Licensing & Approvals Services – Smooth, Timely & Hassle-Free Business Permissions

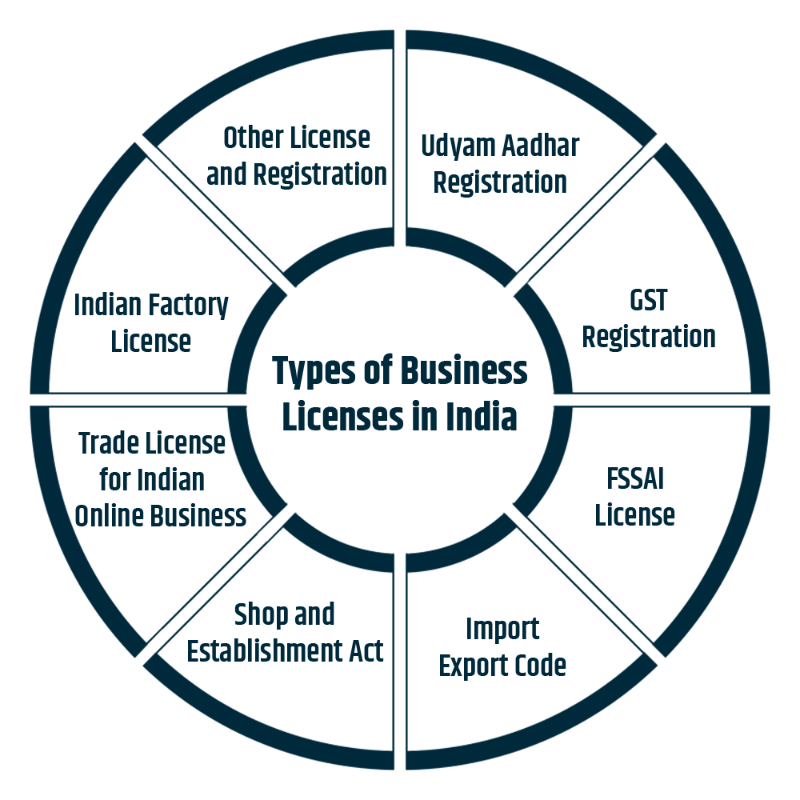

Starting, operating, or expanding a business in India requires multiple licenses, registrations, and statutory approvals from government authorities. ...

NBFC Registration Services – Your Gateway to India’s Financial Services Sector

India’s financial ecosystem is expanding rapidly, creating strong opportunities for businesses in lending, investment, and asset financing. One of the...

Licensing & Approvals Services – Simplifying Business Permissions in India

Starting or expanding a business in India often requires multiple licenses, registrations, and government approvals. From local authorities to central regulators,...

NBFC Registration Services in India – A Complete Guide

Starting a Non-Banking Financial Company (NBFC) in India is a powerful way to enter the financial services sector. NBFCs play a crucial role in providing loans, advances, asset financing...

Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

P2P Lending Is Changing How India Borrows

India’s financial ecosystem is undergoing a major transformation, and Peer-to-Peer (P2P) lending is at the center of this change.

With the industry growing at an impressive 21% CAGR, P2P lending is ...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

India’s Fintech Boom: A ₹82 Lakh Crore Opportunity in the Making

India is witnessing one of the fastest fintech revolutions in the world. With the industry expected to touch $990 billion by 2032, fintech is no longer a niche—it is beco...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

