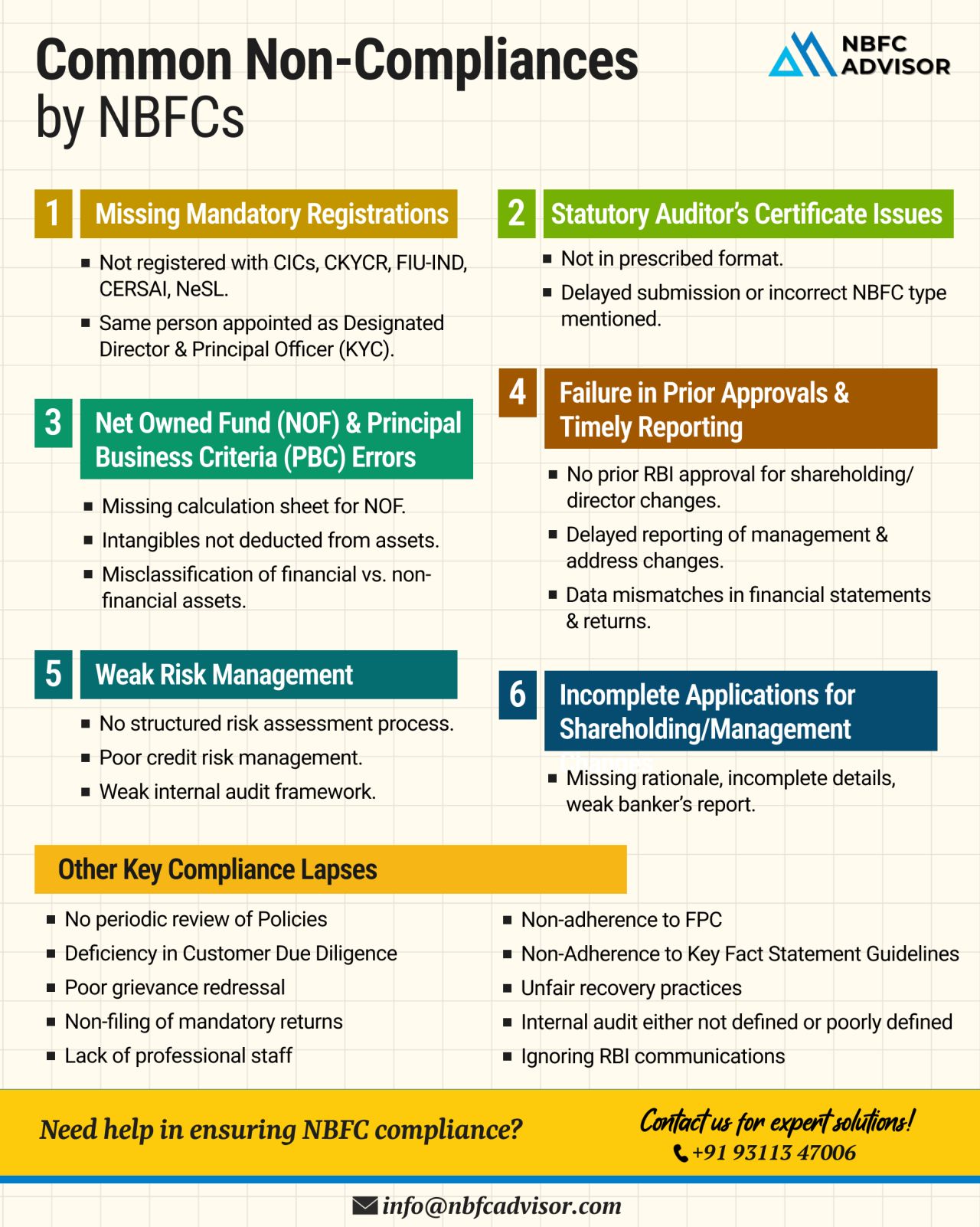

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

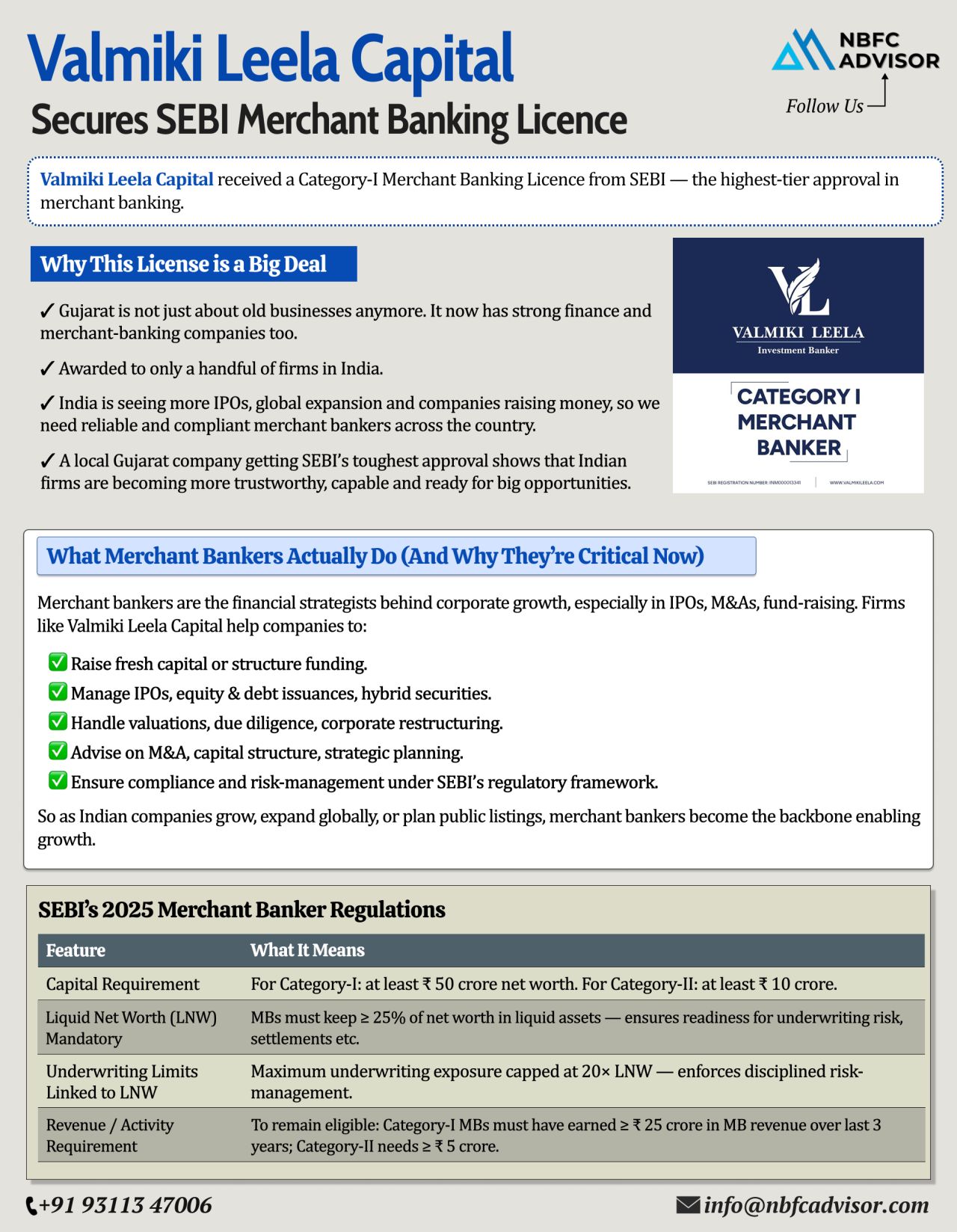

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

Is Your NBFC Really Compliant? Here’s What You Need to Know

The Reserve Bank of India (RBI) has been tightening its regulatory framework around Non-Banking Financial Companies (NBFCs), and the impact is clear — several NBFCs have lost ...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

