Regulatory Compliance Services – Protecting Your Business from Legal & Regulatory Risks

In an increasingly regulated business environment, regulatory compliance is the foundation of a stable, credible, and sustainable organization. Every...

Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

𝐍𝐨𝐭 𝐚𝐥𝐥 𝐍𝐁𝐅𝐂𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞.

RBI has divided NBFCs into 4 layers based on size, risk, and complexity.

The bigger your NBFC is, the stricter the rules.

✓ 𝐁𝐚𝐬𝐞 𝐋𝐚𝐲𝐞𝐫: Smallest NBFCs, lightest regulations

✓ 𝐌𝐢𝐝𝐝�...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

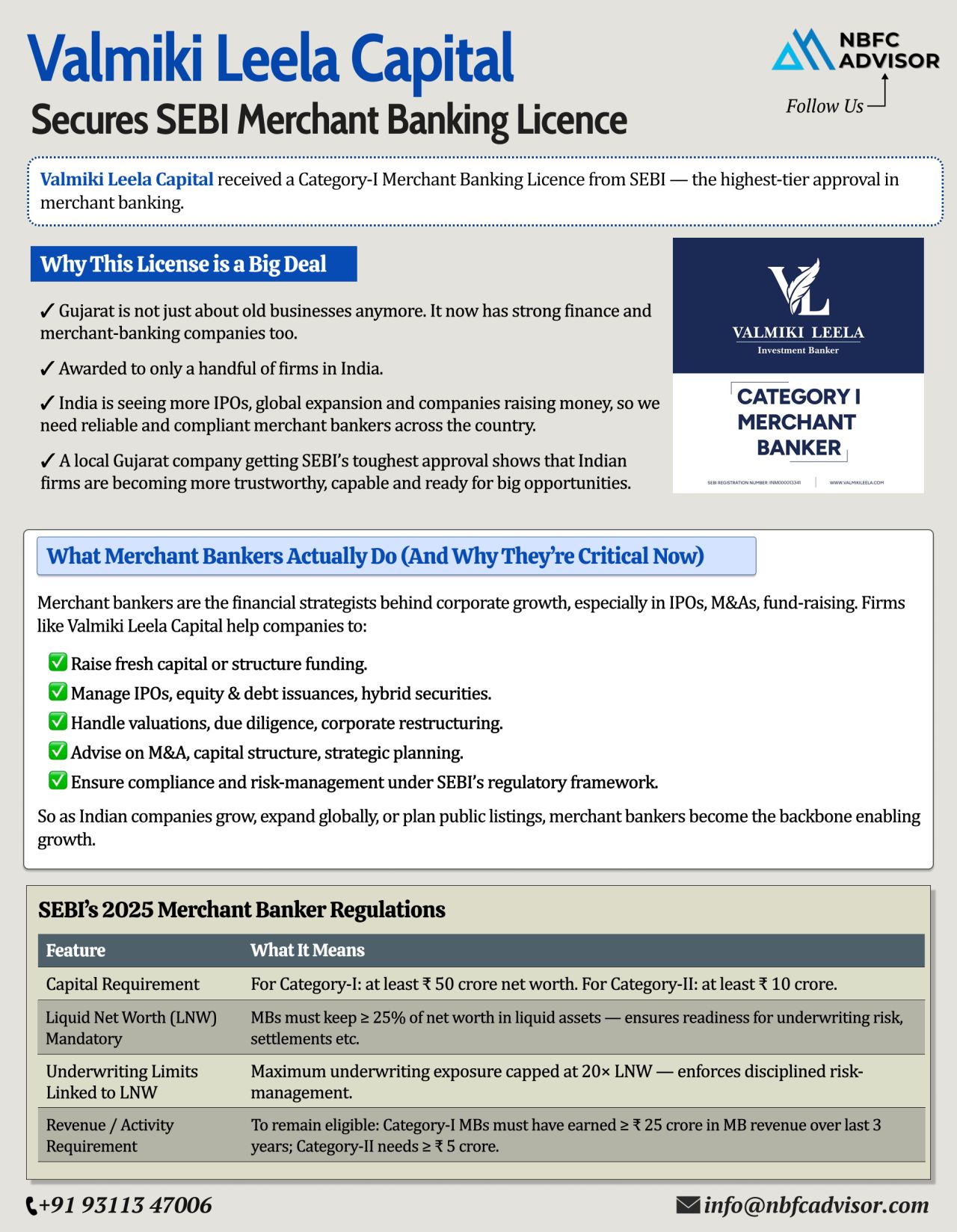

Gujarat Just Proved Everyone Wrong — And It’s a Big Win for India’s Financial Future

For decades, Gujarat has been known for its entrepreneurial spirit — but mostly in textiles, jewellery, and traditional family businesses....

