Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

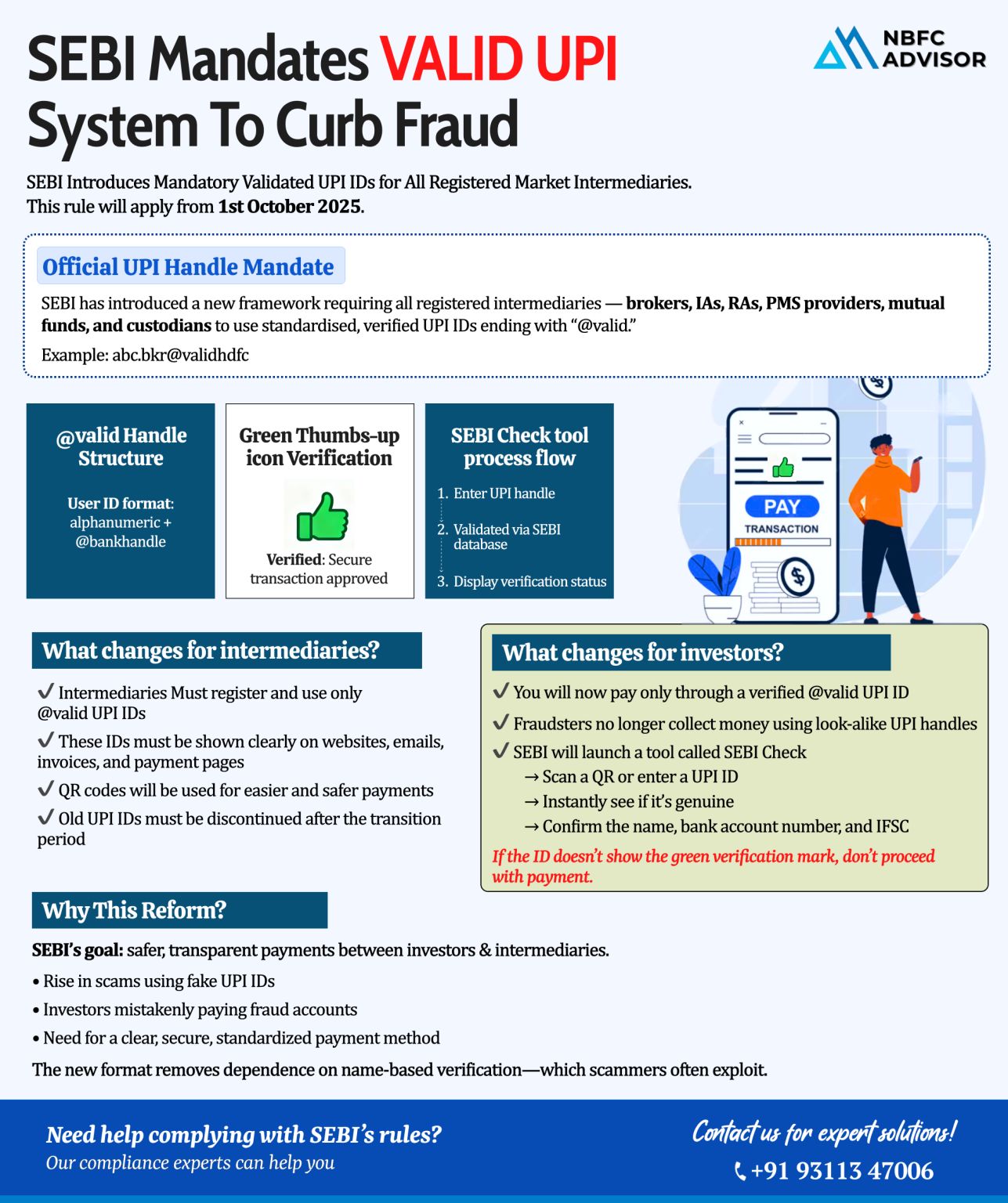

𝐒𝐄𝐁𝐈 𝐢𝐧𝐭𝐫𝐨𝐝𝐮𝐜𝐞𝐬 𝐕𝐀𝐋𝐈𝐃 𝐔𝐏𝐈 𝐒𝐲𝐬𝐭𝐞𝐦!

SEBI now makes it MANDATORY for all brokers, IAs, RAs, PMS providers, mutual funds & custodians to:

✓ Use only SEBI-verified @valid UPI handles

✓ Display these IDs clearly on we...

