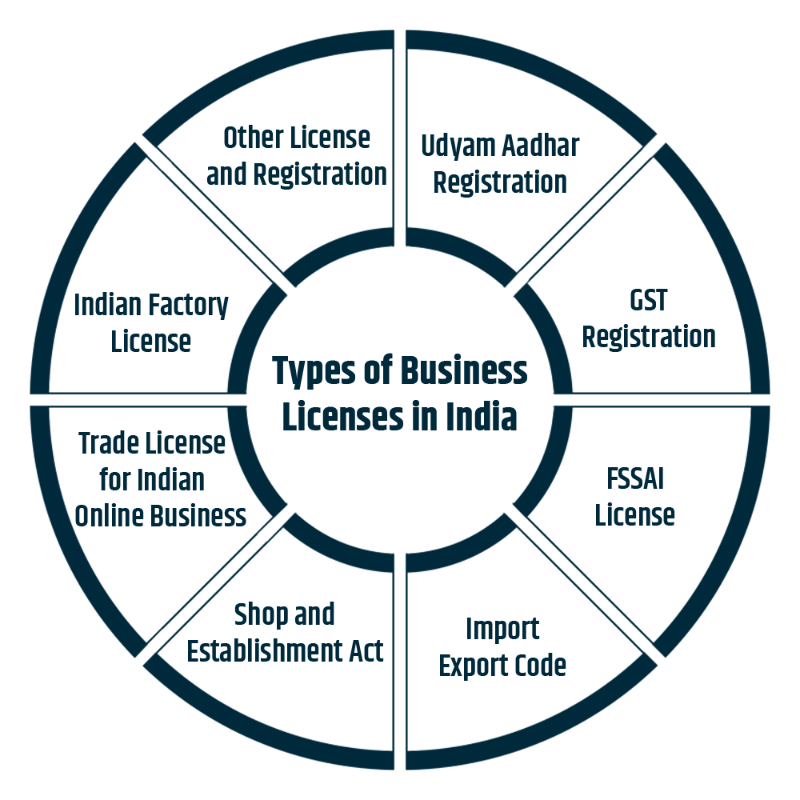

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

NBFC Registration Services in India – A Complete Guide

Starting a Non-Banking Financial Company (NBFC) in India is a powerful way to enter the financial services sector. NBFCs play a crucial role in providing loans, advances, asset financing...

