Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

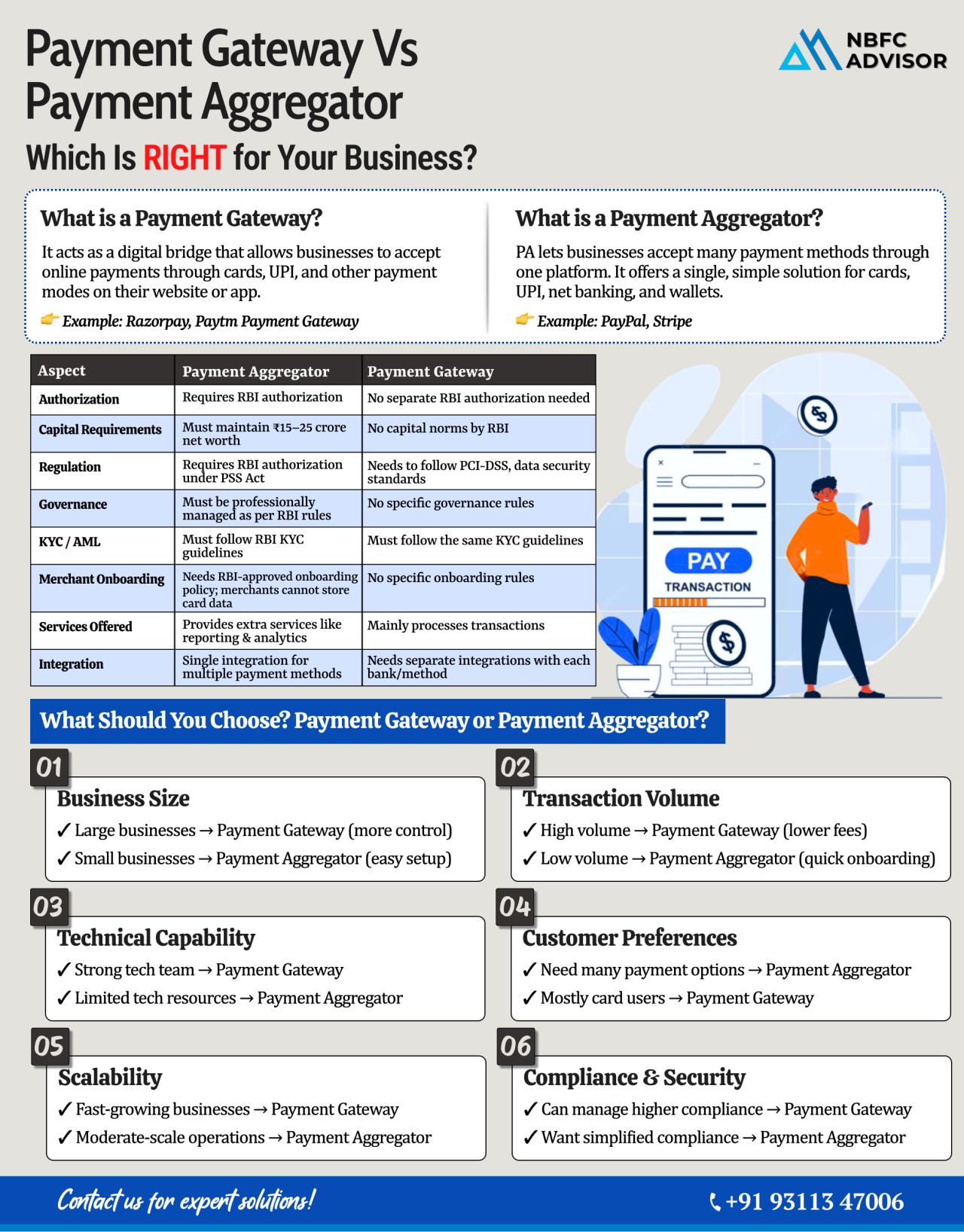

Payment Gateway vs Payment Aggregator: Which One Fits Your Business Better?

As online payments continue to grow in India, choosing the right payment infrastructure has become a strategic decision. A smooth, fast, and secure checkout is essential &...

