Regulatory Compliance Services – Protecting Your Business from Legal & Regulatory Risks

In an increasingly regulated business environment, regulatory compliance is the foundation of a stable, credible, and sustainable organization. Every...

Regulatory Compliance Services – Building a Legally Strong & Trusted Business

In today’s fast-evolving regulatory environment, regulatory compliance is no longer optional—it is essential for business continuity, credibility, ...

Advisory & Consulting Services – Strategic Guidance for Sustainable Business Growth

In an increasingly complex and competitive business environment, making the right decisions at the right time is critical. Whether it’s launching a...

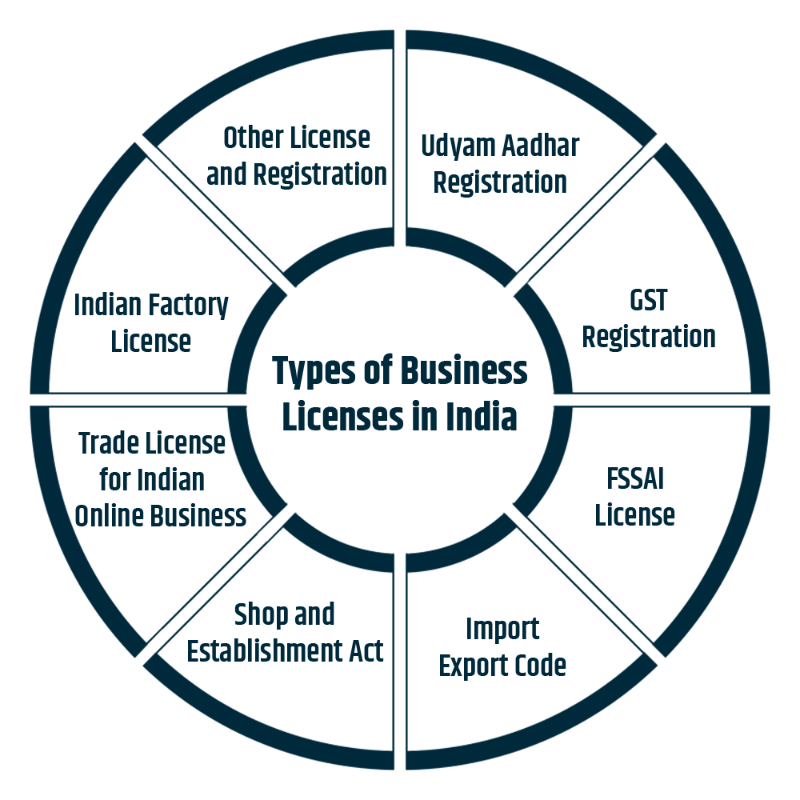

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

What Are Regulatory Compliance Services?

Regulatory compliance services ensure that a business adheres to all applicable laws, rules, guidelines, and regulations issued by government and regulatory bodies. These services cover ongoing legal, finan...

