Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

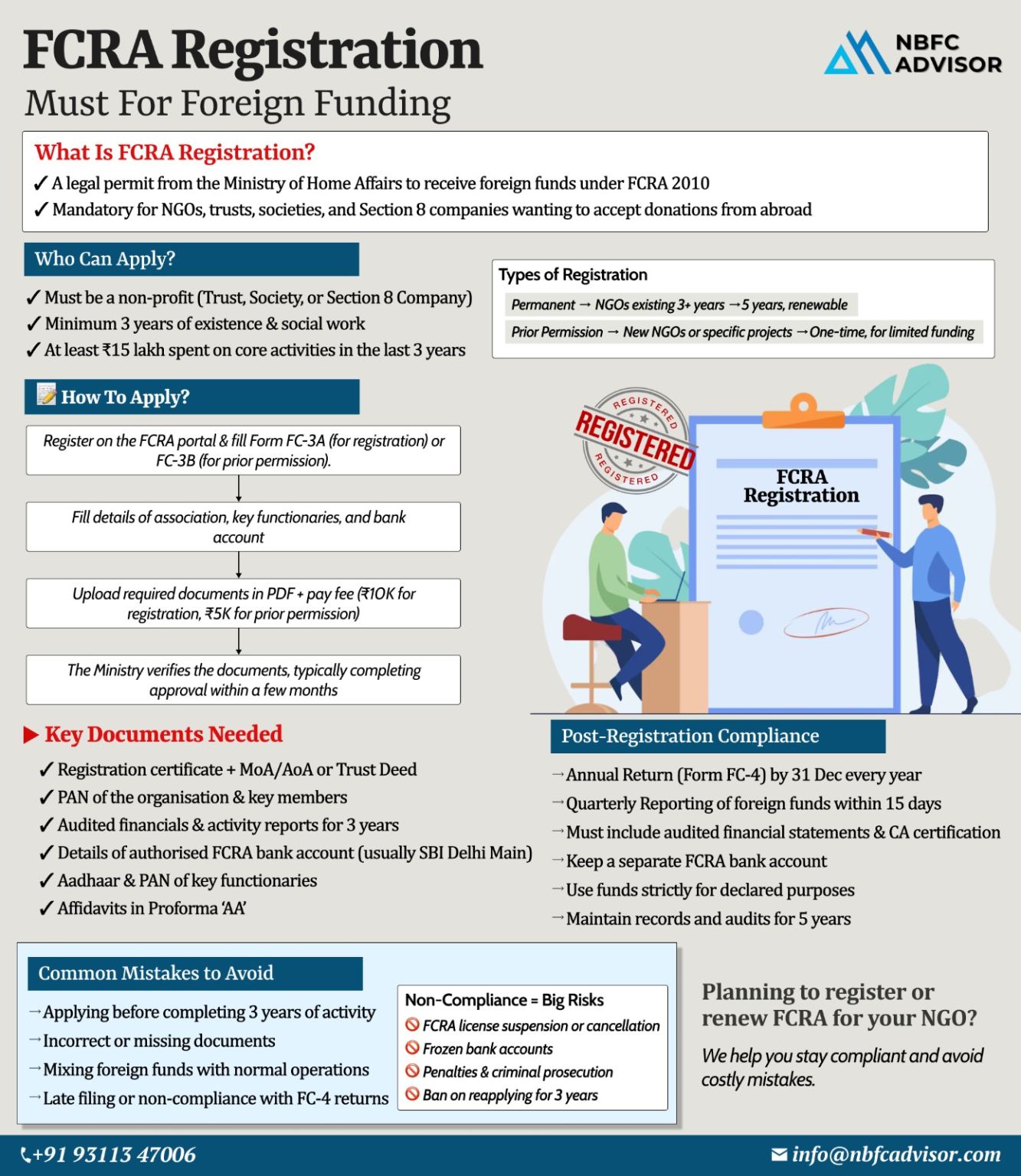

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

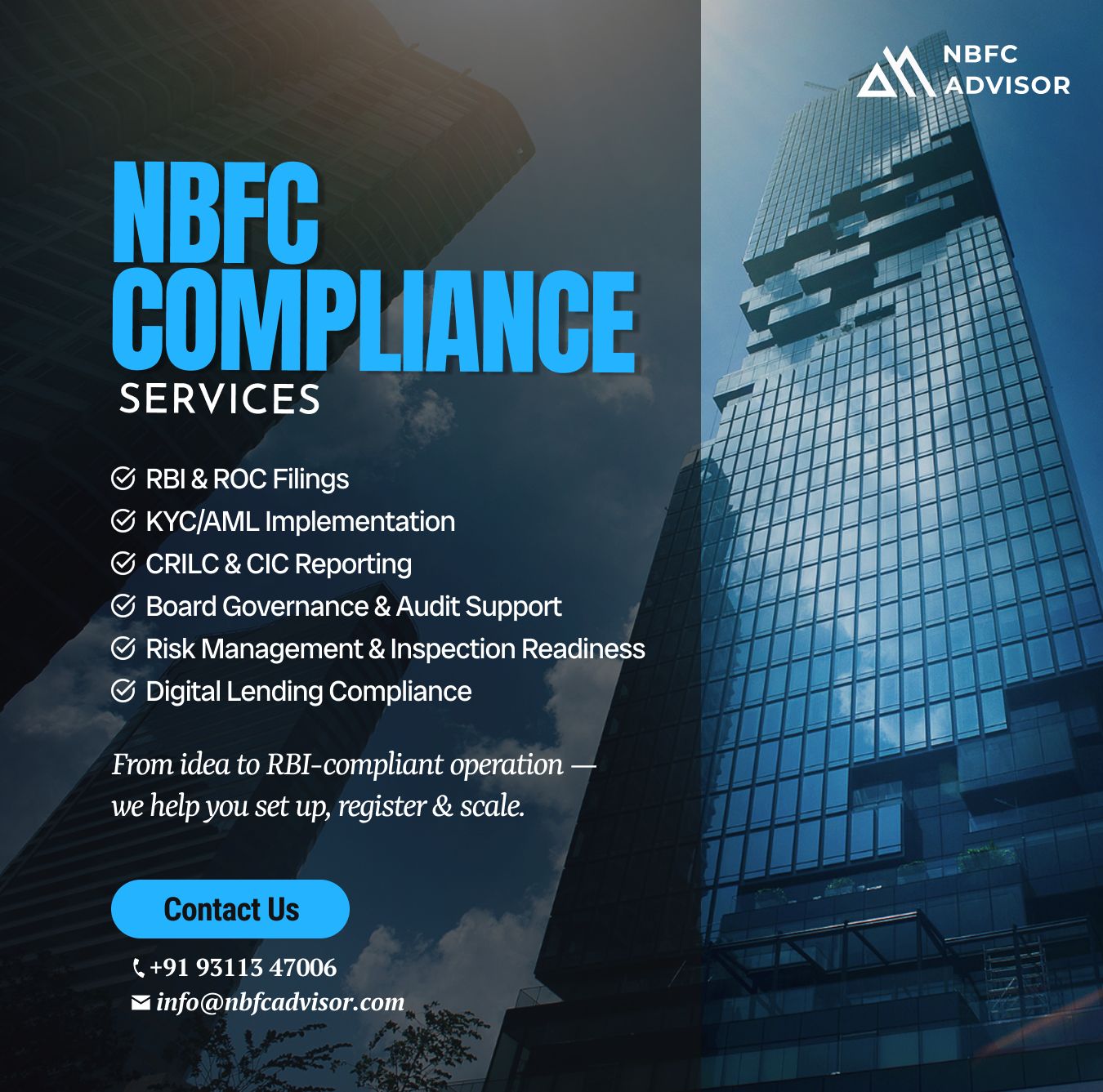

Compliance Gaps Can Break Your Business: Why NBFCs Must Stay Ahead of RBI Regulations

In today’s financial landscape, compliance is no longer optional.

With the Reserve Bank of India (RBI) tightening its oversight, even well-managed NBFCs a...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

Is Your NBFC Really Compliant? Here’s What You Need to Know

The Reserve Bank of India (RBI) has been tightening its regulatory framework around Non-Banking Financial Companies (NBFCs), and the impact is clear — several NBFCs have lost ...

