Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

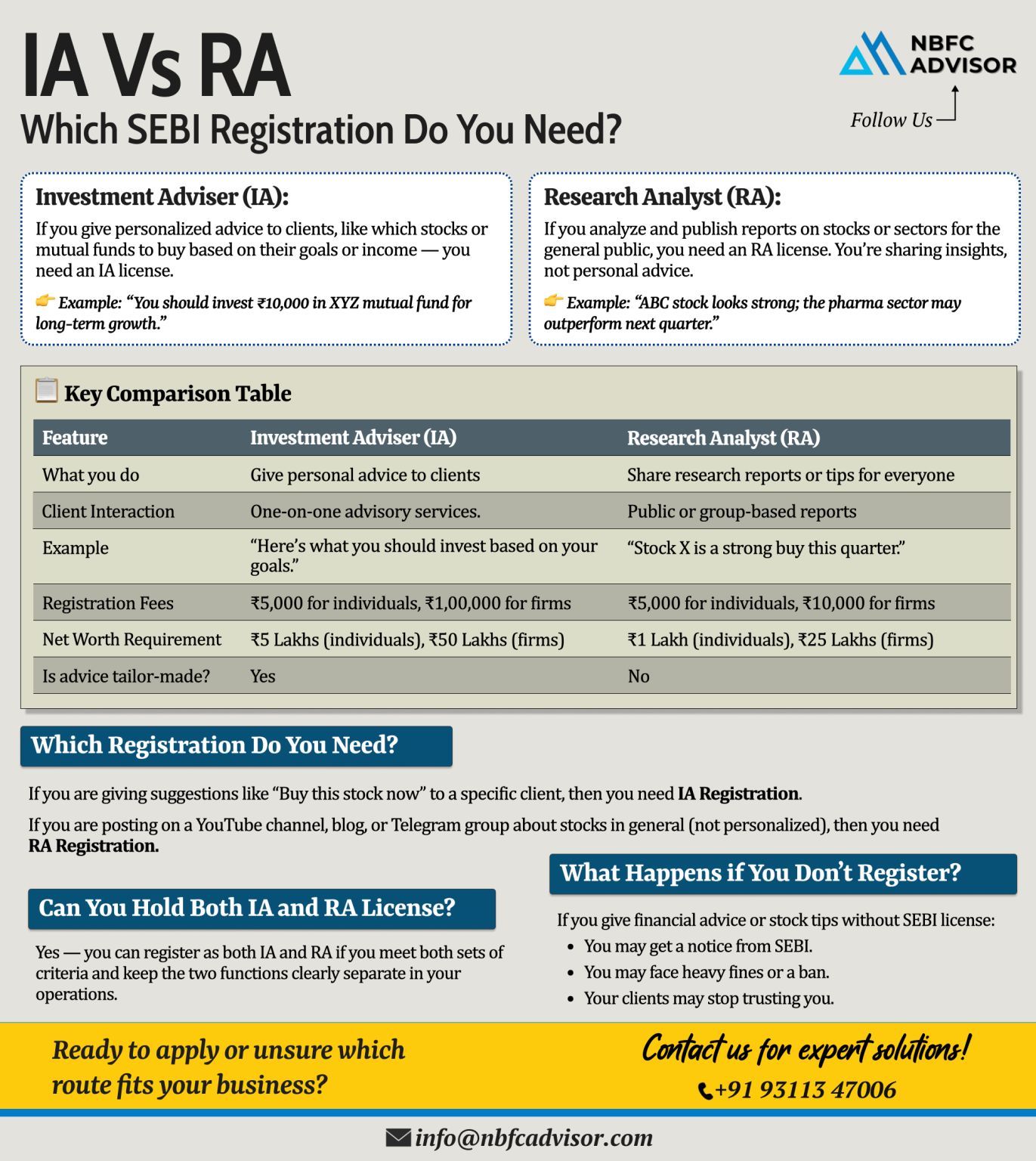

Giving Stock Tips Online? Here’s What You Need to Know

In today’s digital era, social media and online platforms have turned many finance enthusiasts into influencers, educators, and advisors. But when it comes to giving stock market a...

Thinking of Starting a Digital Lending Business? Here’s Why Now is the Right Time

India’s financial landscape is transforming faster than ever before. With fintech innovation and digital infrastructure evolving rapidly, the digital len...

