Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

Compliance Gaps Can Break Your Business: Why NBFCs Must Stay Ahead of RBI Regulations

In today’s financial landscape, compliance is no longer optional.

With the Reserve Bank of India (RBI) tightening its oversight, even well-managed NBFCs a...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

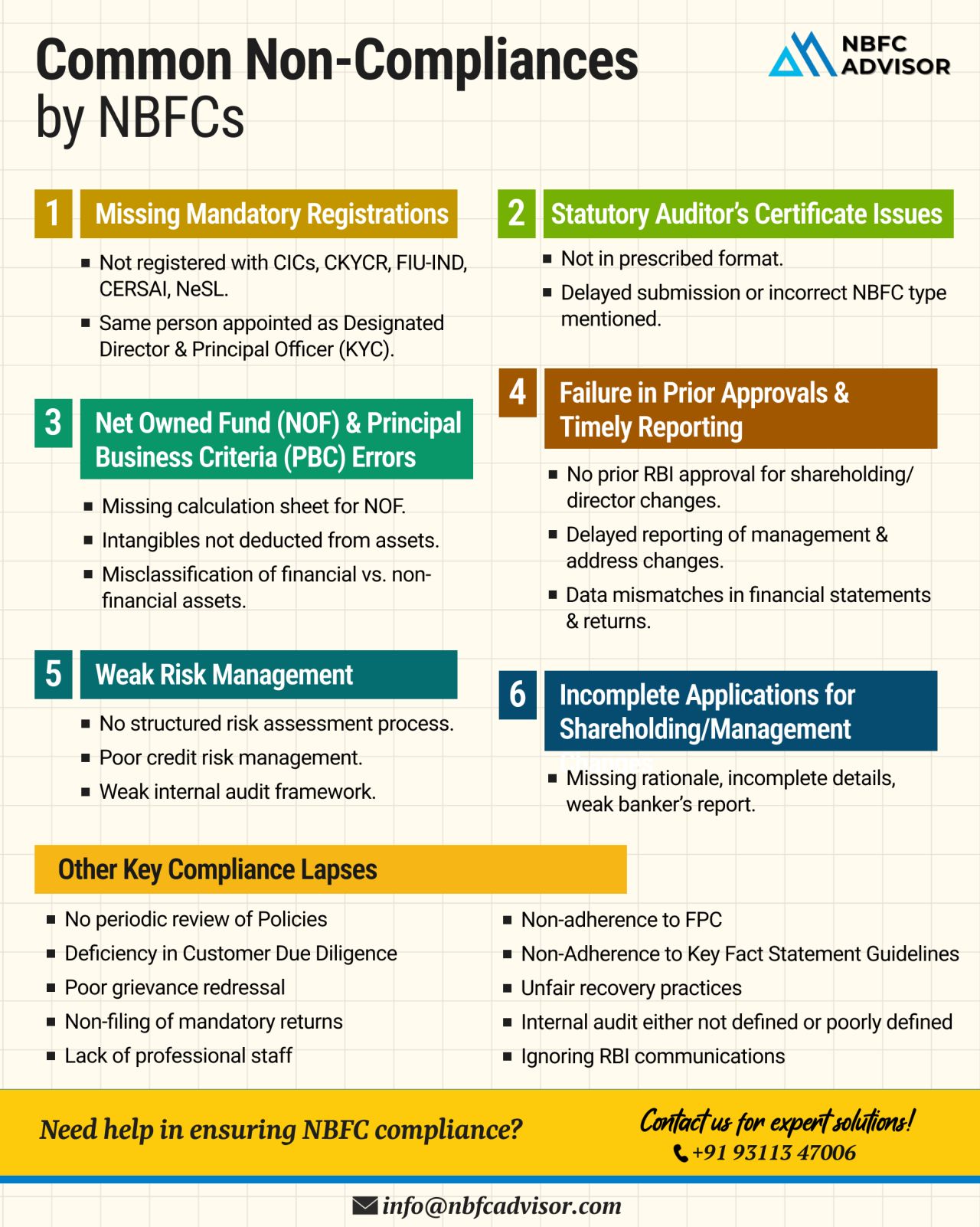

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

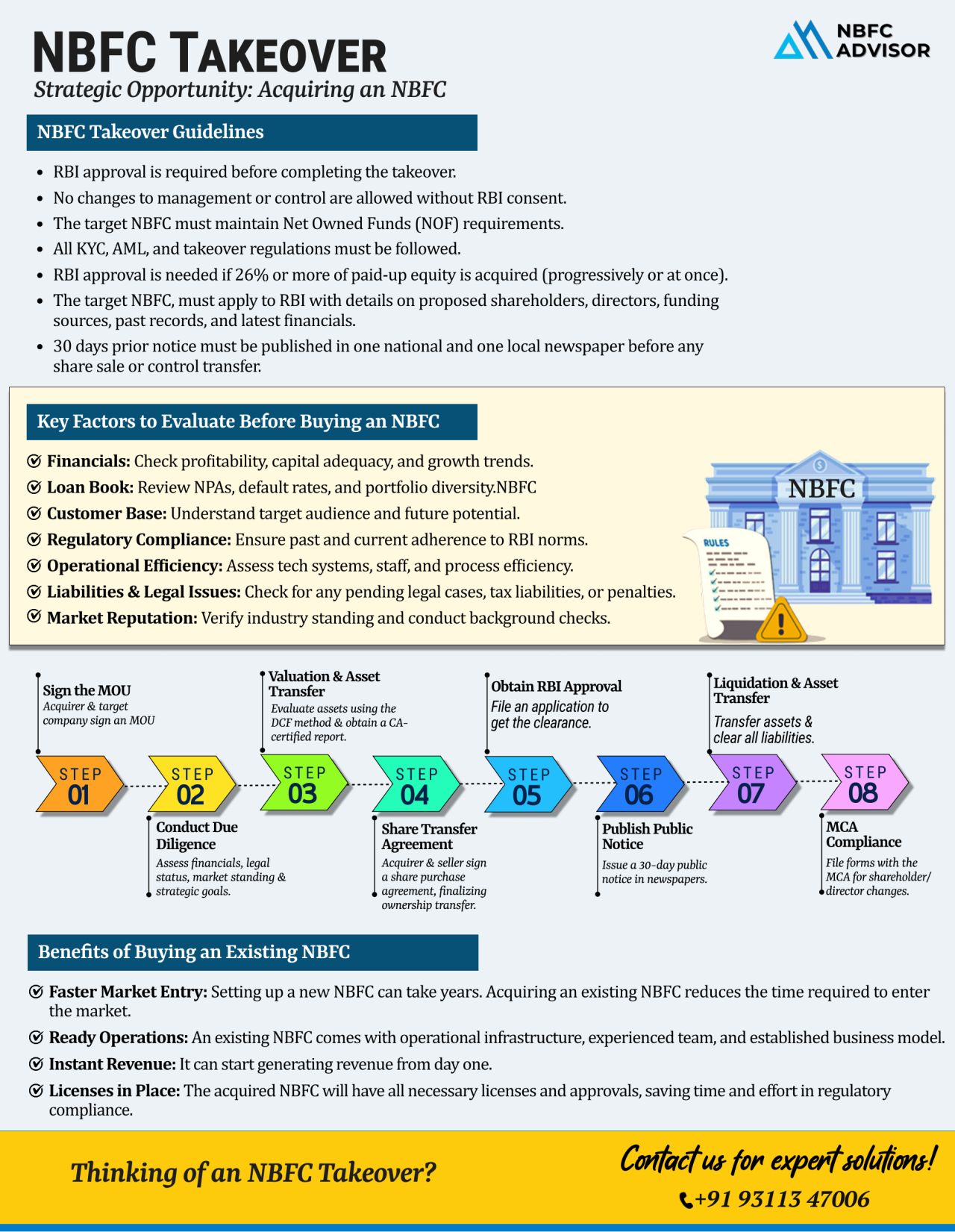

NBFC Takeover vs. New NBFC Registration – The Smarter Way to Enter the Lending Business

Thinking of starting an NBFC (Non-Banking Financial Company) in India? You’re not alone — with the booming fintech ecosystem and rising credi...