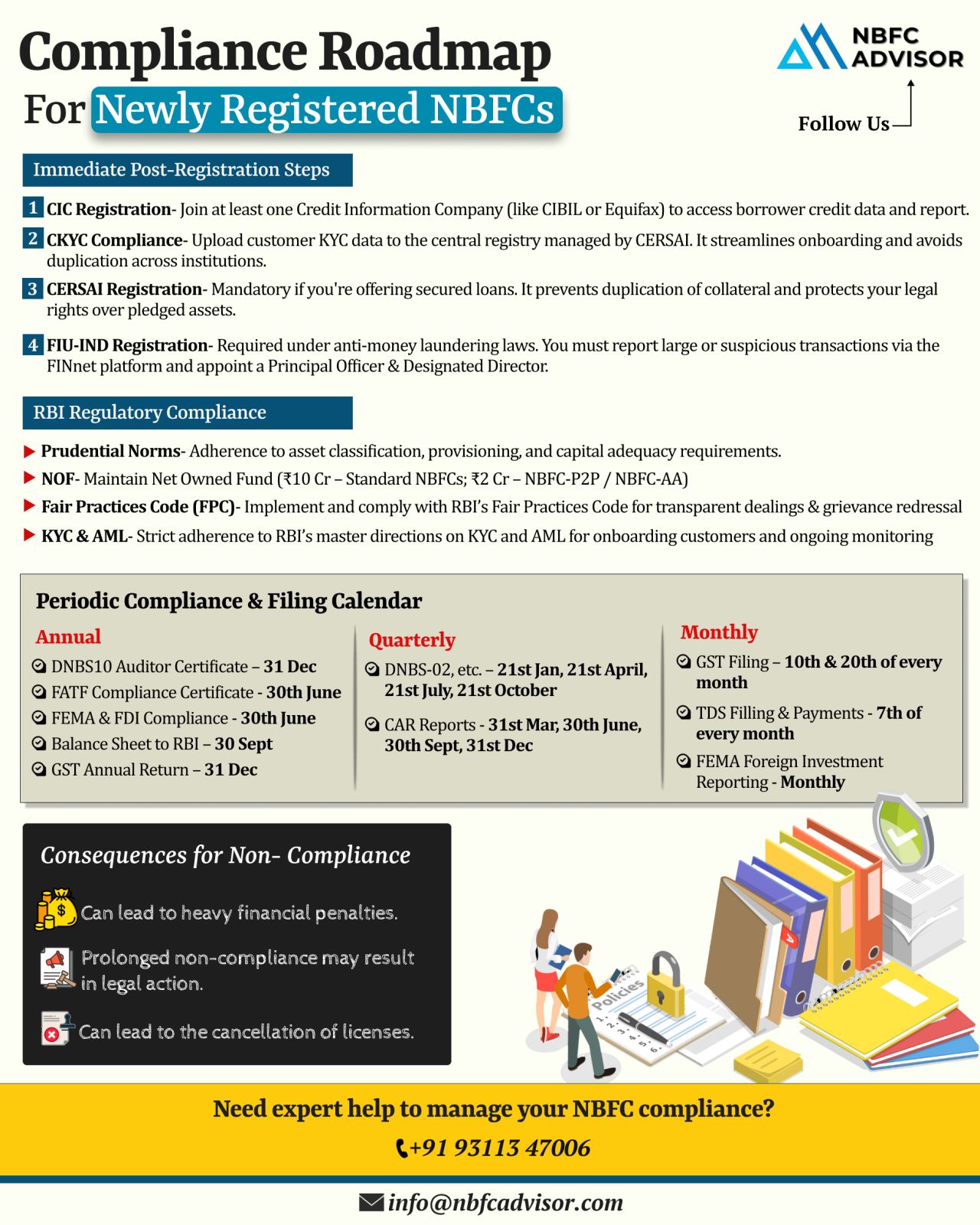

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

RBI’s Officer Training Program: Ushering in a New Era of Digital Finance & Compliance

The Reserve Bank of India (RBI) is preparing for the future of India’s financial ecosystem with a comprehensive officer training initiative in Hy...

