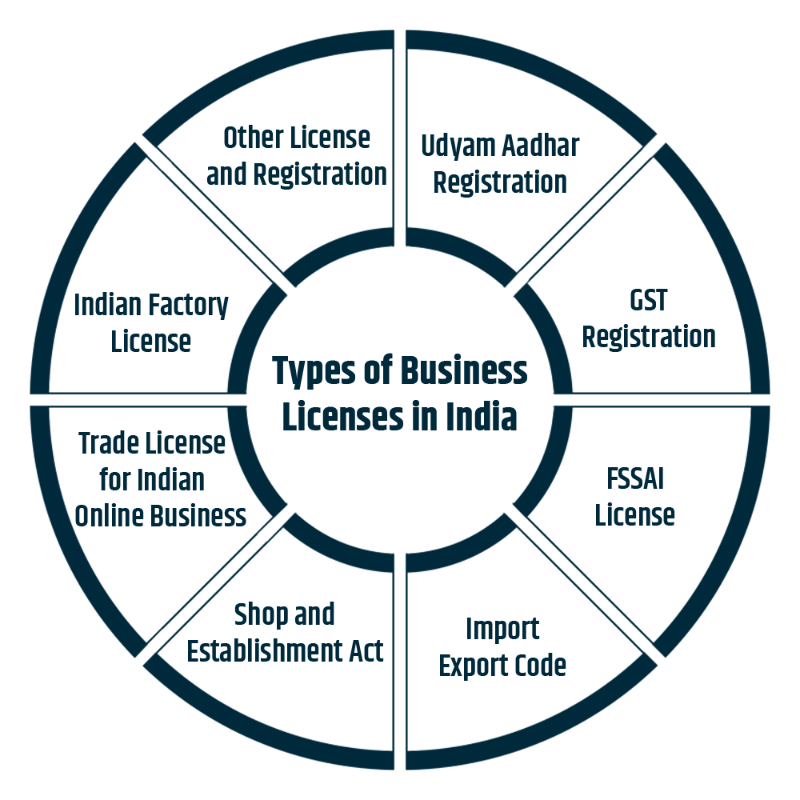

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

What Are Regulatory Compliance Services?

Regulatory compliance services ensure that a business adheres to all applicable laws, rules, guidelines, and regulations issued by government and regulatory bodies. These services cover ongoing legal, finan...

NBFC Registration Services in India – A Complete Guide

Starting a Non-Banking Financial Company (NBFC) in India is a powerful way to enter the financial services sector. NBFCs play a crucial role in providing loans, advances, asset financing...

Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

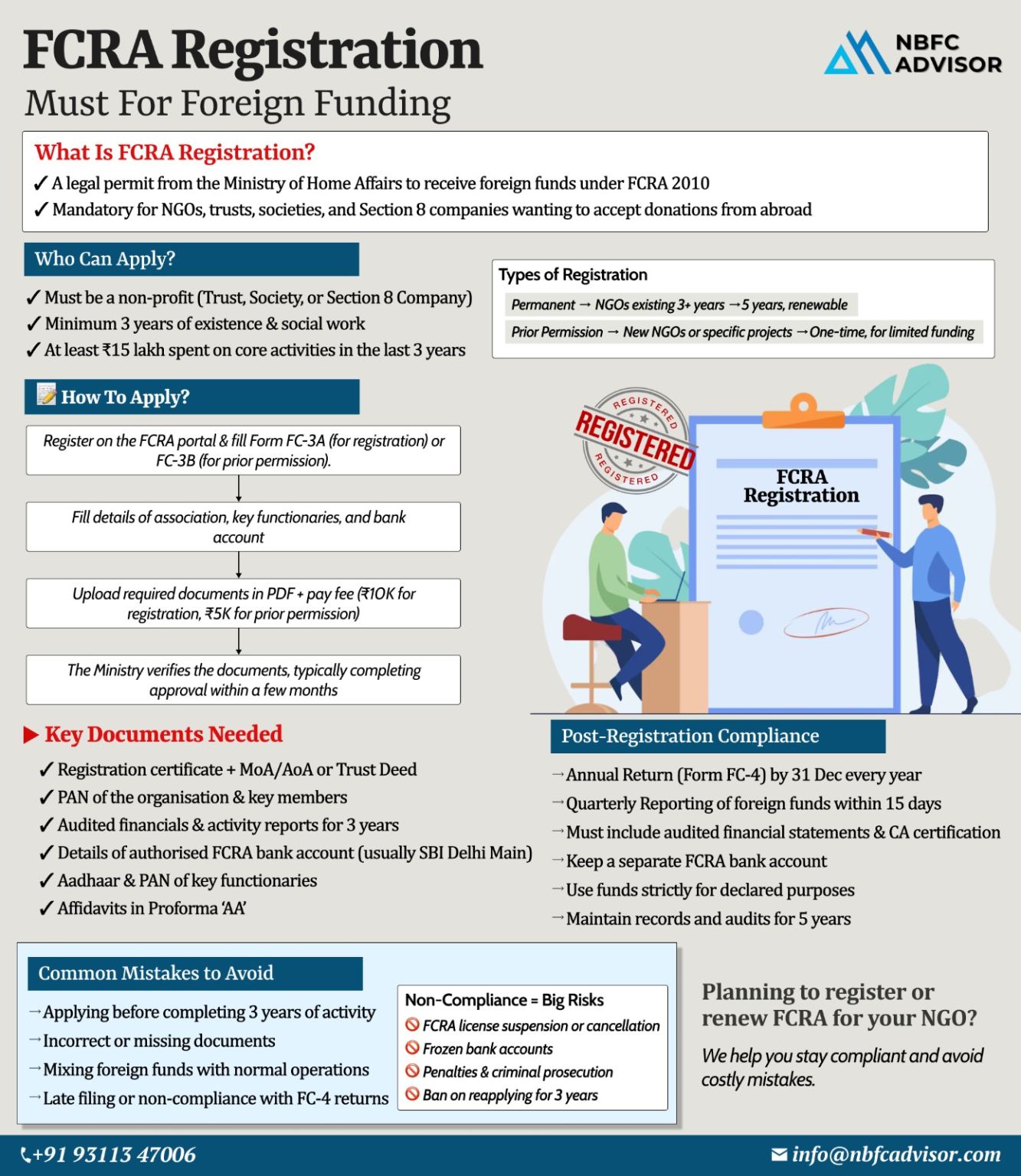

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