Want to Register Your NBFC Faster? Here’s What Most Founders Miss

Starting an NBFC (Non-Banking Financial Company) can be one of the most exciting ventures for any entrepreneur in the finance sector. But here’s the reality — most...

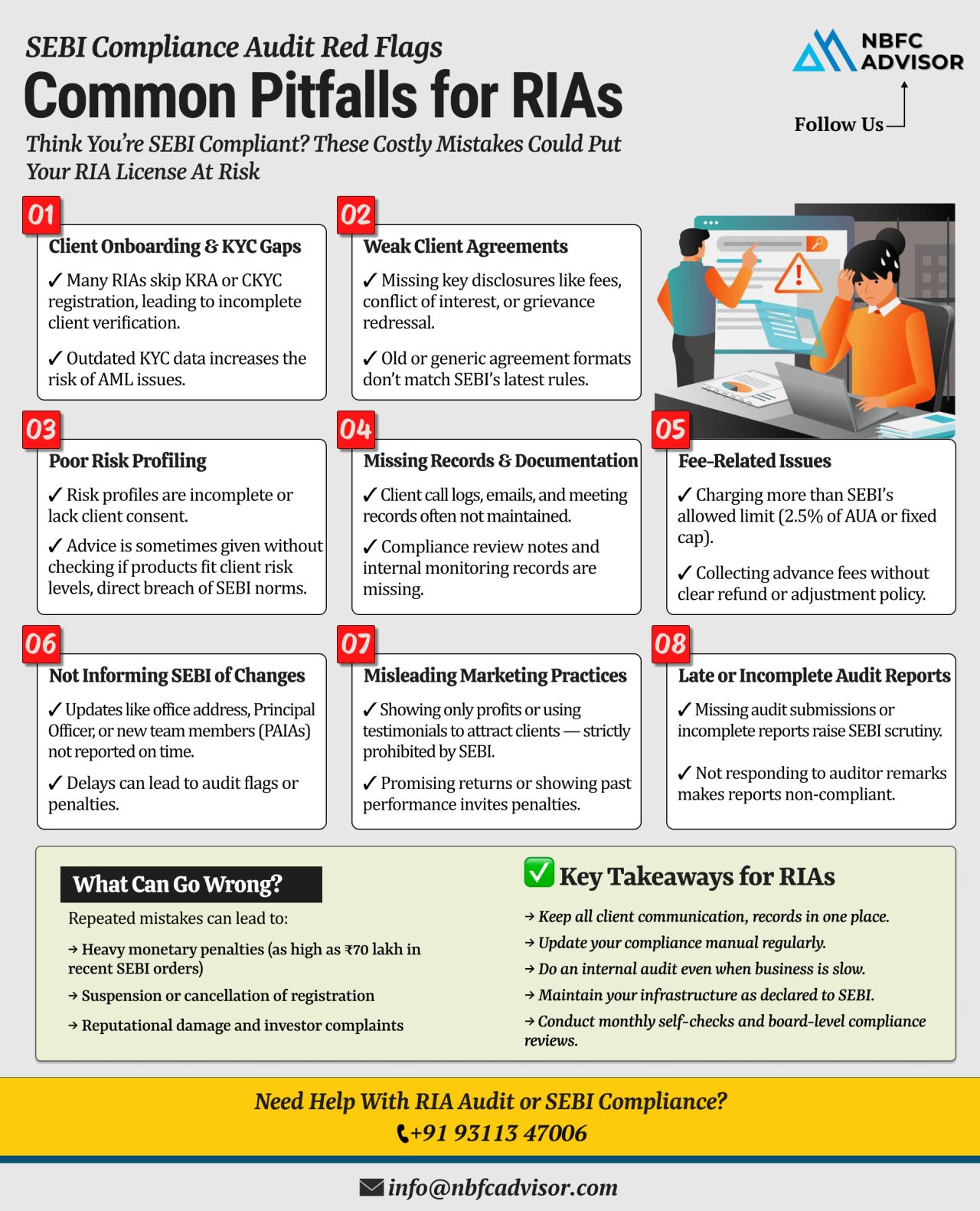

SEBI Compliance Red Flags for RIAs ⚠️

Avoid Costly Mistakes and Protect Your Registration

Registered Investment Advisers (RIAs) play a vital role in India’s financial ecosystem by offering transparent, client-focused investment advice. Ho...