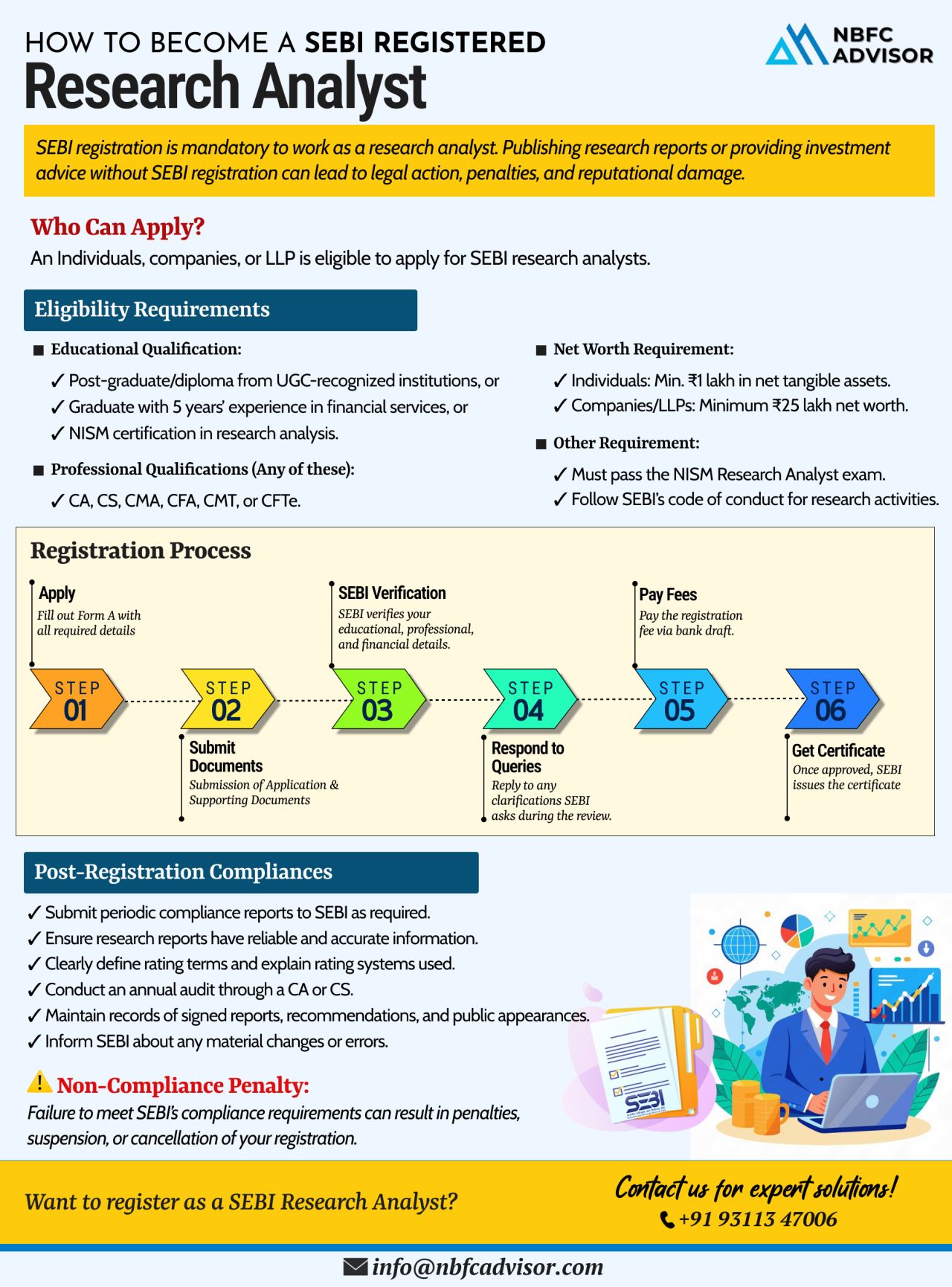

Are You Publishing Research Reports Without SEBI Registration?

That’s a fast track to penalties, suspension, and long-term reputational damage.

