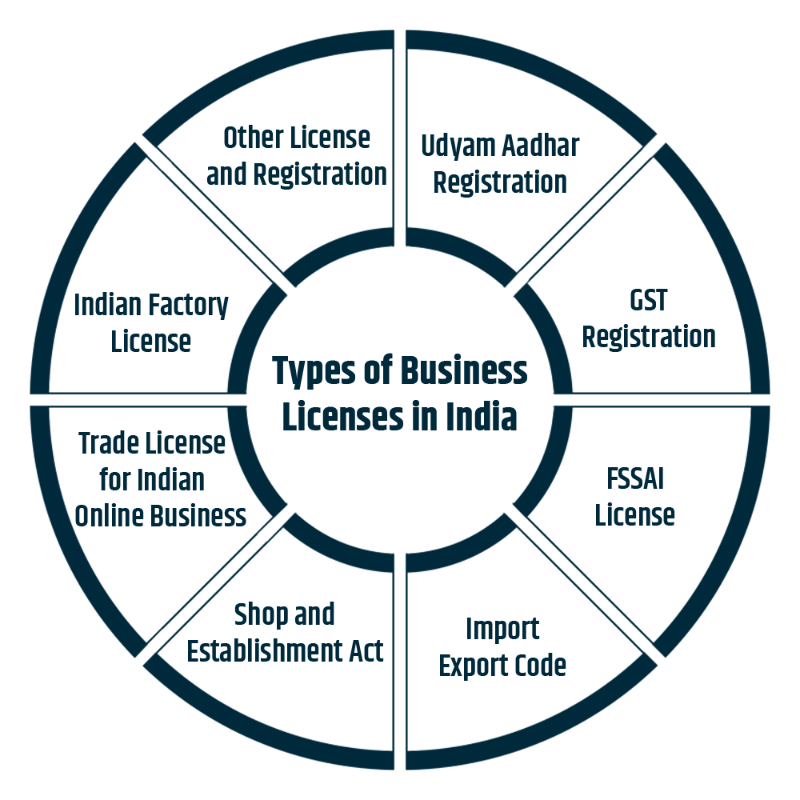

Licensing & Approvals Services – Smooth, Timely & Hassle-Free Business Permissions

Starting, operating, or expanding a business in India requires multiple licenses, registrations, and statutory approvals from government authorities. ...

Regulatory Compliance Services – Protecting Your Business from Legal & Regulatory Risks

In an increasingly regulated business environment, regulatory compliance is the foundation of a stable, credible, and sustainable organization. Every...

NBFC Registration Services – Your Gateway to India’s Financial Services Sector

India’s financial ecosystem is expanding rapidly, creating strong opportunities for businesses in lending, investment, and asset financing. One of the...

Regulatory Compliance Services – Building a Legally Strong & Trusted Business

In today’s fast-evolving regulatory environment, regulatory compliance is no longer optional—it is essential for business continuity, credibility, ...

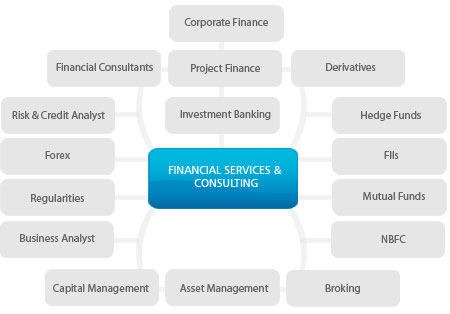

Advisory & Consulting Services – Expert Guidance for Smart Business Decisions

In today’s dynamic and regulated business landscape, success depends not only on hard work but on well-informed decisions. Businesses face challenges rel...

Advisory & Consulting Services – Strategic Guidance for Sustainable Business Growth

In an increasingly complex and competitive business environment, making the right decisions at the right time is critical. Whether it’s launching a...

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

What Are Regulatory Compliance Services?

Regulatory compliance services ensure that a business adheres to all applicable laws, rules, guidelines, and regulations issued by government and regulatory bodies. These services cover ongoing legal, finan...

NBFC Registration Services in India – A Complete Guide

Starting a Non-Banking Financial Company (NBFC) in India is a powerful way to enter the financial services sector. NBFCs play a crucial role in providing loans, advances, asset financing...

Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

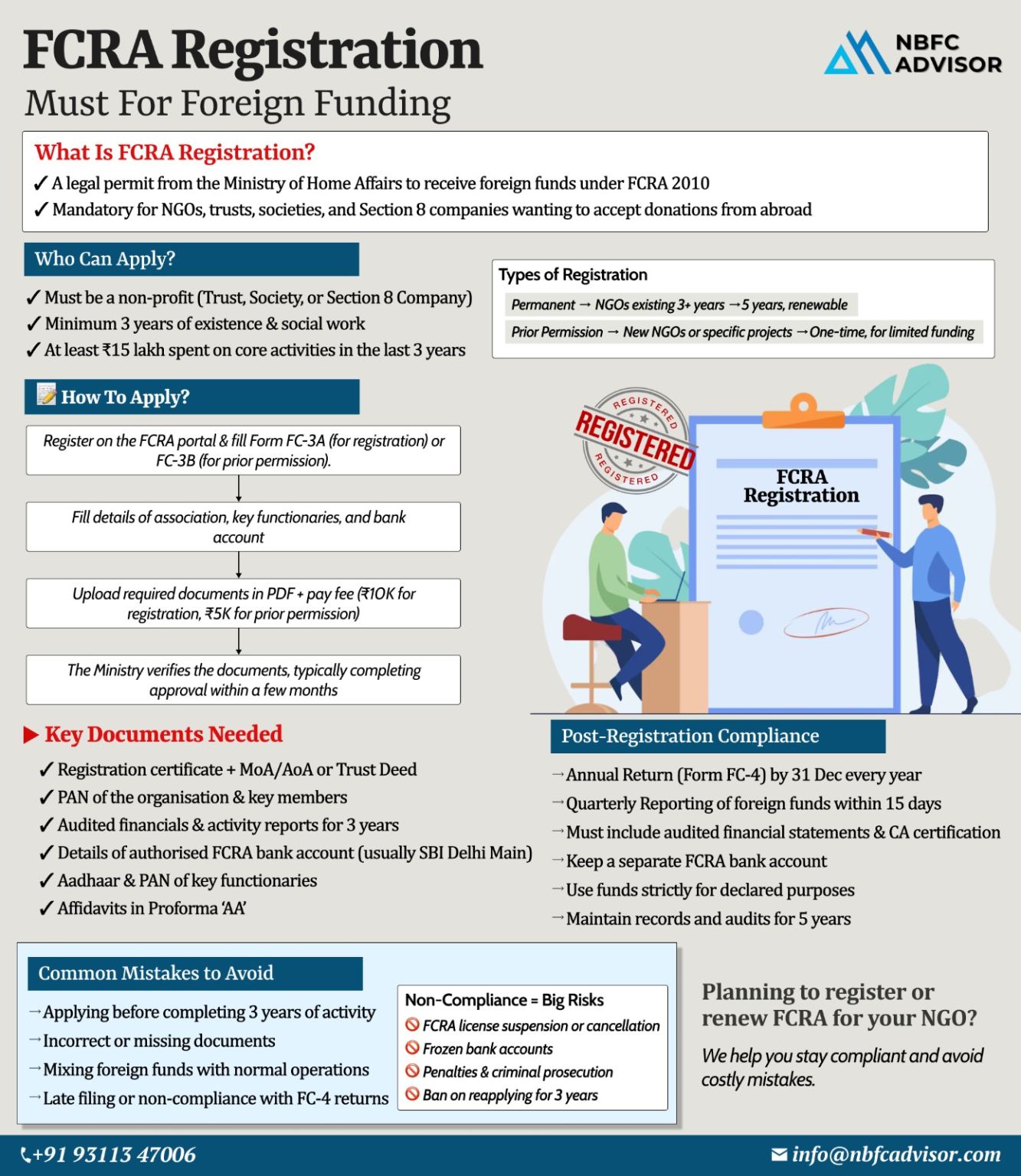

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

Want to Register Your NBFC Faster? Here’s What Most Founders Miss

Starting an NBFC (Non-Banking Financial Company) can be one of the most exciting ventures for any entrepreneur in the finance sector. But here’s the reality — most...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

NBFC Takeover vs. New NBFC Registration – The Smarter Way to Enter the Lending Business

Thinking of starting an NBFC (Non-Banking Financial Company) in India? You’re not alone — with the booming fintech ecosystem and rising credi...

