Regulatory Compliance Services – Building a Legally Strong & Trusted Business

In today’s fast-evolving regulatory environment, regulatory compliance is no longer optional—it is essential for business continuity, credibility, ...

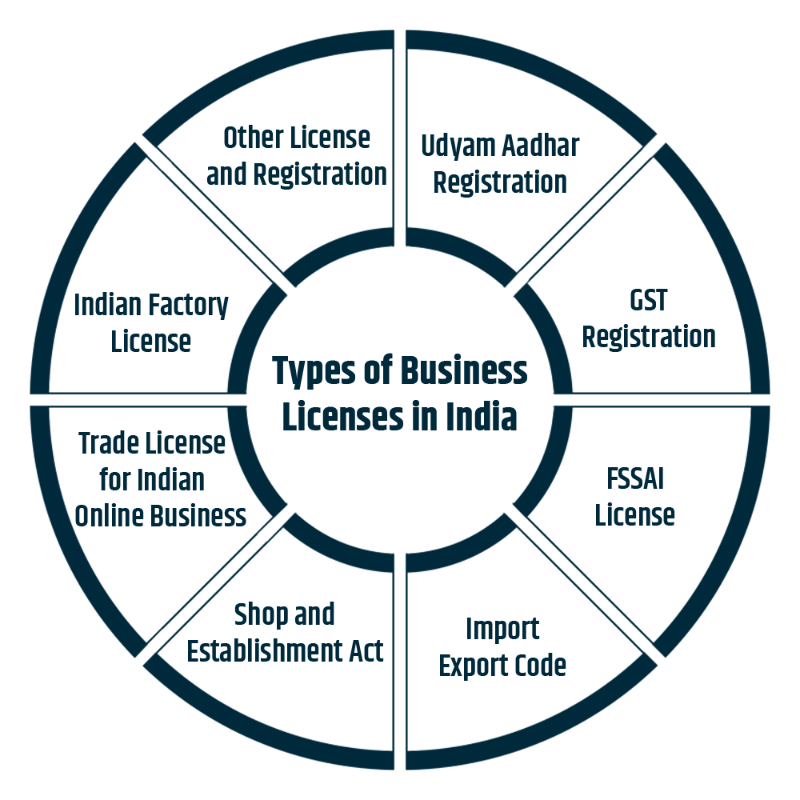

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

What Are Regulatory Compliance Services?

Regulatory compliance services ensure that a business adheres to all applicable laws, rules, guidelines, and regulations issued by government and regulatory bodies. These services cover ongoing legal, finan...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