In today’s regulated financial ecosystem, SEBI registration is mandatory if you wish to wo...

RBI Is Coming Down Hard on NBFCs — Are You Prepared?

The Reserve Bank of India (RBI) is sending a strong message to the NBFC sector: regulatory compliance is critical. Over the last year, RBI has taken serious enforcement actions against bot...

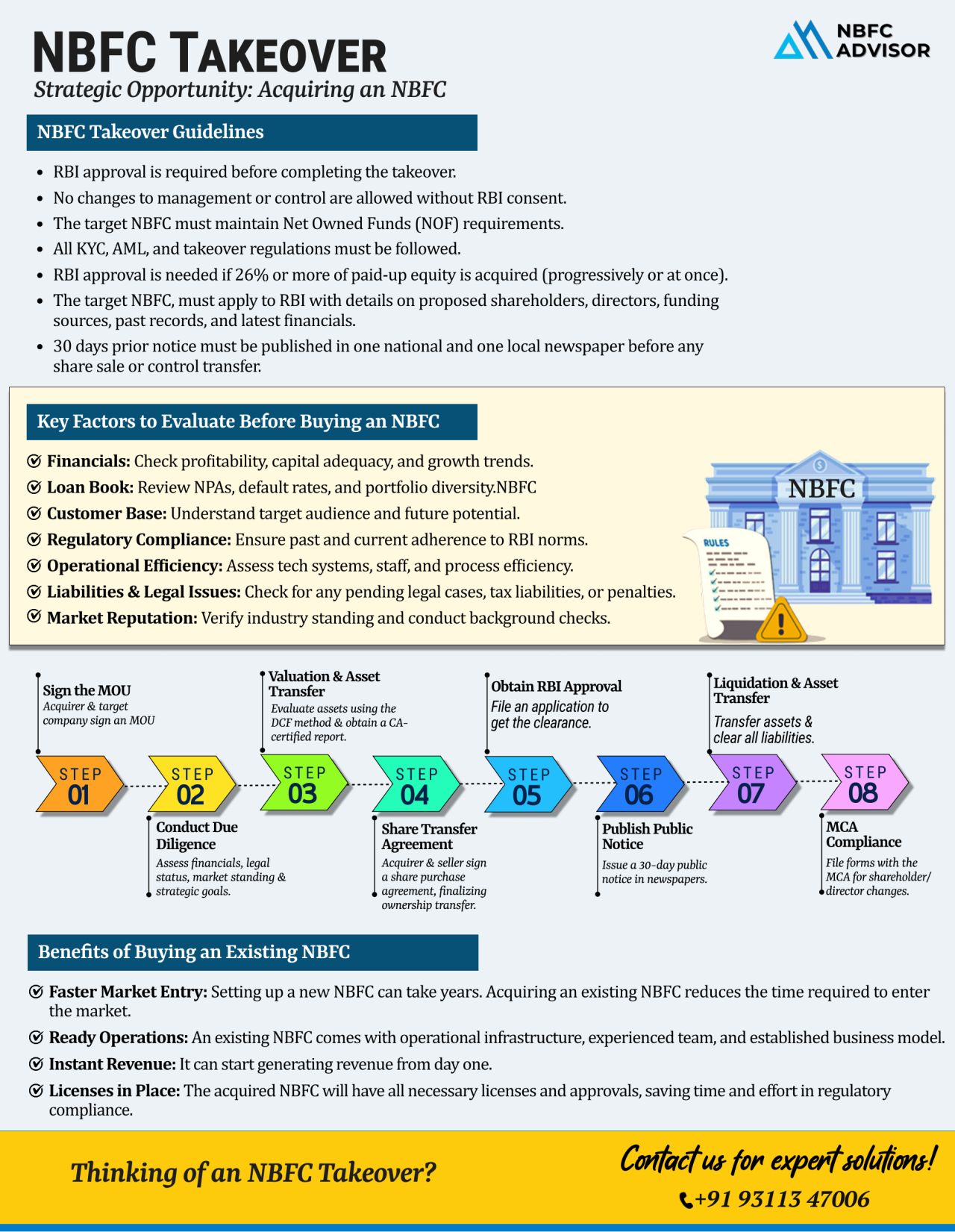