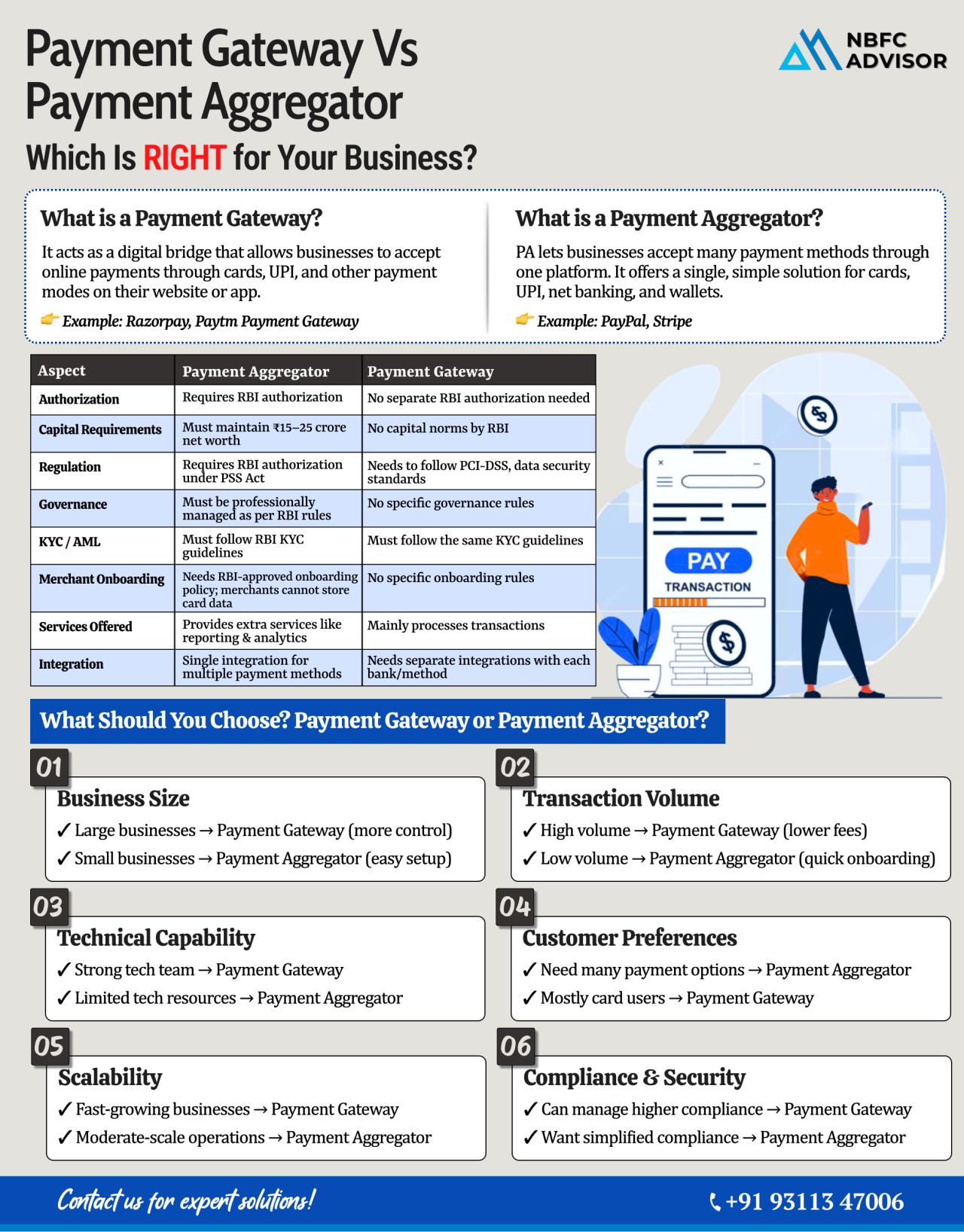

Payment Gateway vs Payment Aggregator: Which One Fits Your Business Better?