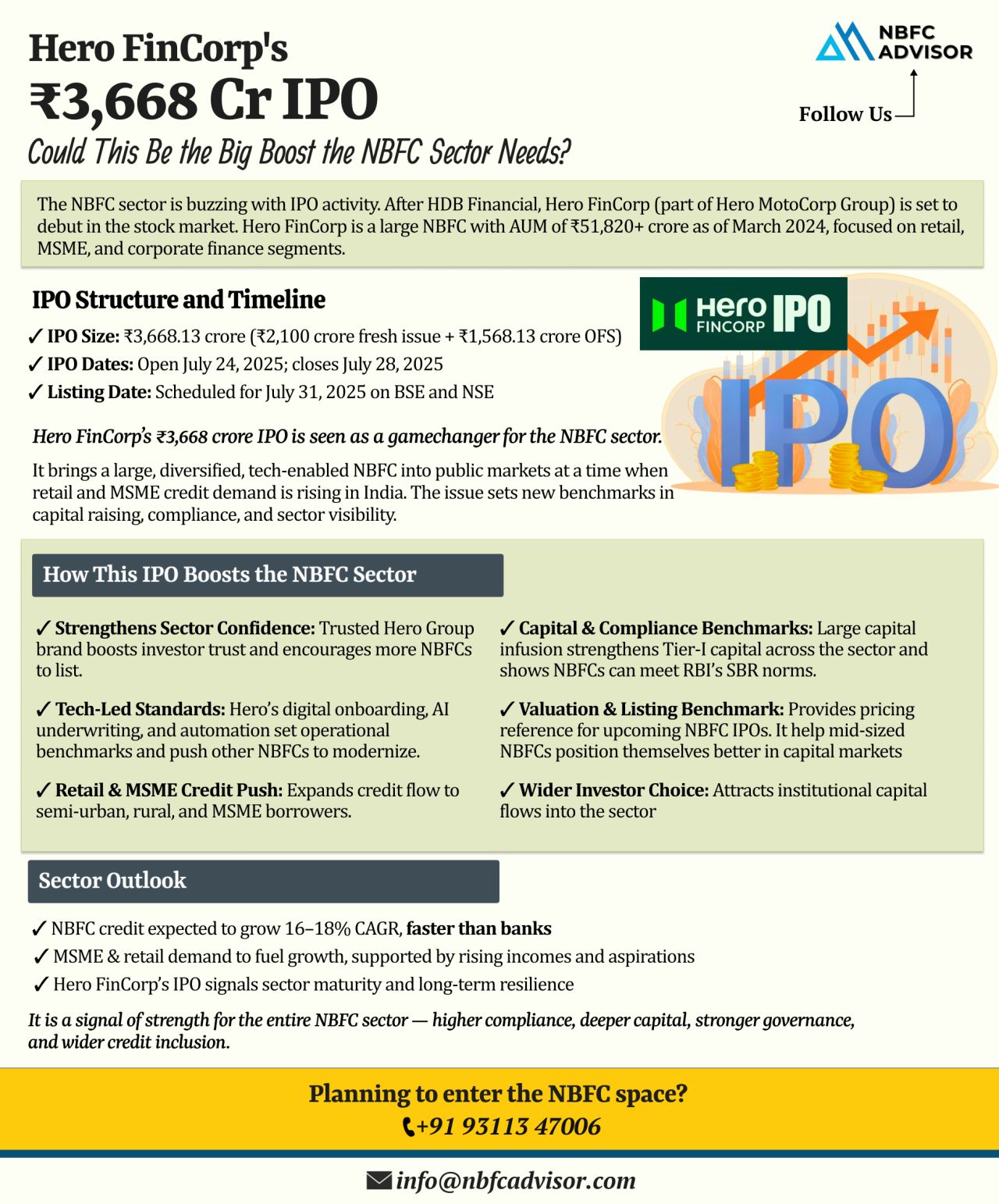

Hero FinCorp’s ₹3,668 Cr IPO: Implications for the NBFC Sector

The Indian Non-Banking Financial Company (NBFC) sector is witnessing heightened IPO activity, reflecting growing investor confidence and sectoral growth. Following HDB Financial ...

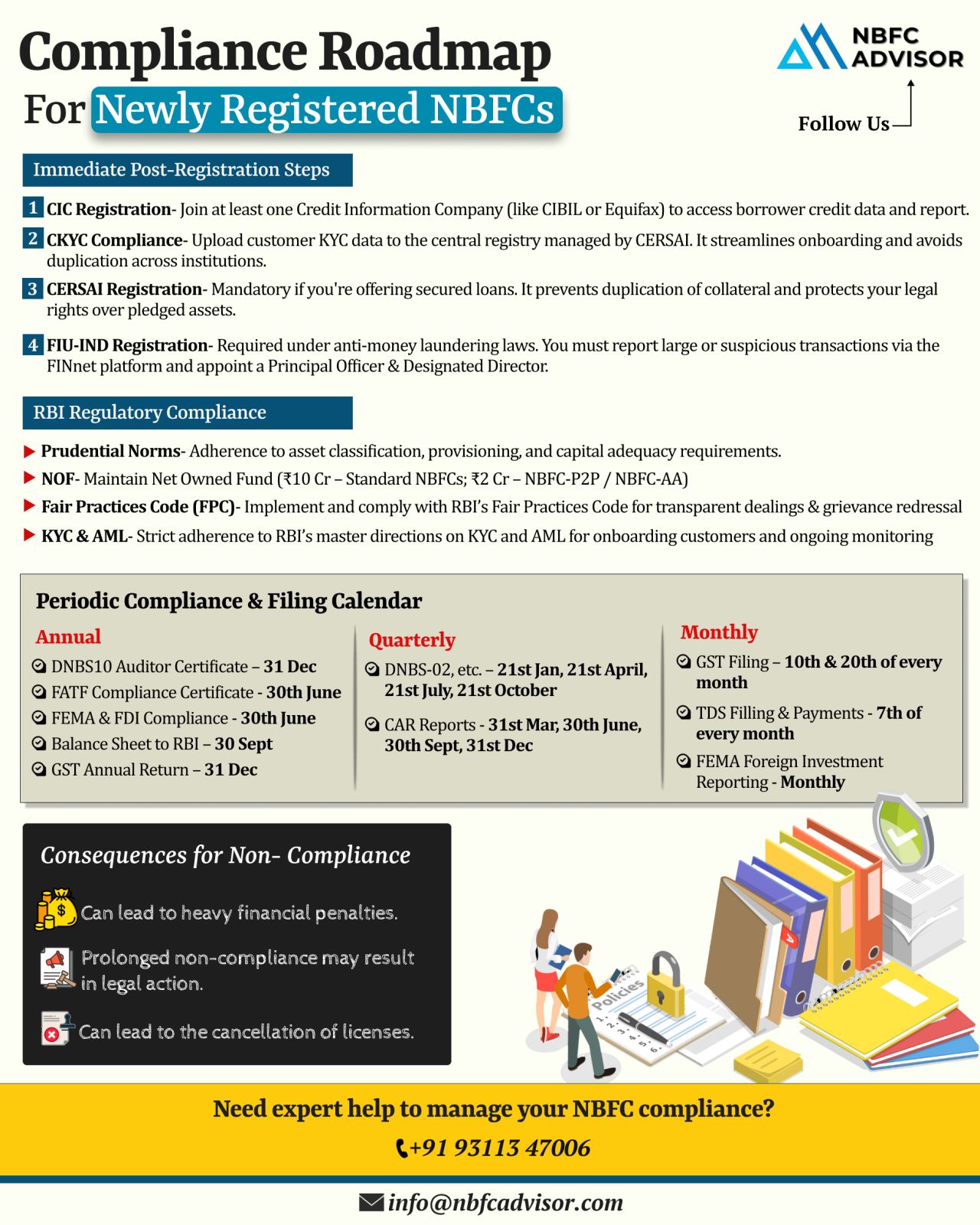

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

Why Fintechs are Surpassing NBFCs

The financial services industry is undergoing a major shift, and fintechs are rapidly overtaking NBFCs in terms of growth and innovation. The core reason lies in their approach—while NBFCs still depend on tr...