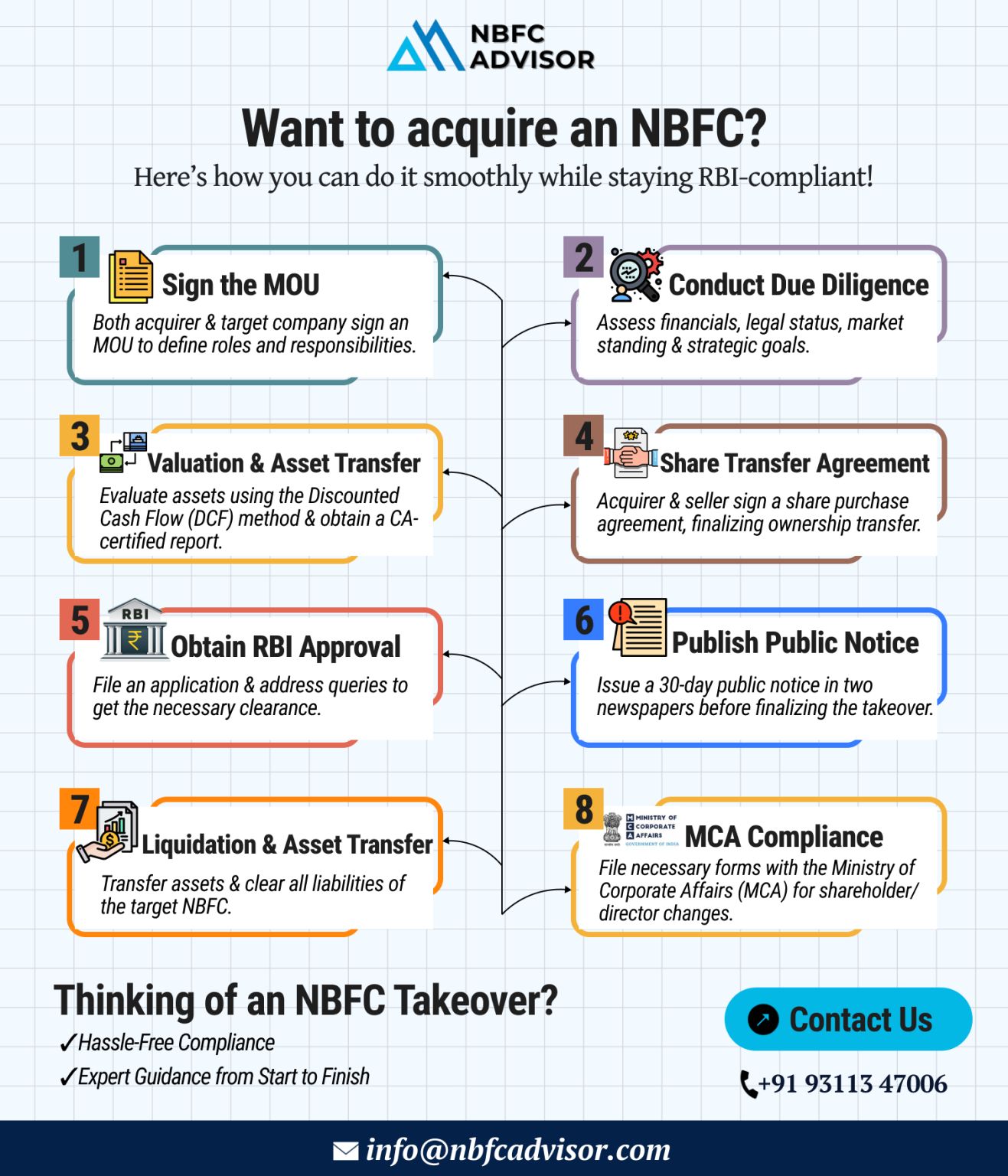

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

🚀 The NBFC Sector in India is Witnessing Unprecedented Growth! 🚀

Are You Ready to Unlock New Opportunities?

The Non-Banking Financial Company (NBFC) landscape in India is rapidly expanding, fueled by the surging demand for digital lending, mi...