Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

𝐍𝐨𝐭 𝐚𝐥𝐥 𝐍𝐁𝐅𝐂𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞.

RBI has divided NBFCs into 4 layers based on size, risk, and complexity.

The bigger your NBFC is, the stricter the rules.

✓ 𝐁𝐚𝐬𝐞 𝐋𝐚𝐲𝐞𝐫: Smallest NBFCs, lightest regulations

✓ 𝐌𝐢𝐝𝐝�...

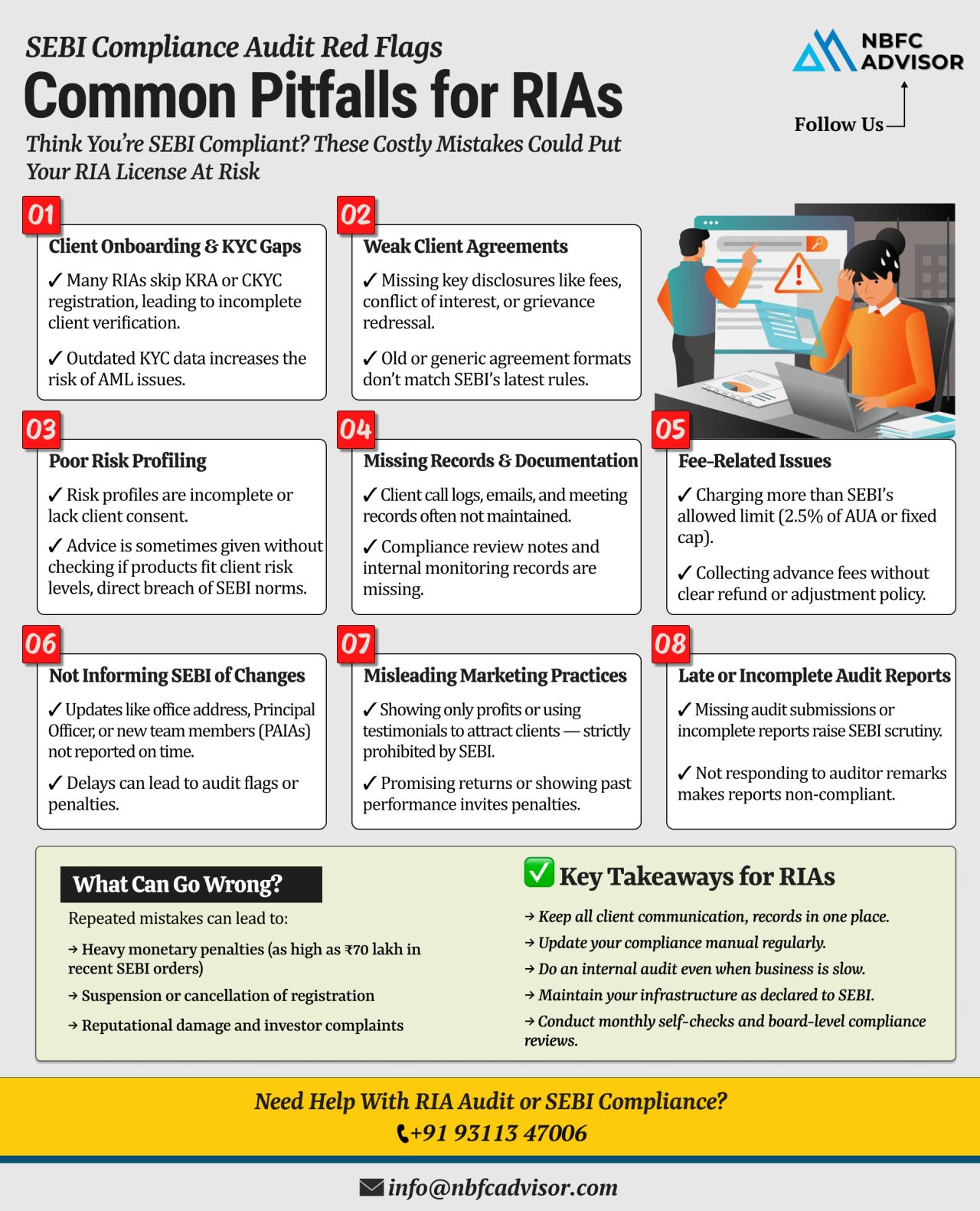

SEBI Compliance Red Flags for RIAs ⚠️

Avoid Costly Mistakes and Protect Your Registration

Registered Investment Advisers (RIAs) play a vital role in India’s financial ecosystem by offering transparent, client-focused investment advice. Ho...

