Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

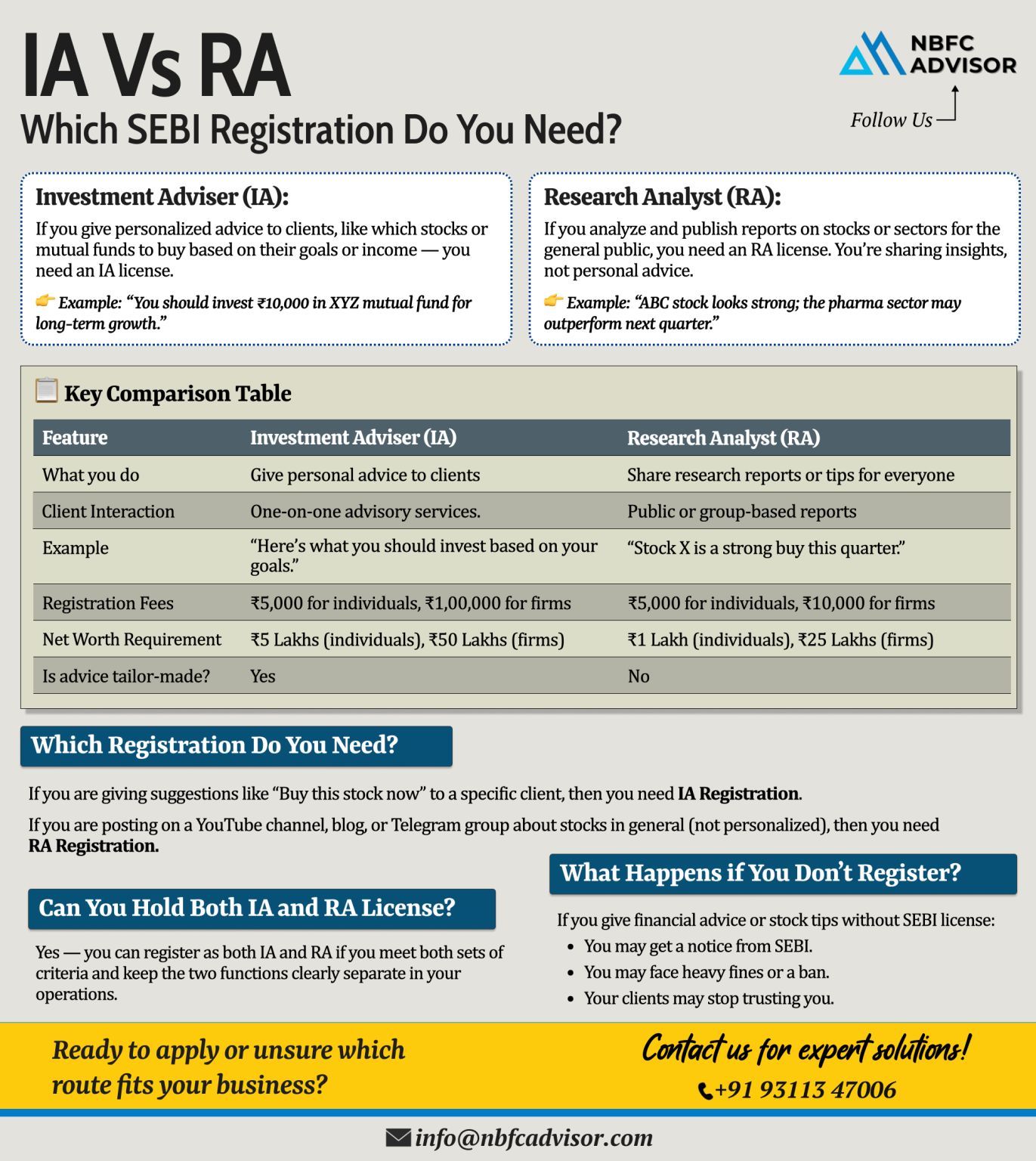

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

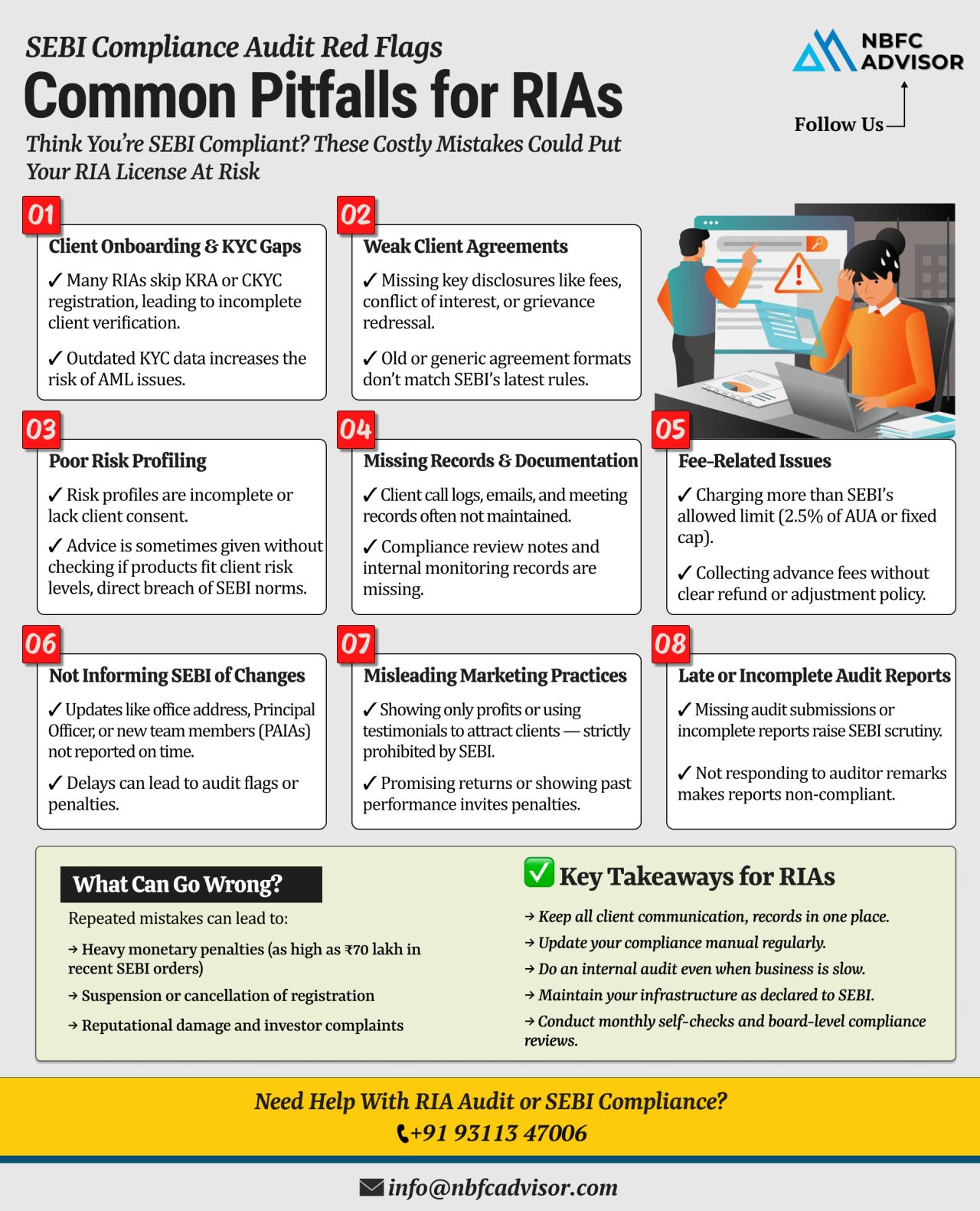

SEBI Compliance Red Flags for RIAs ⚠️

Avoid Costly Mistakes and Protect Your Registration

Registered Investment Advisers (RIAs) play a vital role in India’s financial ecosystem by offering transparent, client-focused investment advice. Ho...