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

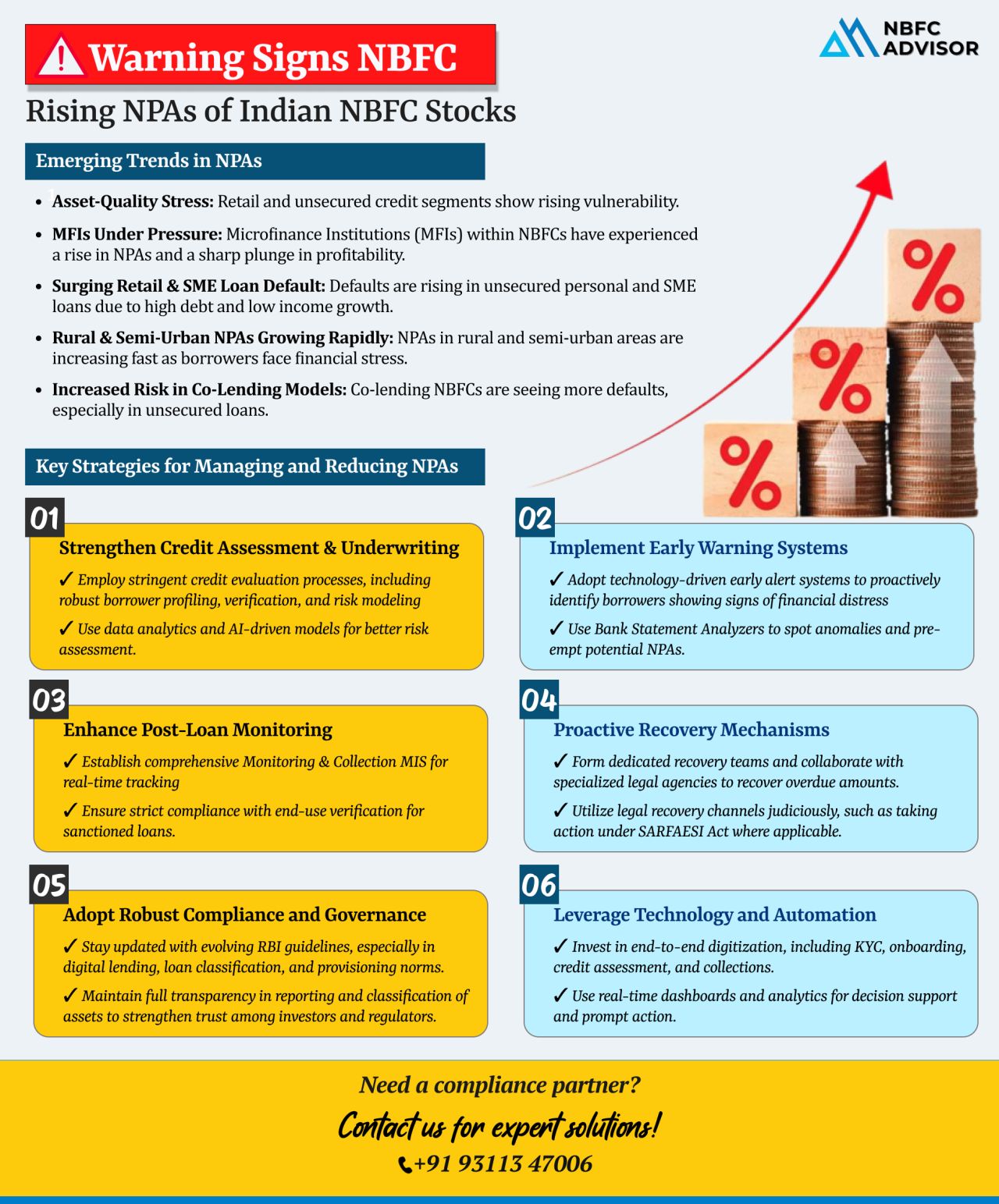

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

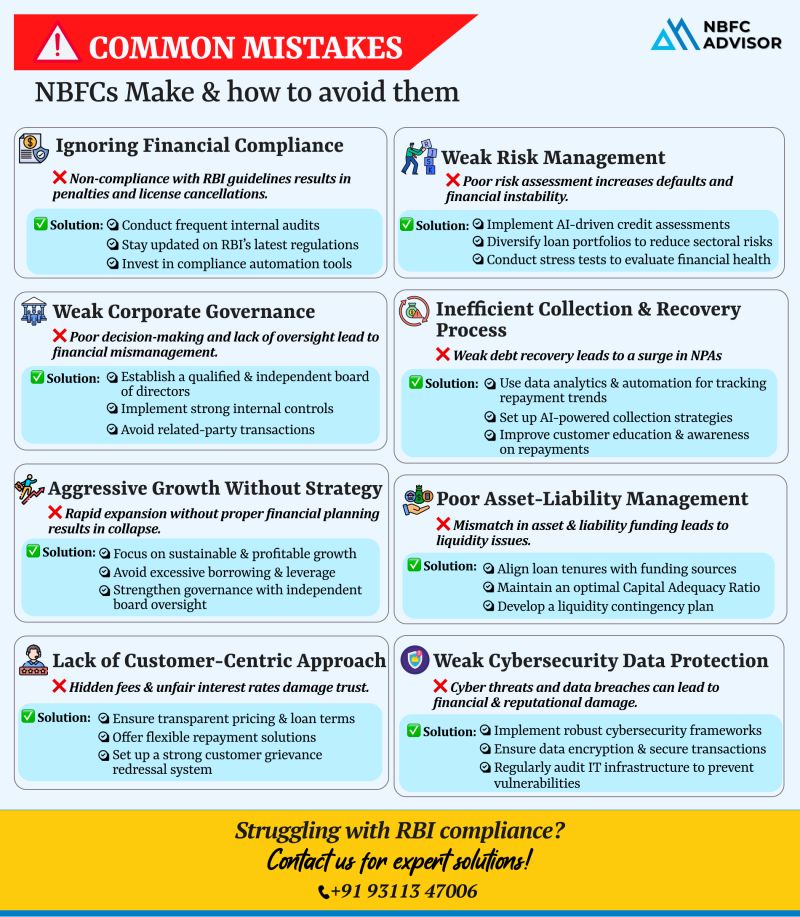

Is Your NBFC Making These Critical Mistakes?

The NBFC sector in India has seen impressive growth—but with that growth comes increased scrutiny from regulators like the RBI. Alarmingly, many NBFCs face operational hurdles, rising NPAs, or eve...

