P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

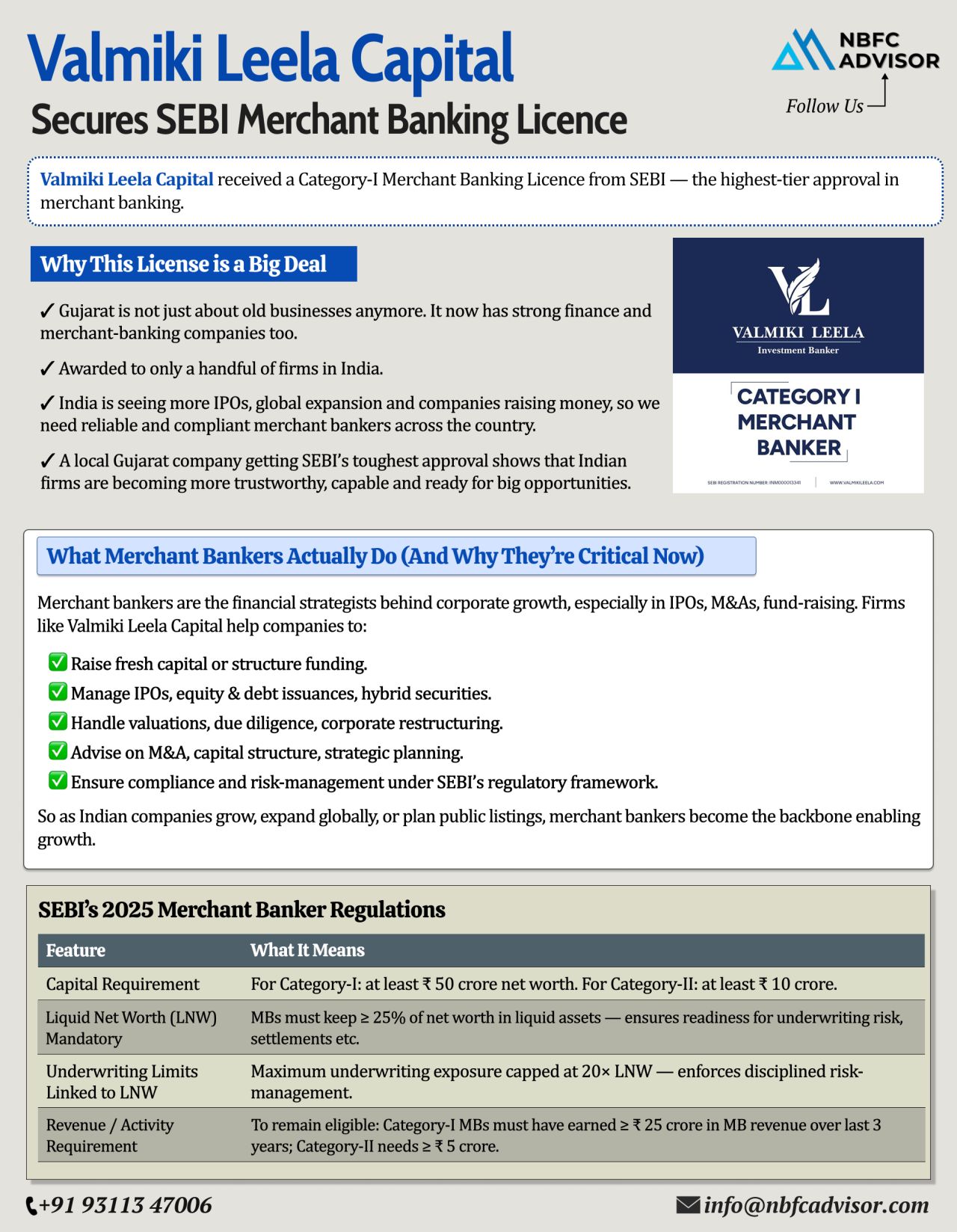

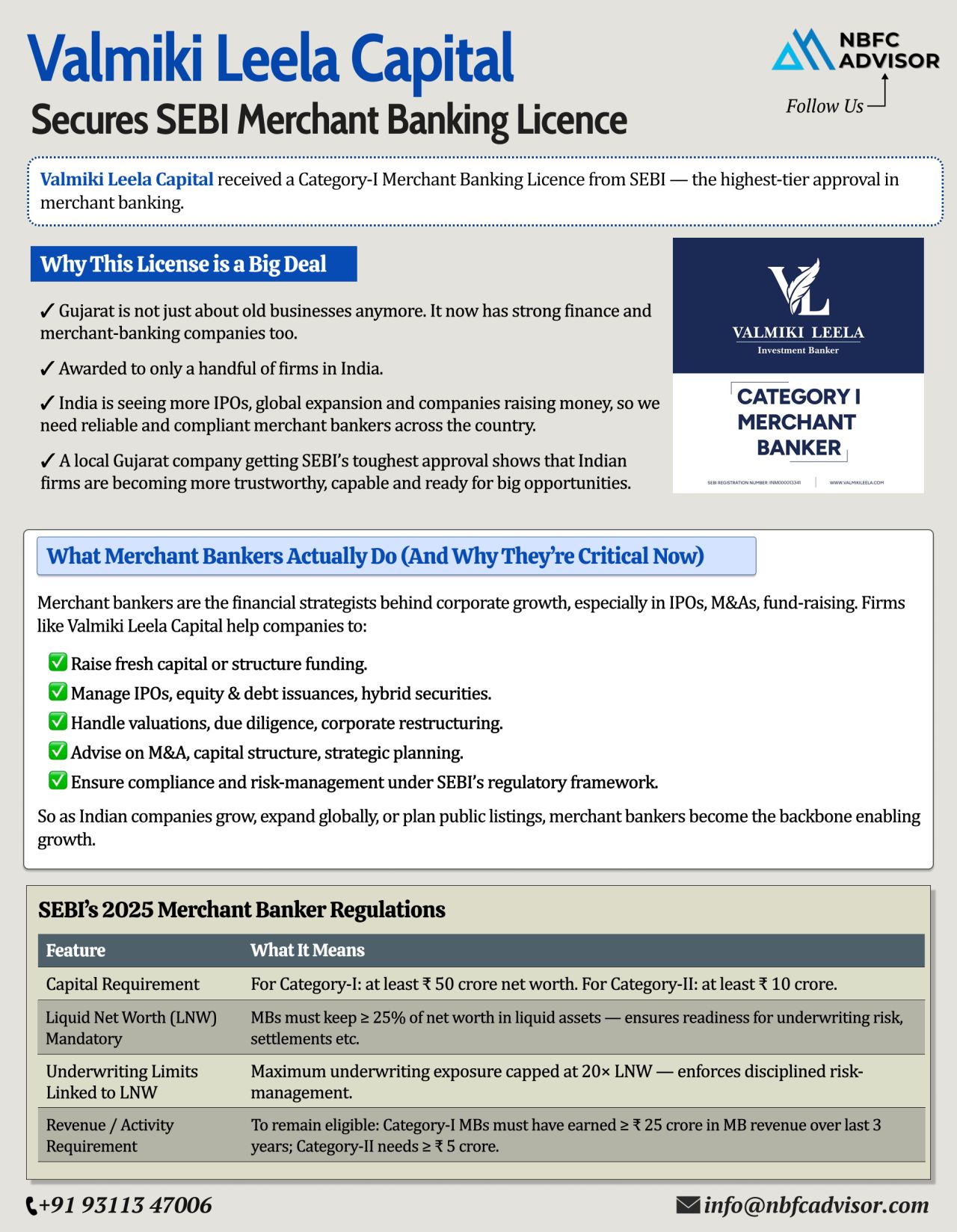

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

Gujarat Just Proved Everyone Wrong — And It’s a Big Win for India’s Financial Future

For decades, Gujarat has been known for its entrepreneurial spirit — but mostly in textiles, jewellery, and traditional family businesses....