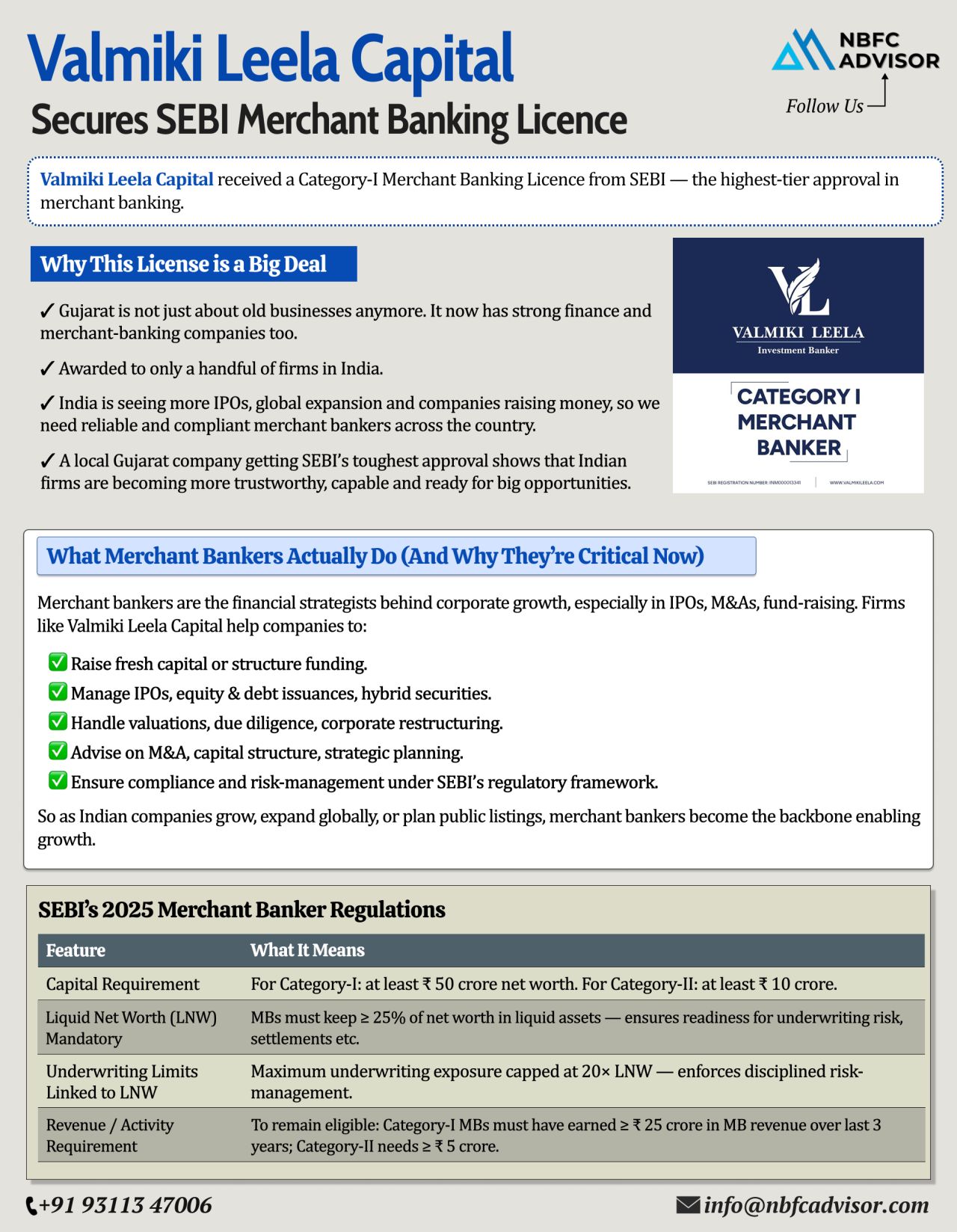

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

Thinking of Starting a Digital Lending Business? Here’s Why Now is the Right Time

India’s financial landscape is transforming faster than ever before. With fintech innovation and digital infrastructure evolving rapidly, the digital len...