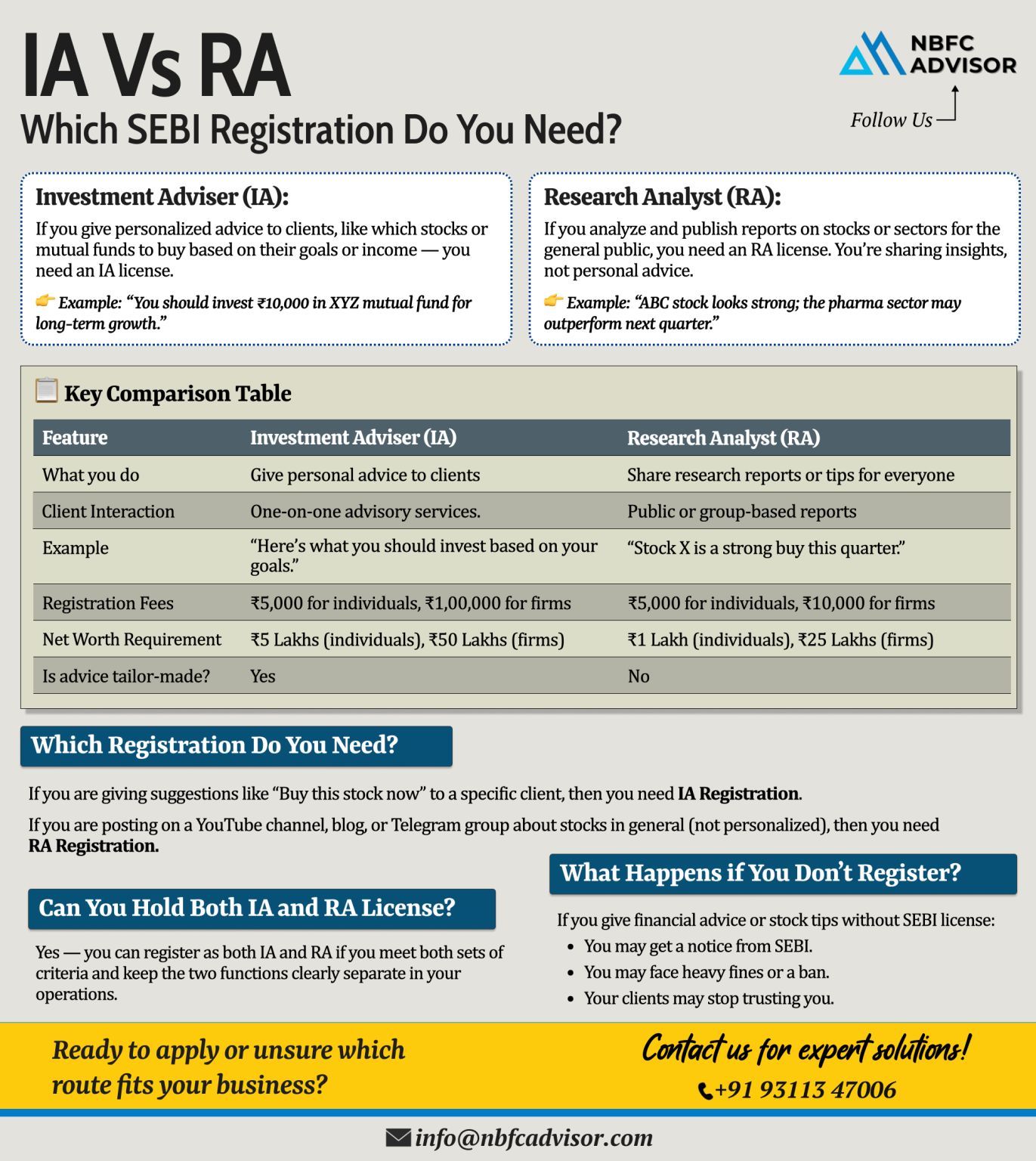

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

Want to Register Your NBFC Faster? Here’s What Most Founders Miss

Starting an NBFC (Non-Banking Financial Company) can be one of the most exciting ventures for any entrepreneur in the finance sector. But here’s the reality — most...

Thinking of Starting a Digital Lending Business? Here’s Why Now is the Right Time

India’s financial landscape is transforming faster than ever before. With fintech innovation and digital infrastructure evolving rapidly, the digital len...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