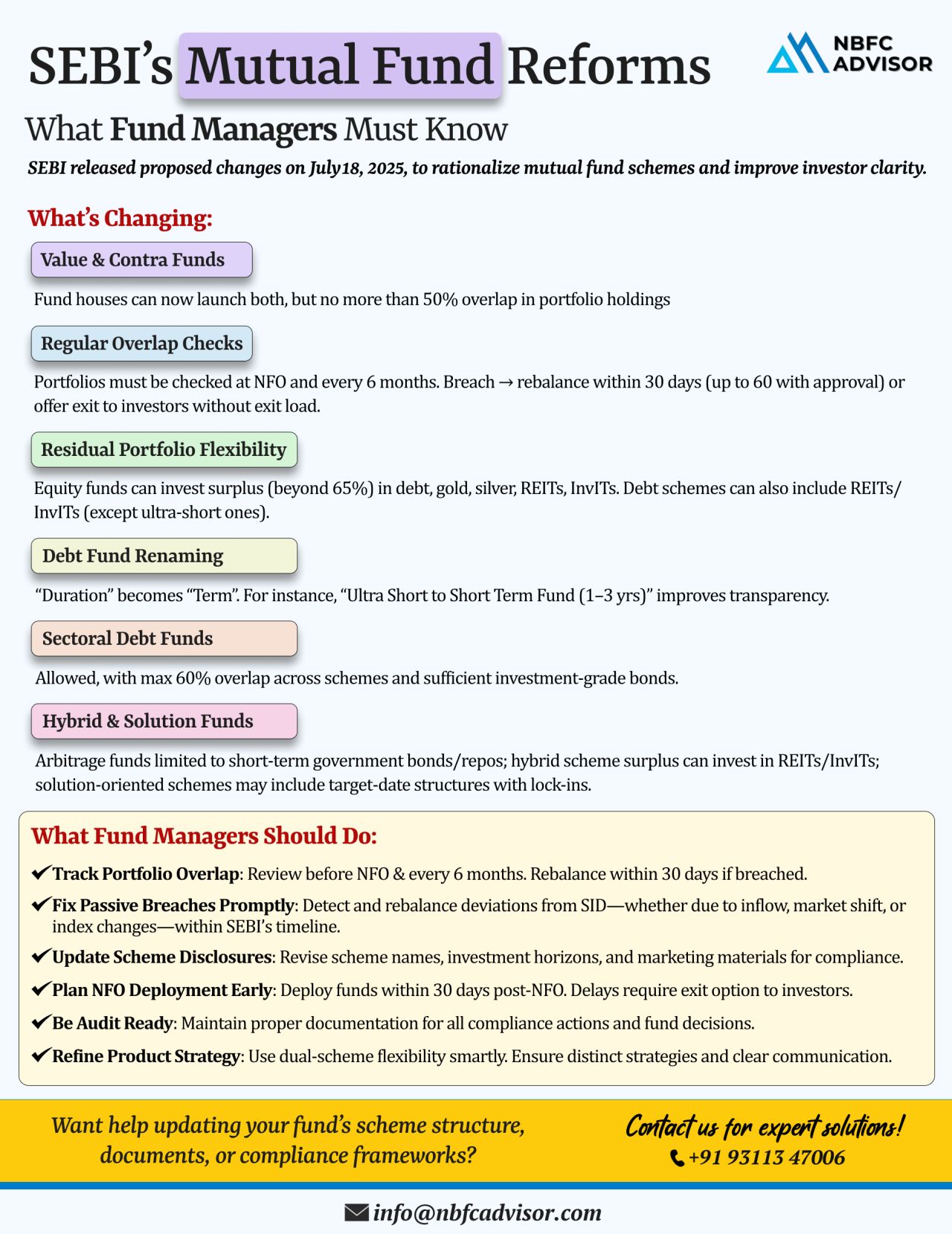

📰 SEBI’s Latest Mutual Fund Reforms: A Step Towards Clarity and Better Risk Management

The Securities and Exchange Board of India (SEBI) has introduced a series of proposed reforms to bring greater transparency, clarity, and structure to mu...