As online payments continue to grow in India, choosing the right payment infrastructure has become a strategic decision. A smooth, fast, and secure checkout is essential &...

RBI Is Coming Down Hard on NBFCs — Are You Prepared?

The Reserve Bank of India (RBI) is sending a strong message to the NBFC sector: regulatory compliance is critical. Over the last year, RBI has taken serious enforcement actions against bot...

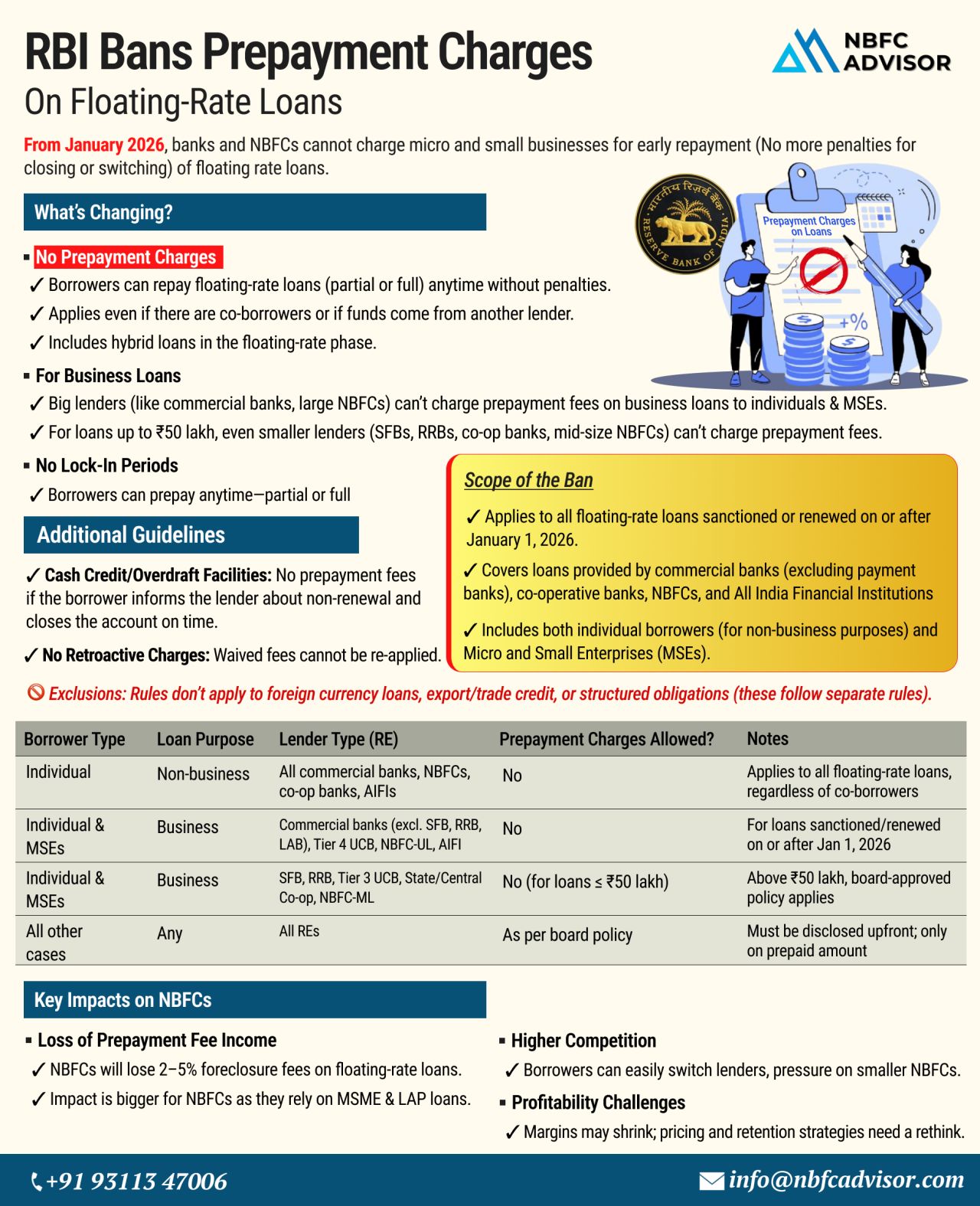

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

.png)