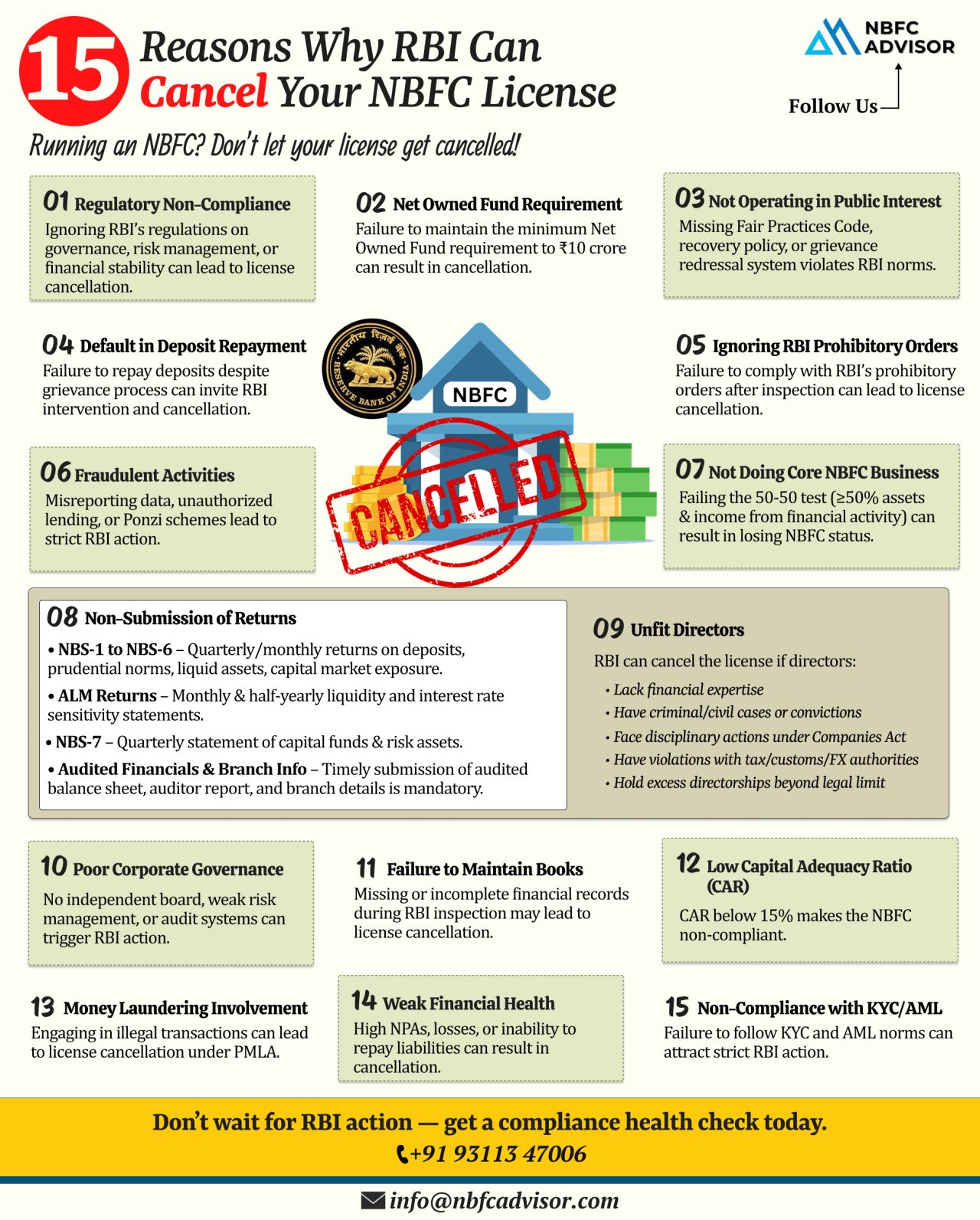

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

Why Fintechs are Surpassing NBFCs

The financial services industry is undergoing a major shift, and fintechs are rapidly overtaking NBFCs in terms of growth and innovation. The core reason lies in their approach—while NBFCs still depend on tr...