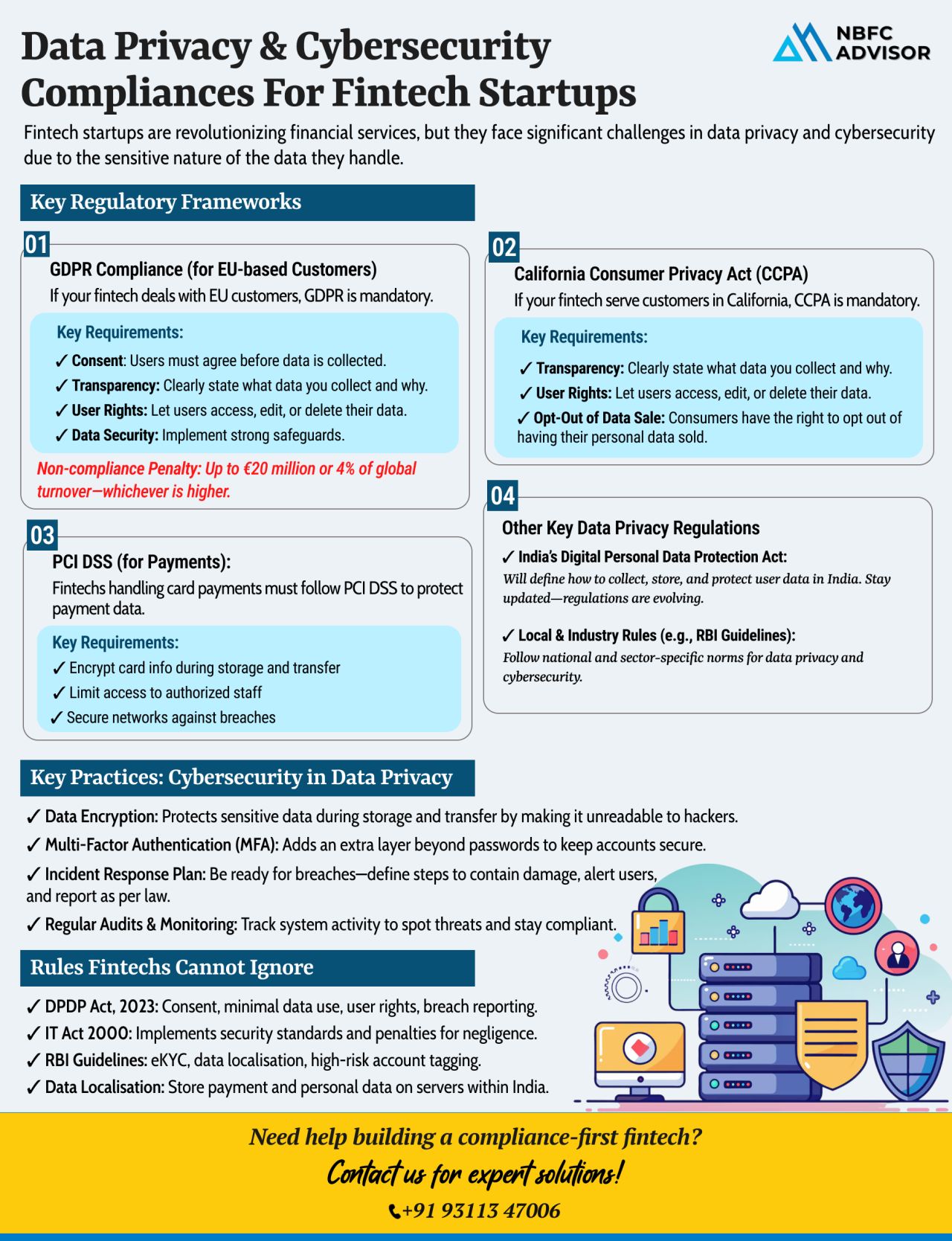

Launching a Fintech? One Data Breach Could Derail Everything

Building a fintech startup is an exciting journey—but with great innovation comes greater responsibility. In the world of digital finance, data protection and cybersecurity complia...

RBI’s Officer Training Program: Ushering in a New Era of Digital Finance & Compliance

The Reserve Bank of India (RBI) is preparing for the future of India’s financial ecosystem with a comprehensive officer training initiative in Hy...

⚠️ Is Your NBFC Vulnerable to RBI Action?

With increasing regulatory scrutiny, the Reserve Bank of India (RBI) is taking strict action against Non-Banking Financial Companies (NBFCs) that fail to comply with its guidelines. From financia...

RBI to Tighten Supervisory Norms for NBFCs in FY26: What It Means for the Sector

The Reserve Bank of India (RBI) is preparing to introduce stricter supervisory regulations for Non-Banking Financial Companies (NBFCs) in the financial year 2025&ndas...

