NBFC Registration Services – Your Gateway to India’s Financial Services Sector

India’s financial ecosystem is expanding rapidly, creating strong opportunities for businesses in lending, investment, and asset financing. One of the...

Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

𝐍𝐨𝐭 𝐚𝐥𝐥 𝐍𝐁𝐅𝐂𝐬 𝐚𝐫𝐞 𝐭𝐡𝐞 𝐬𝐚𝐦𝐞.

RBI has divided NBFCs into 4 layers based on size, risk, and complexity.

The bigger your NBFC is, the stricter the rules.

✓ 𝐁𝐚𝐬𝐞 𝐋𝐚𝐲𝐞𝐫: Smallest NBFCs, lightest regulations

✓ 𝐌𝐢𝐝𝐝�...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

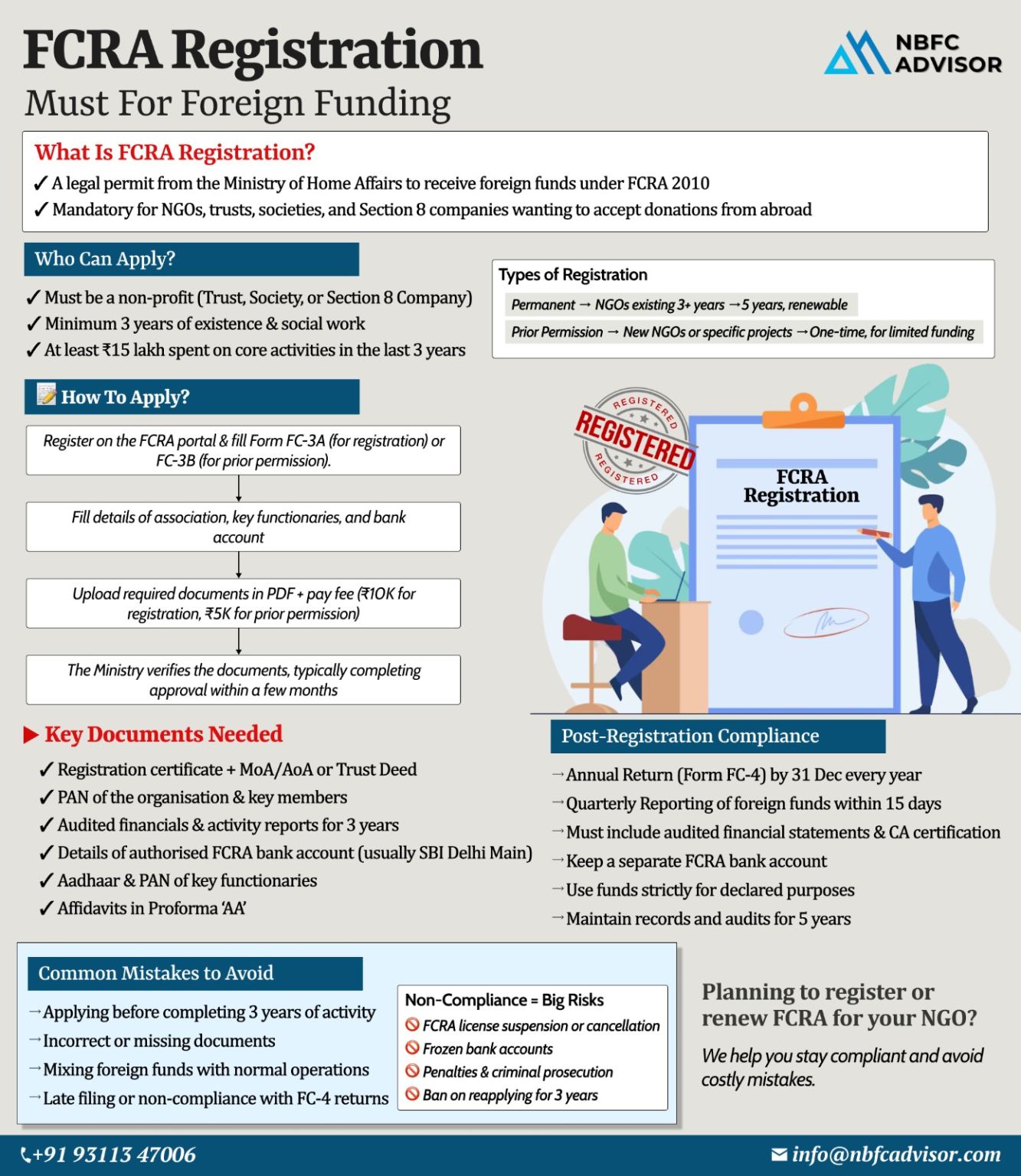

Many NGOs Lose Foreign Funding Due to One Missed FCRA Rule

For thousands of NGOs in India, foreign contributions are a lifeline. Yet every year, many organisations lose access to foreign funding—not because of fraud, but due to one missed FC...