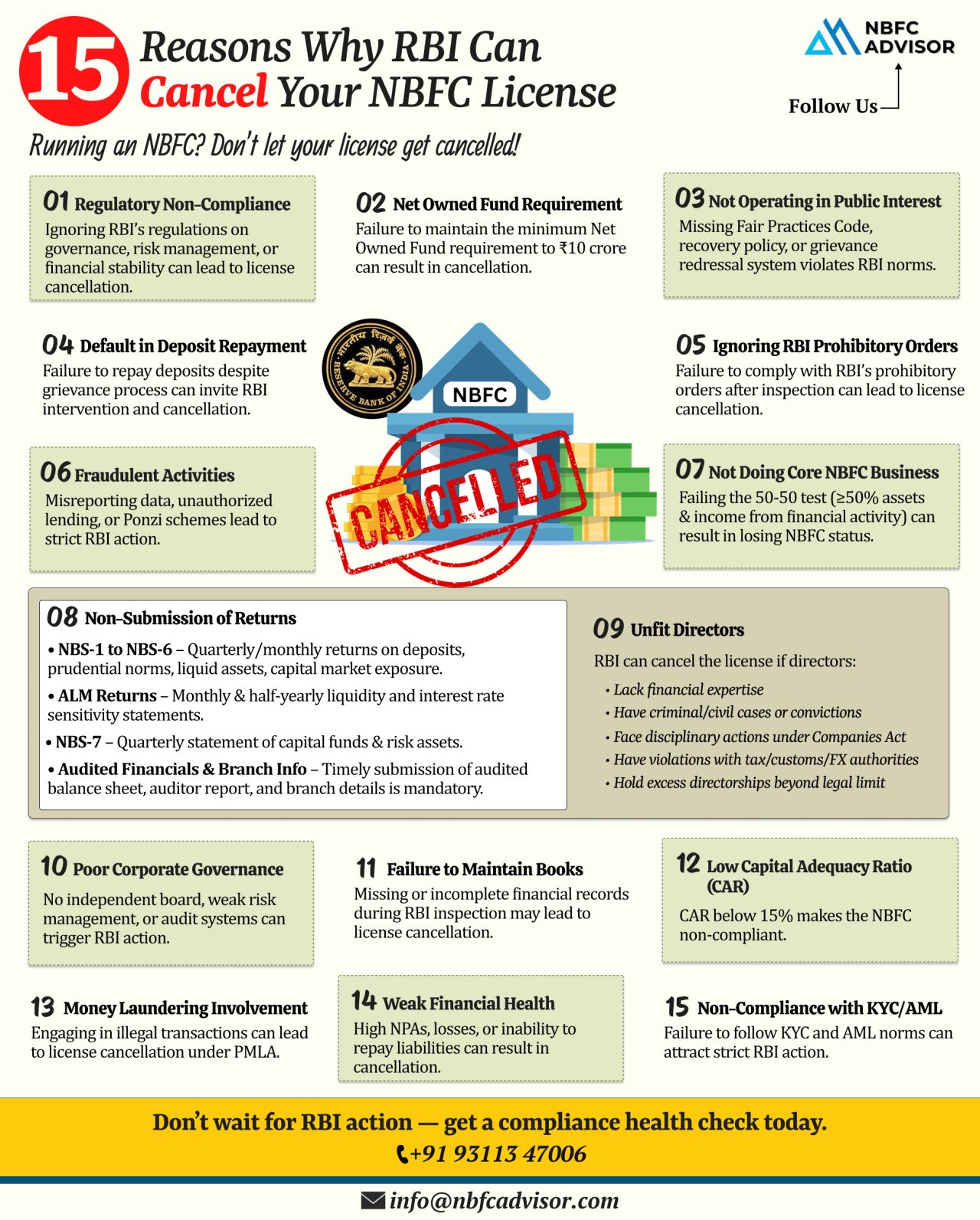

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

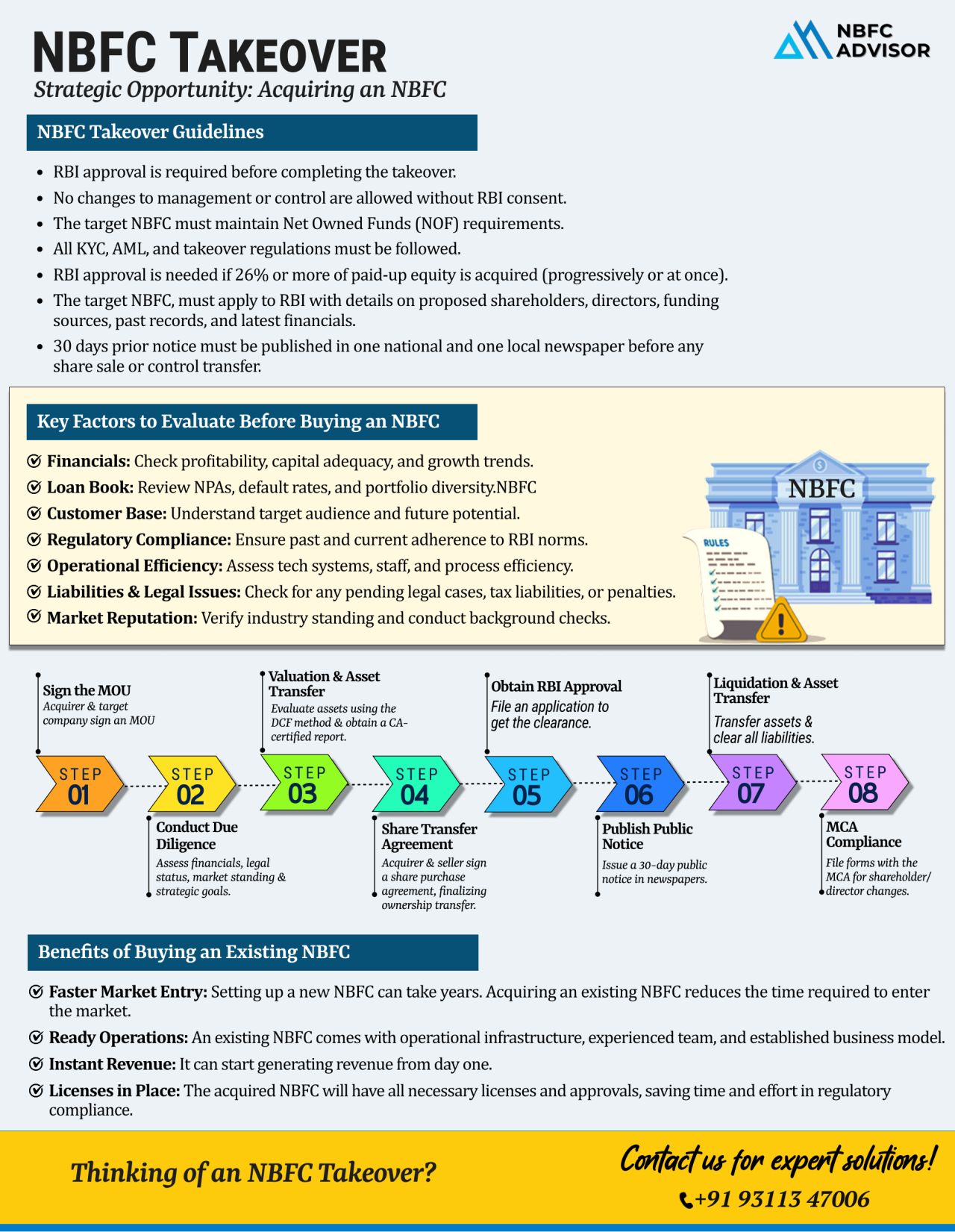

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

Blog Title: Top 10 Mistakes to Avoid When Registering an AIF

Setting up an Alternative Investment Fund (AIF) in India can open doors to diverse investment opportunities—but navigating the registration process with SEBI isn’t as straigh...