Is Your NBFC Really Compliant? Here’s What You Need to Know

The Reserve Bank of India (RBI) has been tightening its regulatory framework around Non-Banking Financial Companies (NBFCs), and the impact is clear — several NBFCs have lost ...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

NBFC Takeover vs. New NBFC Registration – The Smarter Way to Enter the Lending Business

Thinking of starting an NBFC (Non-Banking Financial Company) in India? You’re not alone — with the booming fintech ecosystem and rising credi...

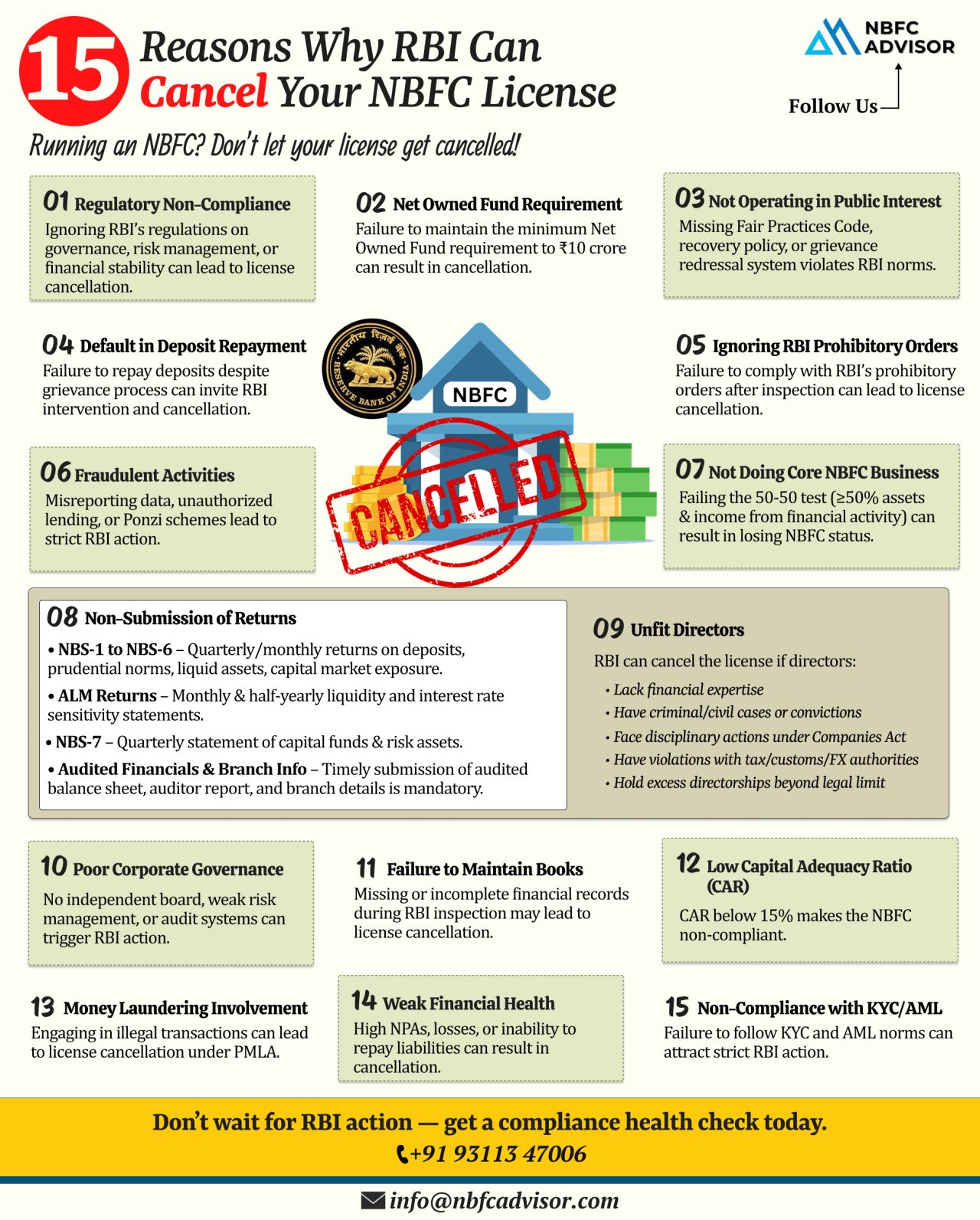

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

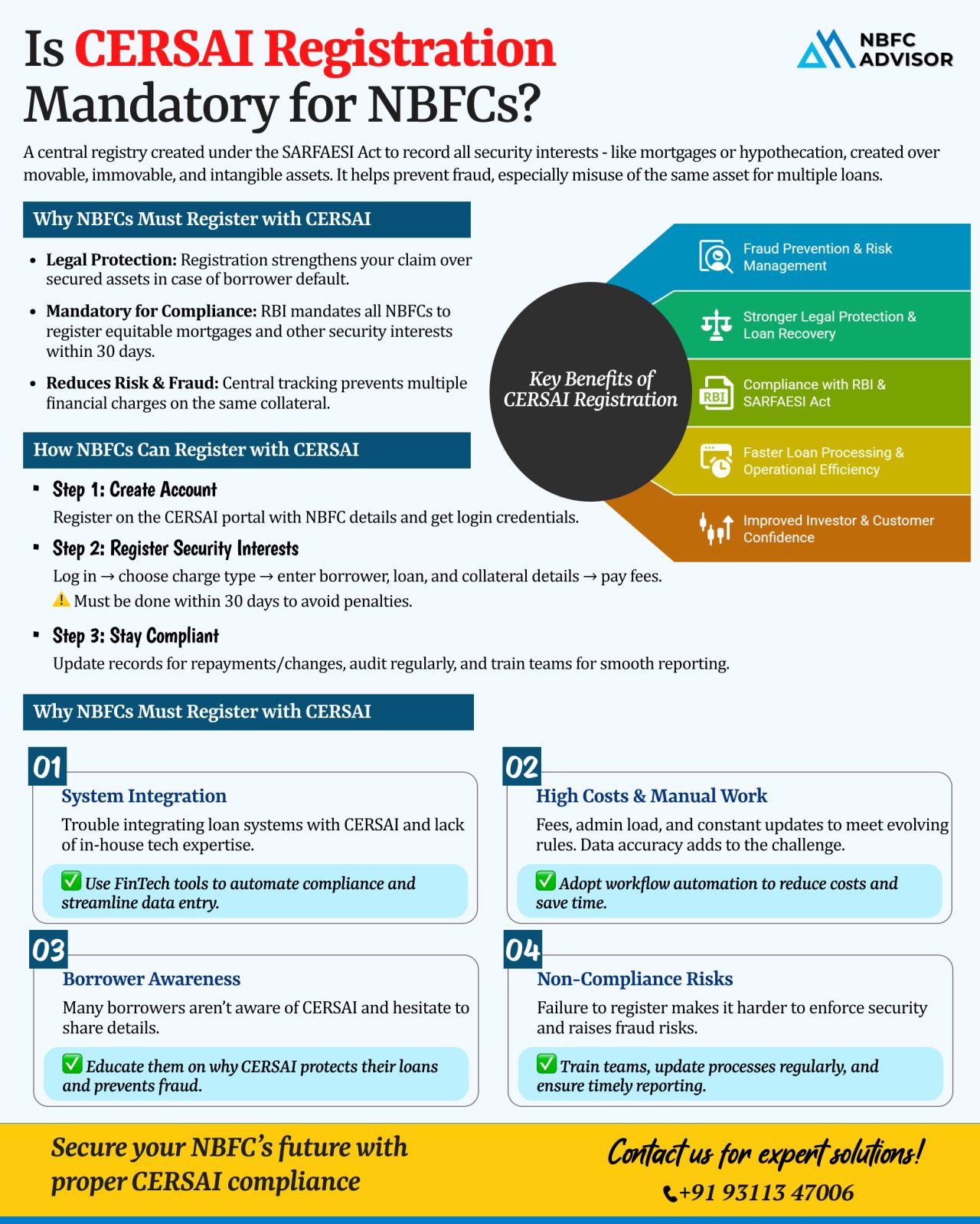

Is CERSAI Registration Compulsory for NBFCs?