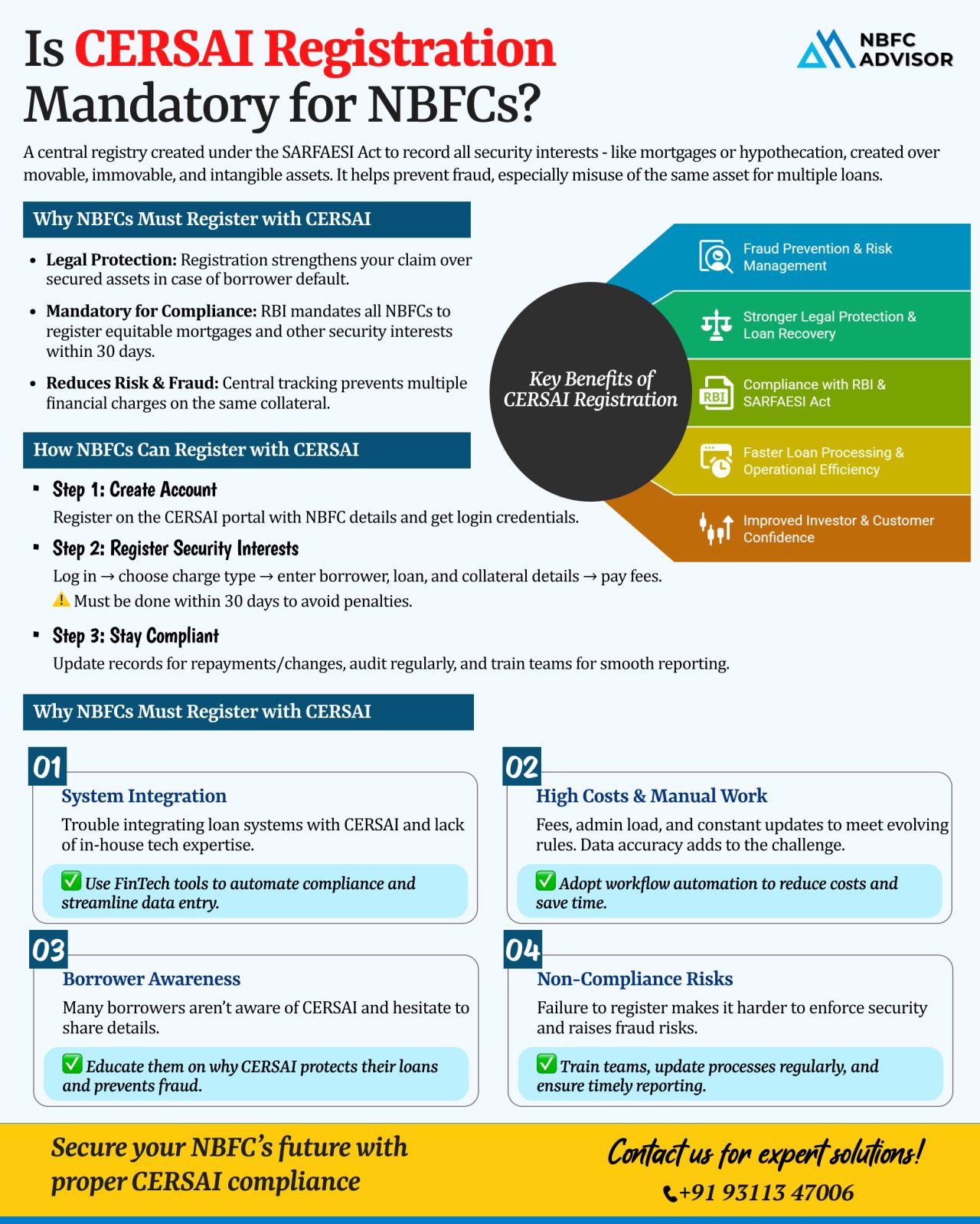

Is CERSAI Registration Compulsory for NBFCs?

A frequent compliance gap seen among NBFCs is neglecting CERSAI registration. While lenders are usually diligent about RBI directives and customer verification, many overlook this crucial step—whi...