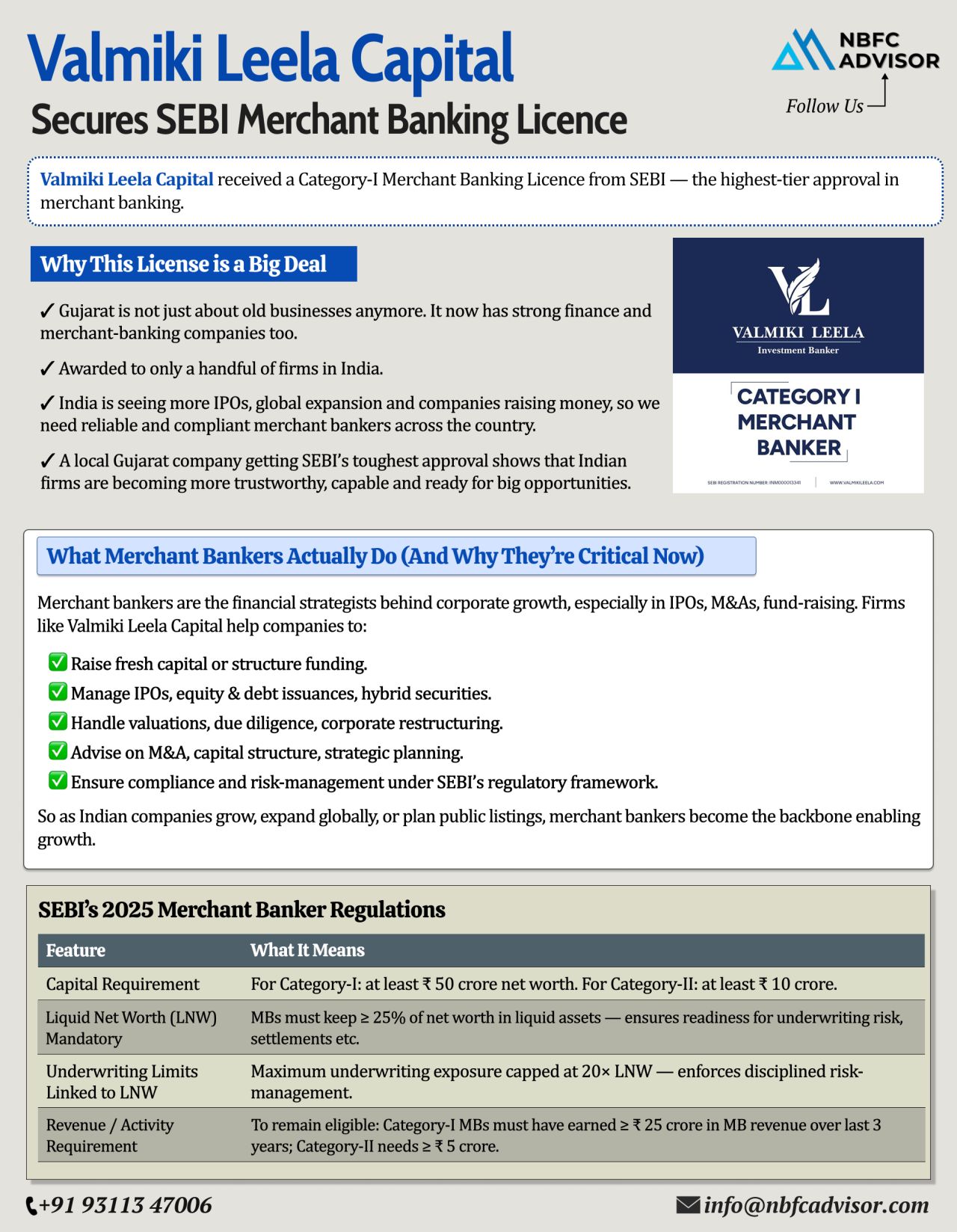

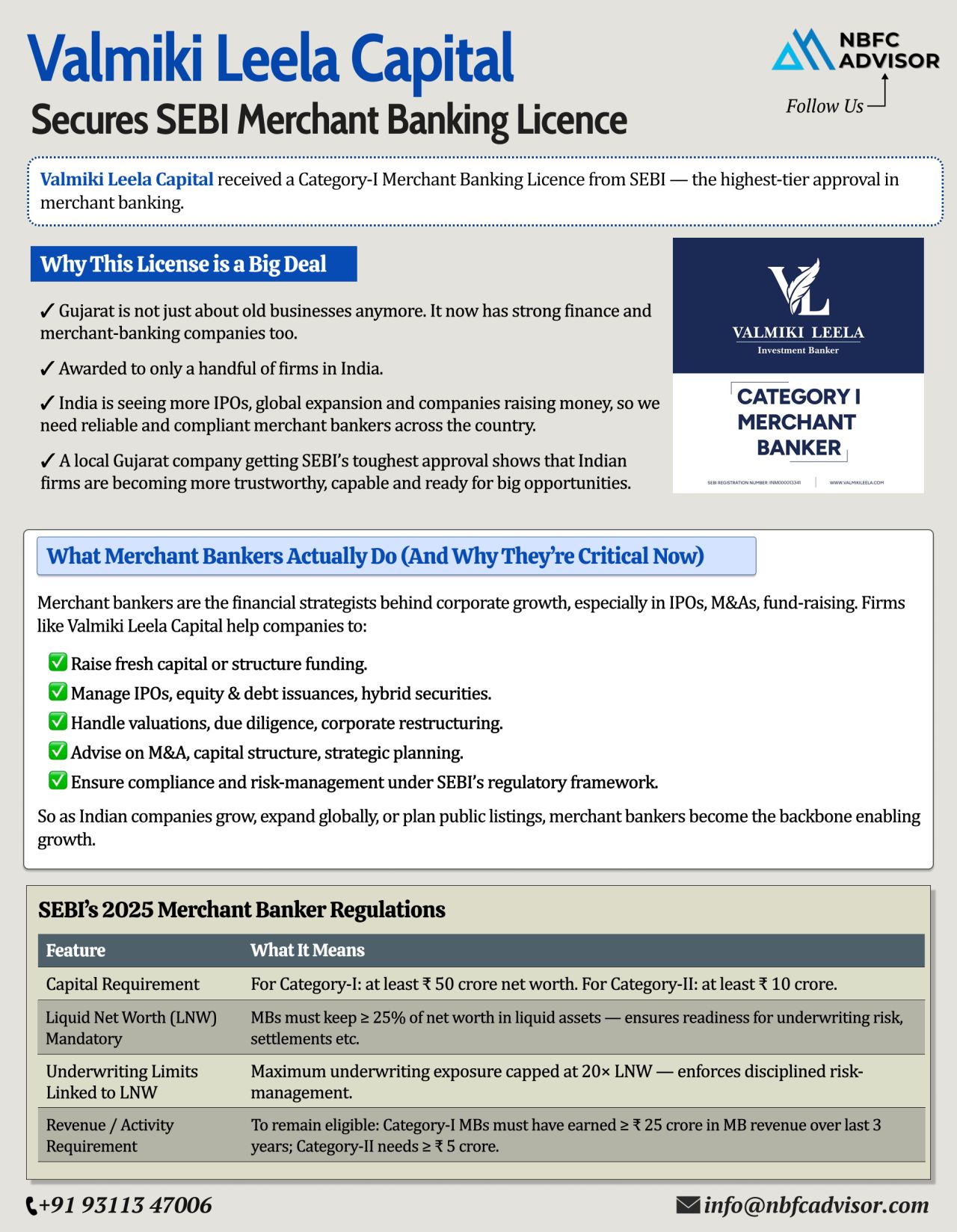

Gujarat Just Proved Everyone Wrong

For decades, Gujarat was seen through a narrow lens—textiles, jewellery, trading, and family-run enterprises. While these sectors remain strong, a quiet transformation has been underway.

Now, the narrati...

Gujarat Just Proved Everyone Wrong — And It’s a Big Win for India’s Financial Future

For decades, Gujarat has been known for its entrepreneurial spirit — but mostly in textiles, jewellery, and traditional family businesses....

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

Want to Register Your NBFC Faster? Here’s What Most Founders Miss

Starting an NBFC (Non-Banking Financial Company) can be one of the most exciting ventures for any entrepreneur in the finance sector. But here’s the reality — most...

Thinking of Starting a Digital Lending Business? Here’s Why Now is the Right Time

India’s financial landscape is transforming faster than ever before. With fintech innovation and digital infrastructure evolving rapidly, the digital len...