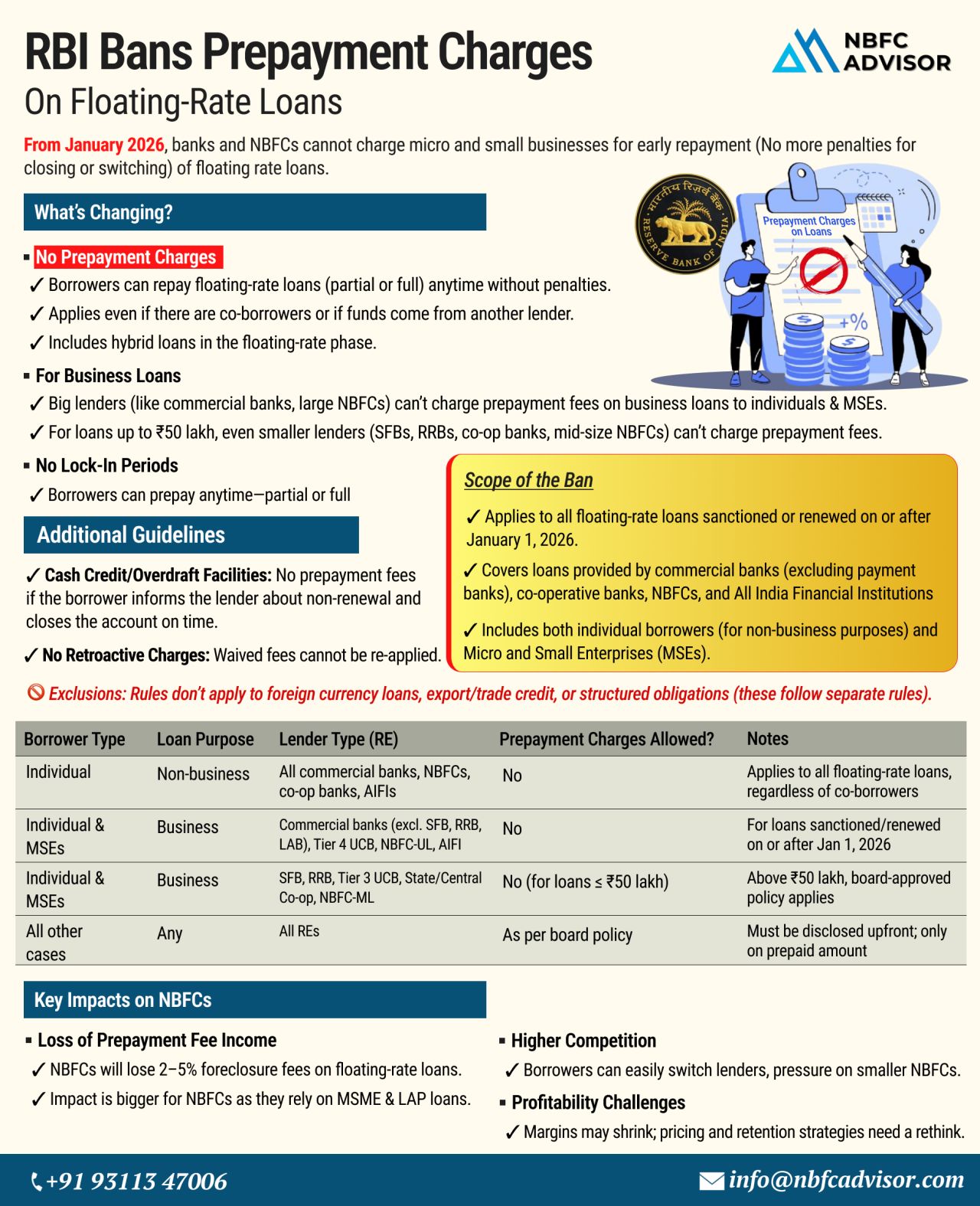

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...