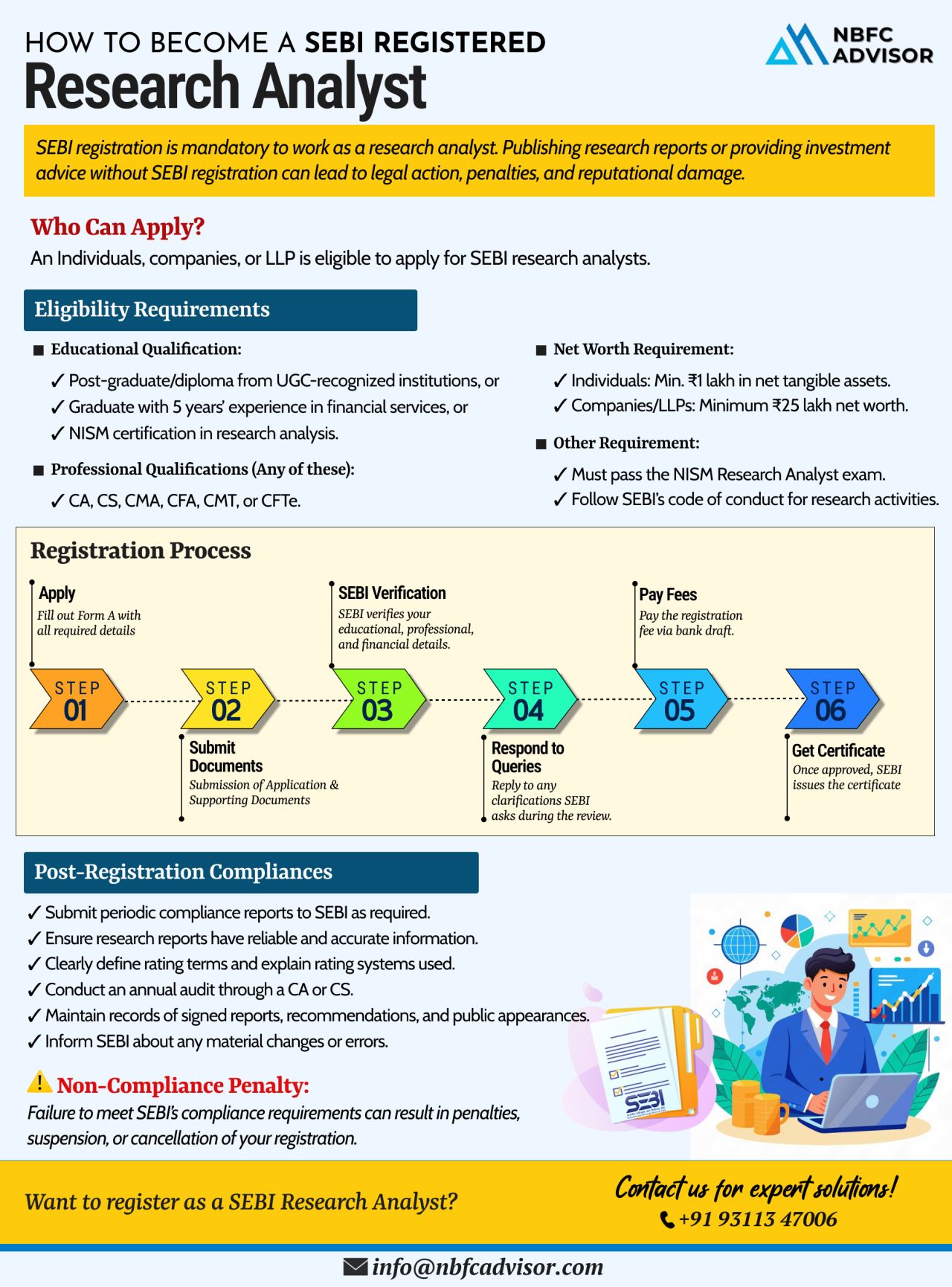

Are You Publishing Research Reports Without SEBI Registration?

