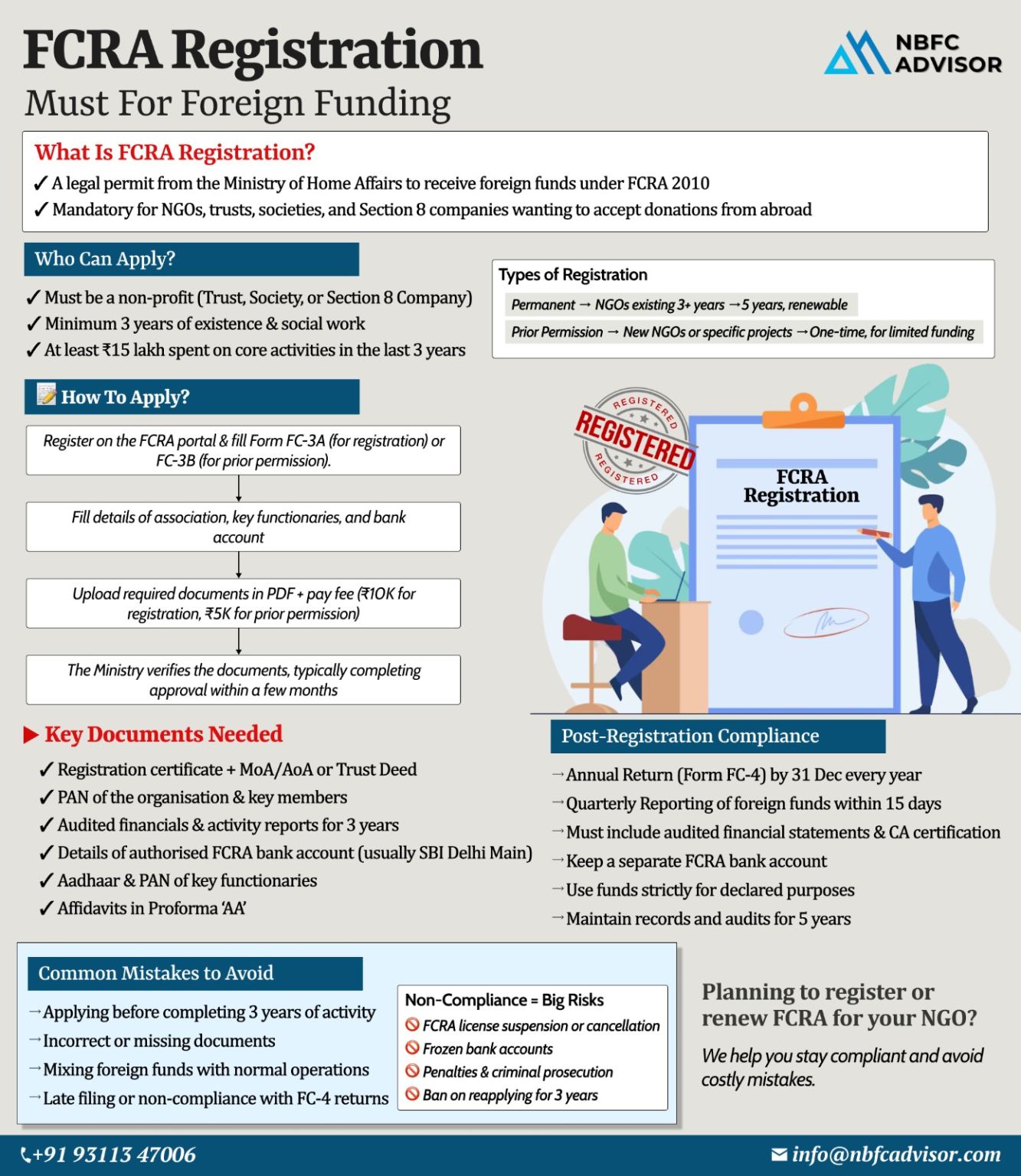

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

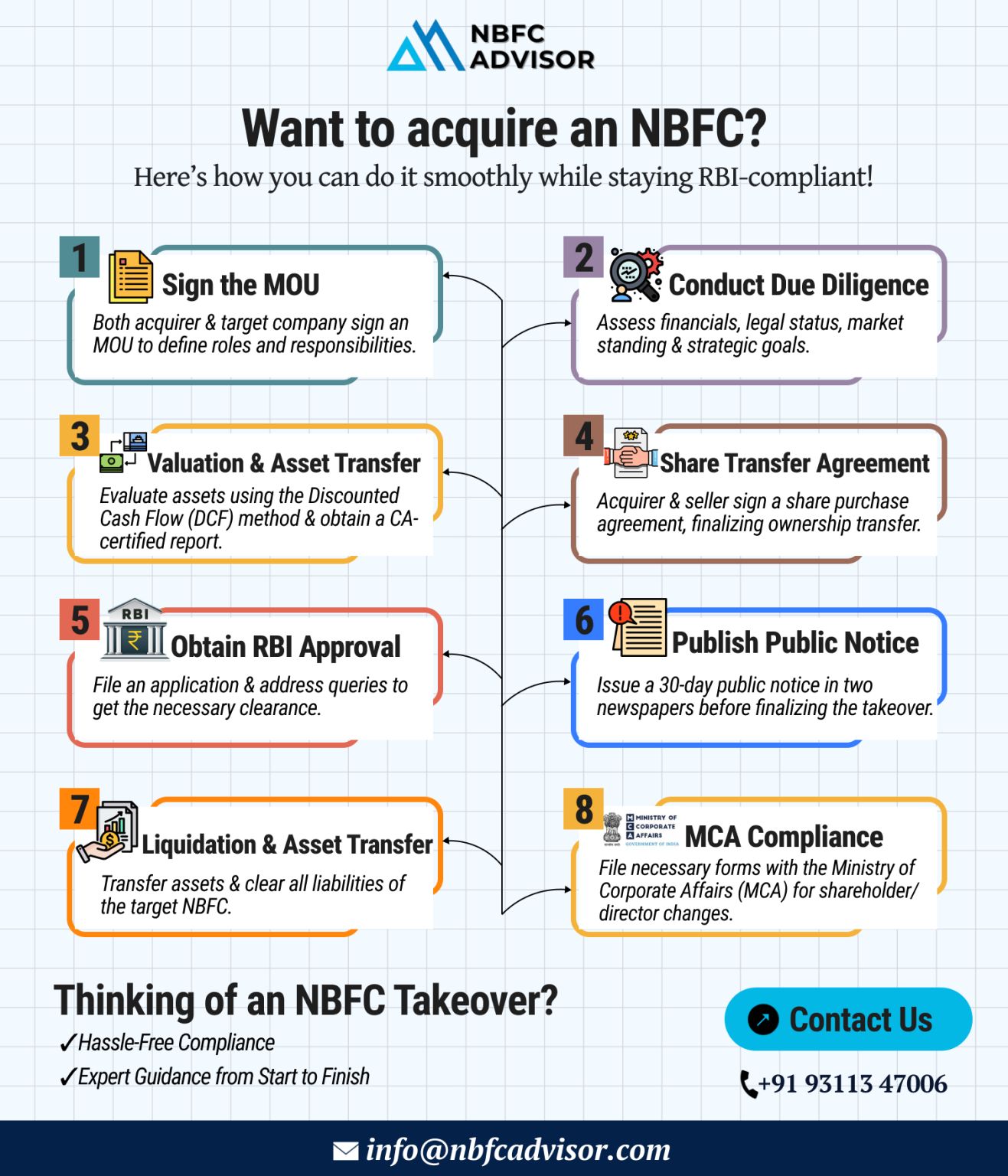

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

Blog Title: Top 10 Mistakes to Avoid When Registering an AIF

Setting up an Alternative Investment Fund (AIF) in India can open doors to diverse investment opportunities—but navigating the registration process with SEBI isn’t as straigh...

