Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

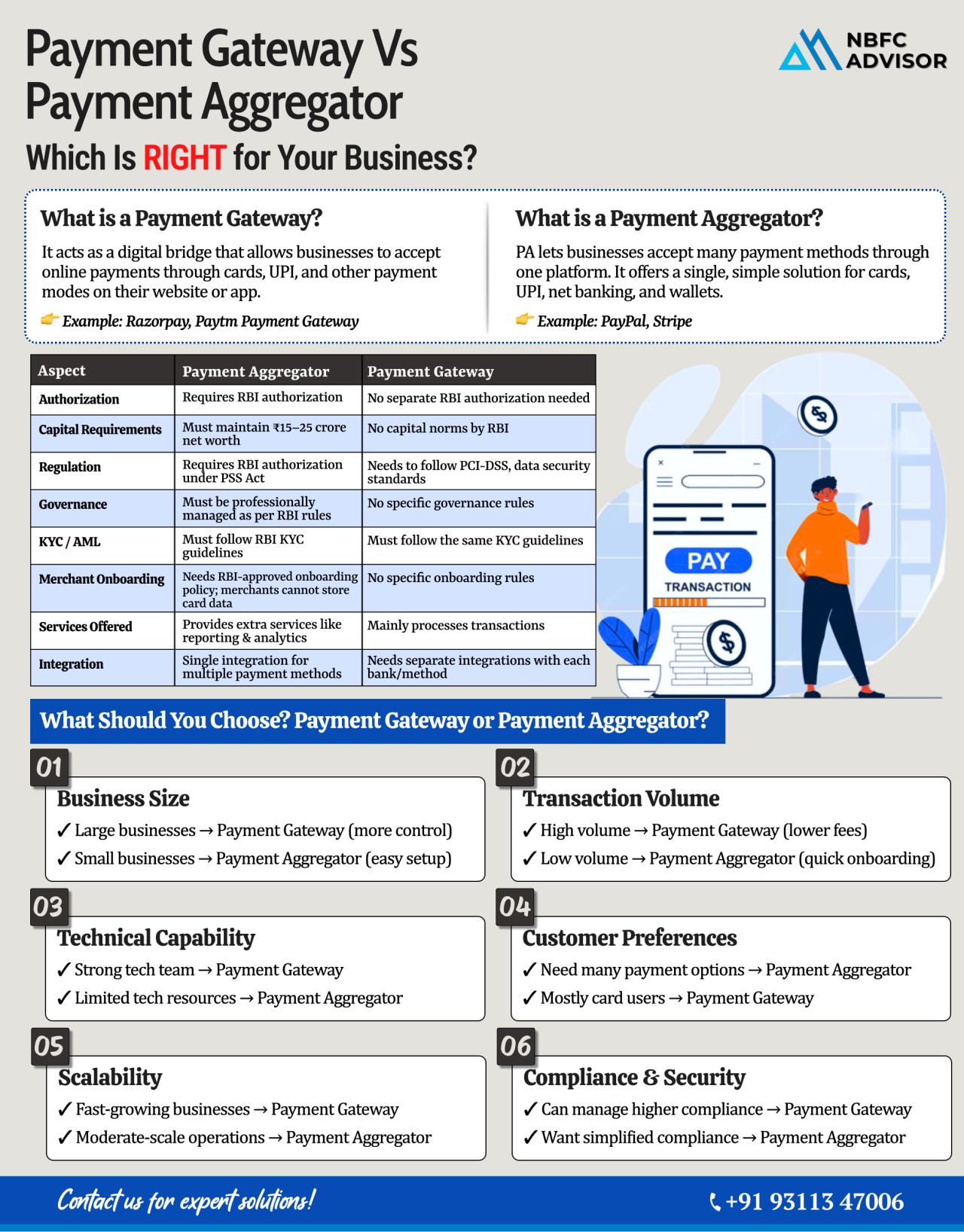

Payment Gateway vs Payment Aggregator: Which One Fits Your Business Better?

As online payments continue to grow in India, choosing the right payment infrastructure has become a strategic decision. A smooth, fast, and secure checkout is essential &...