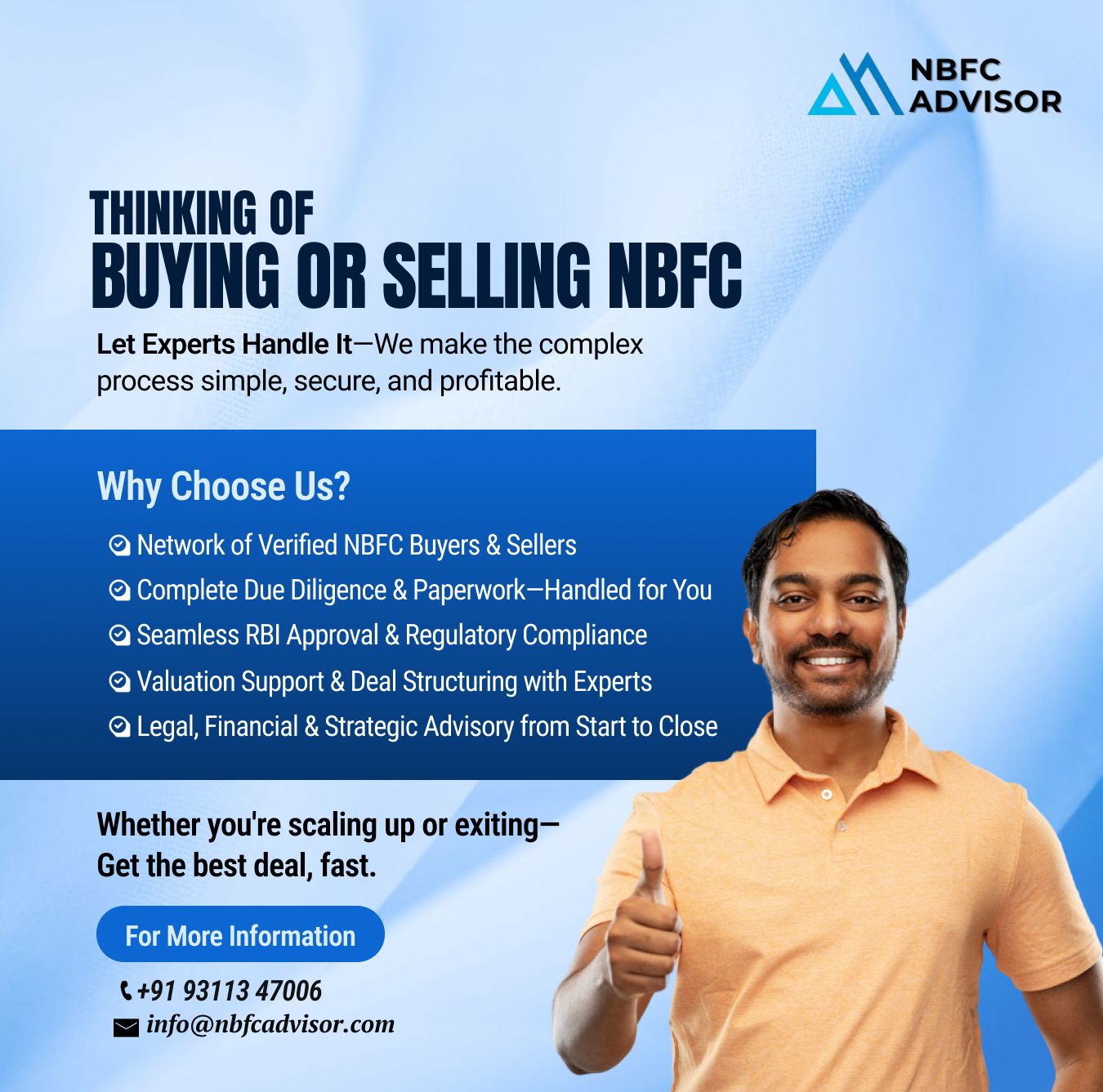

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

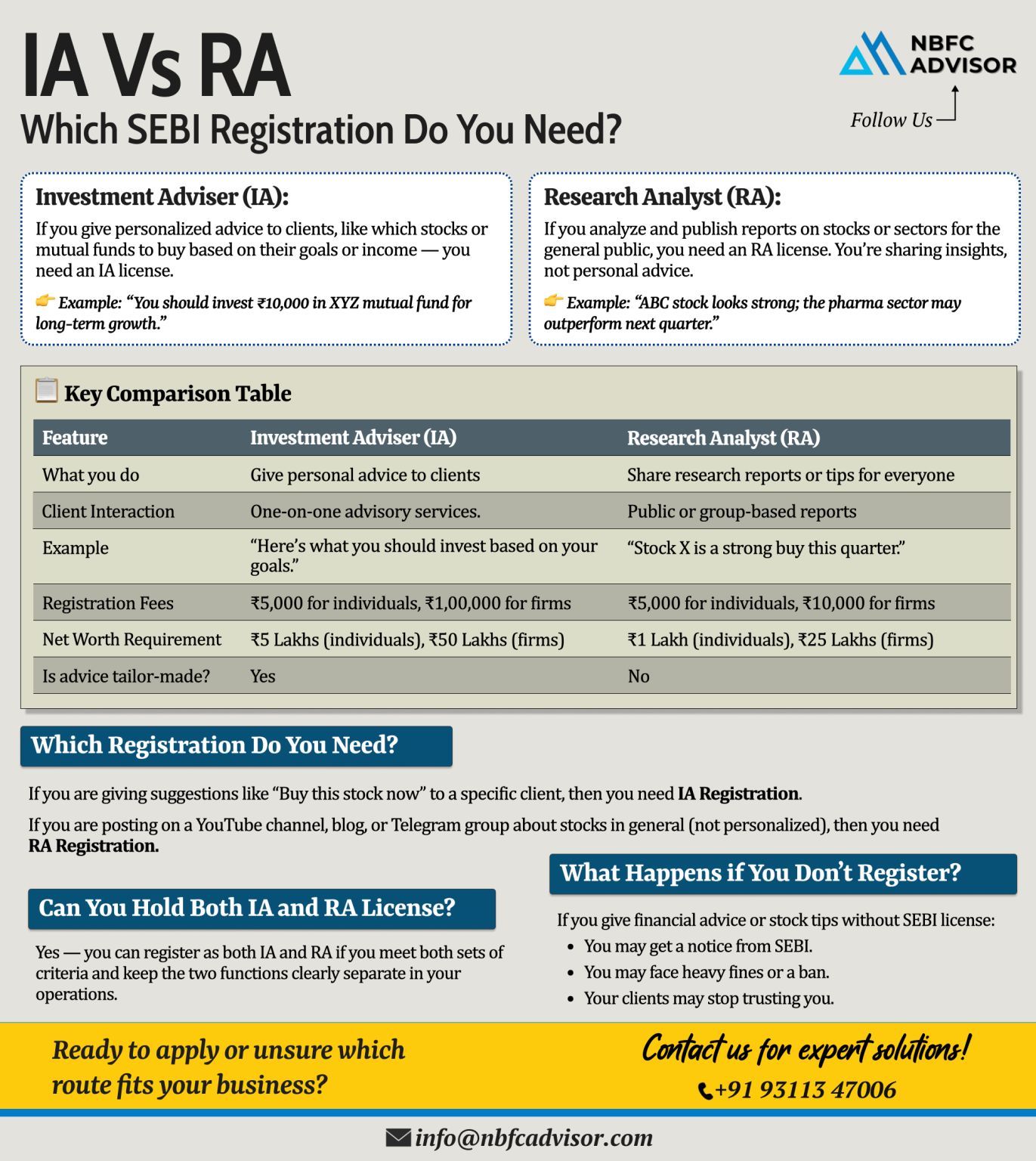

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

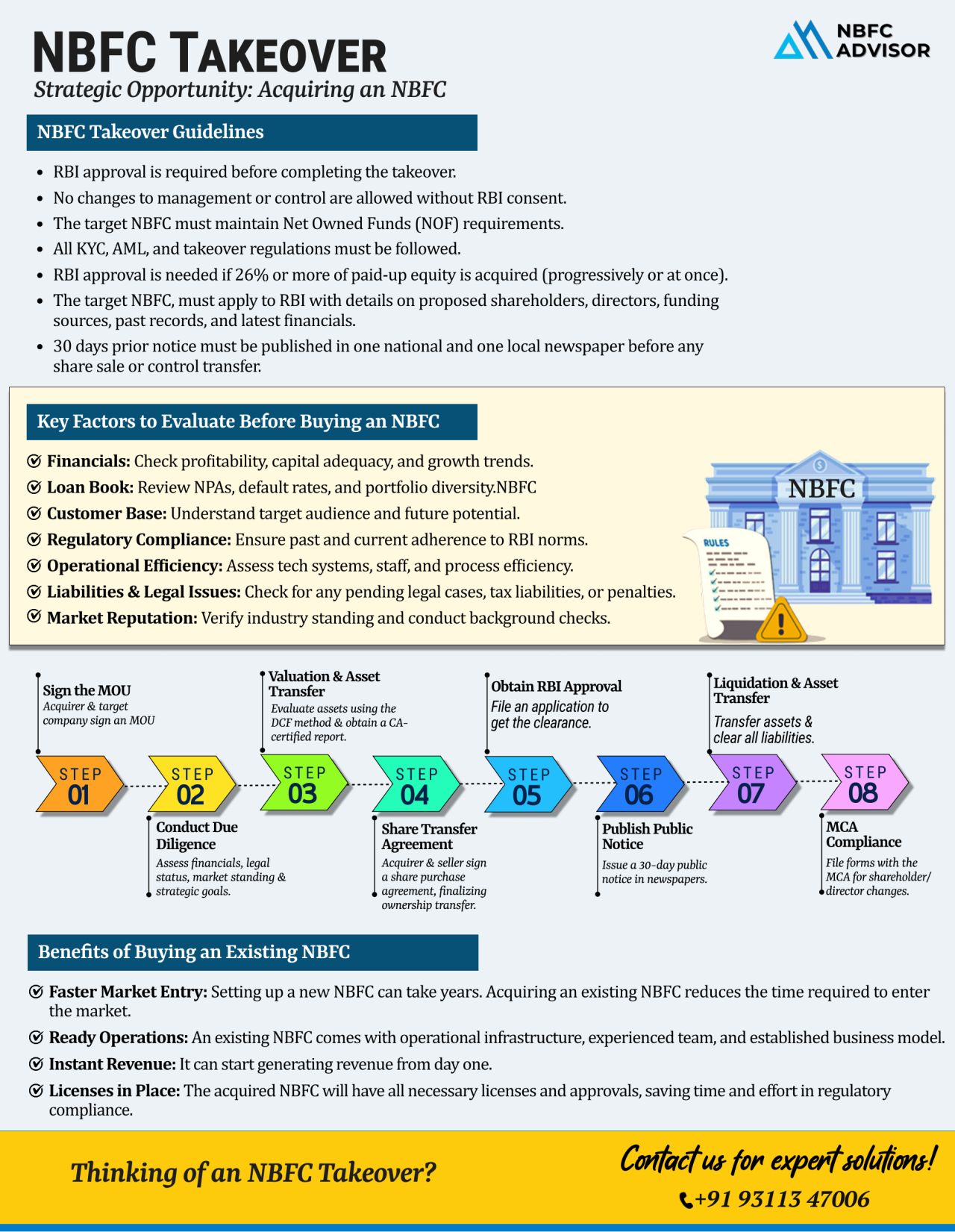

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

𝐑𝐁𝐈 𝐔𝐩𝐝𝐚𝐭𝐞: 𝐒𝐭𝐫𝐢𝐜𝐭𝐞𝐫 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐍𝐨𝐫𝐦𝐬 𝐀𝐫𝐞 𝐇𝐞𝐫𝐞 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐑𝐞𝐚𝐝𝐲?

