Struggling to Raise Funds for Your NBFC? Here’s What You Need to Know

Raising funds has become one of the biggest challenges for Non-Banking Financial Companies (NBFCs) today.

High borrowing costs, tighter RBI regulations, and limited acces...

Planning to Exit Your NBFC? Here’s What You Need to Know

Exiting an NBFC is not as simple as shutting down a company or selling a business. It is a highly regulated process under the strict supervision of the Reserve Bank of India (RBI).

...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

Compliance Gaps Can Break Your Business: Why NBFCs Must Stay Ahead of RBI Regulations

In today’s financial landscape, compliance is no longer optional.

With the Reserve Bank of India (RBI) tightening its oversight, even well-managed NBFCs a...

15 Compliance Gaps That Can Put NBFCs Under RBI Scrutiny

In the last two years, the Reserve Bank of India (RBI) has imposed penalties on several Non-Banking Financial Companies (NBFCs) — not for fraud or major violations, but for avoidable c...

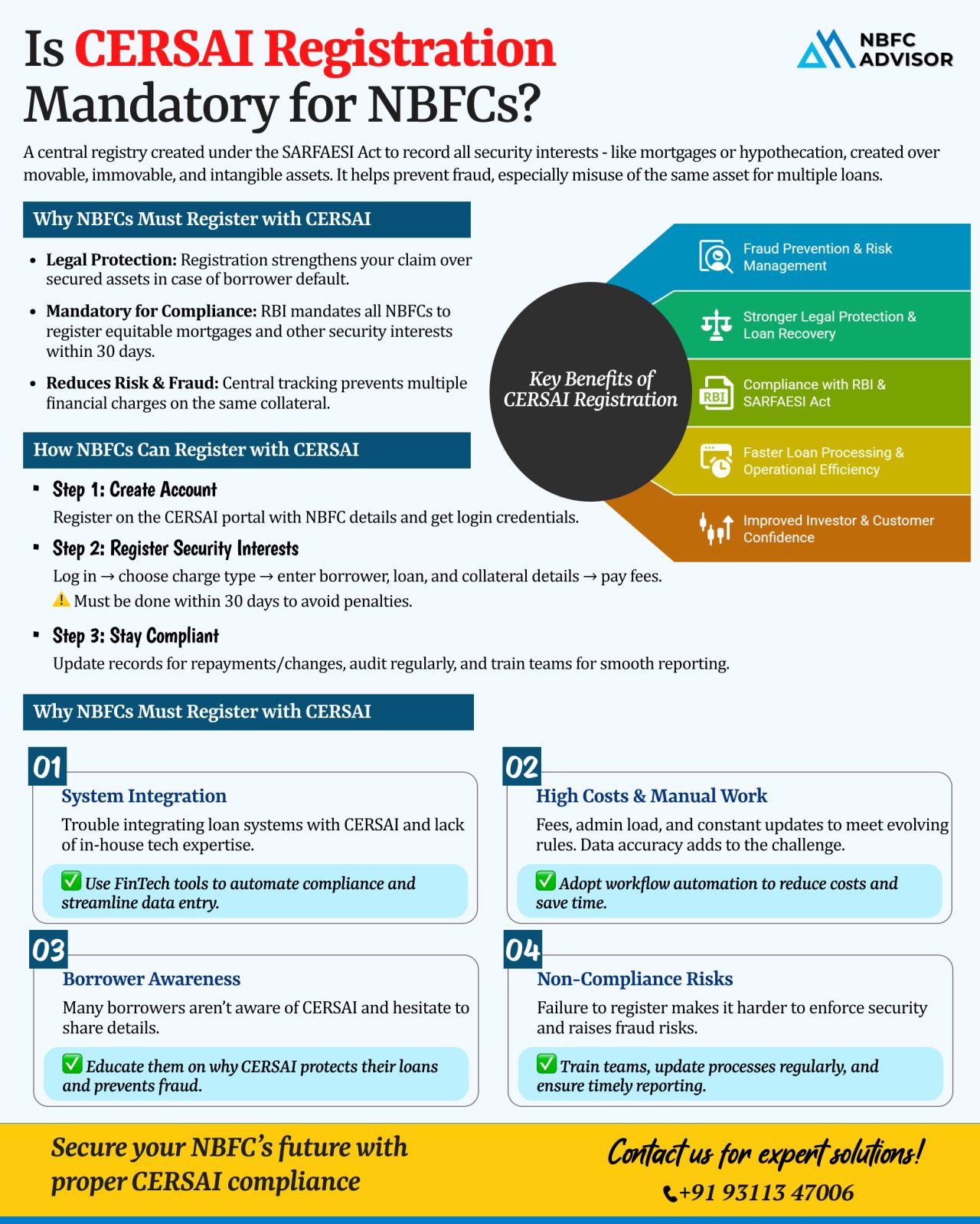

Is CERSAI Registration Compulsory for NBFCs?

A frequent compliance gap seen among NBFCs is neglecting CERSAI registration. While lenders are usually diligent about RBI directives and customer verification, many overlook this crucial step—whi...

RBI Is Coming Down Hard on NBFCs — Are You Prepared?

The Reserve Bank of India (RBI) is sending a strong message to the NBFC sector: regulatory compliance is critical. Over the last year, RBI has taken serious enforcement actions against bot...