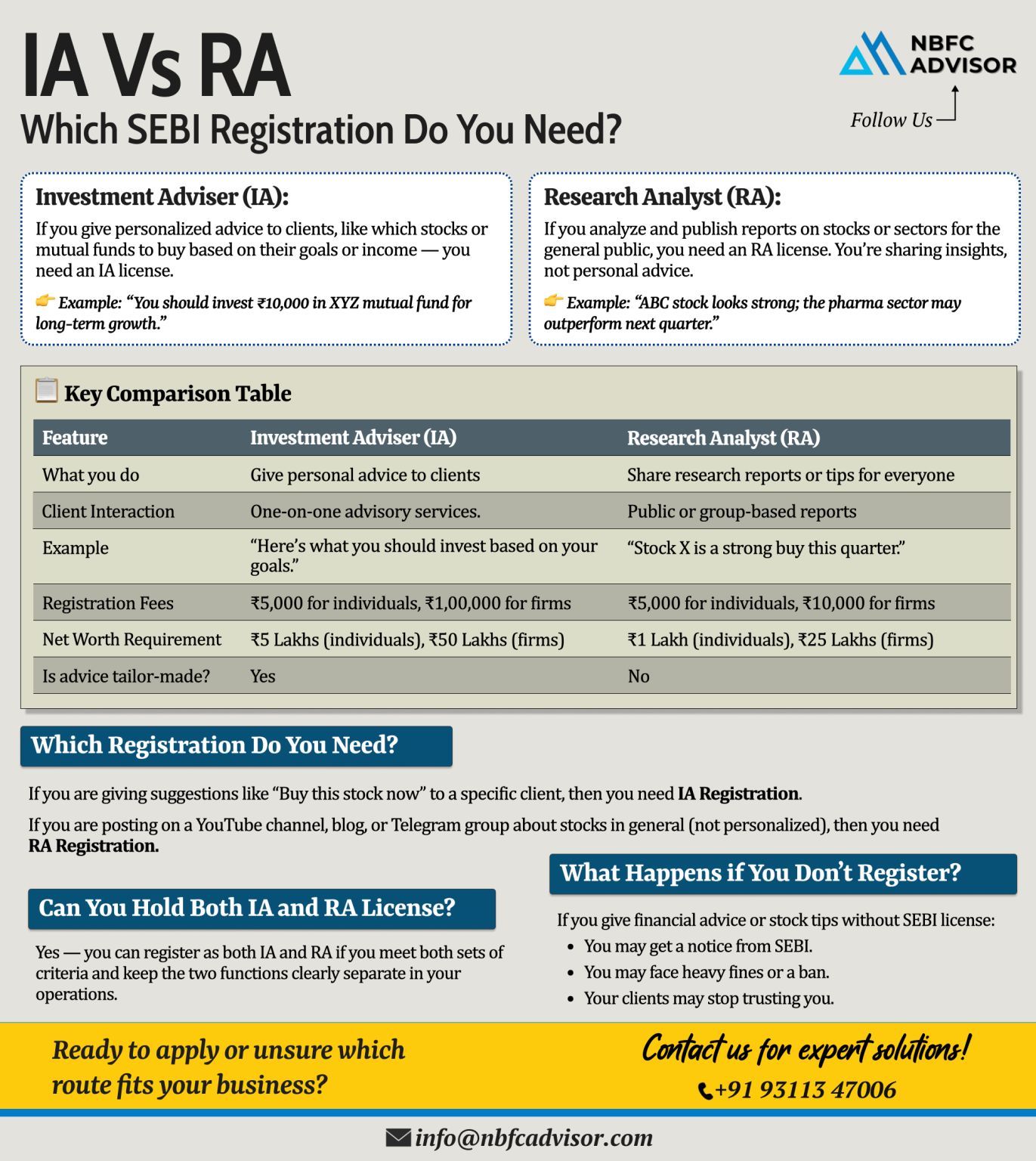

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

Starting a Non-Banking Financial Company (NBFC) in India can be a lucrative venture, but it requires compliance with stringent regulatory frameworks laid out by the Reserve Bank of India (RBI). At NBFC Registration, we make this process easier, ensur...

.png)

.png)