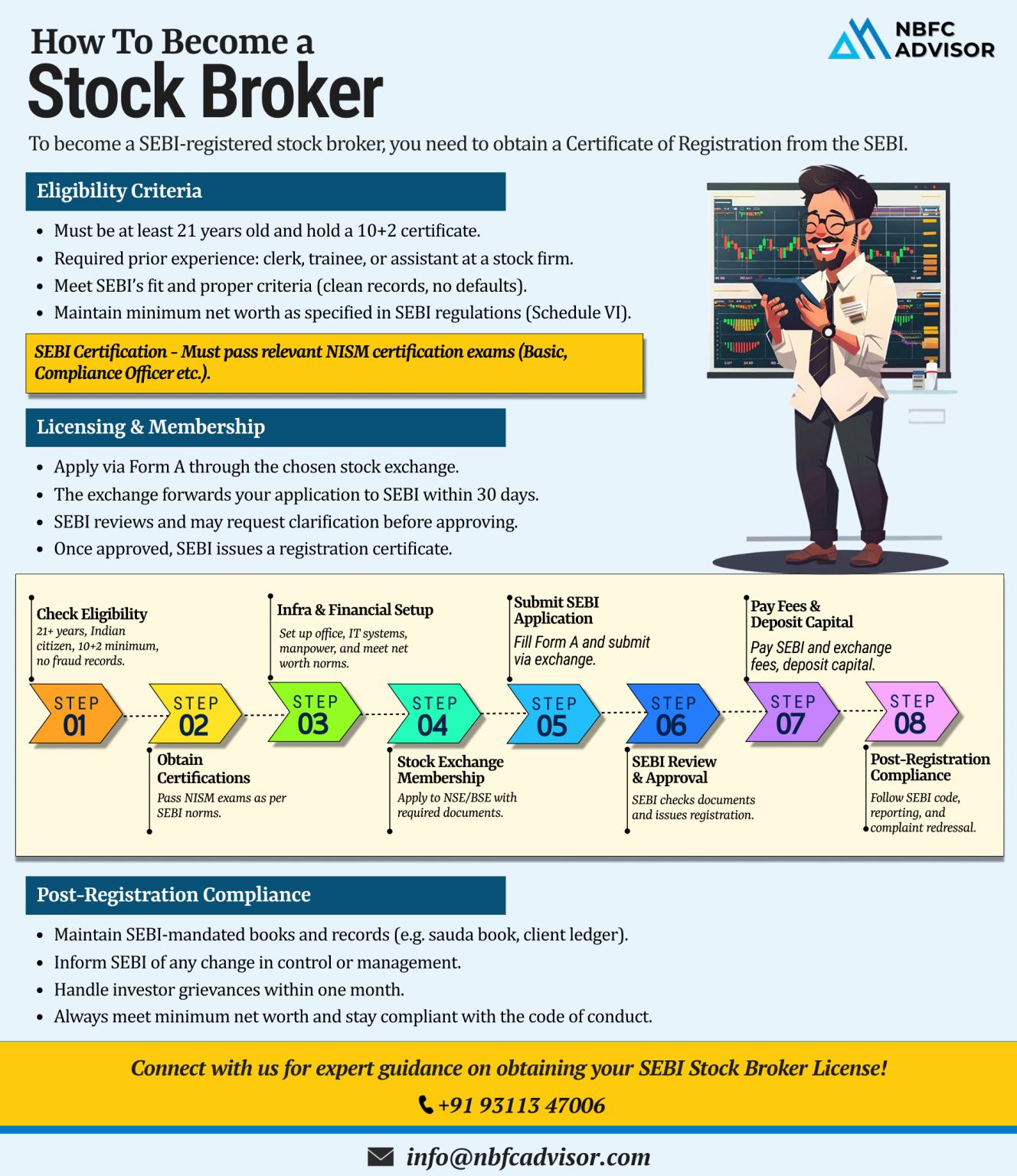

Want to Become a SEBI-Registered Stock Broker?

If you’re looking to enter India’s capital markets as a stock broker, obtaining a SEBI registration is a must. This license not only authorizes you to operate legally but also builds trust...