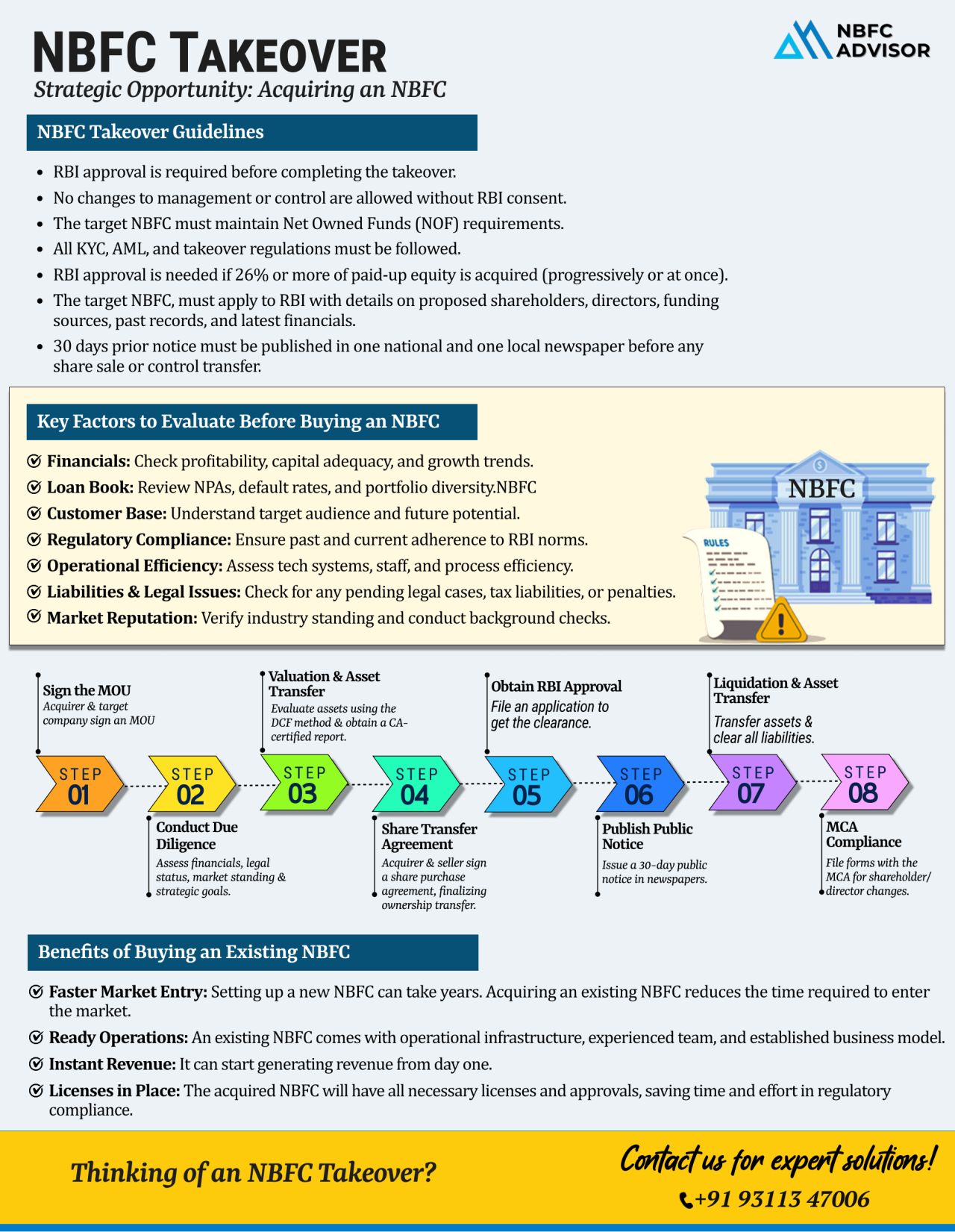

NBFC Takeover vs. New NBFC Registration – The Smarter Way to Enter the Lending Business

Thinking of starting an NBFC (Non-Banking Financial Company) in India? You’re not alone — with the booming fintech ecosystem and rising credi...

Why Fintechs are Surpassing NBFCs

The financial services industry is undergoing a major shift, and fintechs are rapidly overtaking NBFCs in terms of growth and innovation. The core reason lies in their approach—while NBFCs still depend on tr...

Cheques to Clear in Hours – From October 2025!

A game-changing update is coming for India’s banking customers and professionals. The Reserve Bank of India (RBI) is set to redefine cheque clearance, cutting the wait time from days to ju...