That’s a fast track to penalties, suspension, and long-term reputational damage.

In today’s regulated financial ecosystem, SEBI registration is mandatory if you wish to wo...

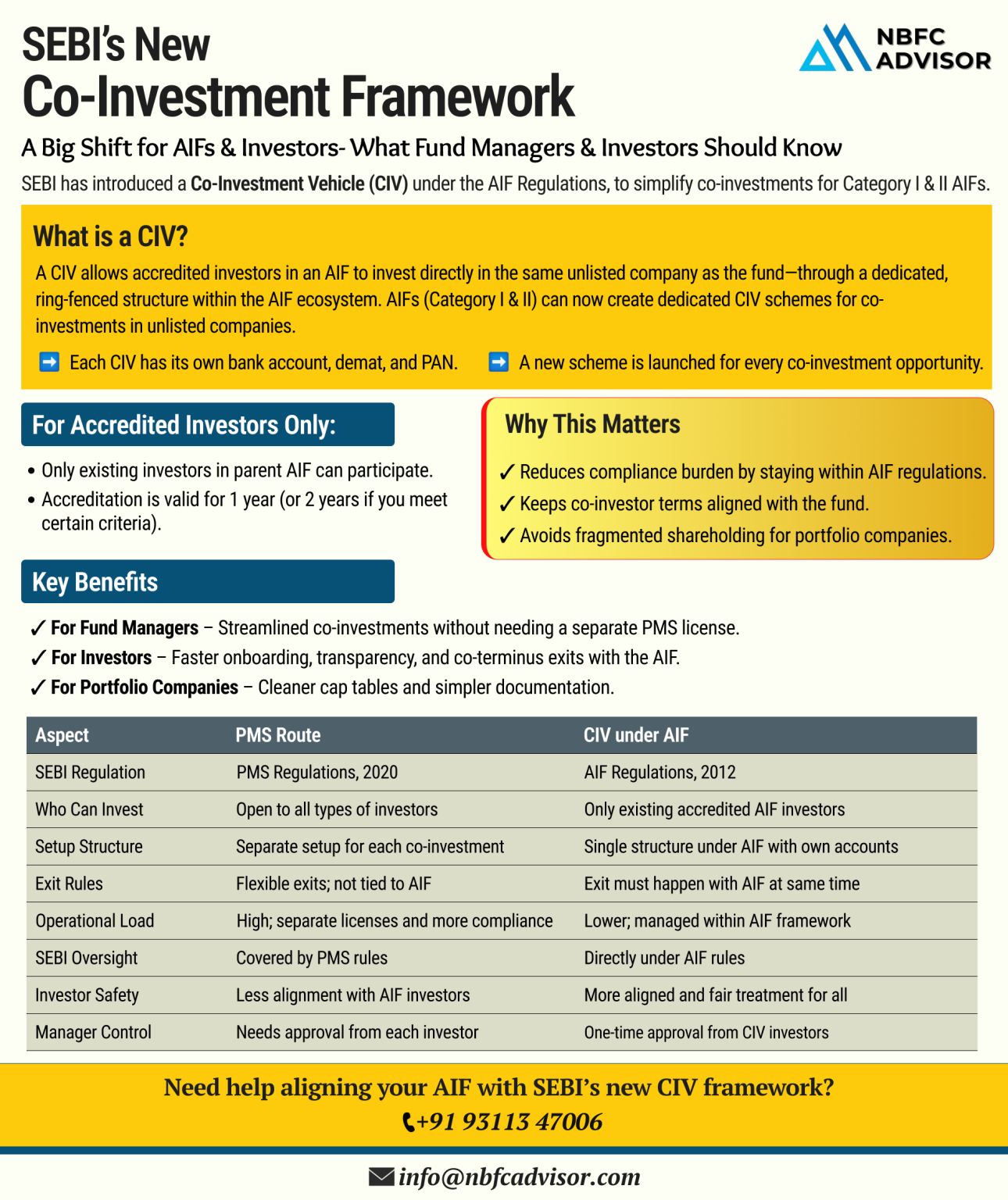

SEBI Rolls Out New Co-Investment Framework: A Big Win for India’s Private Market

India’s private capital landscape just received a significant boost.