RBI Just Fined HDFC Bank — And an NBFC. Compliance Lapses Are No Longer Tolerated.

The Reserve Bank of India continues to send a clear message:

No lender — not even the biggest bank in the country — is beyond scrutiny.

In its...

Thinking of Starting a Digital Lending Business? Now Is the Best Time.

Digital lending is transforming India’s credit ecosystem. What once took days—or even weeks—can now be completed in minutes. From SMEs to first-time borrowers...

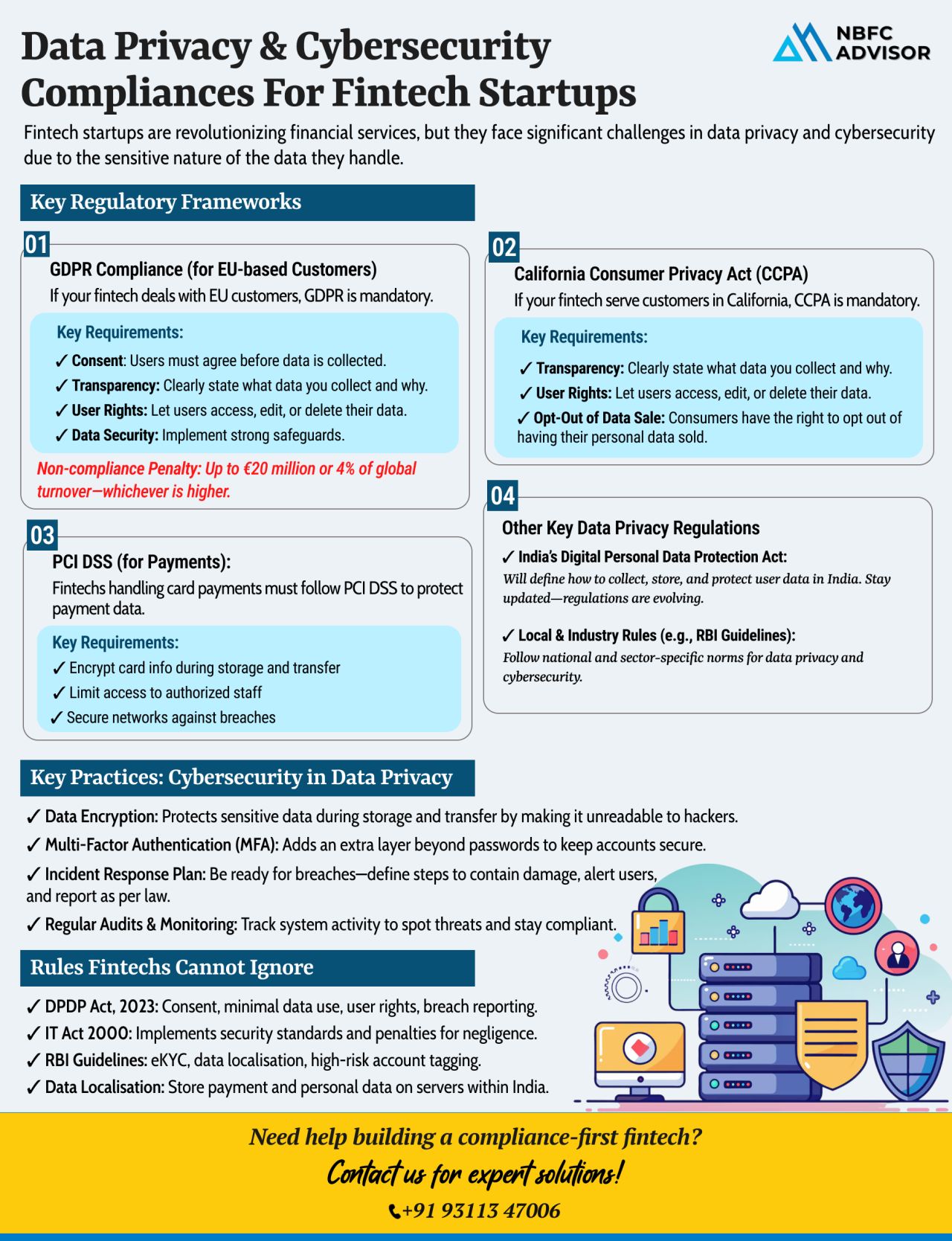

Launching a Fintech? One Data Breach Could Derail Everything

Building a fintech startup is an exciting journey—but with great innovation comes greater responsibility. In the world of digital finance, data protection and cybersecurity complia...

