Regulatory Compliance Services – Building a Legally Strong & Trusted Business

In today’s fast-evolving regulatory environment, regulatory compliance is no longer optional—it is essential for business continuity, credibility, ...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

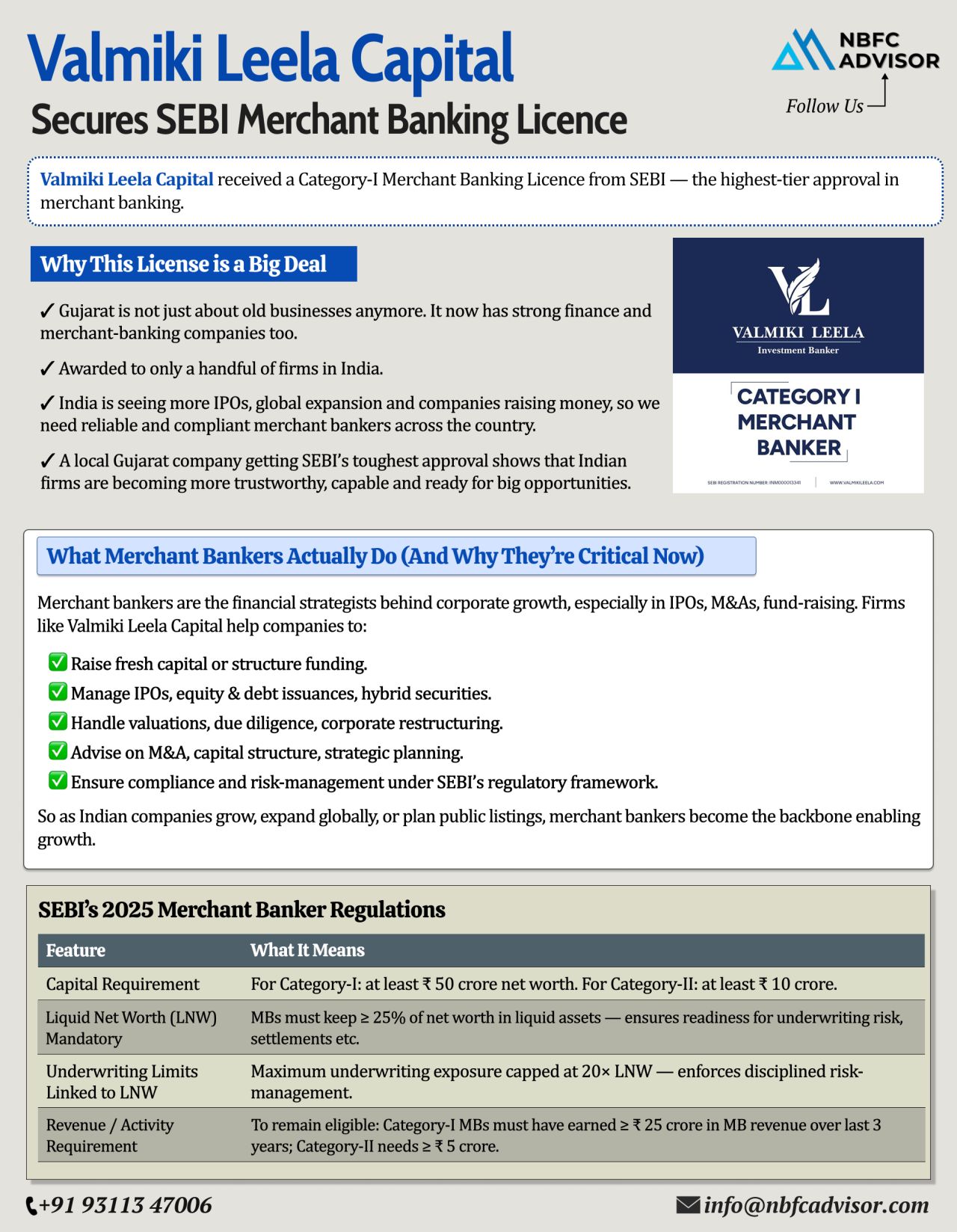

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

SEBI Just Reclassified REITs as Equity — And It Changes Everything

SEBI has officially reclassified Real Estate Investment Trusts (REITs) as equity investments — a landmark regulatory shift that will reshape how institutions and invest...