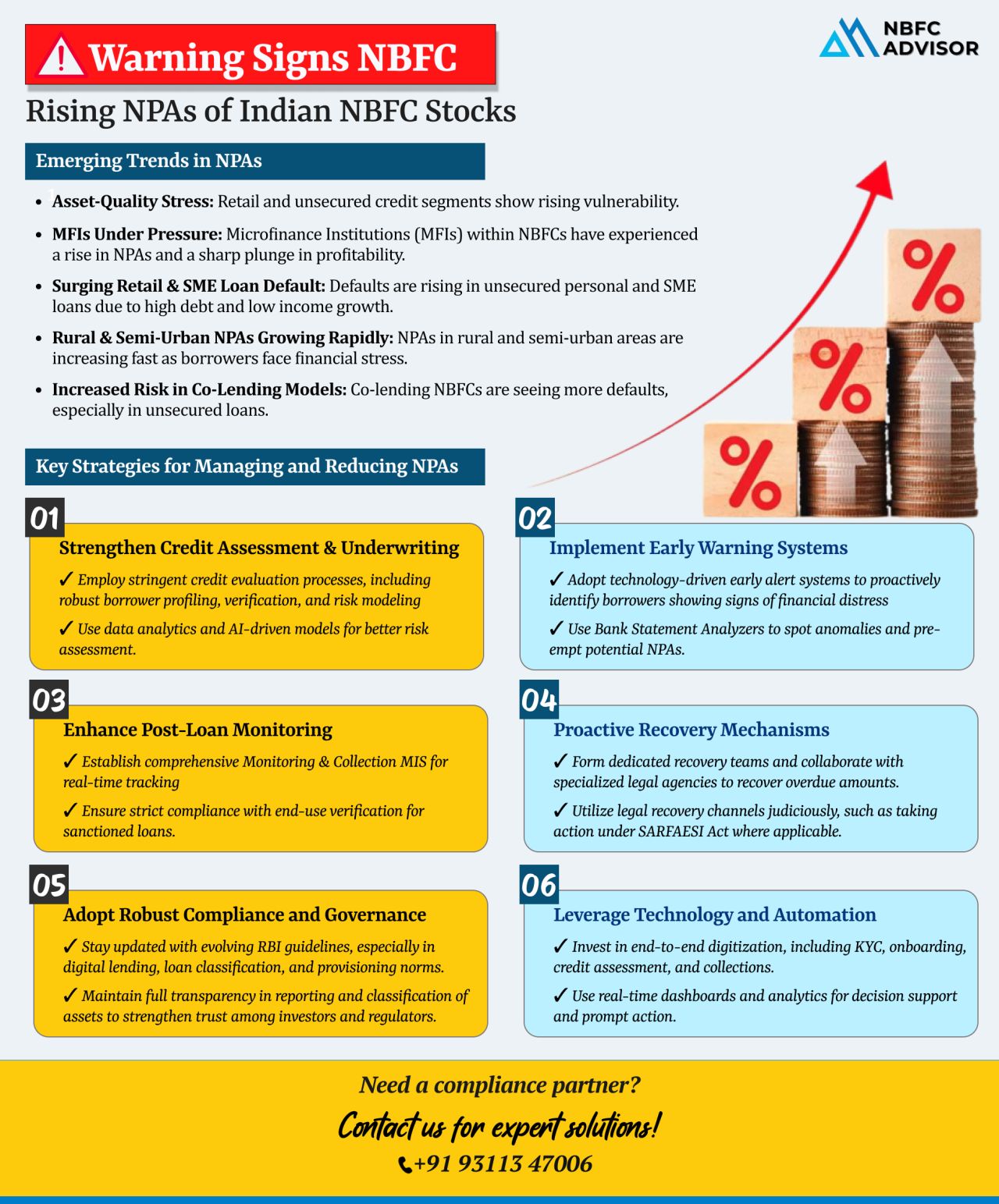

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

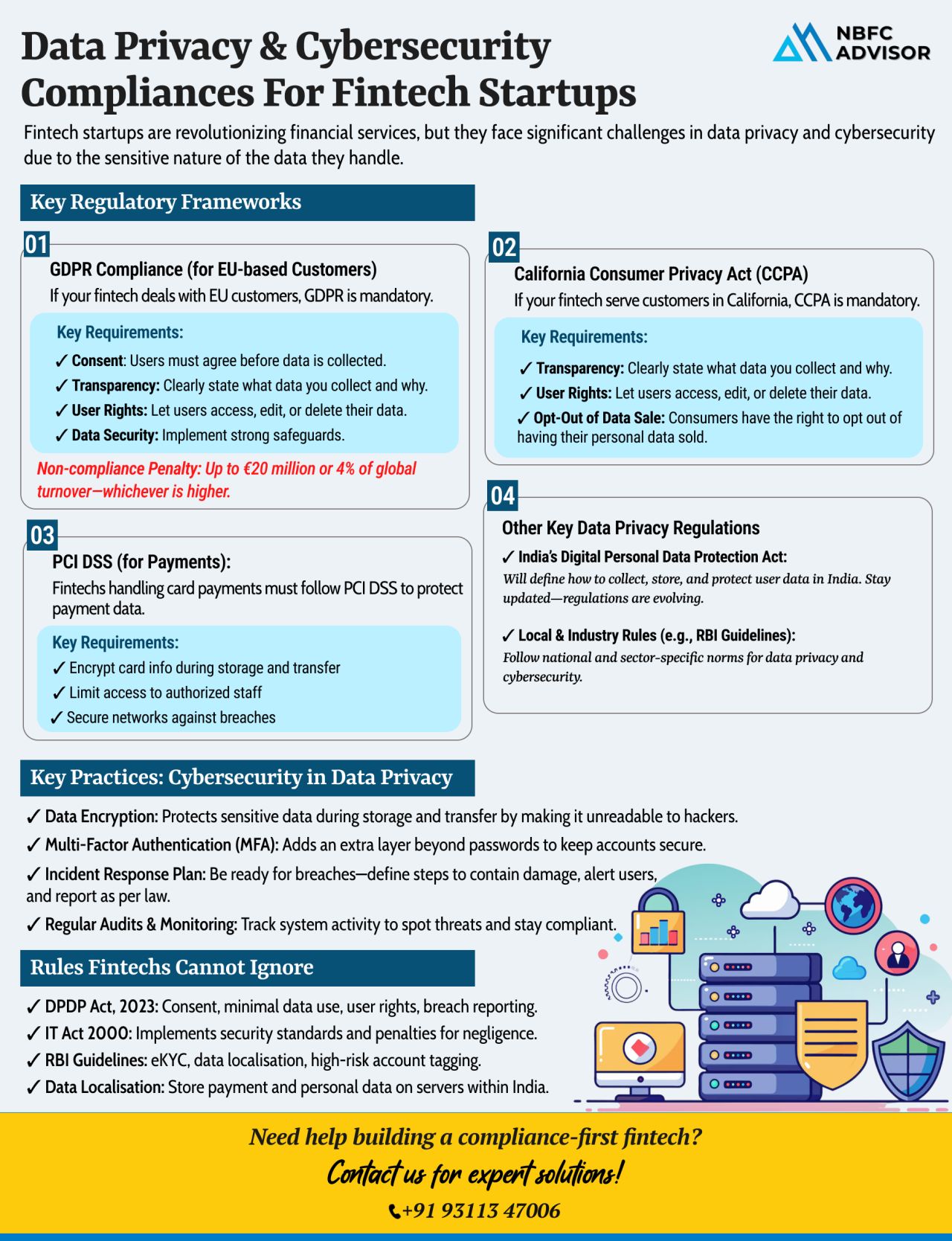

Launching a Fintech? One Data Breach Could Derail Everything

Building a fintech startup is an exciting journey—but with great innovation comes greater responsibility. In the world of digital finance, data protection and cybersecurity complia...

RBI’s Officer Training Program: Ushering in a New Era of Digital Finance & Compliance

The Reserve Bank of India (RBI) is preparing for the future of India’s financial ecosystem with a comprehensive officer training initiative in Hy...