NBFC Takeovers: The Fastest Route to Enter India’s Growing Digital Lending Space

India’s digital lending sector is on an exponential growth path and is expected to reach $515 billion by 2030. Innovative models like peer-to-peer (P2P) l...

Looking to Break Into India’s Lending Market—Without the Long Wait?

India’s credit landscape is rapidly evolving, powered by digital lending, financial inclusion, and strong credit demand. But launching a new NBFC (Non-Banking Fi...

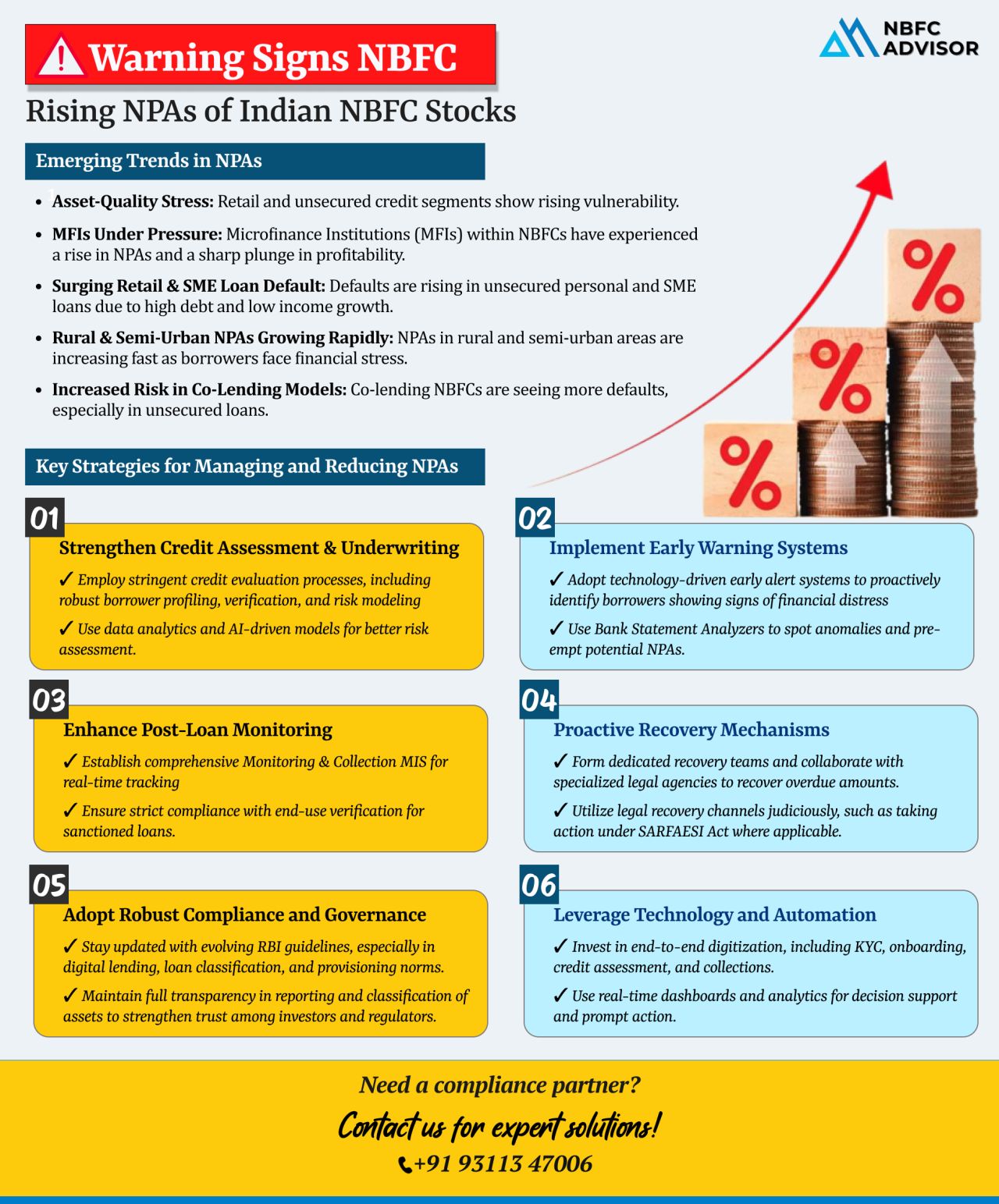

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

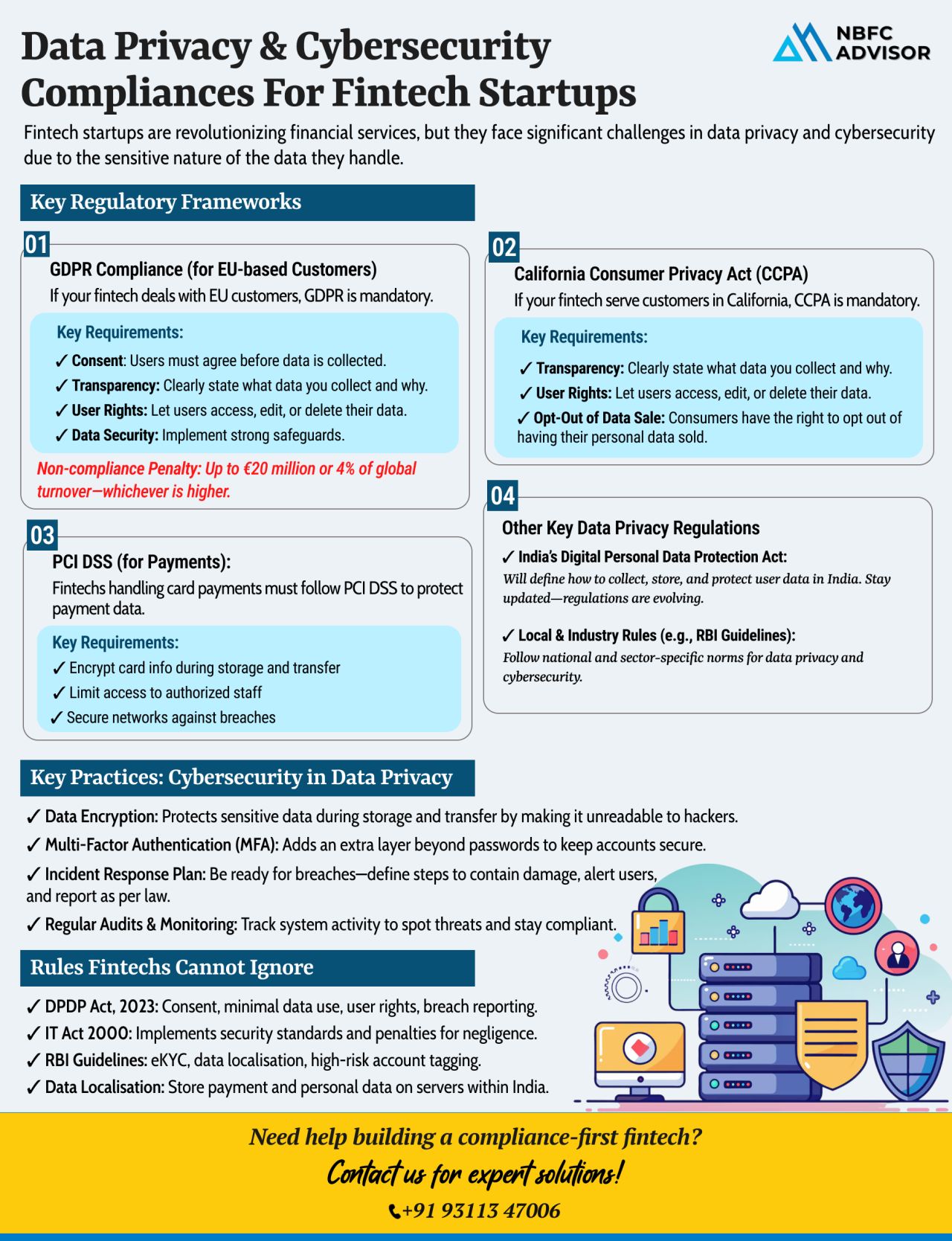

Launching a Fintech? One Data Breach Could Derail Everything

Building a fintech startup is an exciting journey—but with great innovation comes greater responsibility. In the world of digital finance, data protection and cybersecurity complia...

