Payment Gateway vs Payment Aggregator: Which One Fits Your Business Better?

As online payments continue to grow in India, choosing the right payment infrastructure has become a strategic decision. A smooth, fast, and secure checkout is essential — especially when 68% of customers abandon their cart due to complicated payment flows.

Your payment setup affects everything:

customer experience, transaction fees, compliance, scalability, and cash flow.

But should your business choose a Payment Gateway or a Payment Aggregator?

Let’s break it down.

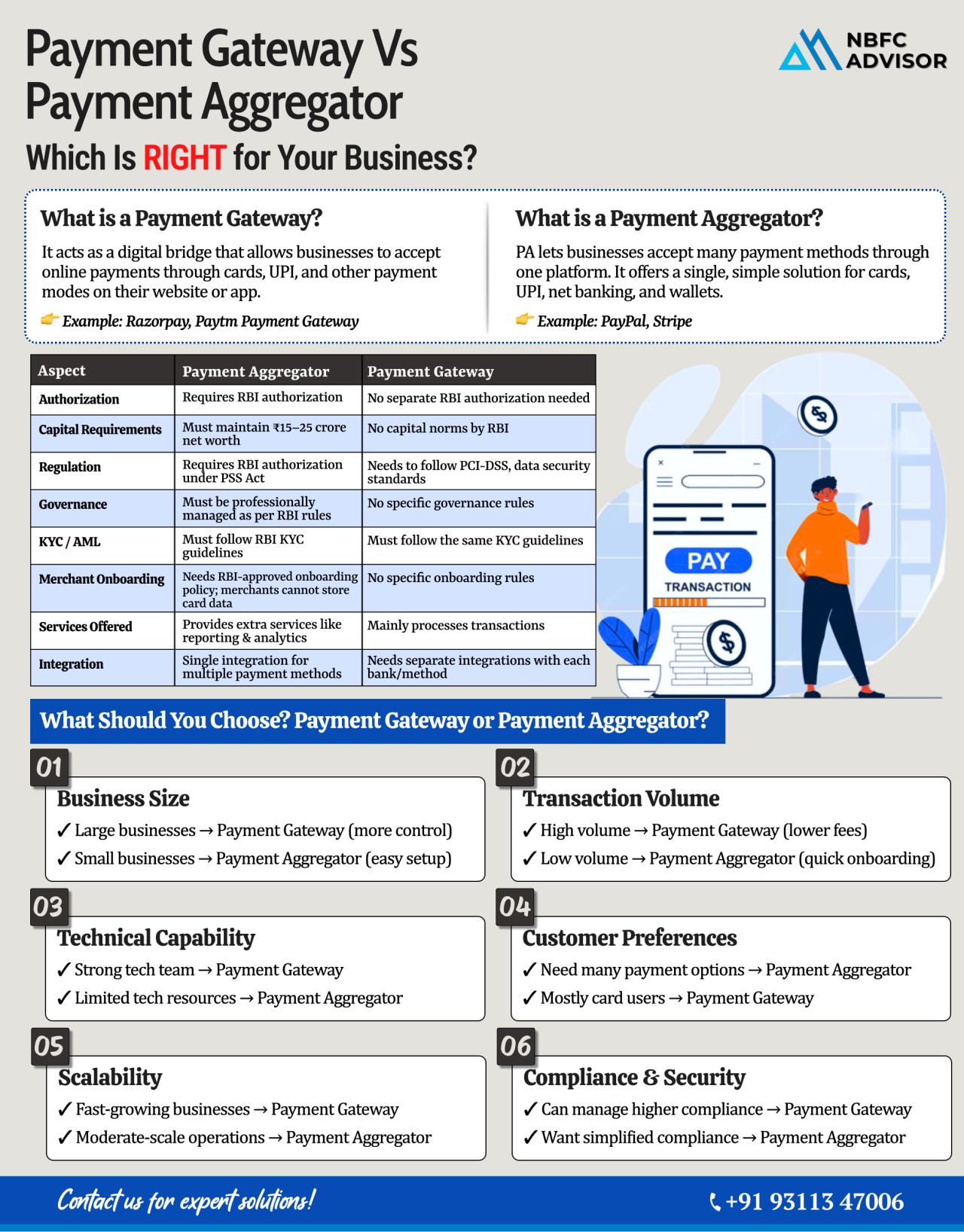

What Is a Payment Gateway?

A Payment Gateway is a technology platform that connects your website/app directly to banks and payment networks. You usually need your own merchant account to use it.

Pros

-

✔ Greater control over transactions

-

✔ Lower fees at scale

-

✔ Better for businesses with high volumes

-

✔ Customizable checkout and reporting

Cons

-

✘ Requires more setup effort

-

✘ Involves compliance & documentation

-

✘ Needs technical integration and support

What Is a Payment Aggregator?

A Payment Aggregator (like Razorpay, PayU, Cashfree) allows businesses to accept online payments without creating their own merchant account. You operate under the aggregator’s umbrella.

Pros

-

✔ Quick onboarding

-

✔ Single integration for multiple payment modes

-

✔ Ideal for startups, SMEs, and new businesses

-

✔ No heavy compliance burden

Cons

-

✘ Slightly higher transaction fees

-

✘ Less control over settlement cycle and custom flows

Gateway vs Aggregator: Which Should You Choose?

✔ Large or fast-growing business → Payment Gateway

You get more control, scalability, and lower long-term fees.

✔ Small or mid-size business → Payment Aggregator

Easy onboarding and minimal setup make it perfect for SMEs.

✔ High-volume user → Payment Gateway

Better pricing and operational efficiency.

✔ Businesses needing multiple payment modes → Payment Aggregator

UPI, cards, wallets, netbanking — all in one place.

What Really Matters?

Before choosing your payment setup, evaluate:

-

Your transaction volume

-

Your tech capability

-

Your compliance readiness

-

Customer behavior and preferred payment modes

-

Expected future growth

The right payment model can increase conversions, reduce cart abandonment, and help your business scale smoothly.

Need Expert Help Choosing the Right Payment Structure?

Get professional guidance tailored to your business model.

📞 +91 93113 47006

Contact us for a free consultation.

Hashtags

#NBFCAdvisor #Fintech #Payments #UPI #NBFC #Startups #Compliance