Co-Lending or Own Book Lending? Choosing the Right Model for Your Growth Strategy

India’s digital lending ecosystem is entering a decisive decade. With the market projected to cross USD 720 billion by 2030, NBFCs and fintech founders face a ...

Why Many NBFC Applications Get Rejected by the RBI — Avoid These Common Mistakes

Meta Title: Why NBFC Applications Get Rejected by RBI | Common Mistakes & Compliance Checklist

Meta Description: Learn why NBFC applications get rejected b...

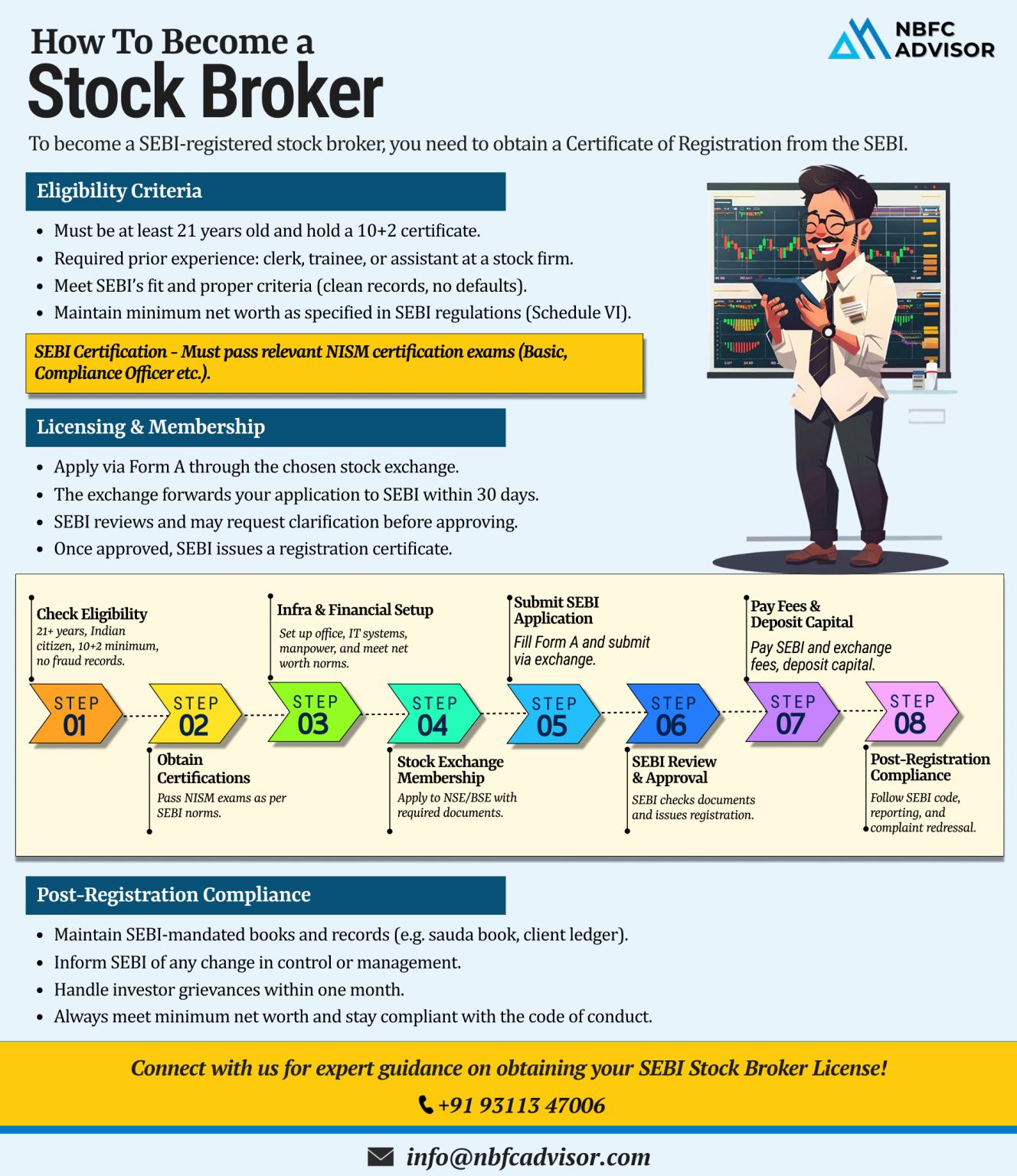

Want to Become a SEBI-Registered Stock Broker?

If you’re looking to enter India’s capital markets as a stock broker, obtaining a SEBI registration is a must. This license not only authorizes you to operate legally but also builds trust...

Rising NPAs: A Red Flag NBFCs Can’t Afford to Ignore

The Non-Banking Financial Company (NBFC) sector in India is facing a serious challenge—a sharp rise in Non-Performing Assets (NPAs). From unsecured personal loans to SME and rural le...

RBI to Tighten Supervisory Norms for NBFCs in FY26: What It Means for the Sector

The Reserve Bank of India (RBI) is preparing to introduce stricter supervisory regulations for Non-Banking Financial Companies (NBFCs) in the financial year 2025&ndas...

UGRO Capital Acquires Profectus Capital for ₹1,400 Crore

A Game-Changing Move in India’s NBFC Sector

In a significant step towards becoming a dominant force in the MSME lending space, UGRO Capital has acquired Profectus Capital Pvt. Ltd. ...

🚀 The NBFC Sector in India is Witnessing Unprecedented Growth! 🚀

Are You Ready to Unlock New Opportunities?

The Non-Banking Financial Company (NBFC) landscape in India is rapidly expanding, fueled by the surging demand for digital lending, mi...

In today’s rapidly evolving financial landscape, the demand for flexible and accessible financial services is at an all-time high. One of the key players in fulfilling this demand is Non-Banking Financial Companies (NBFCs). With their ability t...

.png)