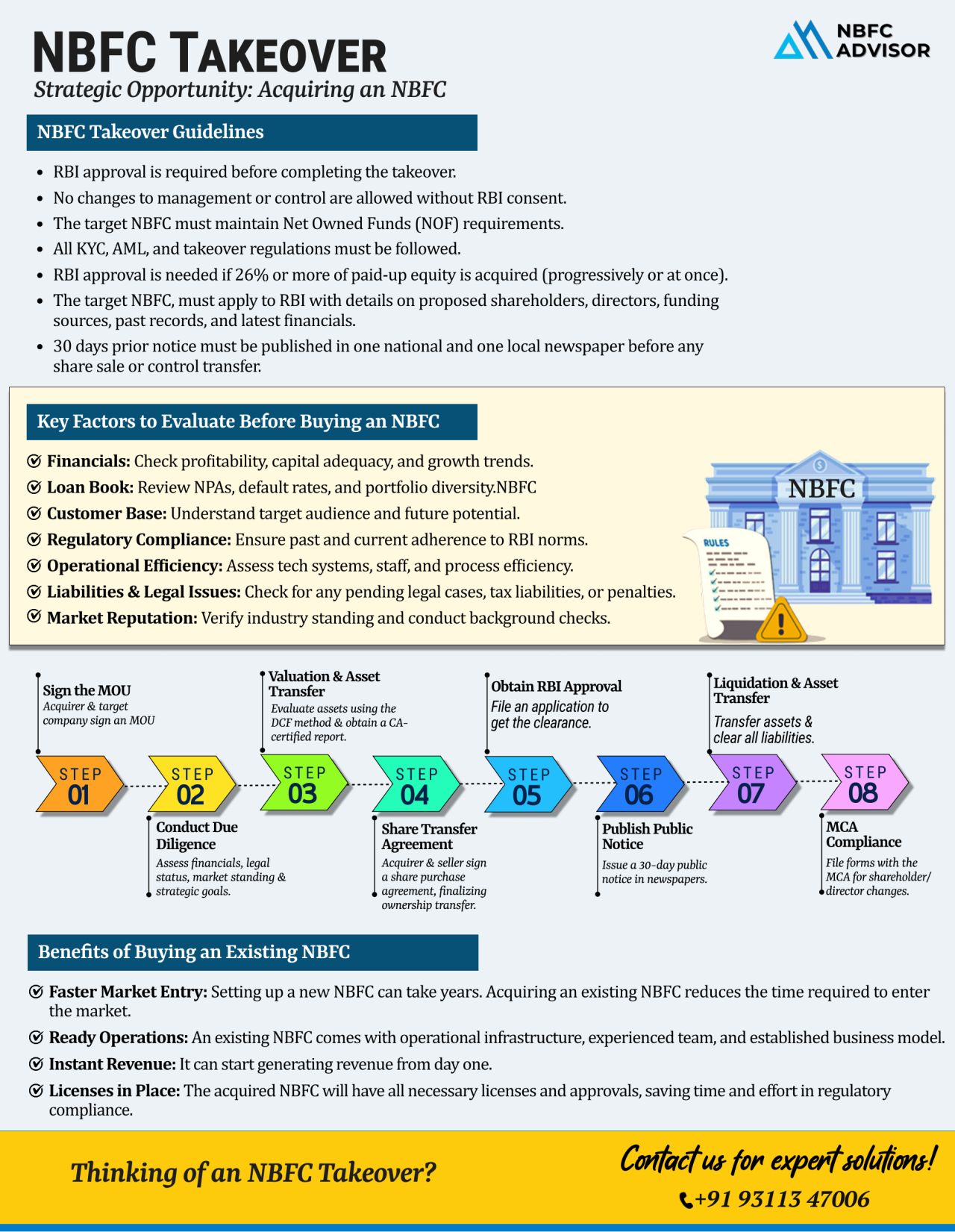

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

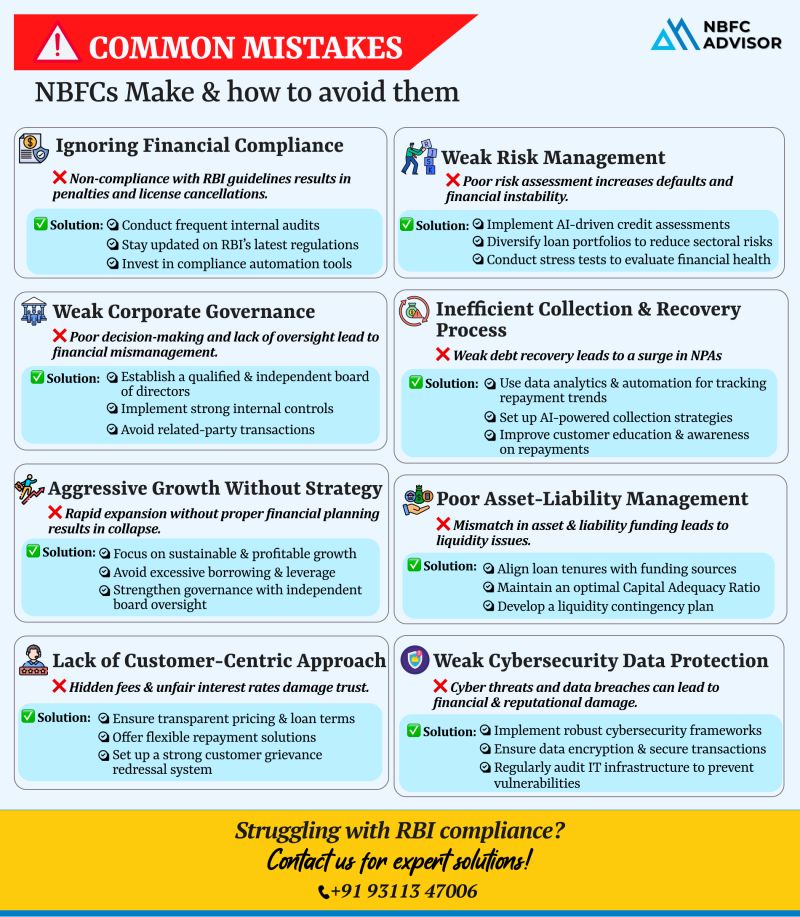

Is Your NBFC Making These Critical Mistakes?

The NBFC sector in India has seen impressive growth—but with that growth comes increased scrutiny from regulators like the RBI. Alarmingly, many NBFCs face operational hurdles, rising NPAs, or eve...

Blog Title: Top 10 Mistakes to Avoid When Registering an AIF

Setting up an Alternative Investment Fund (AIF) in India can open doors to diverse investment opportunities—but navigating the registration process with SEBI isn’t as straigh...