Is Your NBFC Audit-Ready? Here’s What RBI Expects in 2025

The Reserve Bank of India (RBI) has significantly increased its supervision of Non-Banking Financial Companies (NBFCs). Today, NBFC audits are not just about meeting formalities &mdas...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

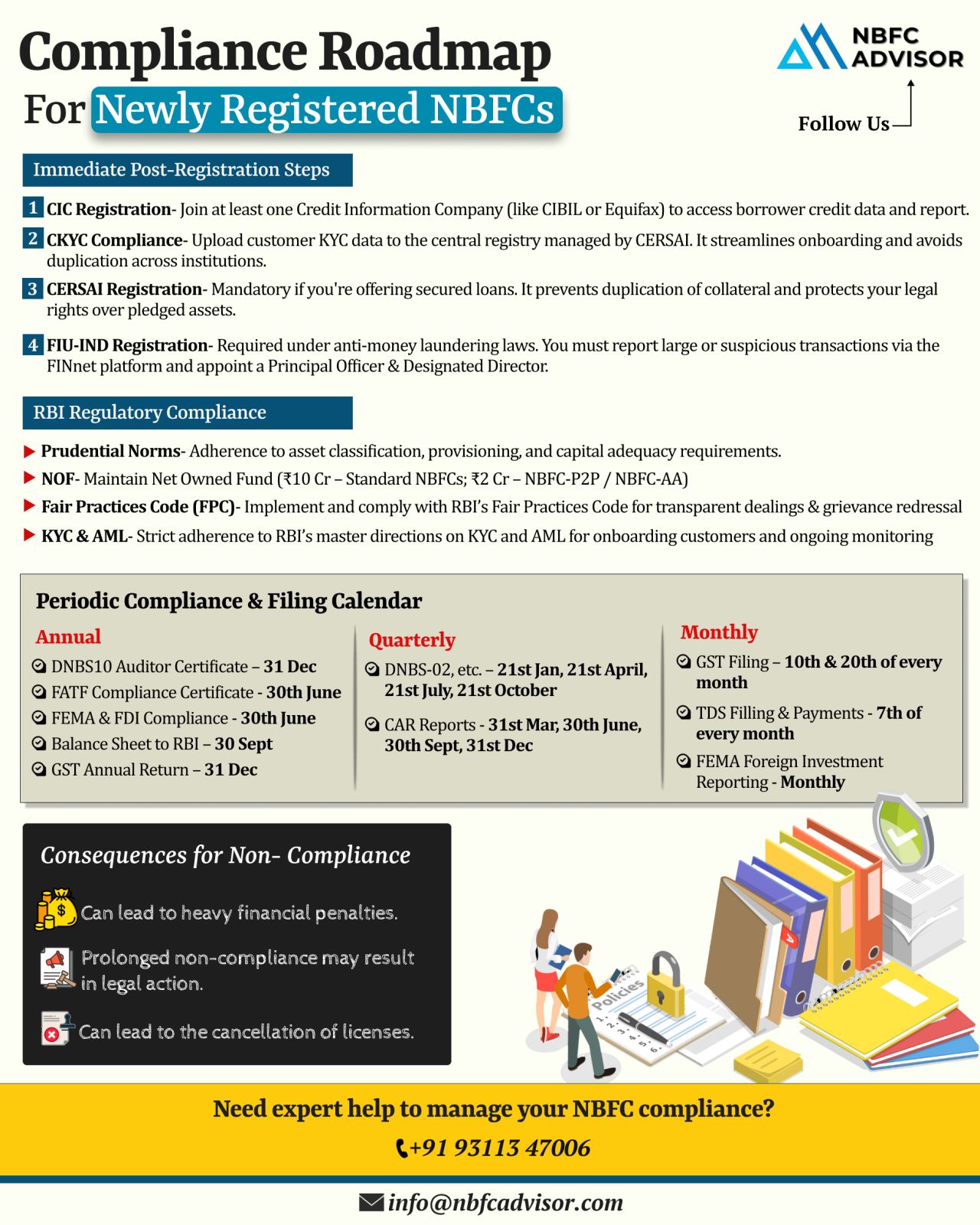

Just Registered as an NBFC? Here’s Your Compliance Roadmap

Securing your RBI license is a significant achievement—but it’s only the first step. The bigger challenge lies ahead: staying compliant with regulations that govern every...

