SEBI Reclassifies REITs as Equity Investments: What It Means for Funds and Investors

In a major regulatory shift, SEBI has reclassified Real Estate Investment Trusts (REITs) as equity investments for Mutual Funds and Specialised Investment Funds (...

SEBI Just Reclassified REITs as Equity — And It Changes Everything

SEBI has officially reclassified Real Estate Investment Trusts (REITs) as equity investments — a landmark regulatory shift that will reshape how institutions and invest...

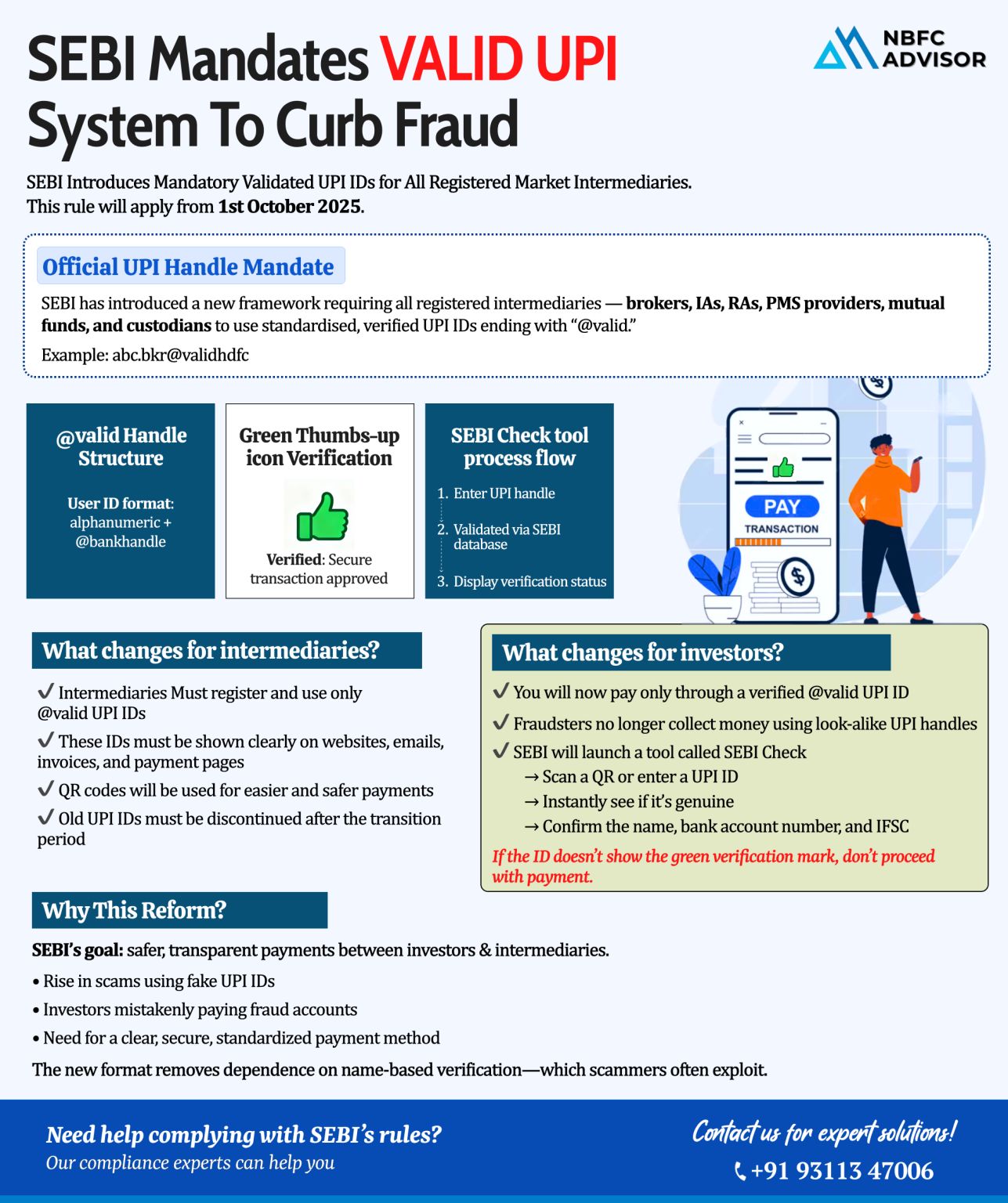

𝐒𝐄𝐁𝐈 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐕𝐀𝐋𝐈𝐃 𝐔𝐏𝐈 𝐒𝐲𝐬𝐭𝐞𝐦!

