Co-Lending or Own Book Lending: Which Model Aligns With Your Strategy?

India’s digital lending market is expected to cross $720 billion by 2030, creating massive opportunities for NBFCs and fintechs.

But as the ecosystem grows, one critical...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Why Ultra-HNIs and Institutions Are Choosing Category III AIFs

For Ultra-High Net-Worth Individuals (Ultra-HNIs), family offices, and institutional investors, traditional investment avenues are no longer enough. In an era of volatile markets and c...

Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Co-Lending or Own Book Lending: Which Model Fits Your Lending Strategy?

India’s digital lending ecosystem is evolving rapidly. With the market projected to cross $720 billion by 2030, NBFCs and fintechs face a crucial strategic decision:

...

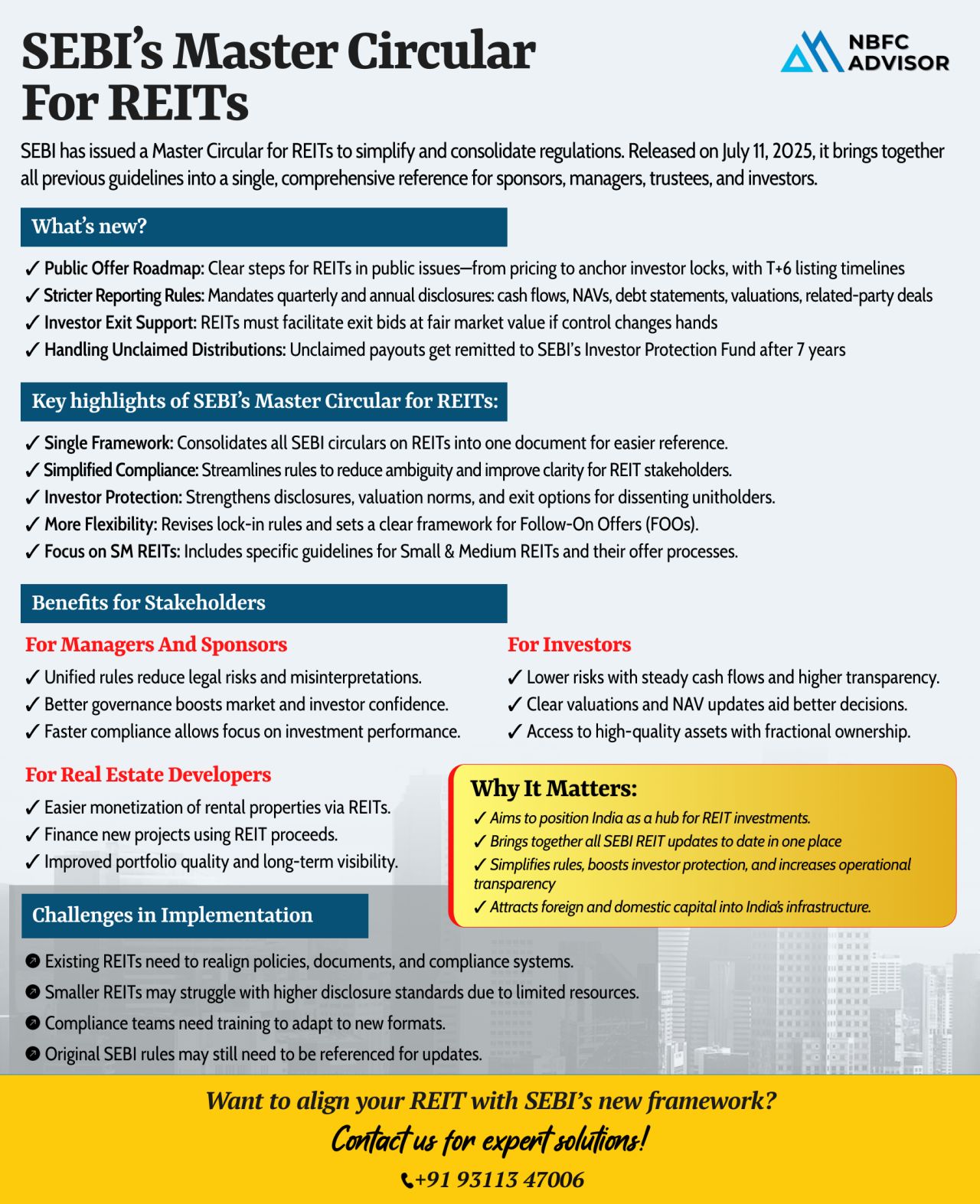

SEBI introduces a unified regulatory framework for REITs, enhancing transparency, investor protection, and ease of compliance. Discover how it transforms India’s real estate investment ecosystem.