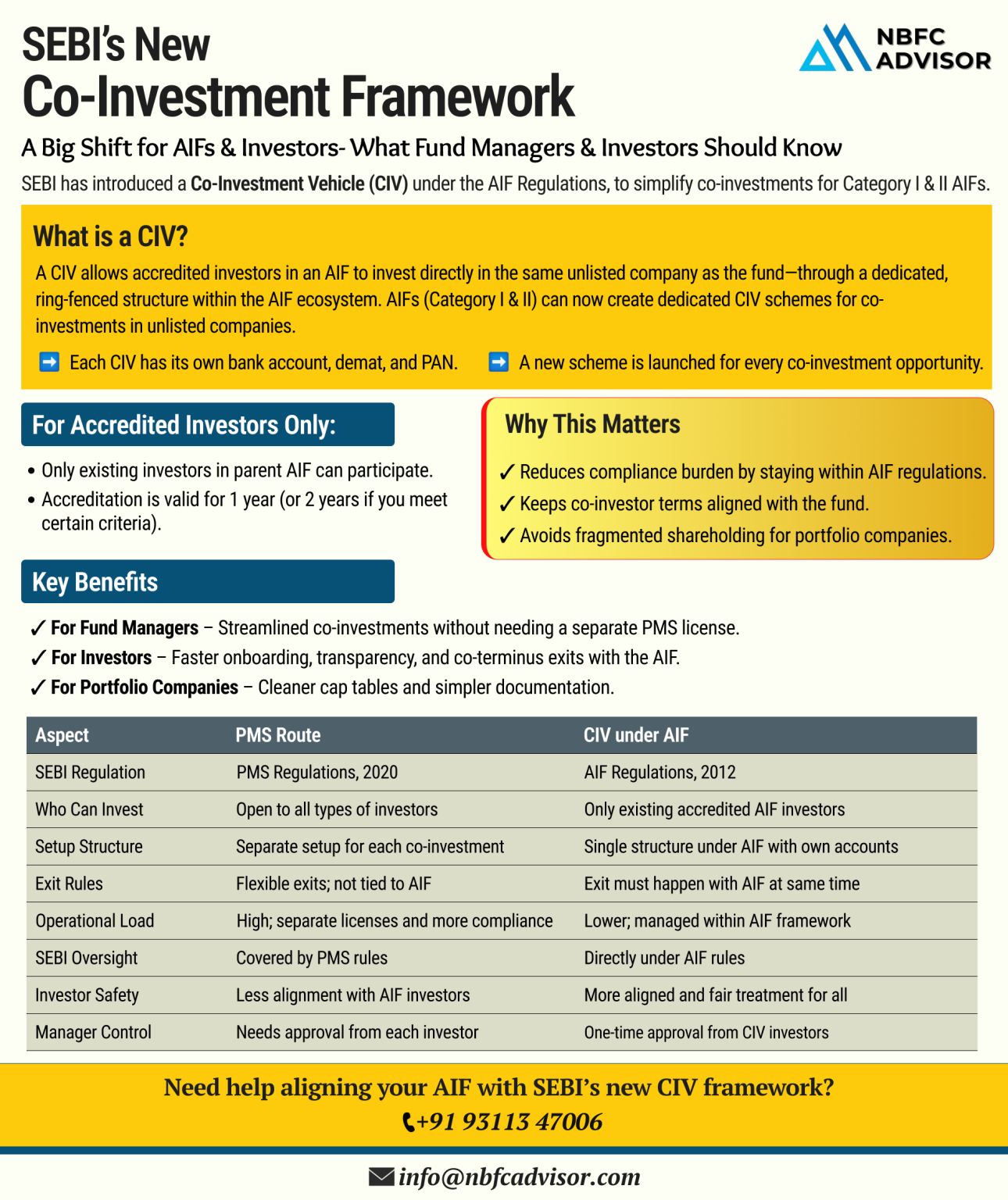

SEBI Rolls Out New Co-Investment Framework: A Big Win for India’s Private Market

India’s private capital landscape just received a significant boost.

In a major regulatory move, the Securities and Exchange Board of India (SEBI) has un...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...