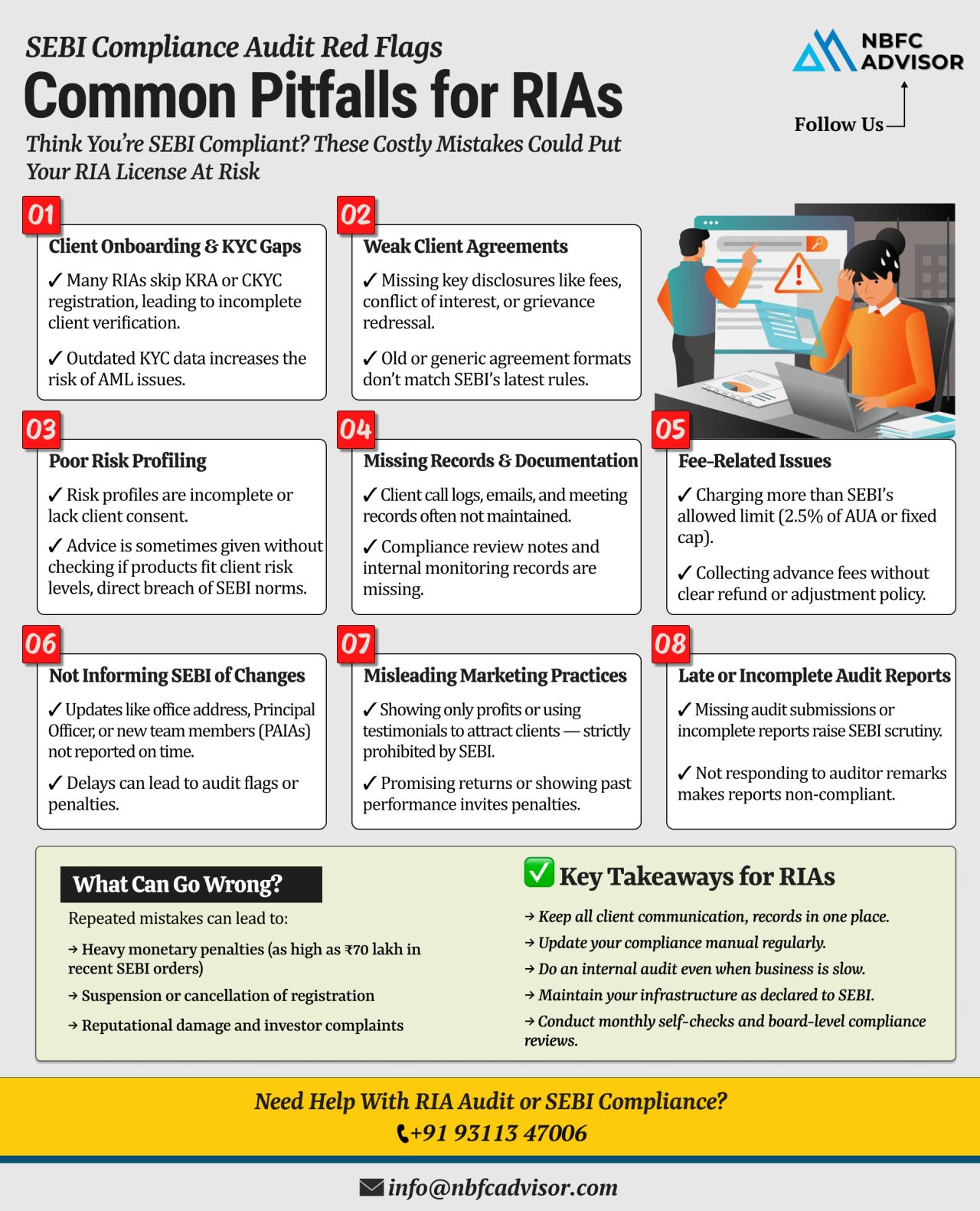

SEBI Compliance Red Flags for RIAs ⚠️

Avoid Costly Mistakes and Protect Your Registration

Registered Investment Advisers (RIAs) play a vital role in India’s financial ecosystem by offering transparent, client-focused investment advice. Ho...