A frequent compliance gap seen among NBFCs is neglecting CERSAI registration. While lenders are usually diligent about RBI directives and customer verification, many overlook this crucial step—whi...

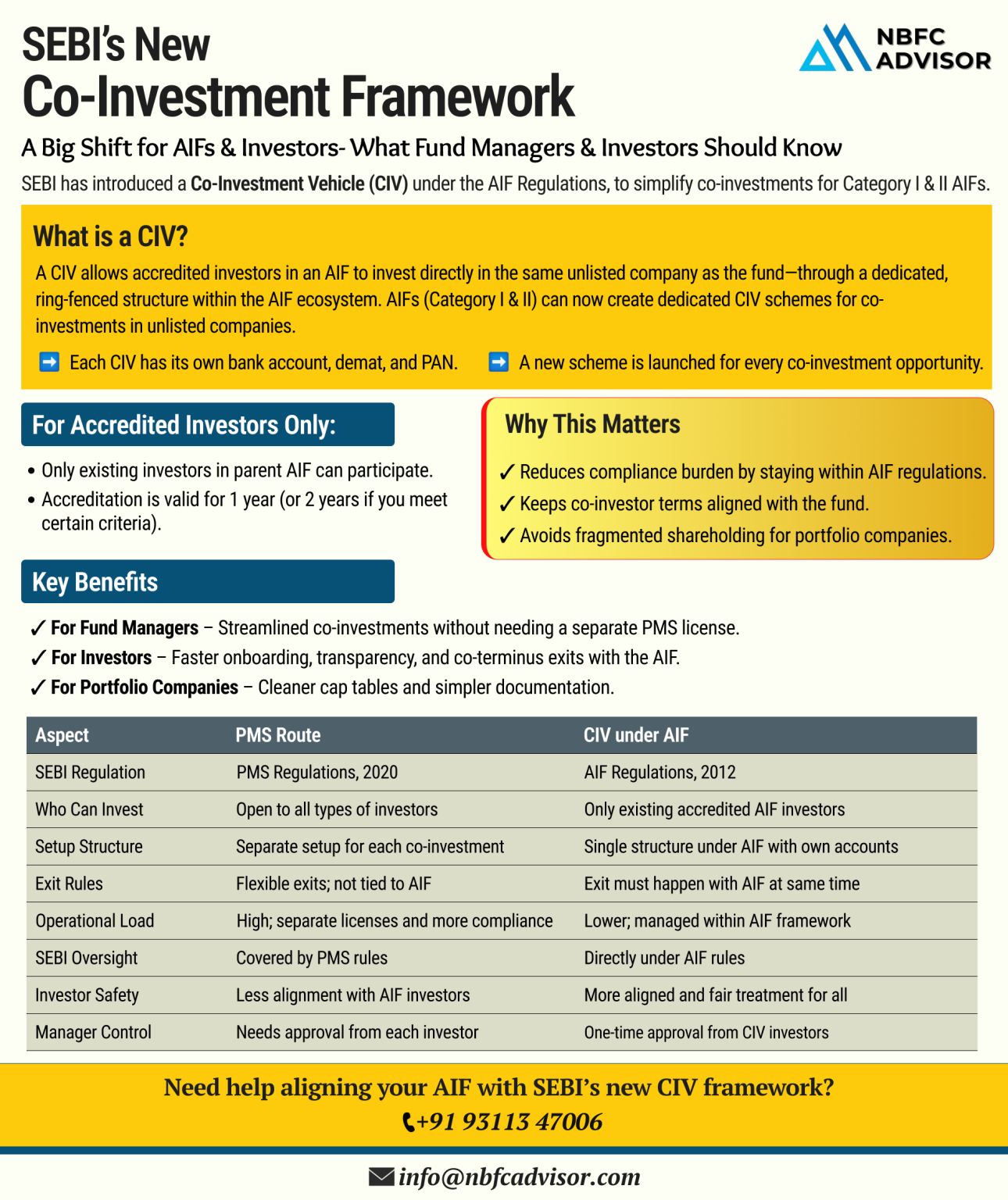

SEBI Rolls Out New Co-Investment Framework: A Big Win for India’s Private Market

India’s private capital landscape just received a significant boost.