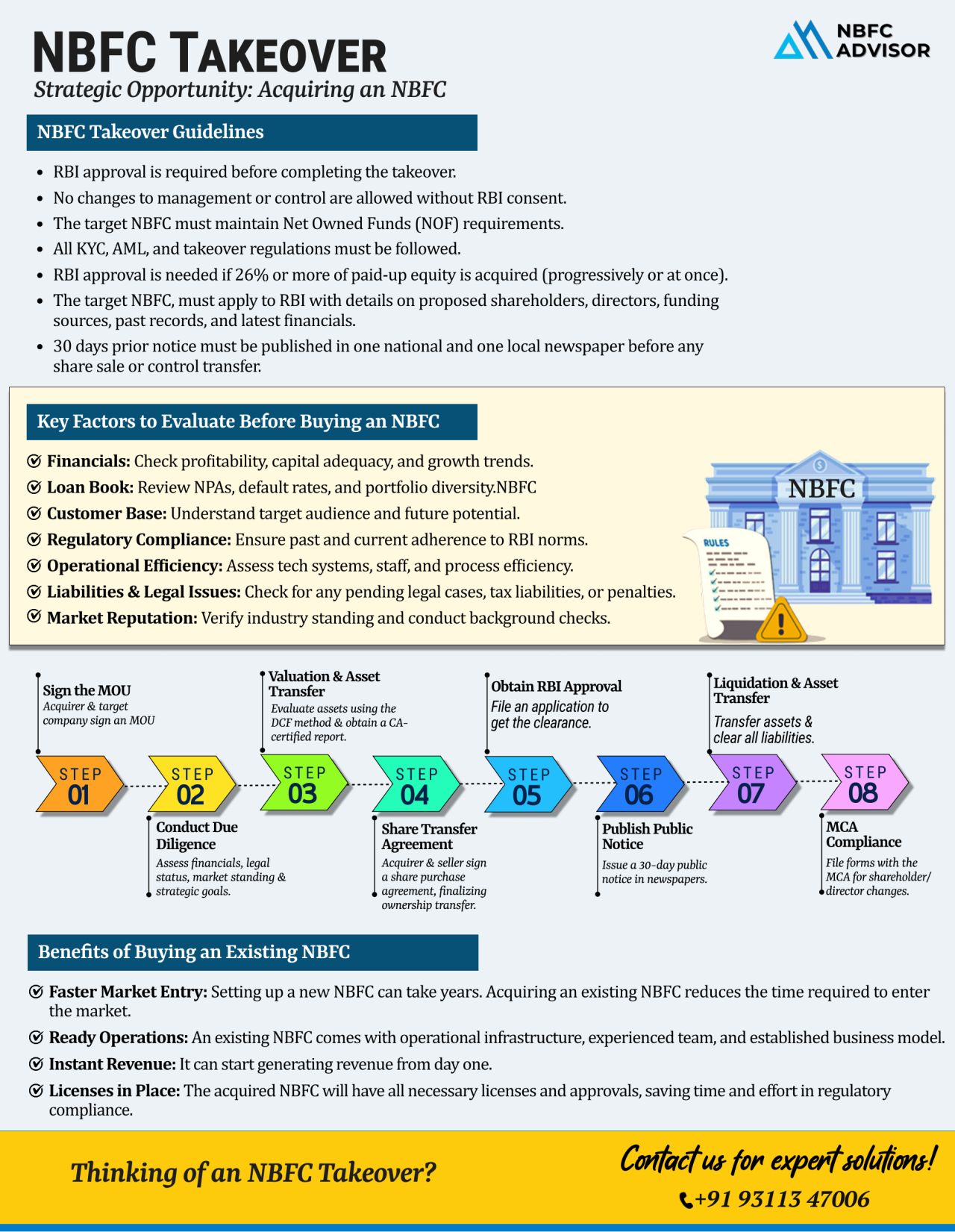

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

❌ Common Reasons Why NBFC License Applications Get Rejected

1. Inadequate Business Plan & Financial Projections

The RBI expects a well-structured, sector-specific business plan that includes strong market research and realistic financial fore...