In a major regulatory move, the Securities and Exchange Board of India (SEBI) has un...

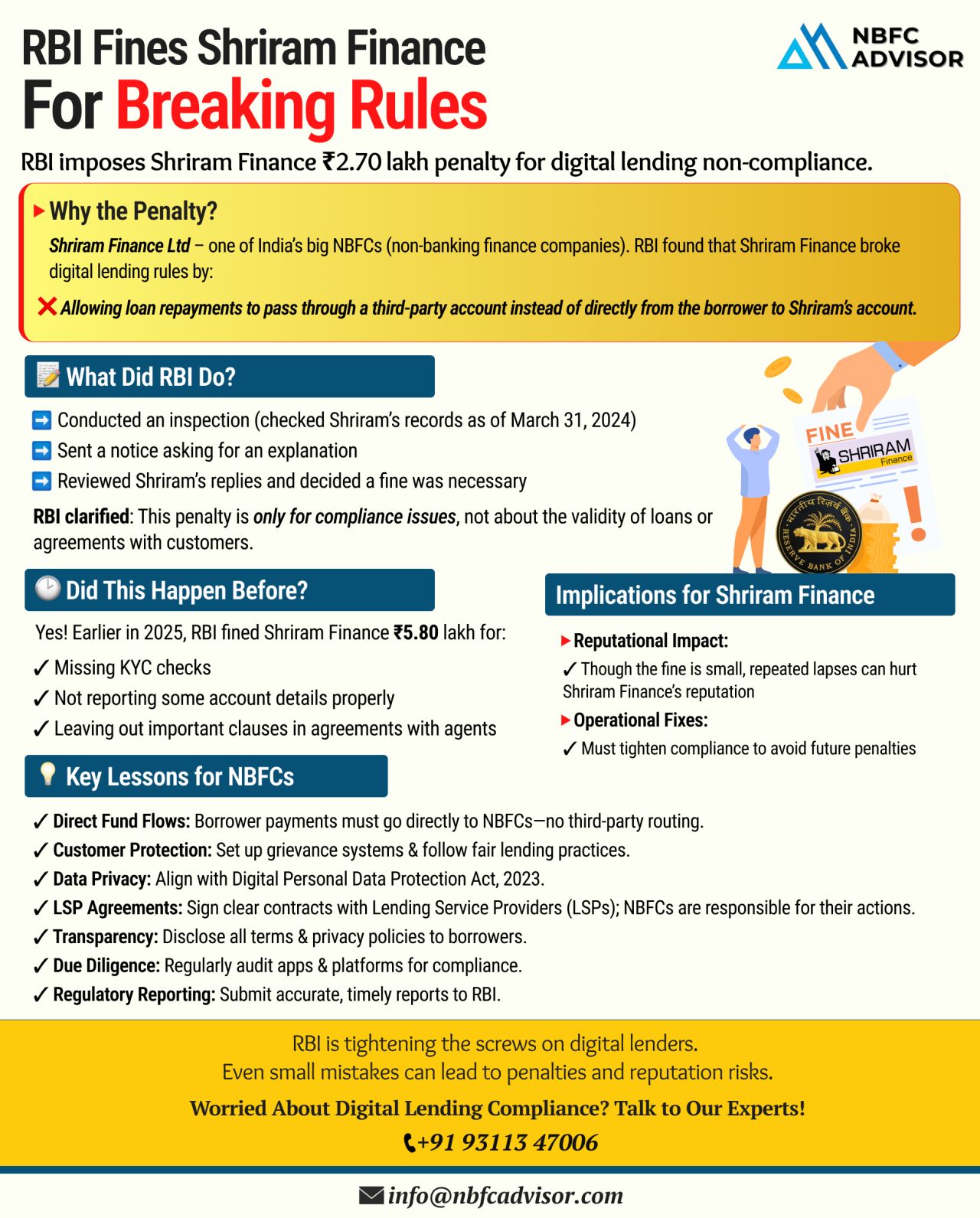