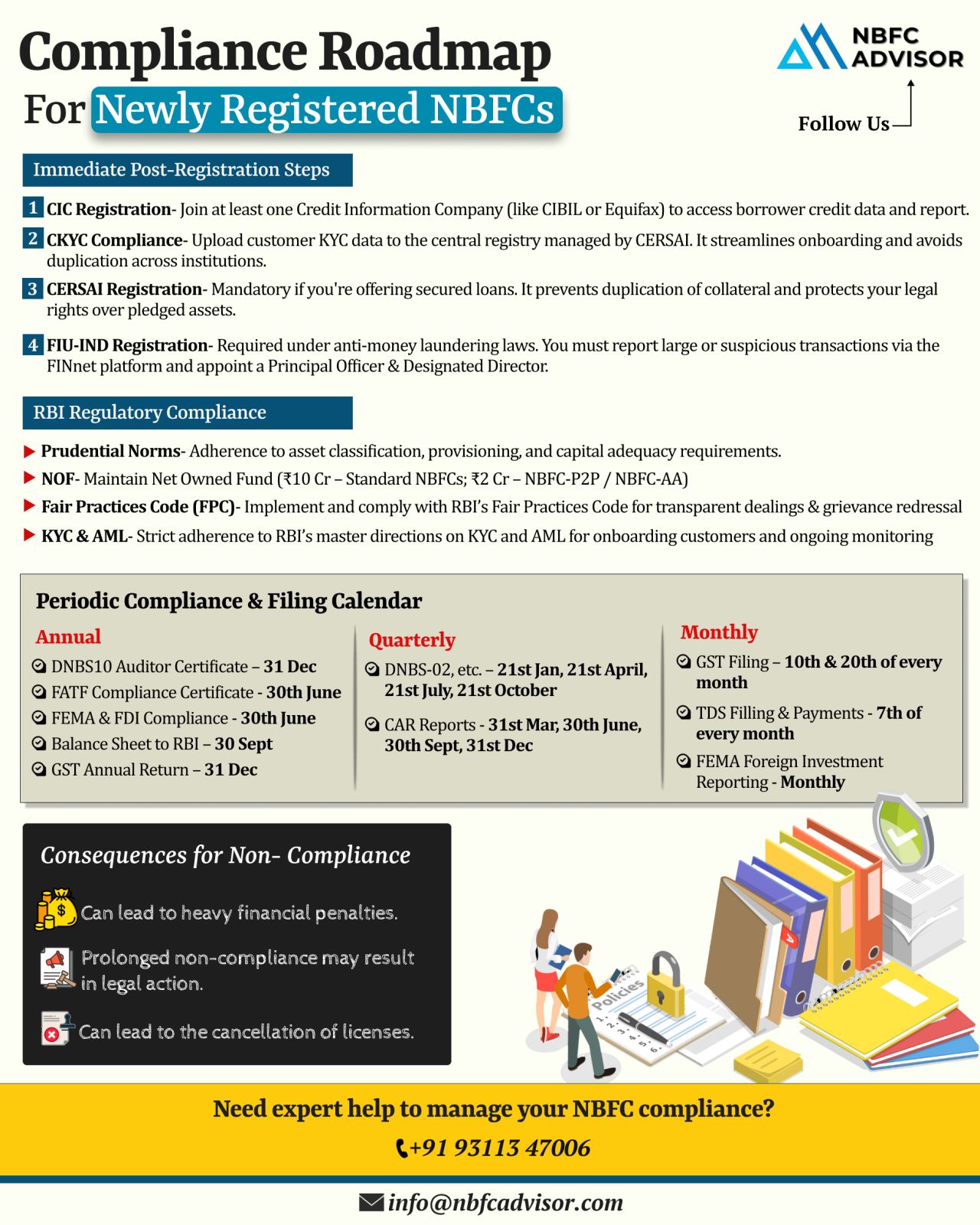

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

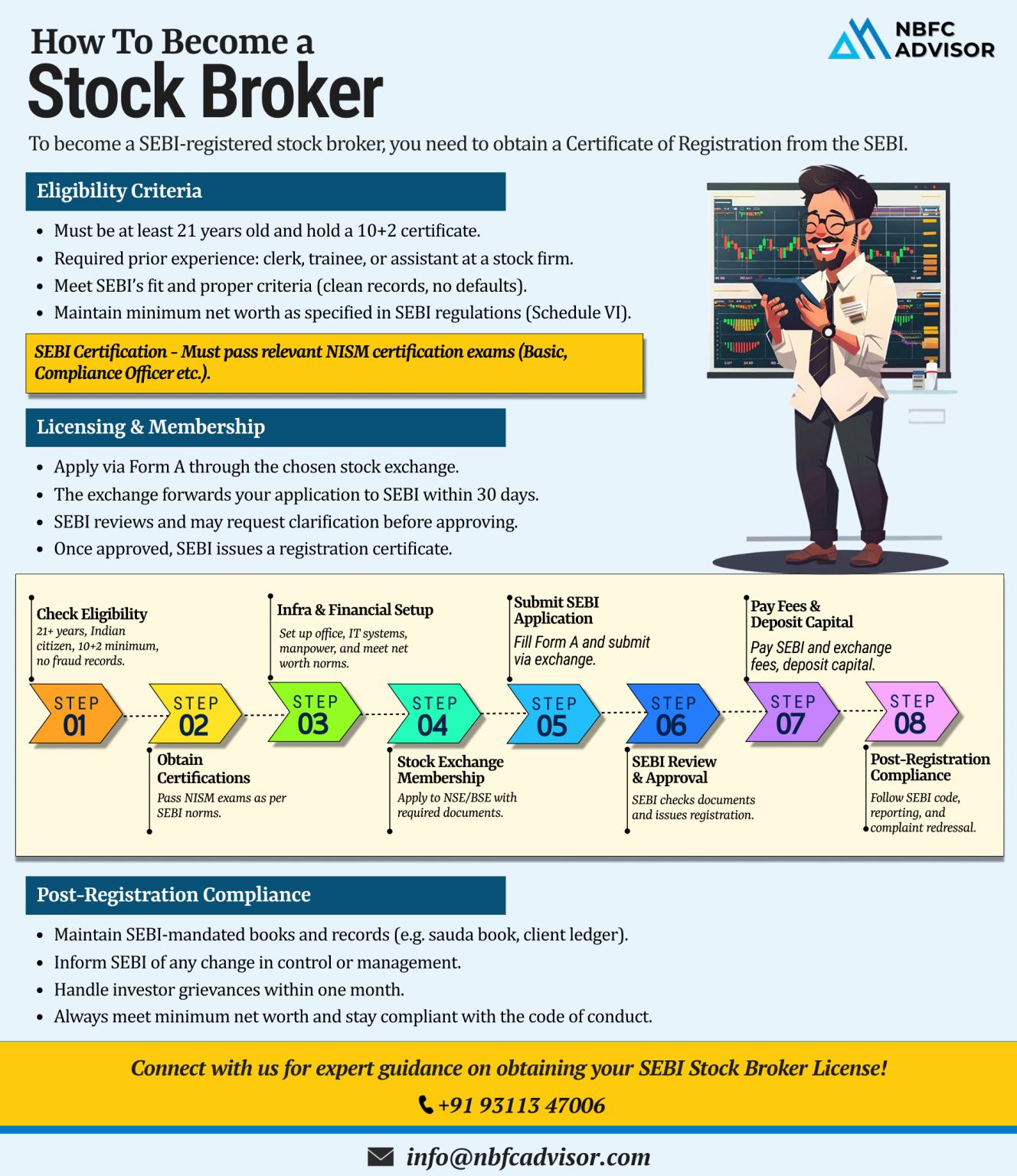

Want to Become a SEBI-Registered Stock Broker?

