Hero FinCorp’s ₹3,668 Cr IPO: Implications for the NBFC Sector

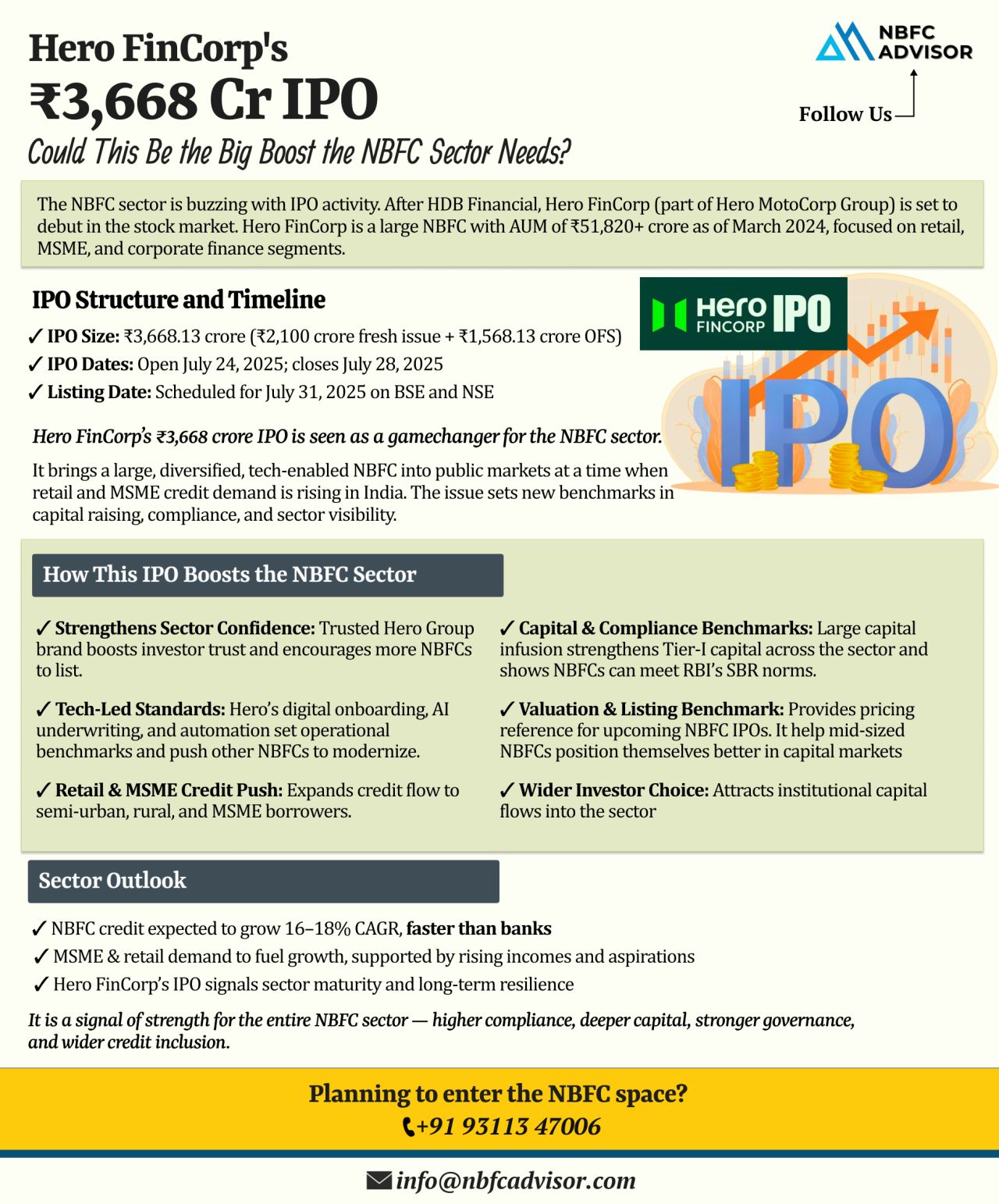

The Indian Non-Banking Financial Company (NBFC) sector is witnessing heightened IPO activity, reflecting growing investor confidence and sectoral growth. Following HDB Financial Services, Hero FinCorp is set to make its market debut with an IPO worth ₹3,668 crore.

(Earlier reports suggested the IPO might open on July 24, 2025, but the official date is yet to be confirmed.)

Why Hero FinCorp’s IPO is Significant

This IPO is important not only for Hero FinCorp but also for the broader NBFC ecosystem. Key impacts include:

-

Strengthening Capital Base: The IPO will boost Hero FinCorp’s capital in line with RBI guidelines, enabling the company to expand operations more effectively.

-

Highlighting Tech-Driven Lending: Investor interest and market scrutiny will encourage NBFCs to adopt innovative, technology-driven lending practices, enhancing operational efficiency.

-

Driving Retail & MSME Credit Growth: With increased capital, NBFCs can extend more credit to retail borrowers and MSMEs, fueling economic activity.

-

Establishing Valuation Benchmarks: Hero FinCorp’s IPO will set a precedent for the valuation of future NBFC listings, guiding both investors and upcoming companies.

NBFC Sector Outlook

NBFC credit is expected to grow at a 16–18% CAGR, outpacing traditional banks. Hero FinCorp’s IPO demonstrates sector maturity and confidence, and it may encourage other NBFCs to explore public market listings in the near future.

Planning Your NBFC Journey

Could this IPO trigger more NBFCs to plan their market debut? With the sector gaining momentum, now is an opportune time for companies to strategize for growth.

If you are looking to enter or expand in the NBFC space, get expert guidance on registration, compliance, and strategic planning. Contact us for a free consultation.

📞 +91 93113 47006

Hashtags:

#NBFCAdvisor #HeroFinCorp #IPO #NBFC #Finance #MSME #StockMarket #NBFCRegistration #NBFCtakeover