Is Your NBFC Really Compliant? Here’s What You Need to Know

The Reserve Bank of India (RBI) has been tightening its regulatory framework around Non-Banking Financial Companies (NBFCs), and the impact is clear — several NBFCs have lost ...

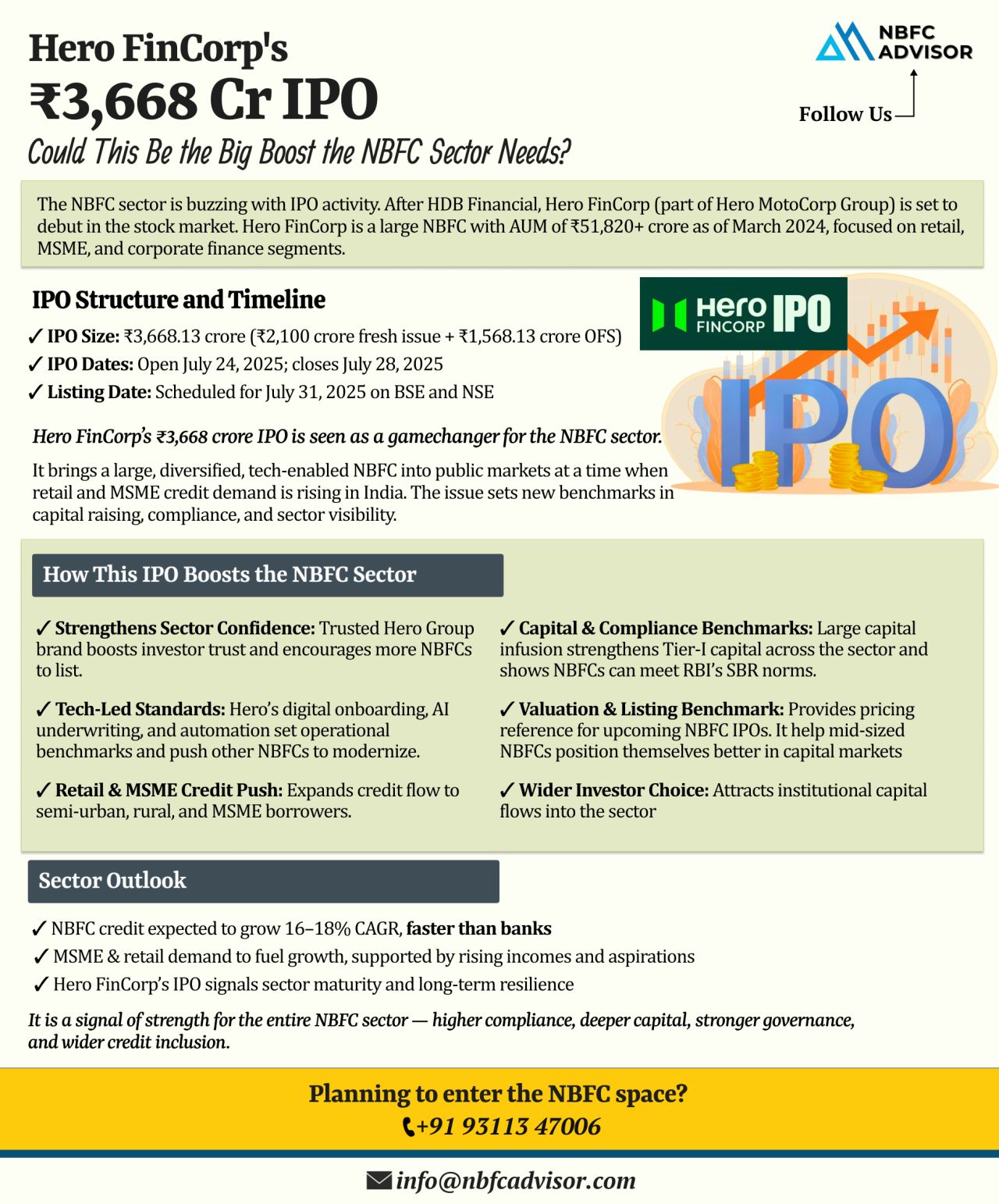

Hero FinCorp’s ₹3,668 Cr IPO: Implications for the NBFC Sector

The Indian Non-Banking Financial Company (NBFC) sector is witnessing heightened IPO activity, reflecting growing investor confidence and sectoral growth. Following HDB Financial ...