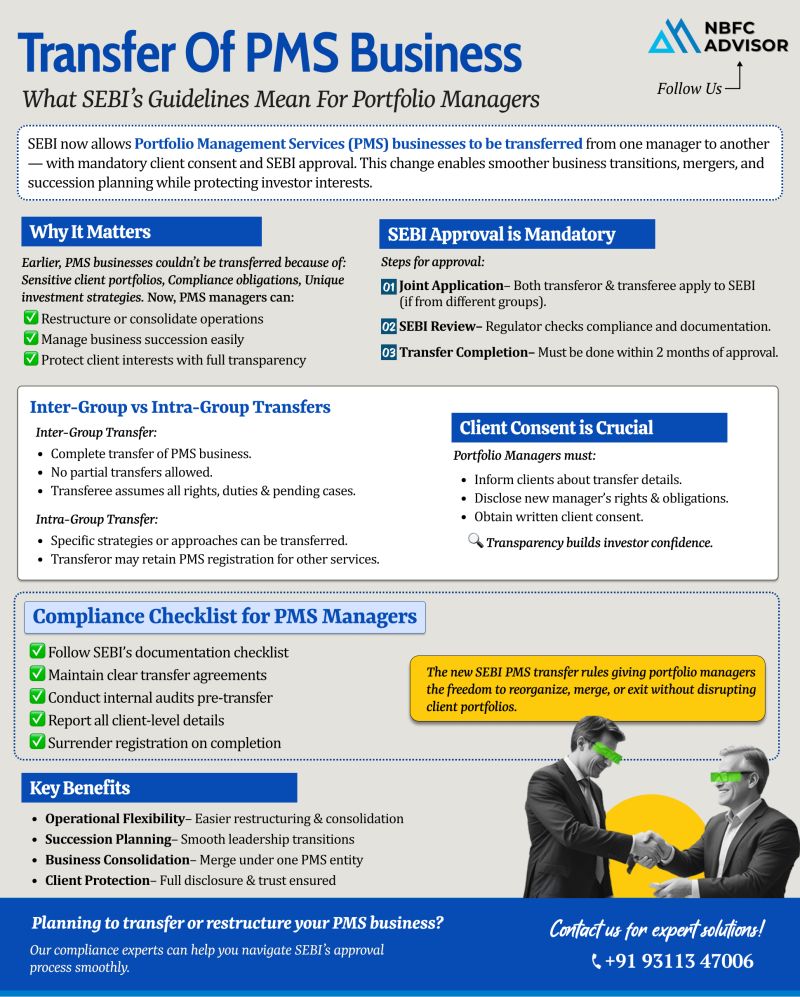

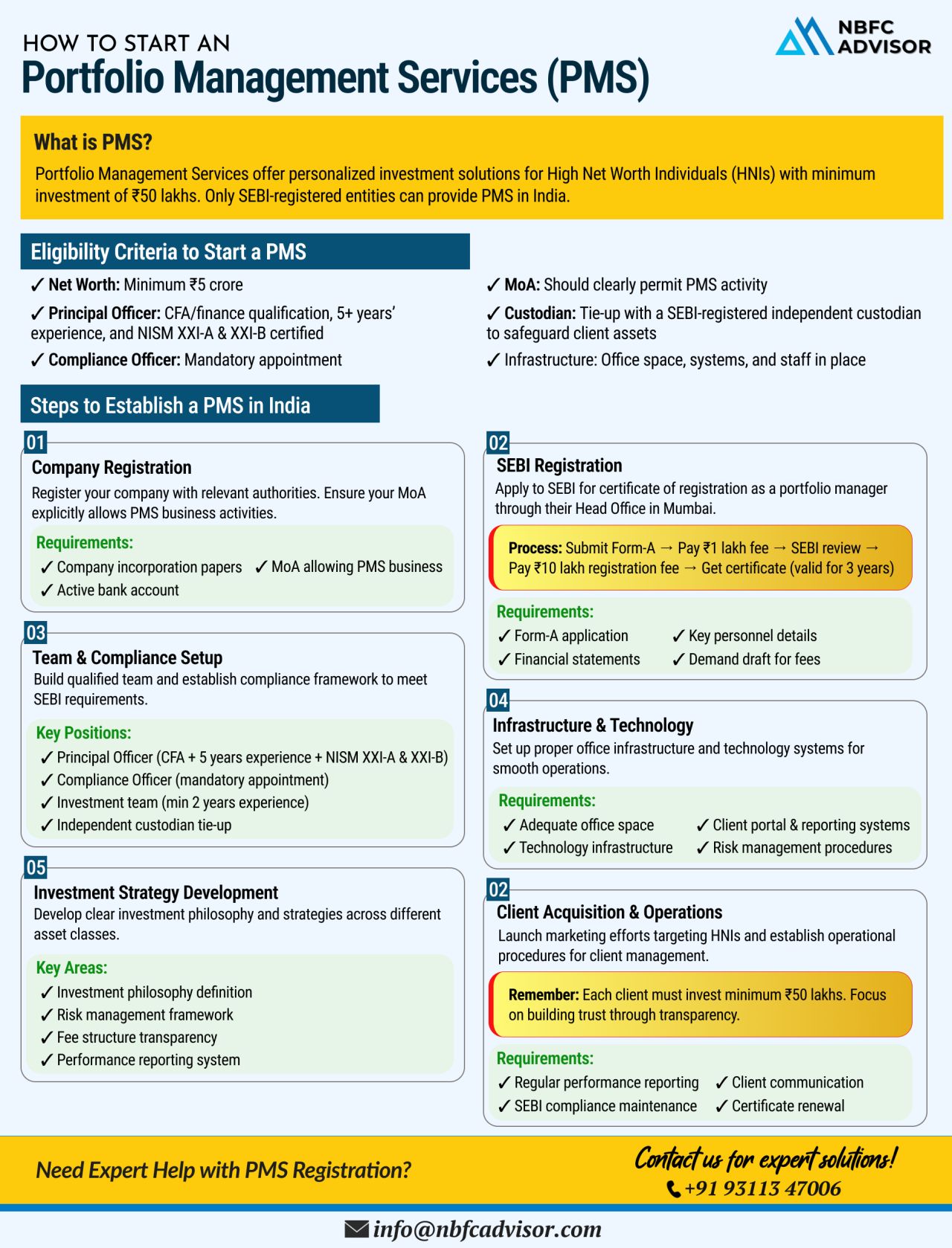

The Portfolio Management Services (PMS) industry in India is experiencing unprecedented growth, with total assets under management (AUM) surpassing ₹7.08 lakh crore. Clocking a CAGR of 33%, PMS is rapidly emerging as a preferred investment option for...

If you’re looking to venture into the financial services sector, registering as a Non-Banking Financial Company (NBFC) could be the right move for you. With the financial market in India expanding rapidly, the demand for diverse financial ...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

In India’s dynamic financial landscape, starting a Non-Banking Financial Company (NBFC) can open doors to immense growth opportunities. However, the process of setting up an NBFC is complex, requiring a deep understanding of regulatory requirem...

.png)

.png)

.png)