SEBI’s New Master Circular: A Landmar...

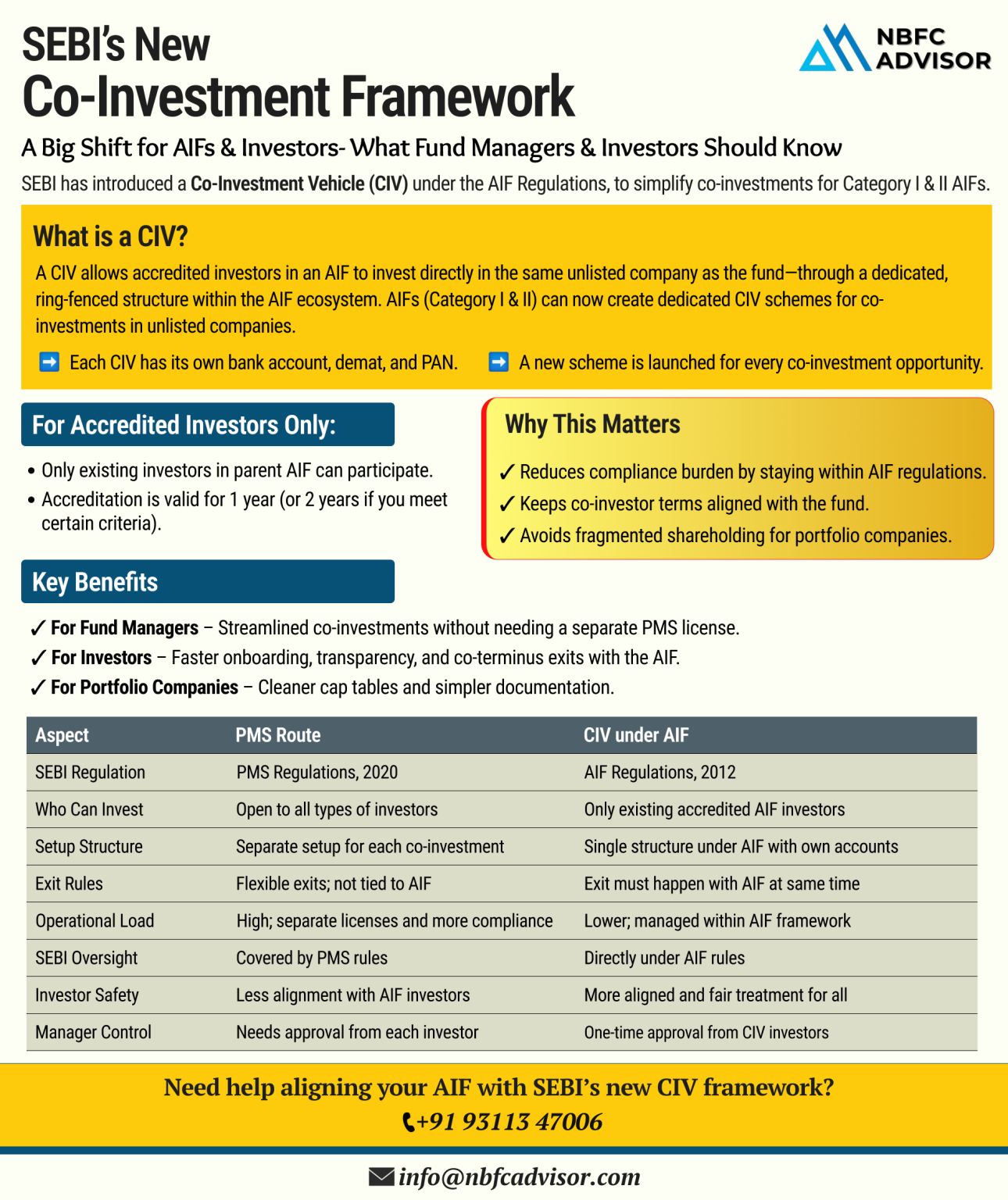

SEBI Rolls Out New Co-Investment Framework: A Big Win for India’s Private Market

India’s private capital landscape just received a significant boost.

In a major regulatory move, the Securities and Exchange Board of India (SEBI) has un...