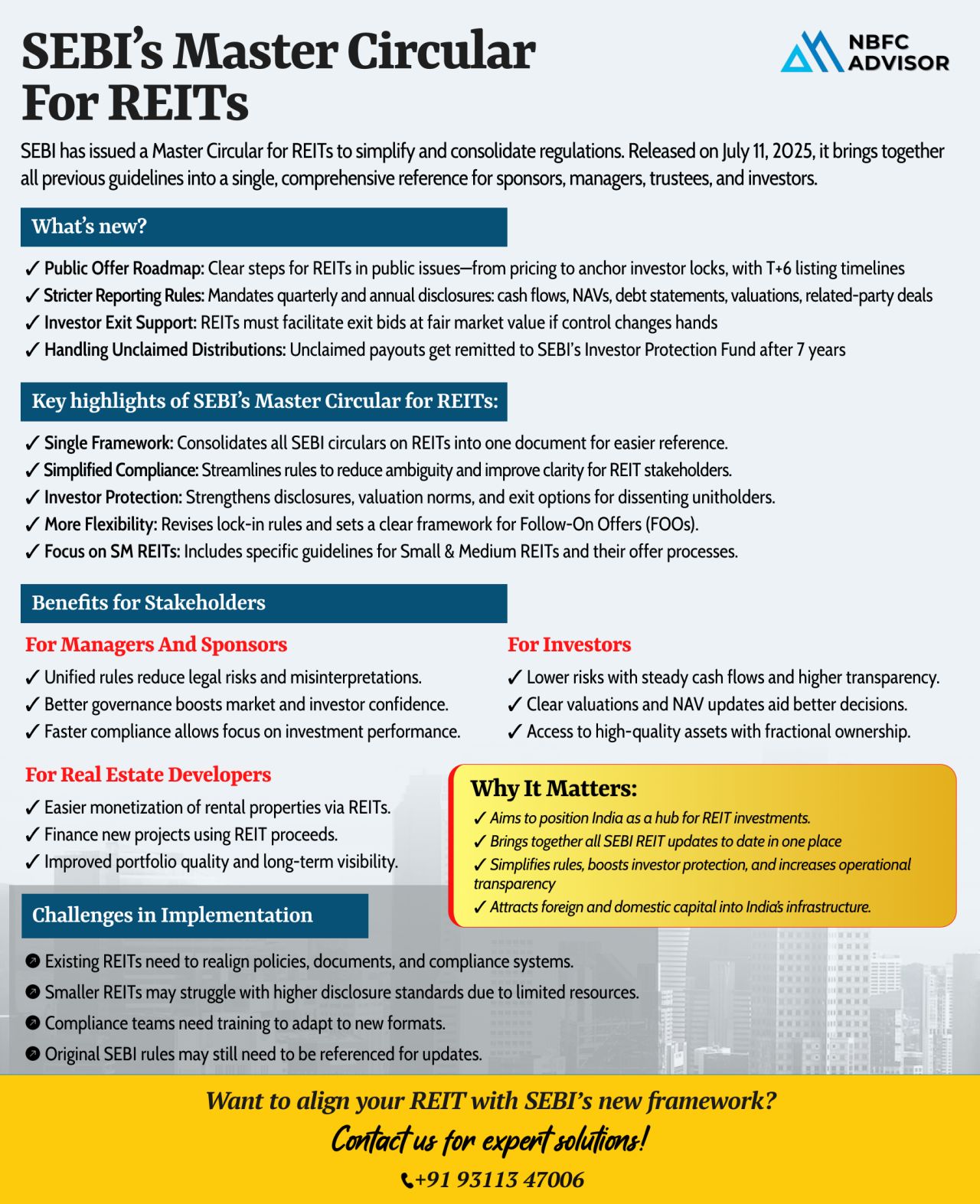

SEBI introduces a unified regulatory framework for REITs, enhancing transparency, investor protection, and ease of compliance. Discover how it transforms India’s real estate investment ecosystem.

SEBI’s New Master Circular: A Landmar...

RBI to Tighten Supervisory Norms for NBFCs in FY26: What It Means for the Sector

The Reserve Bank of India (RBI) is preparing to introduce stricter supervisory regulations for Non-Banking Financial Companies (NBFCs) in the financial year 2025&ndas...