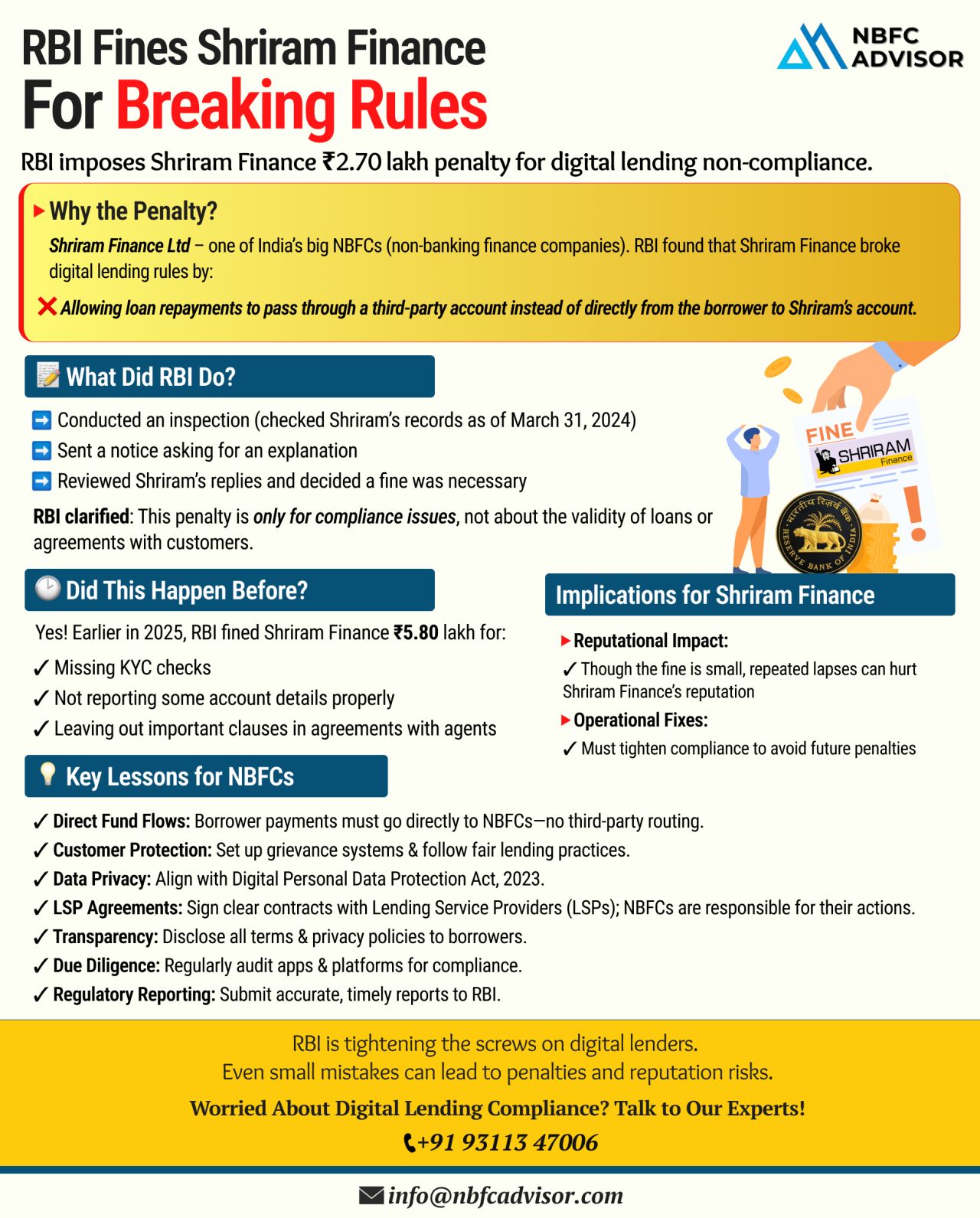

RBI Fines Shriram Finance Limited: A Big Warning for NBFCs & Fintechs

The Reserve Bank of India (RBI) has imposed a penalty on Shriram Finance Limited, one of India’s leading NBFCs, for violating the central bank’s digital lending ...

𝐑𝐁𝐈 𝐔𝐩𝐝𝐚𝐭𝐞: 𝐒𝐭𝐫𝐢𝐜𝐭𝐞𝐫 𝐃𝐢𝐠𝐢𝐭𝐚𝐥 𝐋𝐞𝐧𝐝𝐢𝐧𝐠 𝐍𝐨𝐫𝐦𝐬 𝐀𝐫𝐞 𝐇𝐞𝐫𝐞 — 𝐈𝐬 𝐘𝐨𝐮𝐫 𝐁𝐮𝐬𝐢𝐧𝐞𝐬𝐬 𝐑𝐞𝐚𝐝𝐲?

India’s digital lending landscape is evolving fast, driven by technology and rising demand. But...