India’s digital lending landscape is evolving fast, driven by technology and rising demand. But...

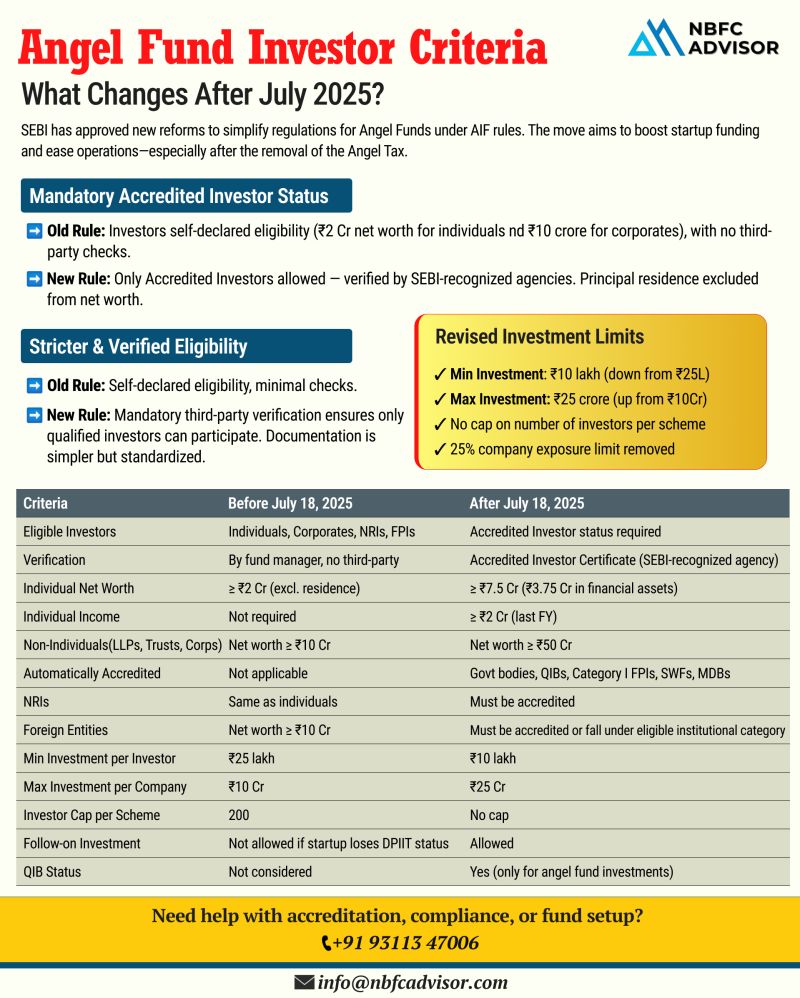

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘦𝘨𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘳𝘦 𝘌𝘷𝘰𝘭𝘷𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘗𝘳𝘦𝘱𝘢𝘳𝘦𝘥?

Starting July 2025, the rules governing Angel Funds in India are undergoing a major overhaul.

These fresh guidelines from SEBI aim to bri...

🚀 The NBFC Sector in India is Witnessing Unprecedented Growth! 🚀

Are You Ready to Unlock New Opportunities?

The Non-Banking Financial Company (NBFC) landscape in India is rapidly expanding, fueled by the surging demand for digital lending, mi...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

.png)

.png)