Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

𝐍𝐨𝐭 𝐚𝐥𝐥 𝐍𝐁𝐅𝐂𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞.

RBI has divided NBFCs into 4 layers based on size, risk, and complexity.

The bigger your NBFC is, the stricter the rules.

✓ 𝐁𝐚𝐬𝐞 𝐋𝐚𝐲𝐞𝐫: Smallest NBFCs, lightest regulations

✓ 𝐌𝐢𝐝𝐝�...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

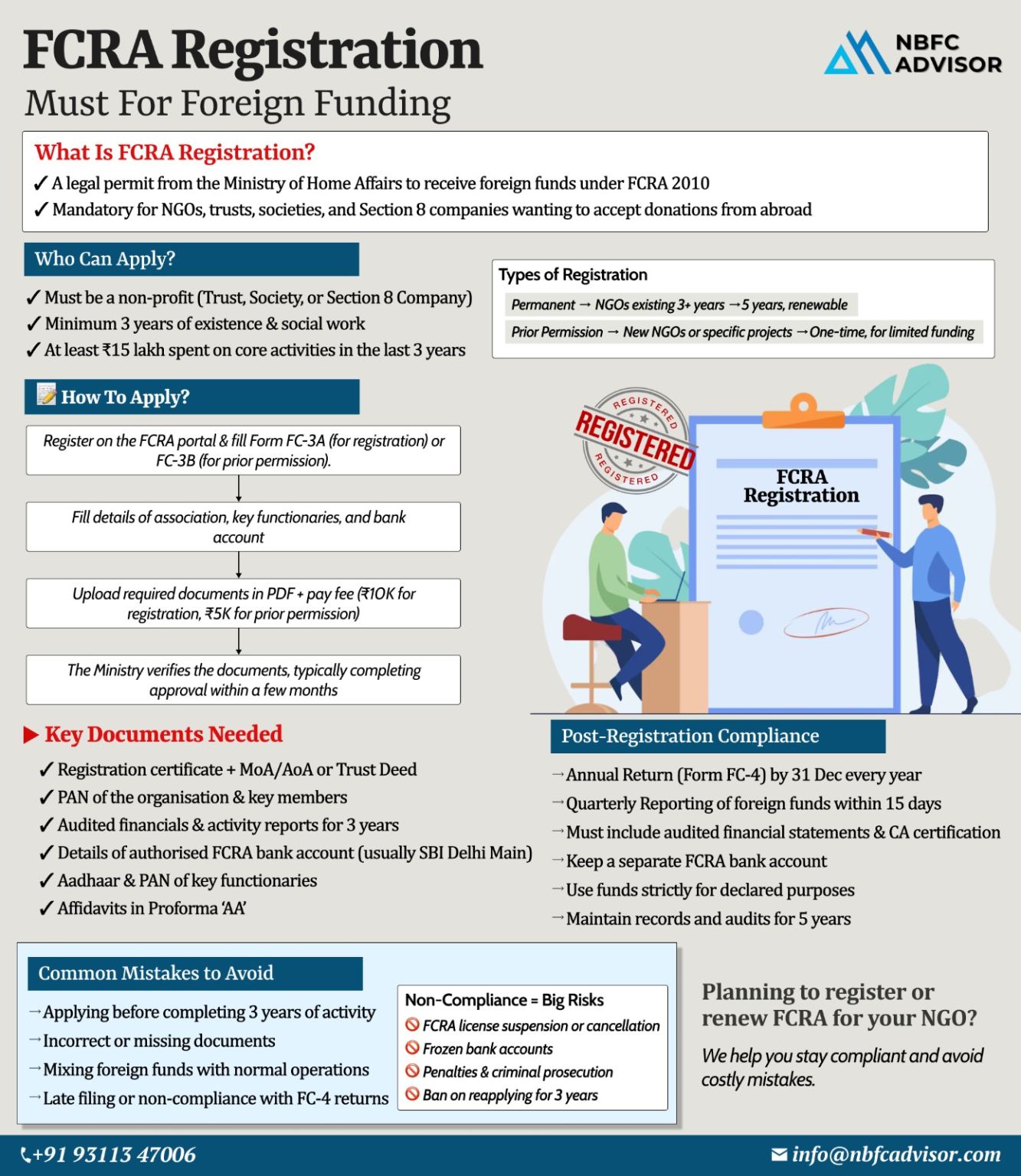

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)

.png)

.png)