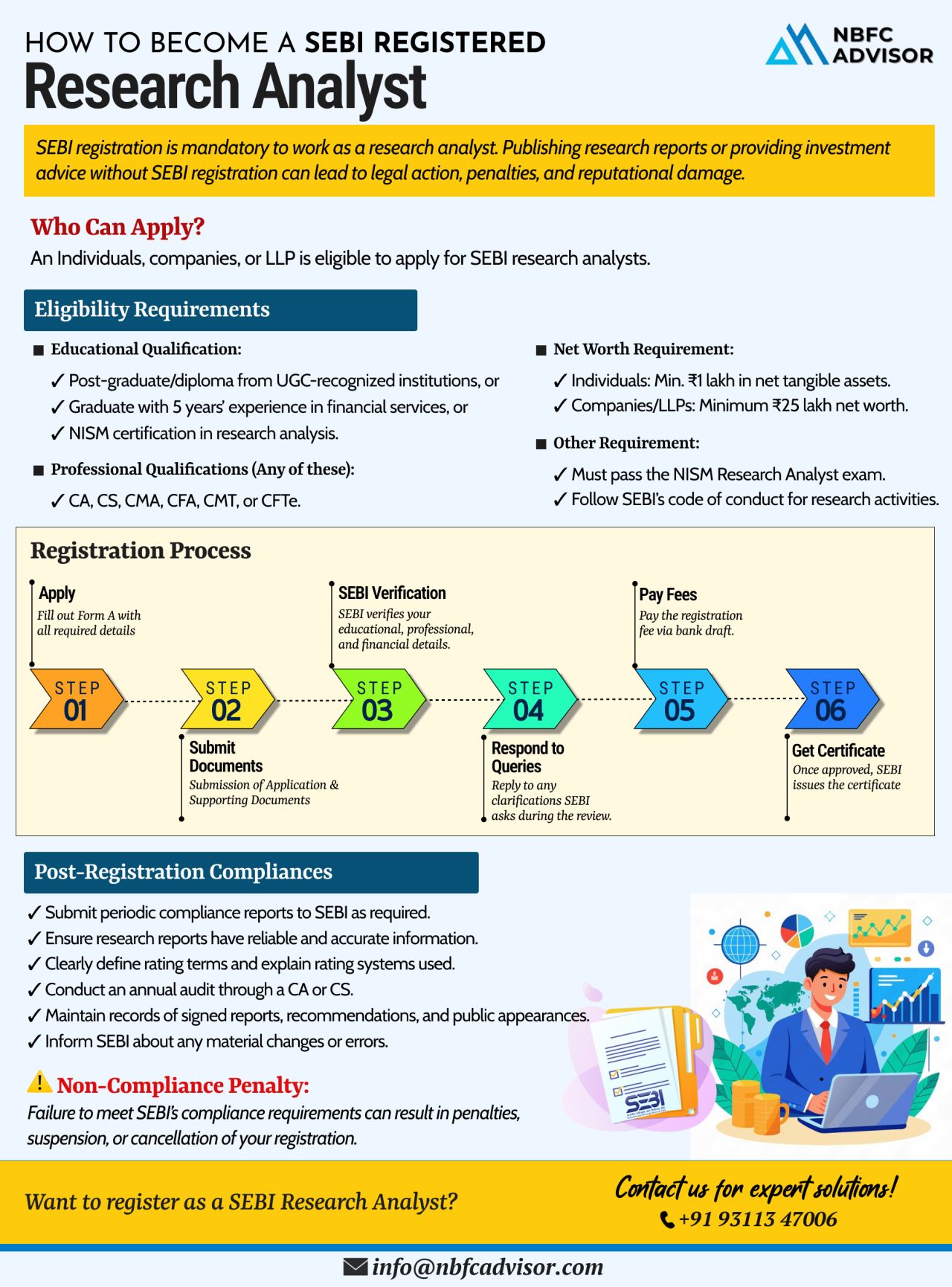

Are You Publishing Research Reports Without SEBI Registration?

That’s a fast track to penalties, suspension, and long-term reputational damage.

In today’s regulated financial ecosystem, SEBI registration is mandatory if you wish to wo...

⚠️ Is Your NBFC Vulnerable to RBI Action?

With increasing regulatory scrutiny, the Reserve Bank of India (RBI) is taking strict action against Non-Banking Financial Companies (NBFCs) that fail to comply with its guidelines. From financia...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)

.png)