NBFC Takeover vs. New NBFC Registration – The Smarter Way to Enter the Lending Business

Thinking of starting an NBFC (Non-Banking Financial Company) in India? You’re not alone — with the booming fintech ecosystem and rising credi...

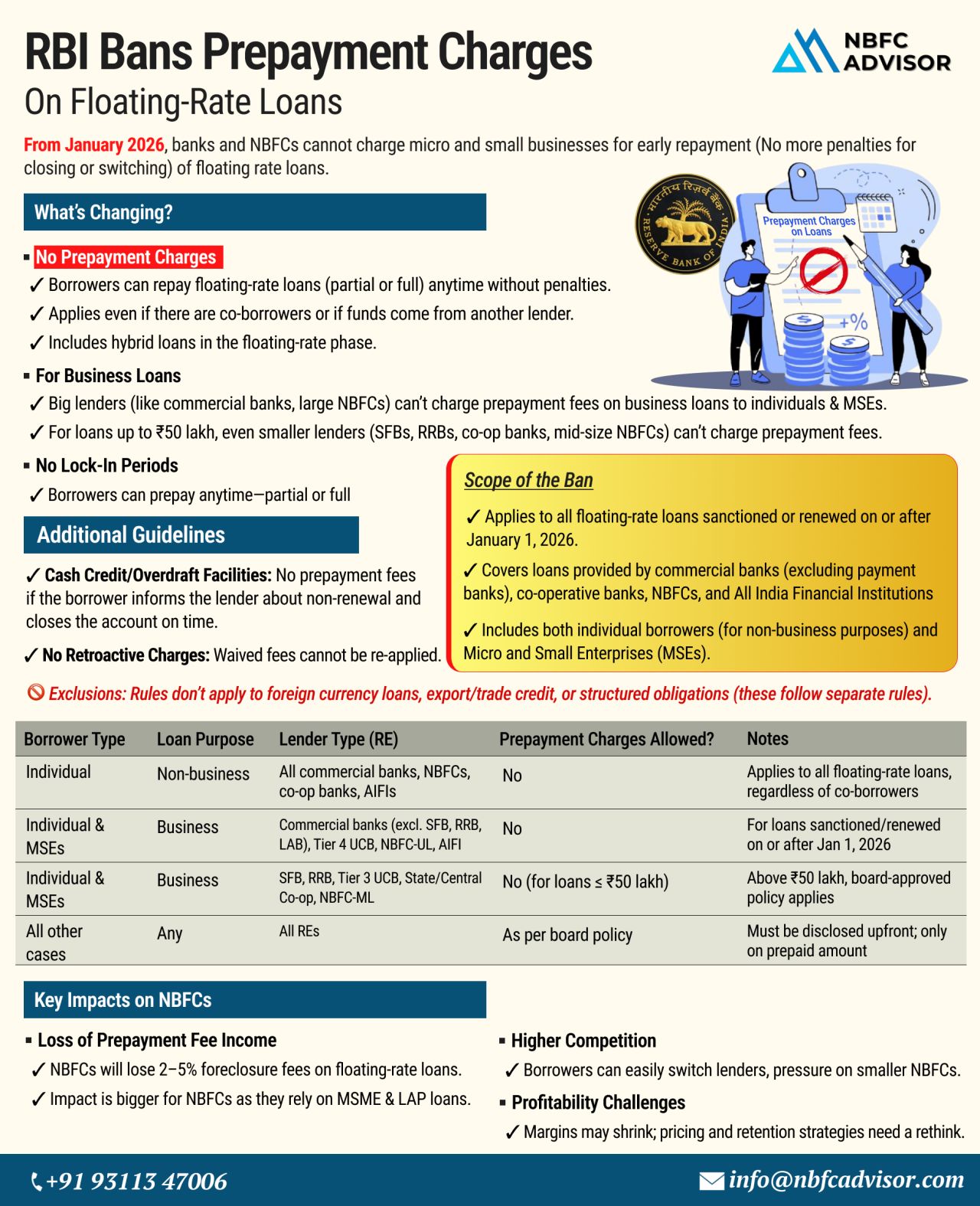

RBI Scraps Prepayment Charges on Floating-Rate Loans

A Game-Changer for NBFCs from January 2026

In a landmark move to empower borrowers and promote transparency, the Reserve Bank of India (RBI) has banned prepayment penalties on floating-rate l...