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

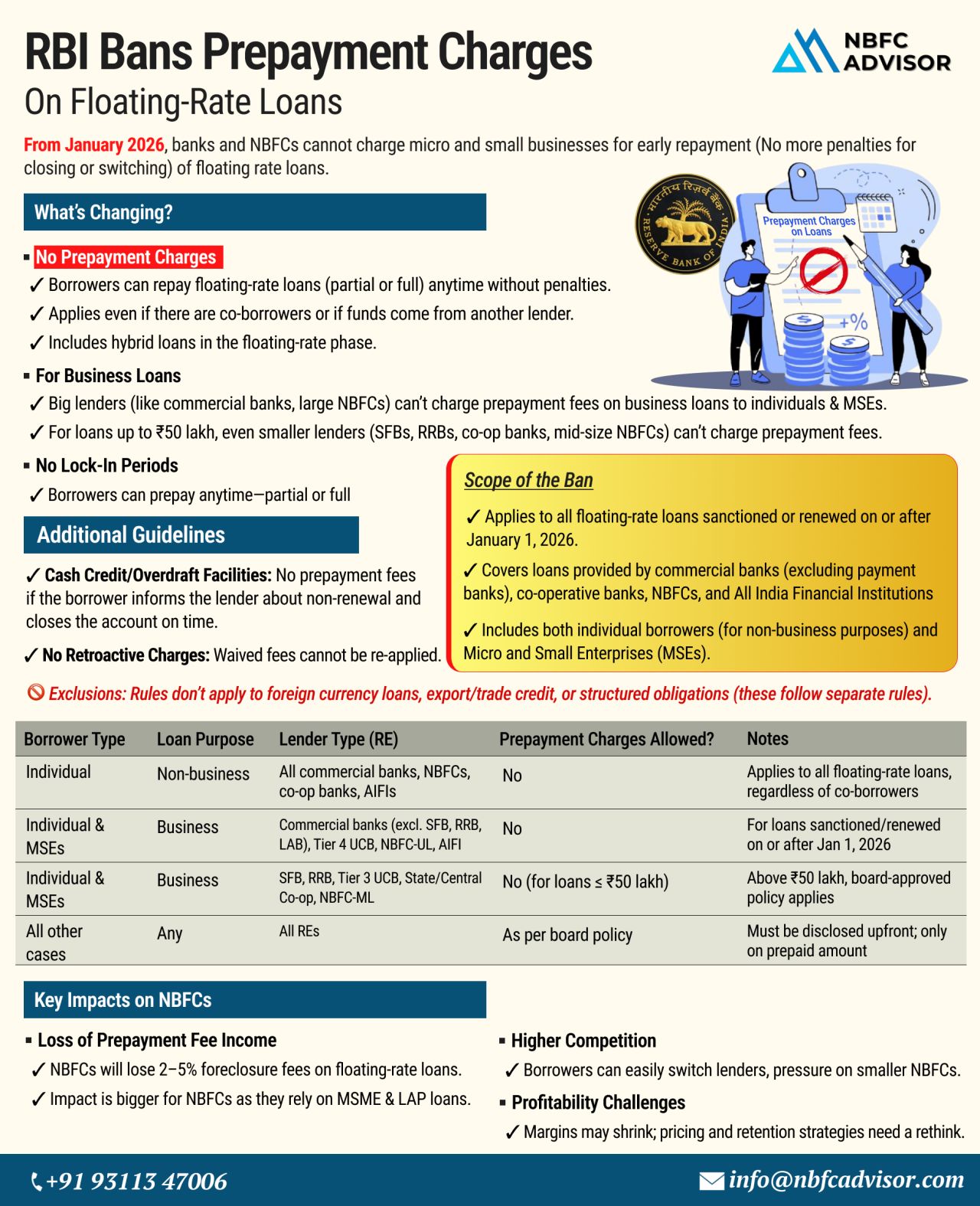

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)

.png)

.png)