SEBI Just Reclassified REITs as Equity — And It Changes Everything

SEBI has officially reclassified Real Estate Investment Trusts (REITs) as equity investments — a landmark regulatory shift that will reshape how institutions and invest...

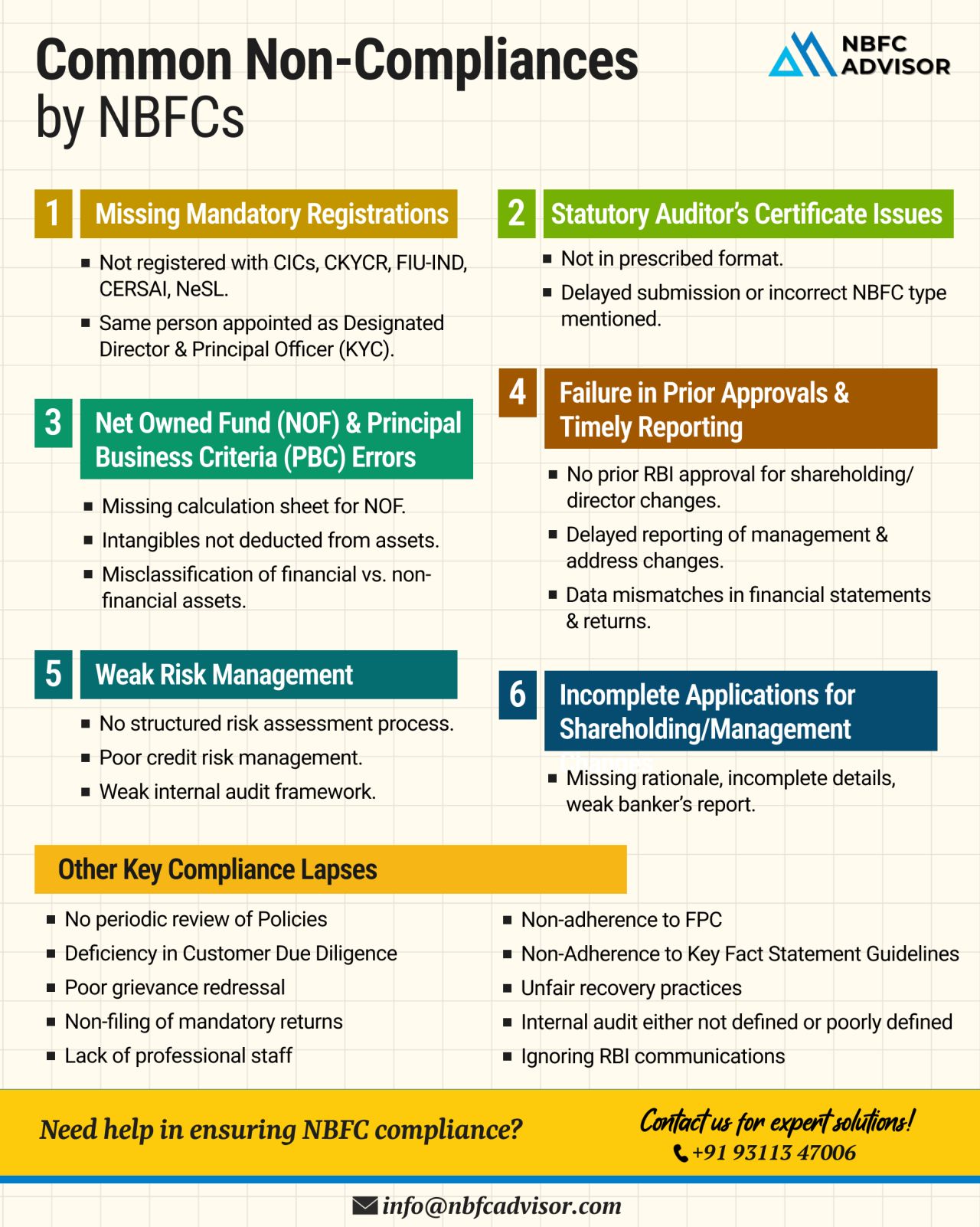

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

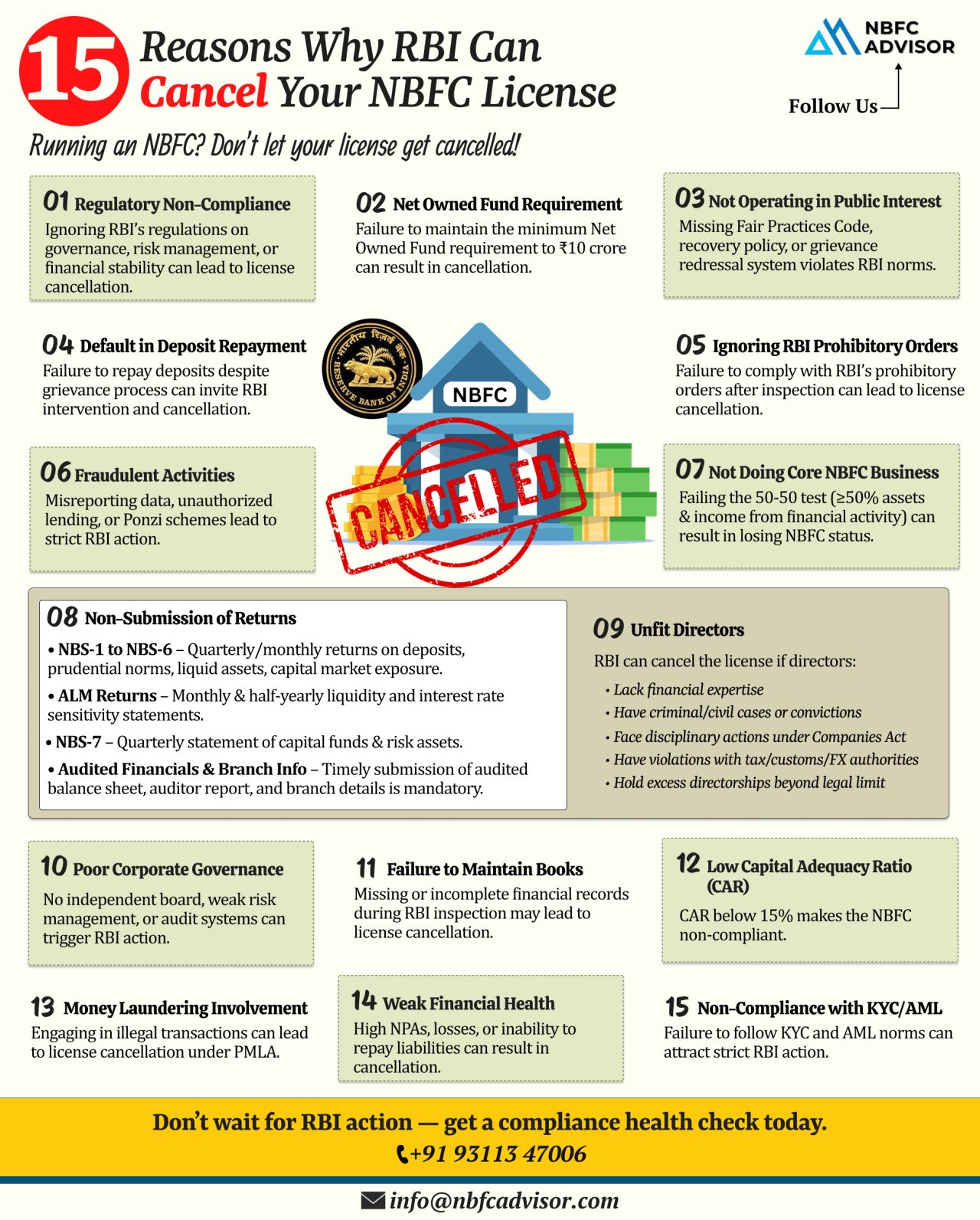

15 Red Flags That Could Lead to Your NBFC Being Shut Down

Every year, the Reserve Bank of India (RBI) revokes licenses of several NBFCs. Contrary to common belief, most of these cancellations are not due to fraud, but arise from non-compliance, we...

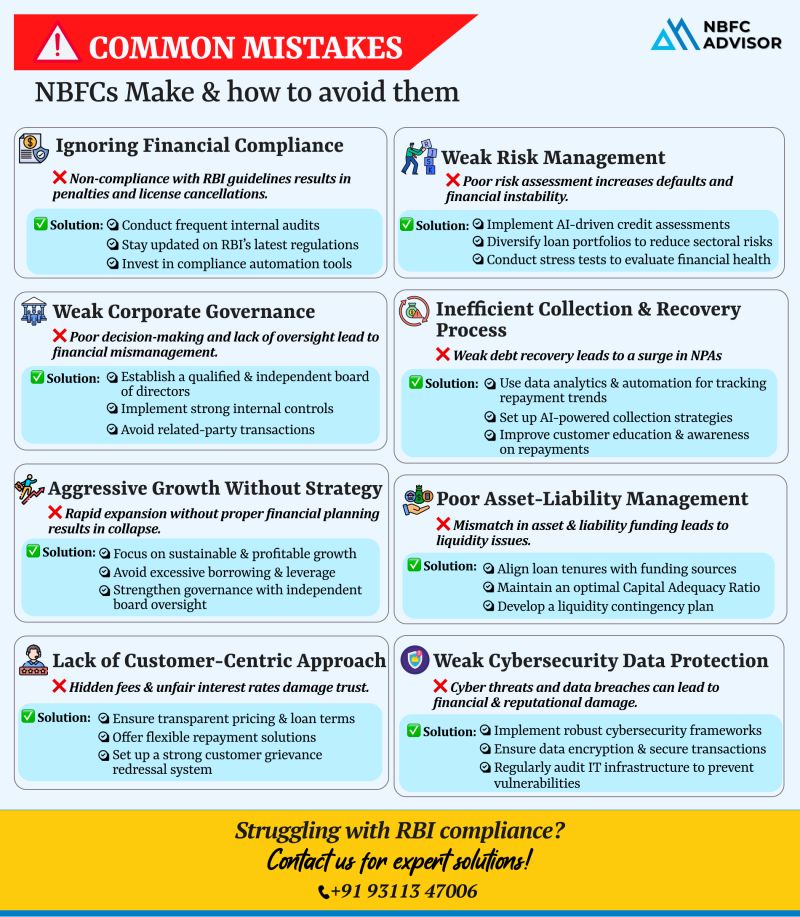

Is Your NBFC Making These Critical Mistakes?

The NBFC sector in India has seen impressive growth—but with that growth comes increased scrutiny from regulators like the RBI. Alarmingly, many NBFCs face operational hurdles, rising NPAs, or eve...

Blog Title: Top 10 Mistakes to Avoid When Registering an AIF

Setting up an Alternative Investment Fund (AIF) in India can open doors to diverse investment opportunities—but navigating the registration process with SEBI isn’t as straigh...

⚠️ Is Your NBFC Vulnerable to RBI Action?

With increasing regulatory scrutiny, the Reserve Bank of India (RBI) is taking strict action against Non-Banking Financial Companies (NBFCs) that fail to comply with its guidelines. From financia...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...