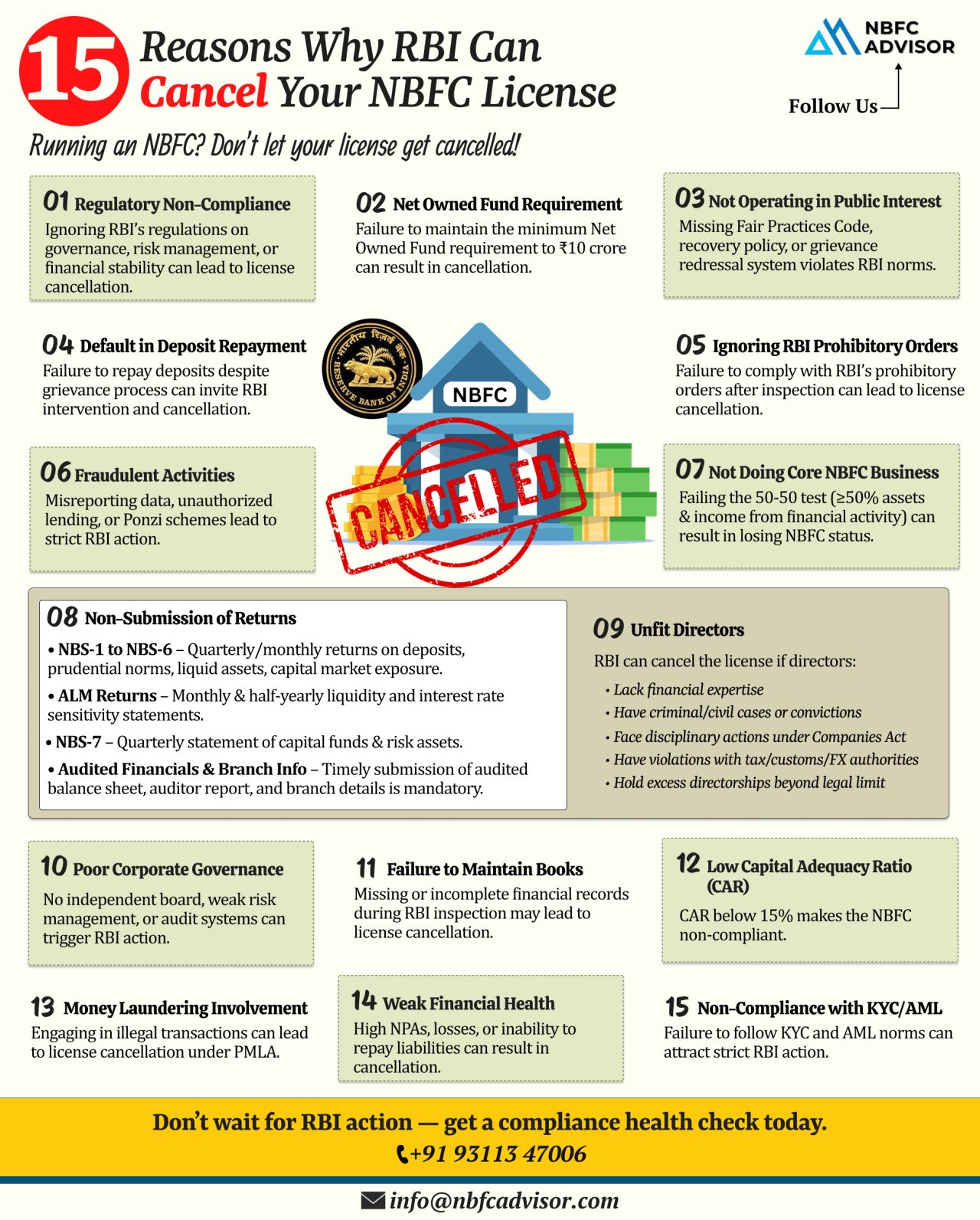

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

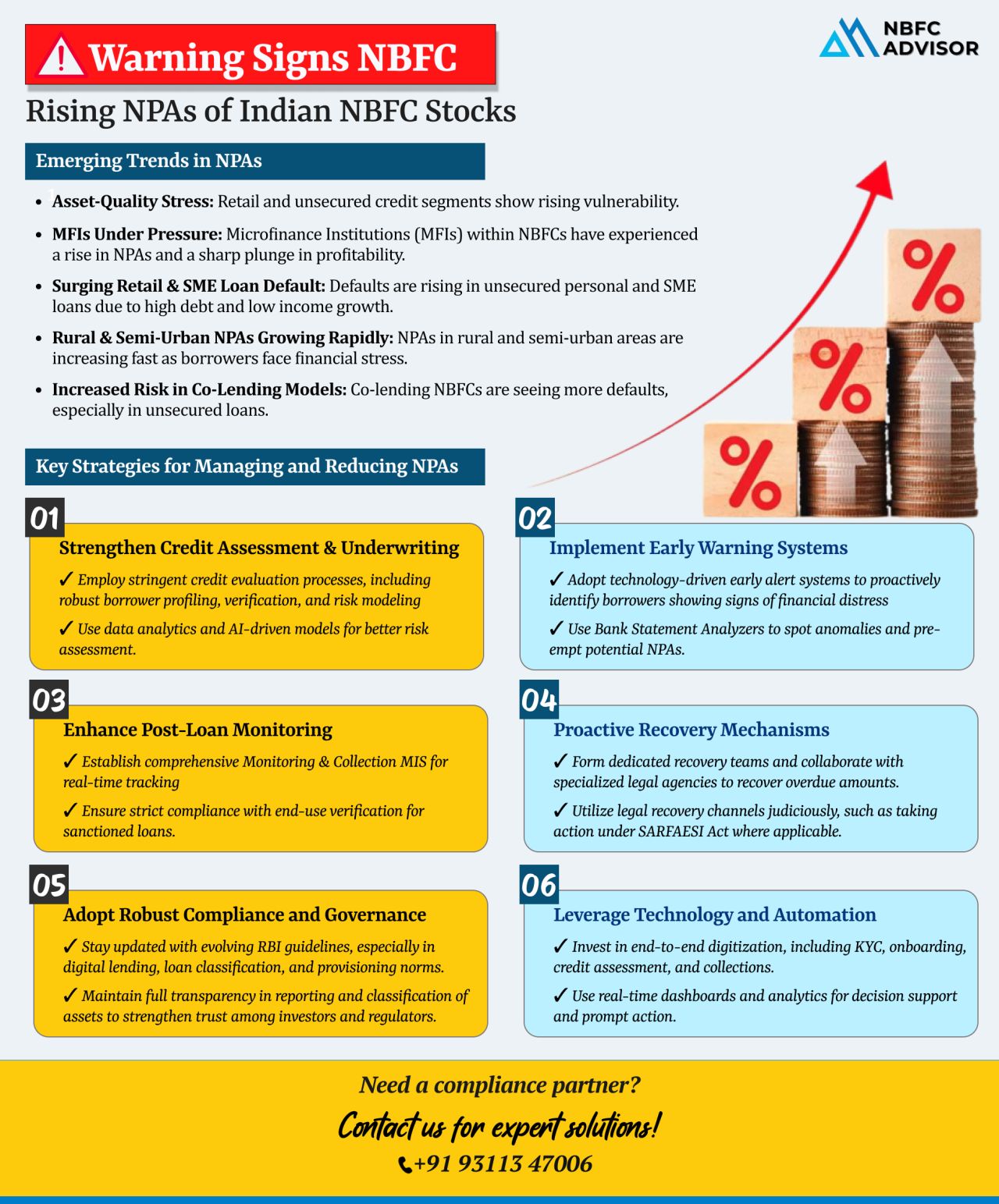

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

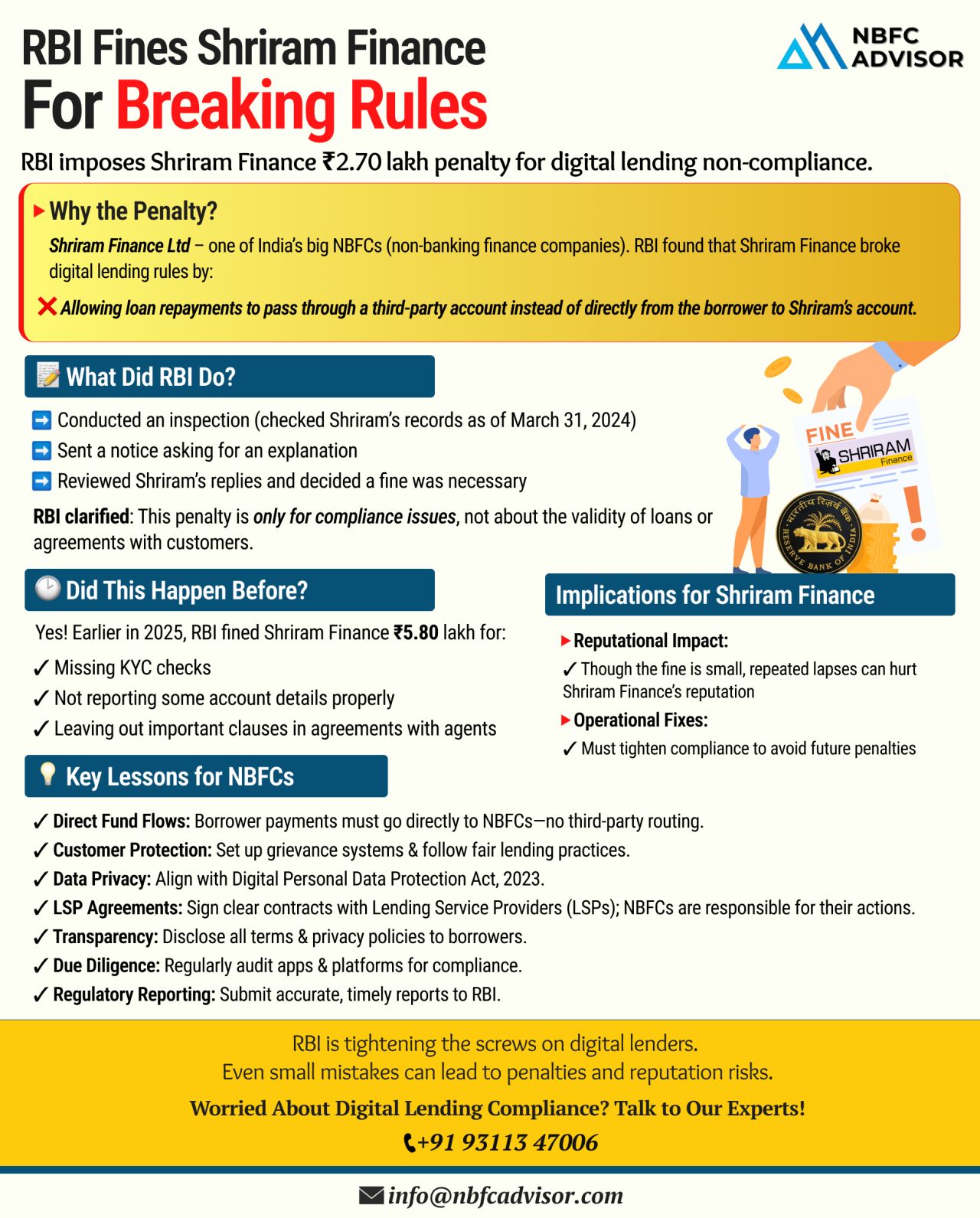

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

RBI to Tighten Supervisory Norms for NBFCs in FY26: What It Means for the Sector

The Reserve Bank of India (RBI) is preparing to introduce stricter supervisory regulations for Non-Banking Financial Companies (NBFCs) in the financial year 2025&ndas...