If you’re looking to enter India’s capital markets as a stock broker, obtaining a SEBI registration is a must. This license not only authorizes you to operate legally but also builds trust...

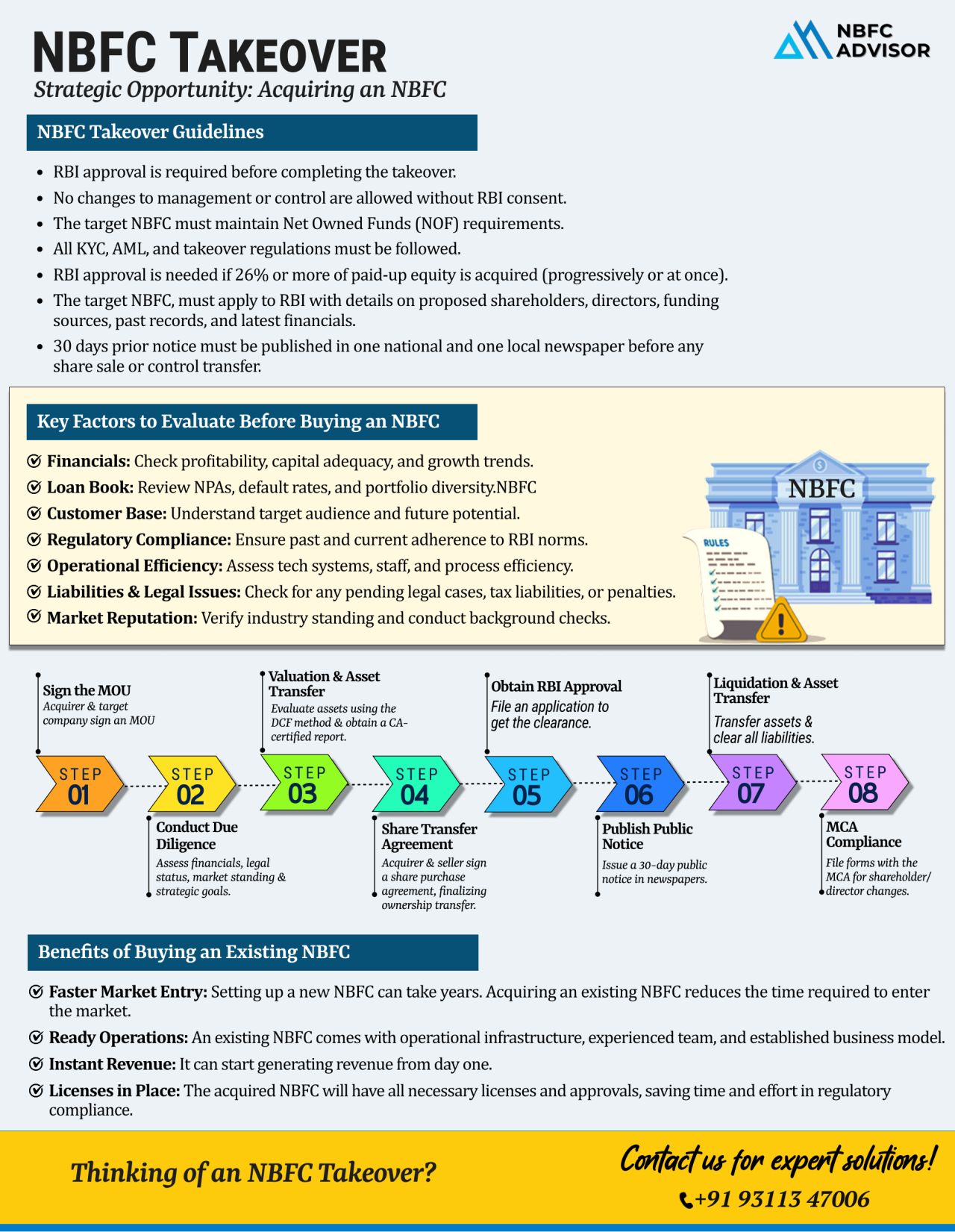

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

Blog Title: Top 10 Mistakes to Avoid When Registering an AIF

Setting up an Alternative Investment Fund (AIF) in India can open doors to diverse investment opportunities—but navigating the registration process with SEBI isn’t as straigh...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)

.png)

.png)