SEBI Compliance Red Flags for RIAs ⚠️

Avoid Costly Mistakes and Protect Your Registration

Registered Investment Advisers (RIAs) play a vital role in India’s financial ecosystem by offering transparent, client-focused investment advice. However, many RIAs face SEBI audit remarks due to simple compliance oversights that can easily be prevented.

If you are a practicing or aspiring RIA, understanding SEBI’s key compliance expectations is critical to avoid penalties, maintain credibility, and protect your registration.

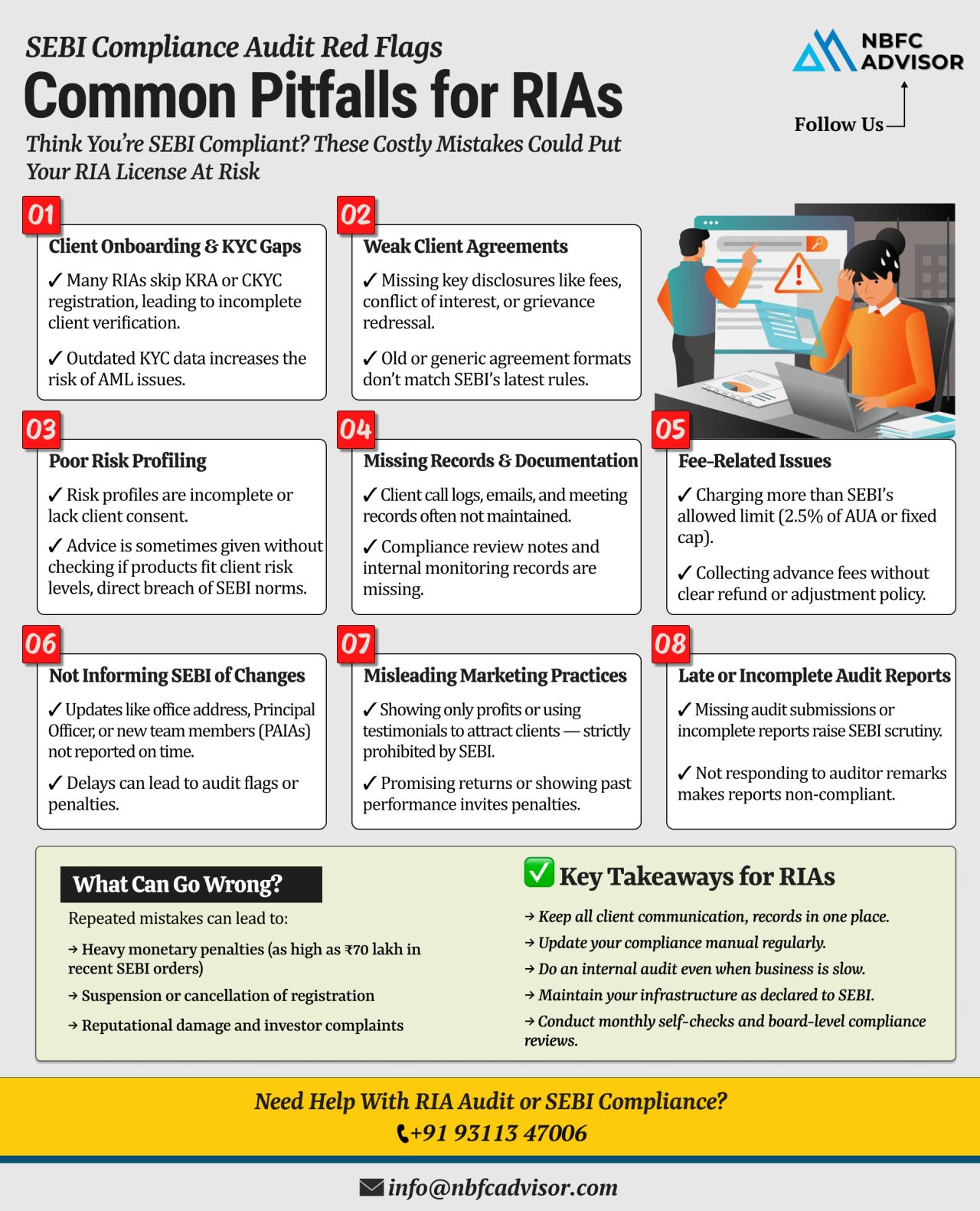

🚨 Common SEBI Compliance Lapses Among RIAs

Here are the top red flags where most Registered Investment Advisers go wrong:

-

Skipping KRA or CKYC Registration

Every client must be registered with KYC Registration Agencies (KRAs) or Central KYC (CKYC) systems. Failing to do so is a direct non-compliance under SEBI norms. -

Not Sharing Signed Client Agreements

RIAs must provide a signed copy of the client agreement before starting advisory services. Missing agreements or unsigned copies are frequent audit concerns. -

Incomplete Risk Profiling or Missing Client Consent

Before offering any advice, RIAs must conduct a comprehensive risk profiling and obtain informed consent. Incomplete documentation can attract strict SEBI remarks. -

Delayed SEBI Updates on Staff or Office Changes

Any change in the principal officer, compliance officer, or branch address must be promptly updated with SEBI. Delay or omission can trigger audit queries. -

Improper Marketing Practices

SEBI strictly prohibits RIAs from using performance claims, testimonials, or misleading advertisements. All marketing communications must be factual and compliant.

⚠️ The Consequences of Non-Compliance

While these may seem like small mistakes, their impact can be serious:

-

💸 Monetary Penalties and Audit Flags

-

⛔ Temporary or Permanent Suspension of Registration

-

📉 Reputational Damage with Clients and Investors

Maintaining SEBI compliance is not just about meeting regulations—it’s about building trust, credibility, and long-term sustainability in your advisory business.

🧩 How NBFC Advisor Can Help

At NBFC Advisor, we specialize in helping Registered Investment Advisers stay compliant with SEBI’s evolving regulatory framework.

Our services include:

✅ RIA Registration and Renewal Assistance

✅ SEBI Audit Preparation and Documentation

✅ Compliance Review and Reporting

✅ Training and Advisory Support

Whether you need help setting up a compliance system or handling an upcoming SEBI audit, our expert team is here to guide you every step of the way.

📞 Get Expert Guidance

Don’t wait for an audit remark to act. Ensure your RIA practice is 100% SEBI-compliant today.

Contact us for a free consultation!

📞 +91 93113 47006

#NBFCAdvisor #SEBI #RIACompliance #InvestmentAdvisers #Fintech #FinanceRegulations #ComplianceAudit #FinancialServices