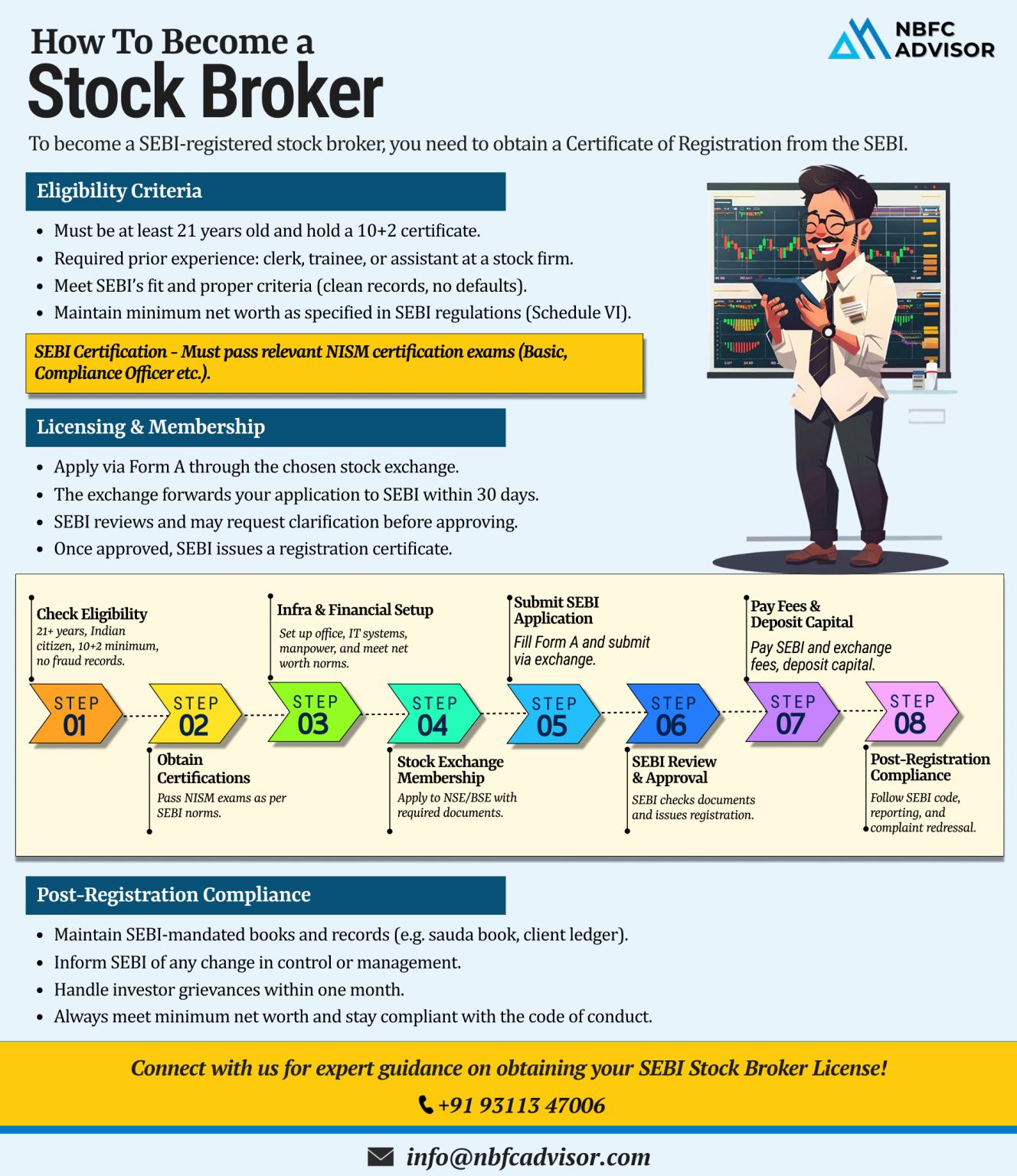

Want to Become a SEBI-Registered Stock Broker?

If you’re looking to enter India’s capital markets as a stock broker, obtaining a SEBI registration is a must. This license not only authorizes you to operate legally but also builds trust...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘑𝘶𝘴𝘵 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Getting your NBFC license is a big milestone — but don’t relax just yet. Receiving RBI approval is only the first step in setting up your fin...