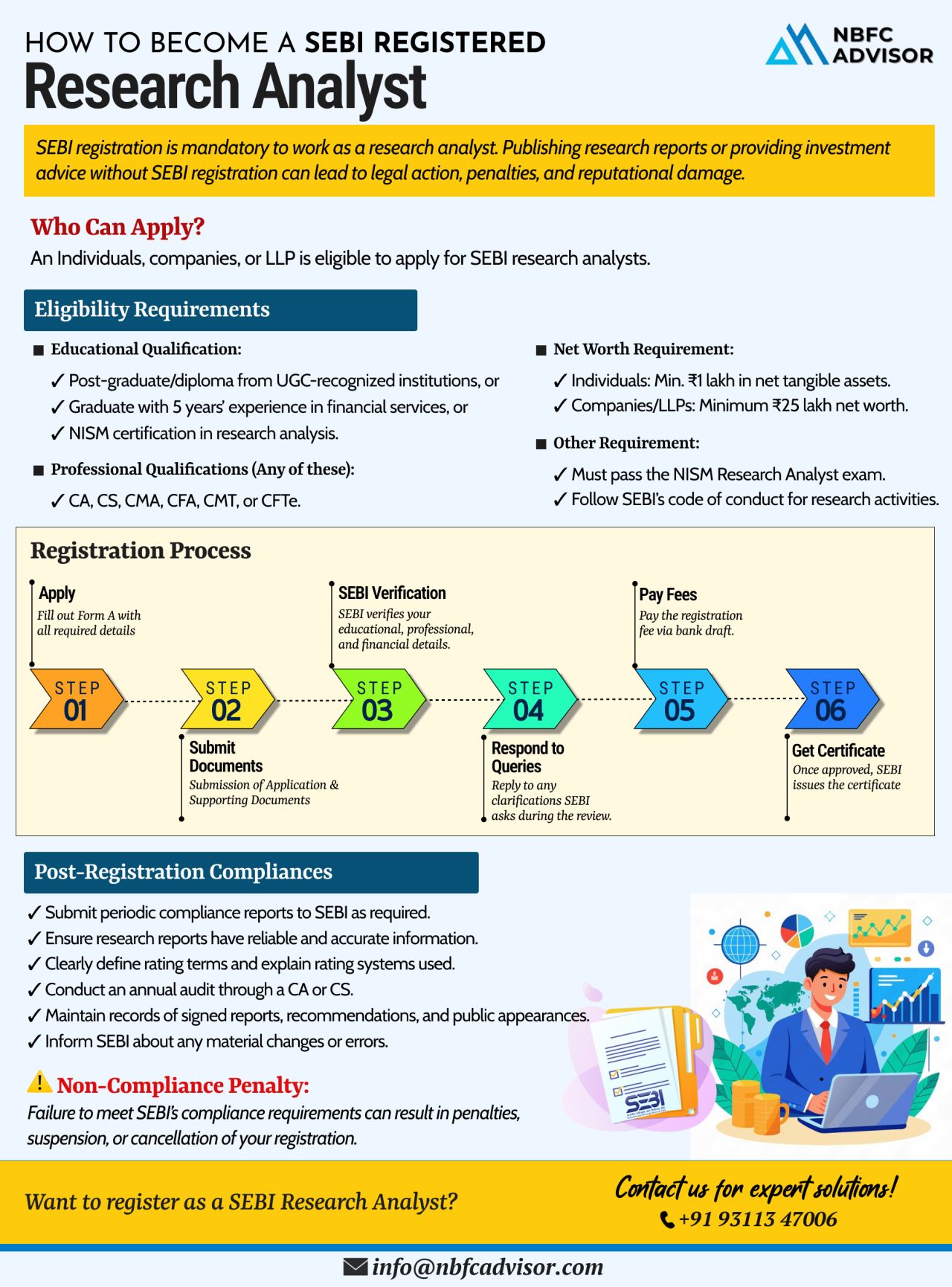

Are You Publishing Research Reports Without SEBI Registration?

That’s a fast track to penalties, suspension, and long-term reputational damage.

In today’s regulated financial ecosystem, SEBI registration is mandatory if you wish to wo...