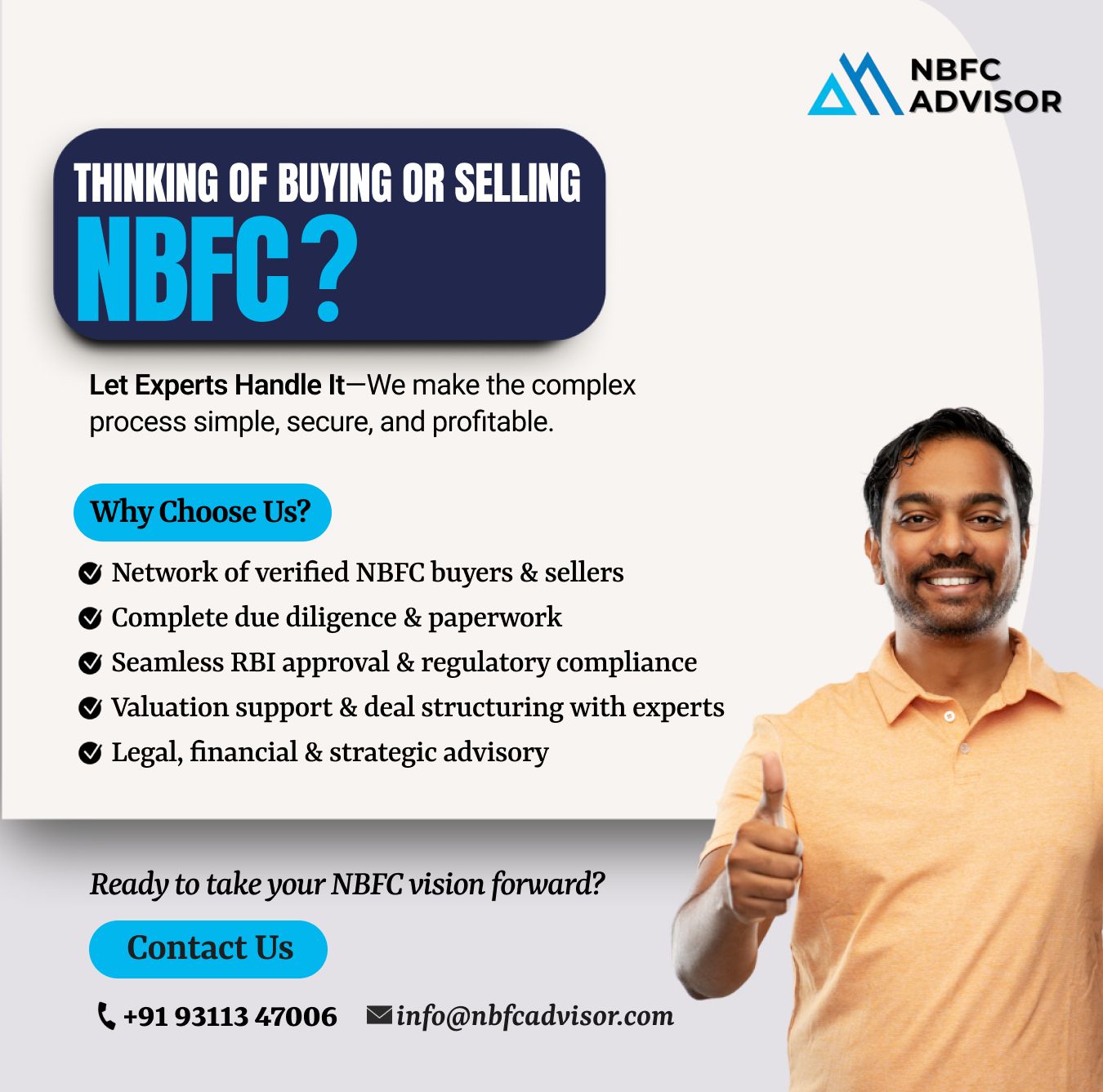

NBFC Takeovers: The Fastest Route to Enter India’s Growing Digital Lending Space

India’s digital lending sector is on an exponential growth path and is expected to reach $515 billion by 2030. Innovative models like peer-to-peer (P2P) l...

RBI’s Officer Training Program: Ushering in a New Era of Digital Finance & Compliance

The Reserve Bank of India (RBI) is preparing for the future of India’s financial ecosystem with a comprehensive officer training initiative in Hy...

India’s Digital Lending Boom: Why Now Is the Time to Build Your Business

India’s digital lending landscape is expanding at a record pace — and the numbers tell a powerful story. By 2030, the market is projected to reach an incred...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)