for example, telling someone which stock or mutual fund to buy or sell — you need to be registered as a SEBI Investment Adviser (IA).

You need IA registration if you:

- Provide personalized investment recommendations

- Charge clients for portfolio advice or stock suggestions

- Create tailored investment plans for individuals or companies

Without this registration, giving personal financial advice is illegal under SEBI regulations and can lead to penalties or a permanent ban from the securities market.

When You Need a SEBI Research Analyst (RA) License

If you publish research reports, market views, or general stock analyses, then you need a Research Analyst (RA) registration instead.

You need RA registration if you:

- Publish market trends, sector reports, or stock research

- Share generalized investment insights publicly

- Work as a research firm or analyst offering non-personalized recommendations

Unlike an IA, an RA doesn’t provide one-on-one investment advice, but the content still falls under SEBI’s purview for research standards and disclosures.

Giving “Personalized Advice” Without SEBI Registration?

That’s a violation of SEBI (Investment Advisers) Regulations, 2013.

You could face:

- Monetary penalties

- Suspension from offering financial services

- A complete ban from participating in securities markets

So, before offering “stock tips” or “buy/sell calls” on YouTube, Telegram, or Instagram — make sure you are legally authorized.

Who Should Get Registered?

- Finance content creators

- Research firms and analysts

- Wealth managers & portfolio advisors

- Independent financial consultants

If you’re involved in any form of investment advisory or research, SEBI registration ensures transparency, credibility, and legal protection.

How NBFC Advisor Helps You

We help you:

- Choose the right SEBI registration type (IA or RA)

- Prepare and file your SEBI application

- Ensure end-to-end compliance with SEBI norms

Our experts guide you through documentation, eligibility checks, and the audit process so you can focus on your clients — not the paperwork.

📞 Get Started Today

Thinking about getting your SEBI registration?

Contact us for a free consultation and make your advisory business 100% compliant.

📞 +91 93113 47006

🌐 www.nbfcadvisor.com

#NBFCAdvisor #InvestmentAdviser #ResearchAnalyst #Finance #SEBI #Compliance #WealthManagement #FinancialAdvisors #StockMarket

Would you like me to make this blog SEO-optimized for “SEBI Investment Adviser Registration” or “SEBI Research Analyst License” keywords (for better ranking)? I can tailor it accordingly.