SEBI now makes it MANDATORY for all brokers, IAs, RAs, PMS providers, mutual funds & custodians to:

✓ Use only SEBI-verified @valid UPI handles

✓ Display these IDs clearly on we...

🔍 Enhancing Clarity, Transparency & Flexibility: SEBI’s Strategic Overhaul of Mutual Funds

SEBI, India’s capital markets regulator, has unveiled a progressive set of reforms for the mutual fund industry, aimed at simplifying struc...

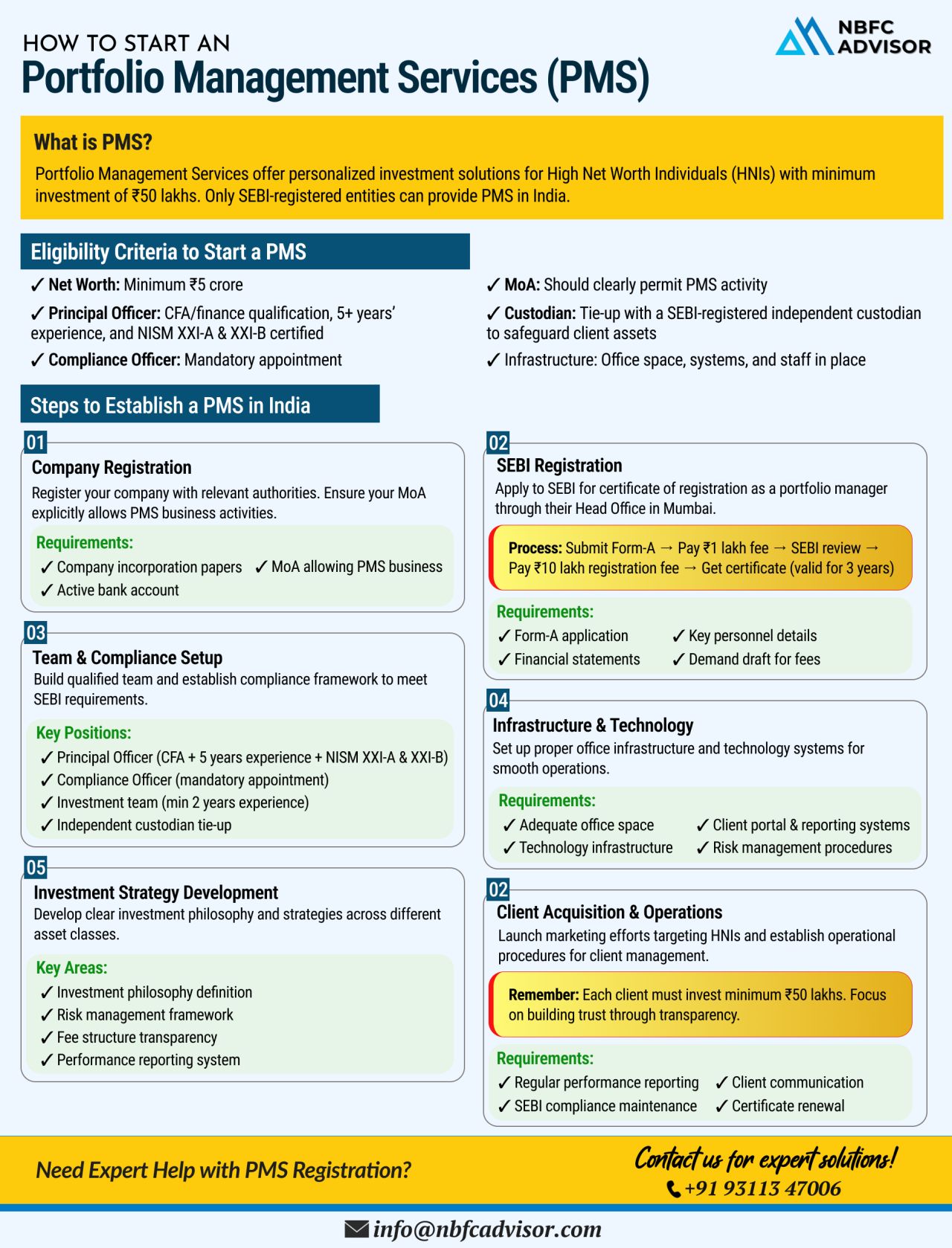

The Portfolio Management Services (PMS) industry in India is experiencing unprecedented growth, with total assets under management (AUM) surpassing ₹7.08 lakh crore. Clocking a CAGR of 33%, PMS is rapidly emerging as a preferred investment option for...