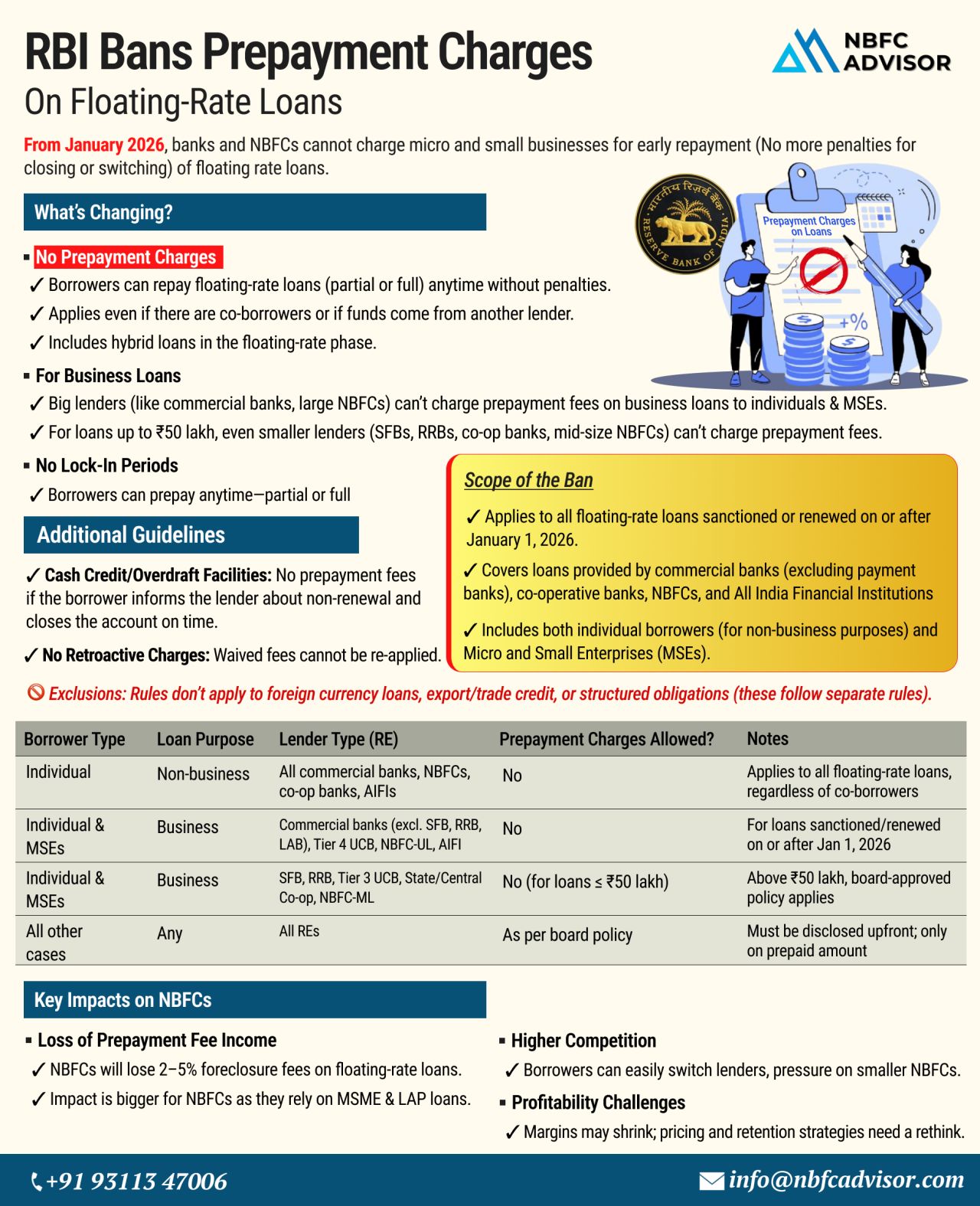

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...