Gujarat Just Proved Everyone Wrong — And It’s a Big Win for India’s Financial Future

For decades, Gujarat has been known for its entrepreneurial spirit — but mostly in textiles, jewellery, and traditional family businesses....

Compliance Gaps Can Break Your Business: Why NBFCs Must Stay Ahead of RBI Regulations

In today’s financial landscape, compliance is no longer optional.

With the Reserve Bank of India (RBI) tightening its oversight, even well-managed NBFCs a...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Why Fintechs are Surpassing NBFCs

The financial services industry is undergoing a major shift, and fintechs are rapidly overtaking NBFCs in terms of growth and innovation. The core reason lies in their approach—while NBFCs still depend on tr...

𝐑𝐁𝐈 𝐔𝐩𝐝𝐚𝐭𝐞: 𝐒𝐭𝐫𝐢𝐜𝐭𝐞𝐫 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐍𝐨𝐫𝐦𝐬 𝐀𝐫𝐞 𝐇𝐞𝐫𝐞 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐑𝐞𝐚𝐝𝐲?

India’s digital lending landscape is evolving fast, driven by technology and rising demand. But...

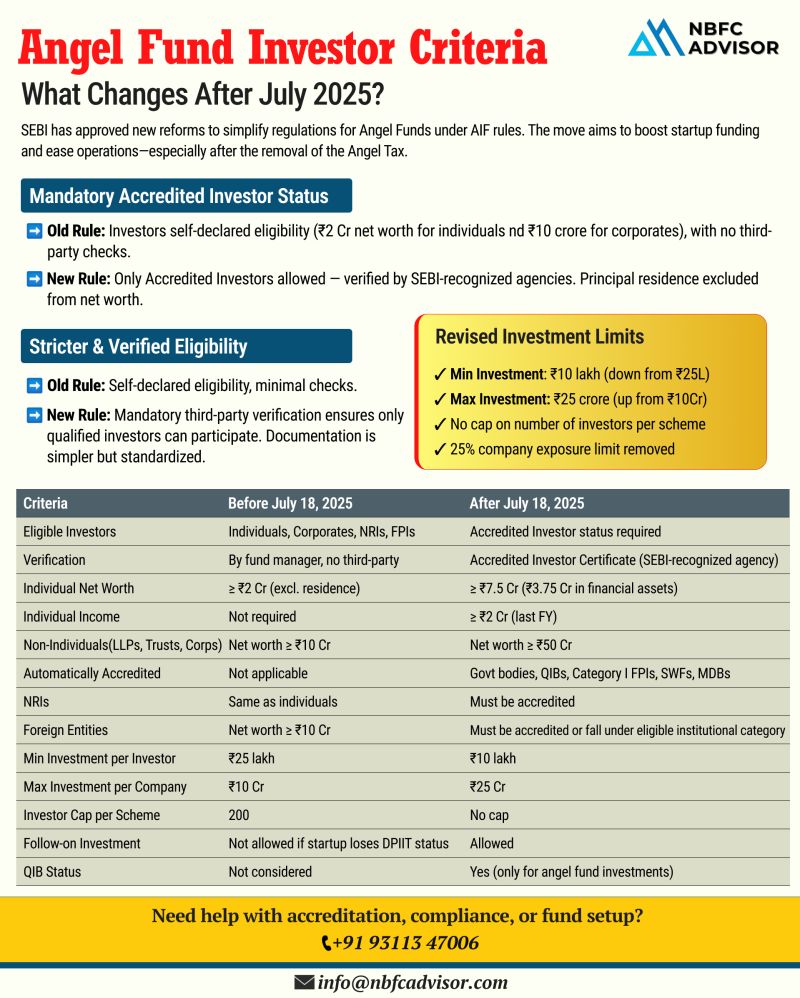

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘦𝘨𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘳𝘦 𝘌𝘷𝘰𝘭𝘷𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘗𝘳𝘦𝘱𝘢𝘳𝘦𝘥?

Starting July 2025, the rules governing Angel Funds in India are undergoing a major overhaul.

These fresh guidelines from SEBI aim to bri...