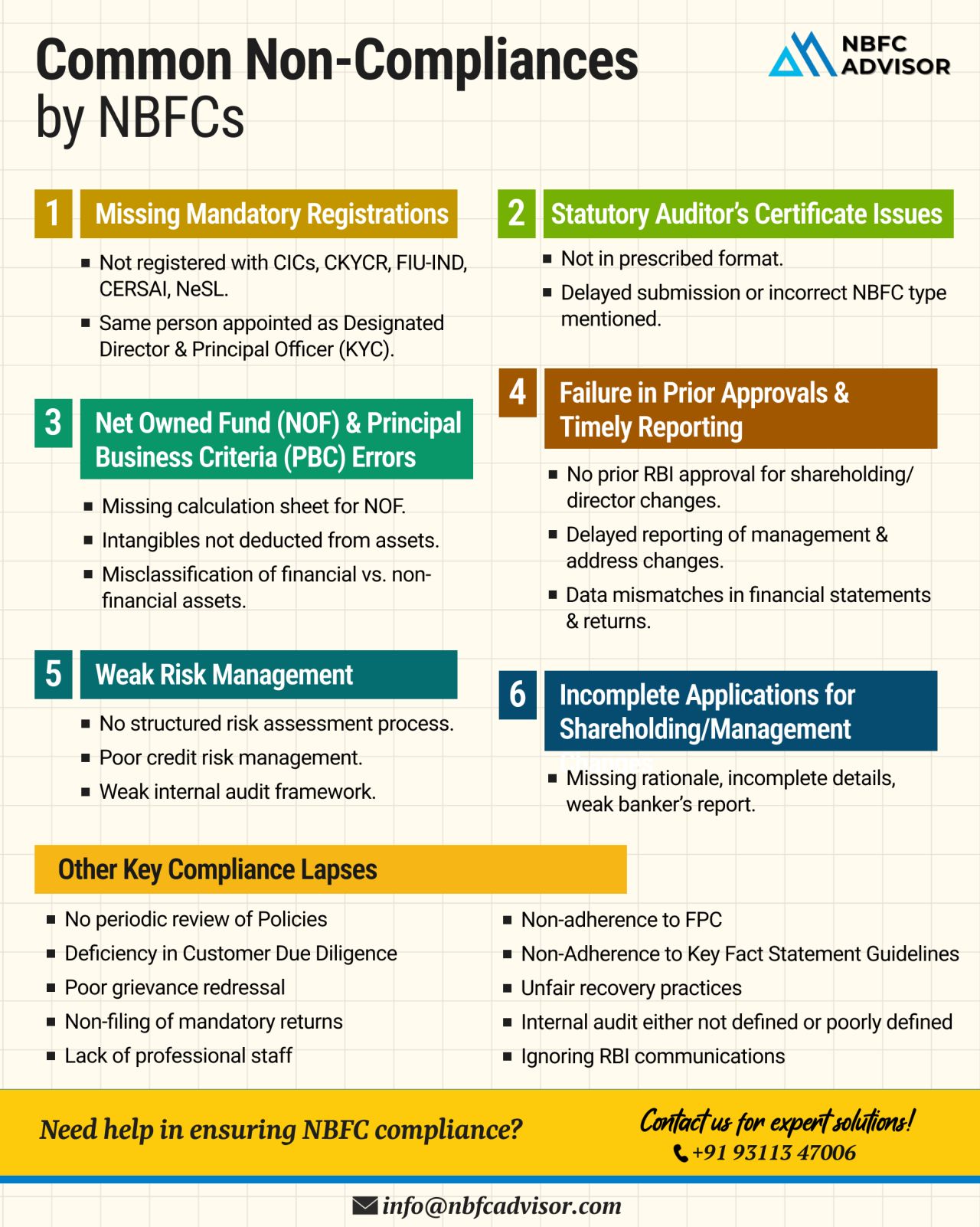

⚠️ Is Your NBFC Vulnerable to RBI Action?

With increasing regulatory scrutiny, the Reserve Bank of India (RBI) is taking strict action against Non-Banking Financial Companies (NBFCs) that fail to comply with its guidelines. From financia...

