SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

SEBI Just Reclassified REITs as Equity — And It Changes Everything

SEBI has officially reclassified Real Estate Investment Trusts (REITs) as equity investments — a landmark regulatory shift that will reshape how institutions and invest...

Cheques to Clear in Hours – From October 2025!

A game-changing update is coming for India’s banking customers and professionals. The Reserve Bank of India (RBI) is set to redefine cheque clearance, cutting the wait time from days to ju...

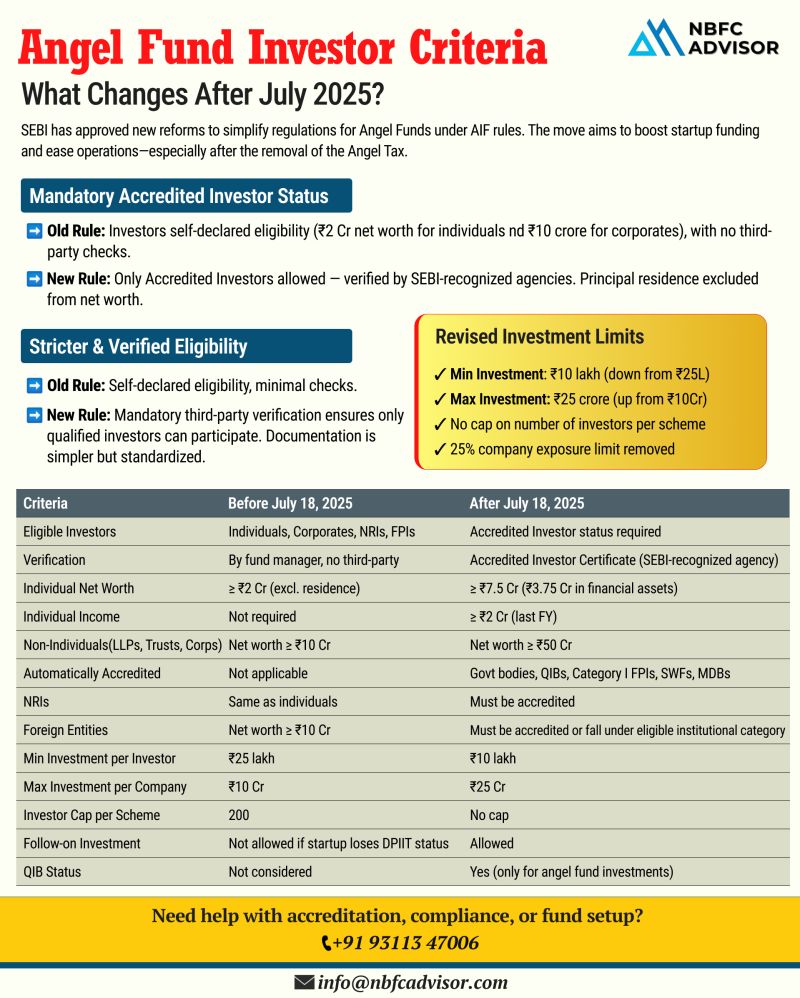

𝘈𝘯𝘨𝘦𝘭 𝘍𝘶𝘯𝘥 𝘙𝘦𝘨𝘶𝘭𝘢𝘵𝘪𝘰𝘯𝘴 𝘈𝘳𝘦 𝘌𝘷𝘰𝘭𝘷𝘪𝘯𝘨 — 𝘈𝘳𝘦 𝘠𝘰𝘶 𝘗𝘳𝘦𝘱𝘢𝘳𝘦𝘥?

Starting July 2025, the rules governing Angel Funds in India are undergoing a major overhaul.

These fresh guidelines from SEBI aim to bri...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

Starting a Non-Banking Financial Company (NBFC) in India can be a lucrative venture, but it requires compliance with stringent regulatory frameworks laid out by the Reserve Bank of India (RBI). At NBFC Registration, we make this process easier, ensur...