In a major regulatory move, the Securities and Exchange Board of India (SEBI) has un...

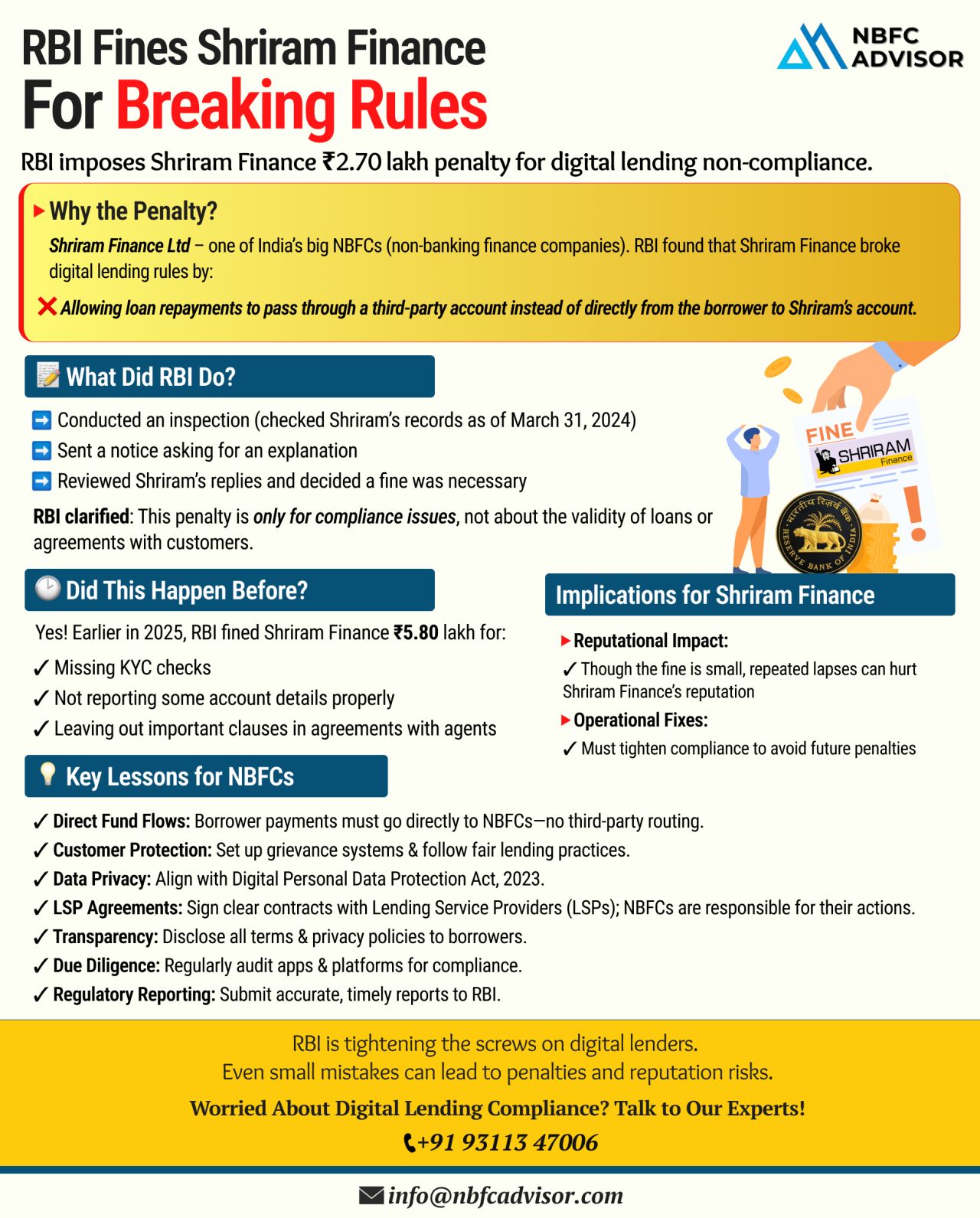

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

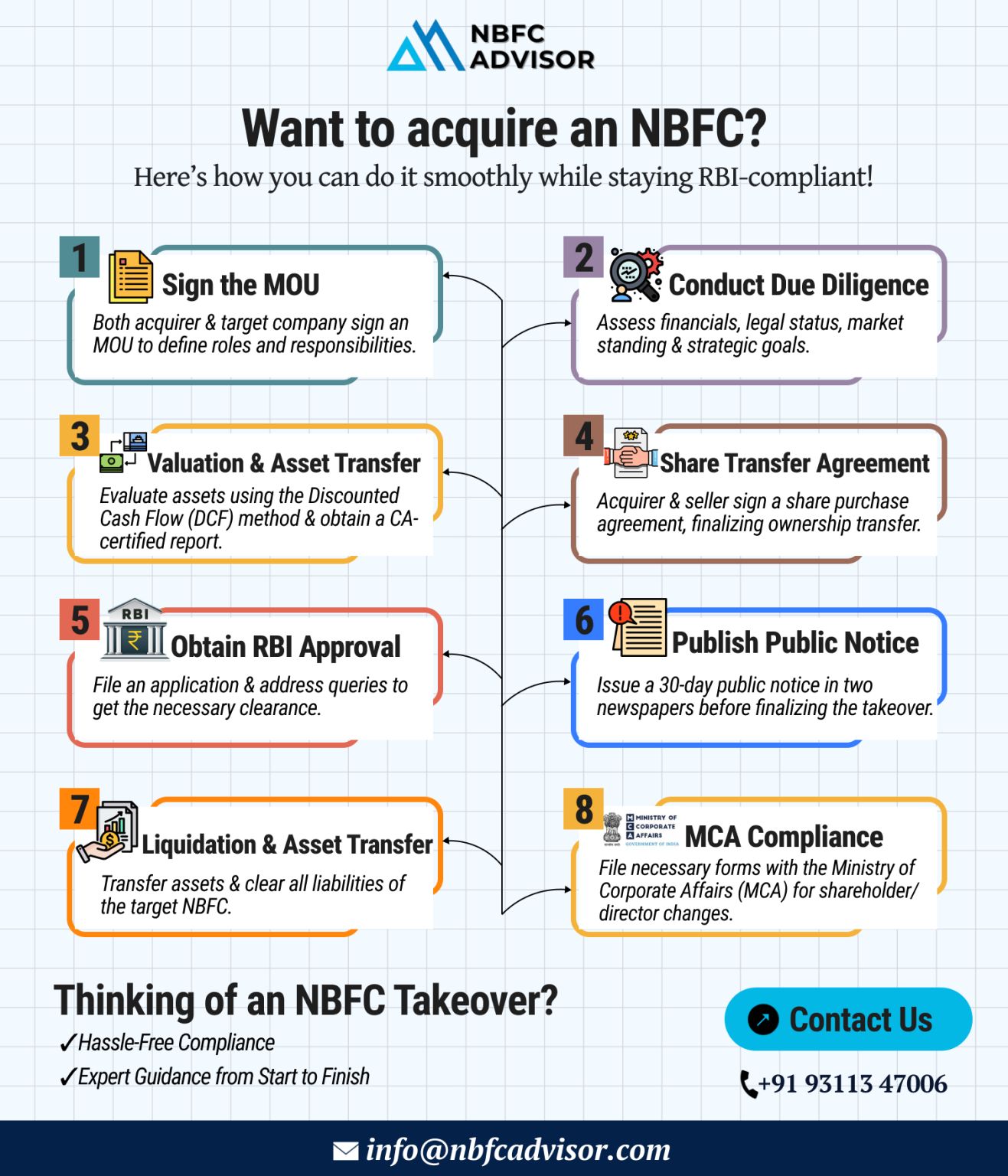

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

⚠️ NBFCs: It’s Time to Prepare for RBI’s NOF Deadline!

The Reserve Bank of India (RBI) has made its stance clear — it's time for NBFCs to ramp up their capital base!

Under the RBI’s Master Direction – NBFC (Sca...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

.png)