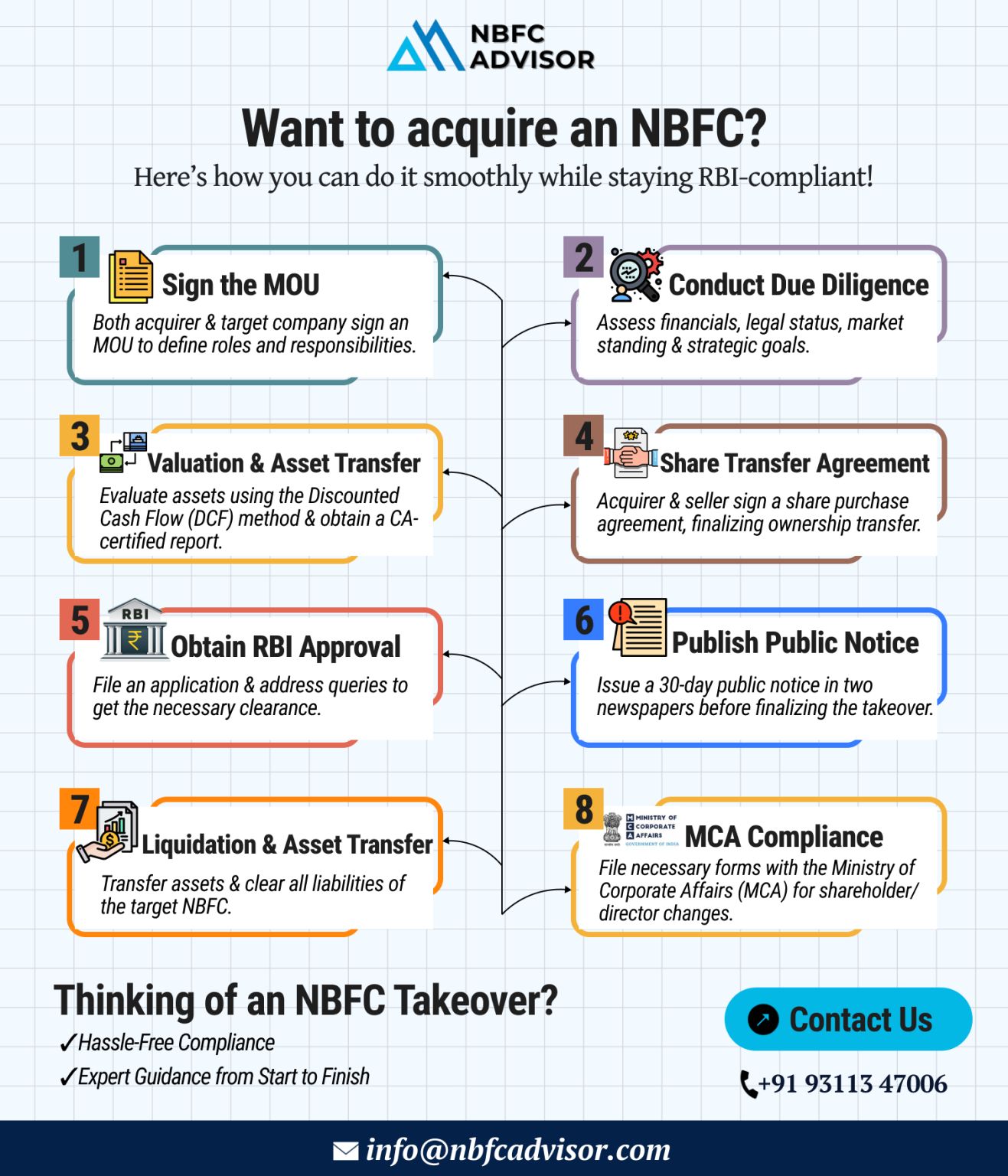

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