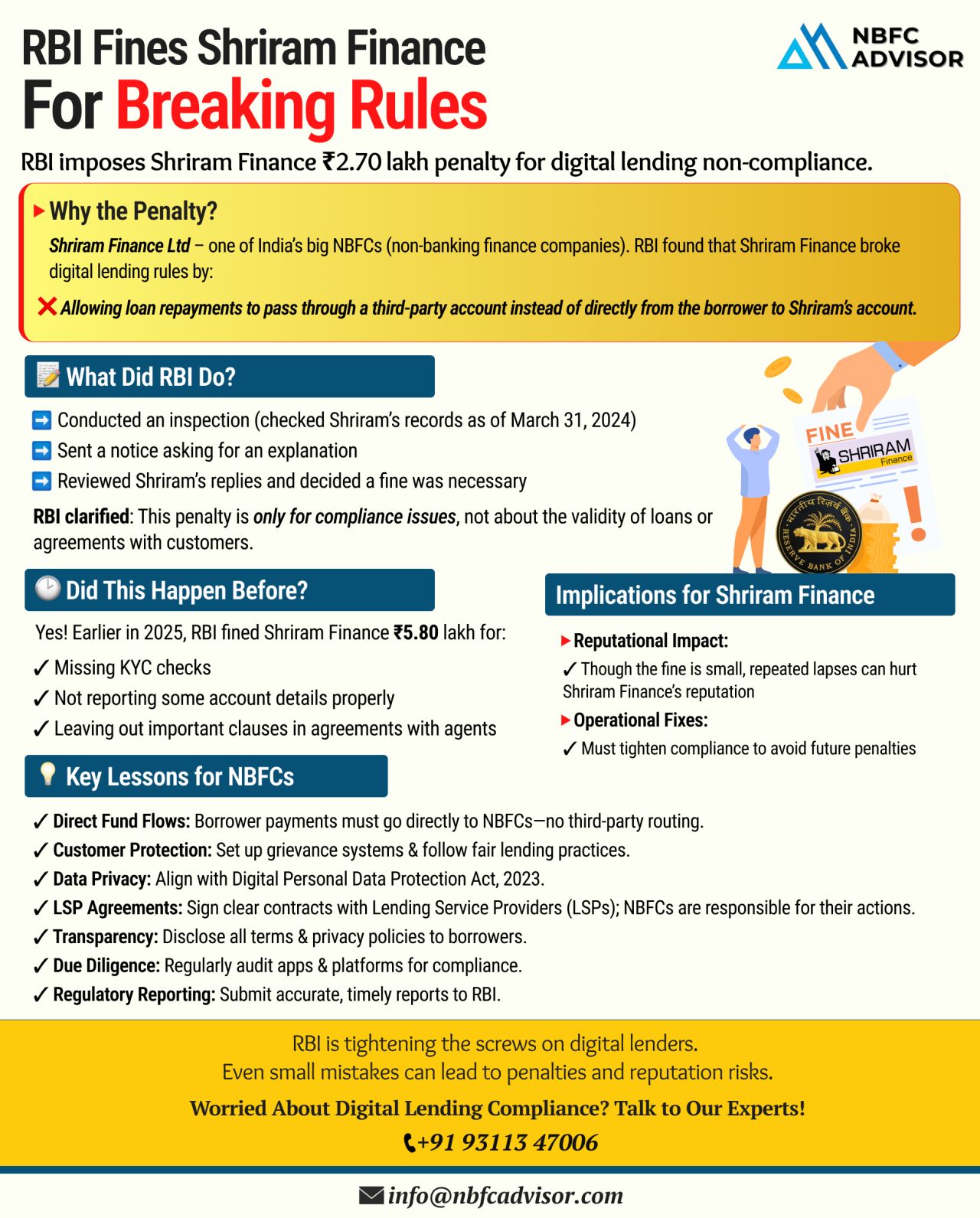

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

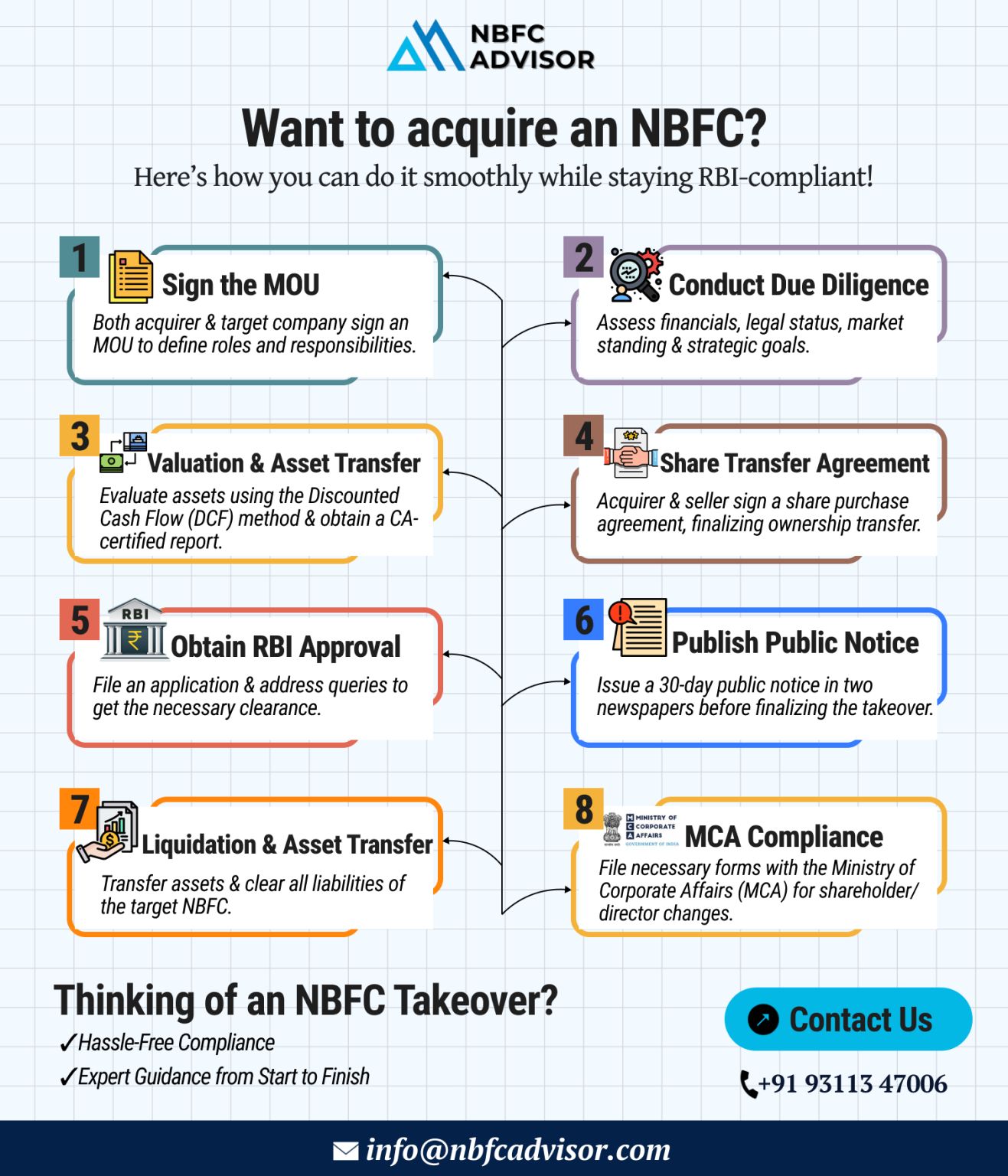

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

RBI to Tighten Supervisory Norms for NBFCs in FY26: What It Means for the Sector

The Reserve Bank of India (RBI) is preparing to introduce stricter supervisory regulations for Non-Banking Financial Companies (NBFCs) in the financial year 2025&ndas...

India’s Digital Lending Boom: Why Now Is the Time to Build Your Business

India’s digital lending landscape is expanding at a record pace — and the numbers tell a powerful story. By 2030, the market is projected to reach an incred...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘑𝘶𝘴𝘵 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Getting your NBFC license is a big milestone — but don’t relax just yet. Receiving RBI approval is only the first step in setting up your fin...

⚠️ NBFCs: It’s Time to Prepare for RBI’s NOF Deadline!

The Reserve Bank of India (RBI) has made its stance clear — it's time for NBFCs to ramp up their capital base!

Under the RBI’s Master Direction – NBFC (Sca...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

Starting a Non-Banking Financial Company (NBFC) in India can be a lucrative venture, but it requires compliance with stringent regulatory frameworks laid out by the Reserve Bank of India (RBI). At NBFC Registration, we make this process easier, ensur...

.png)