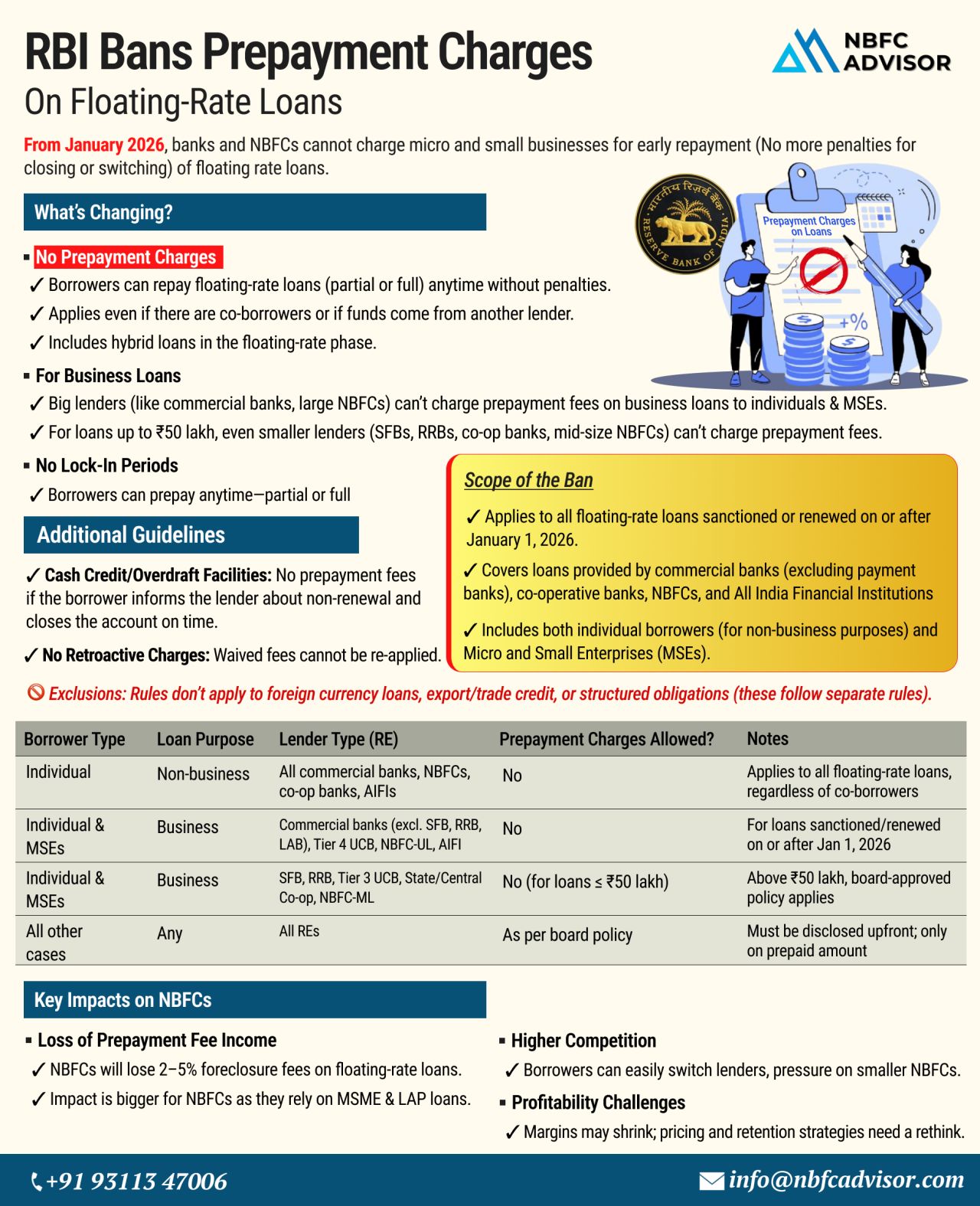

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)