Is Your NBFC Truly RBI Compliant?

Most NBFC founders believe their company is fully compliant with RBI norms—

until an RBI inspection or audit highlights gaps they never noticed.

In today’s highly regulated financial ecosystem, par...

Is Your NBFC Truly RBI Compliant?

Most NBFC founders confidently answer “yes”—

until an RBI inspection, statutory audit, or supervisory review says otherwise.

In today’s regulatory environment, assumed compliance is ris...

Digital Lending Is Growing 10× Faster Than Traditional Banking

India’s credit ecosystem is undergoing a historic shift. Digital lending is no longer a niche—it’s becoming the primary engine of credit growth, expanding nearl...

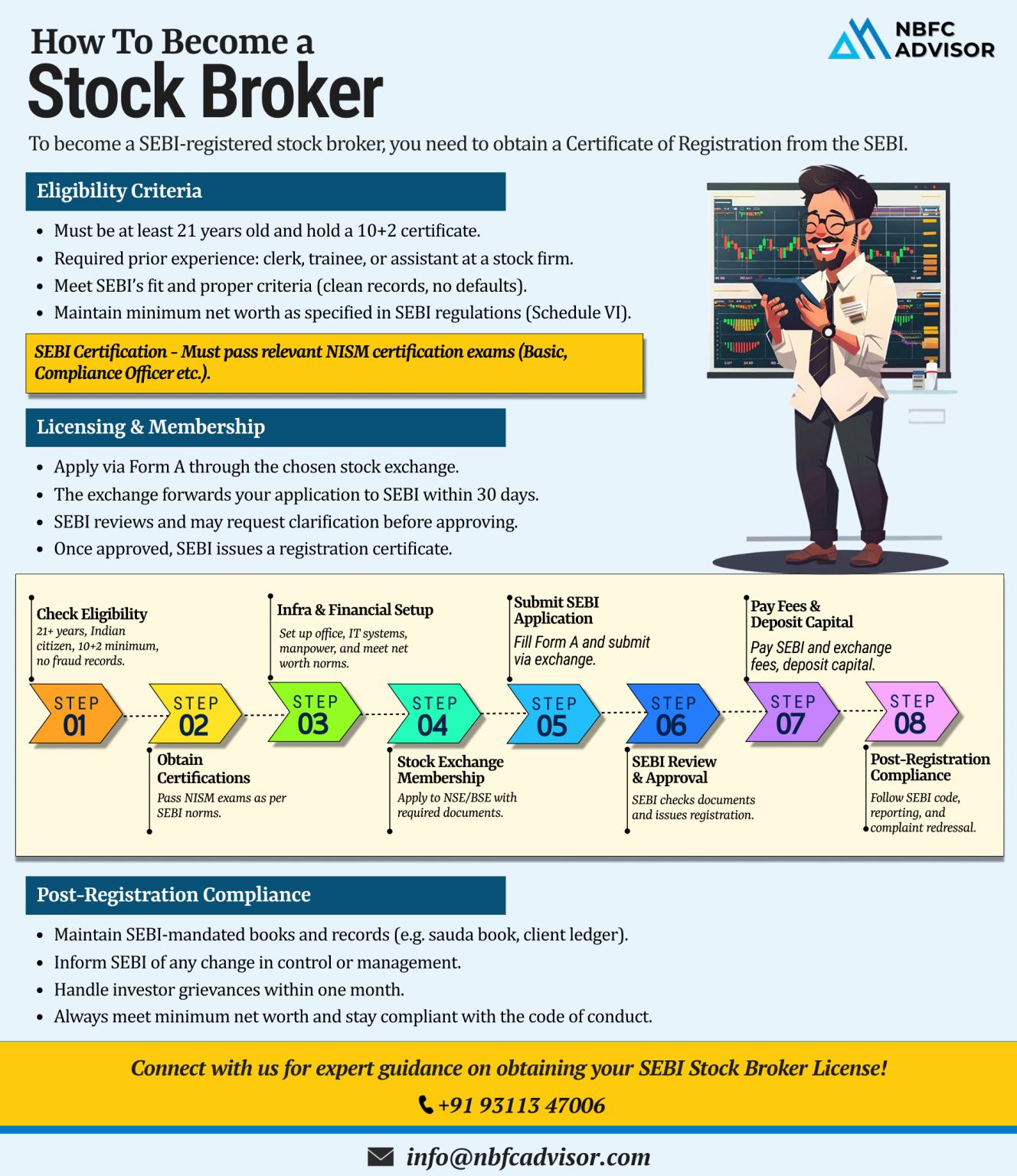

Want to Become a SEBI-Registered Stock Broker?

If you’re looking to enter India’s capital markets as a stock broker, obtaining a SEBI registration is a must. This license not only authorizes you to operate legally but also builds trust...

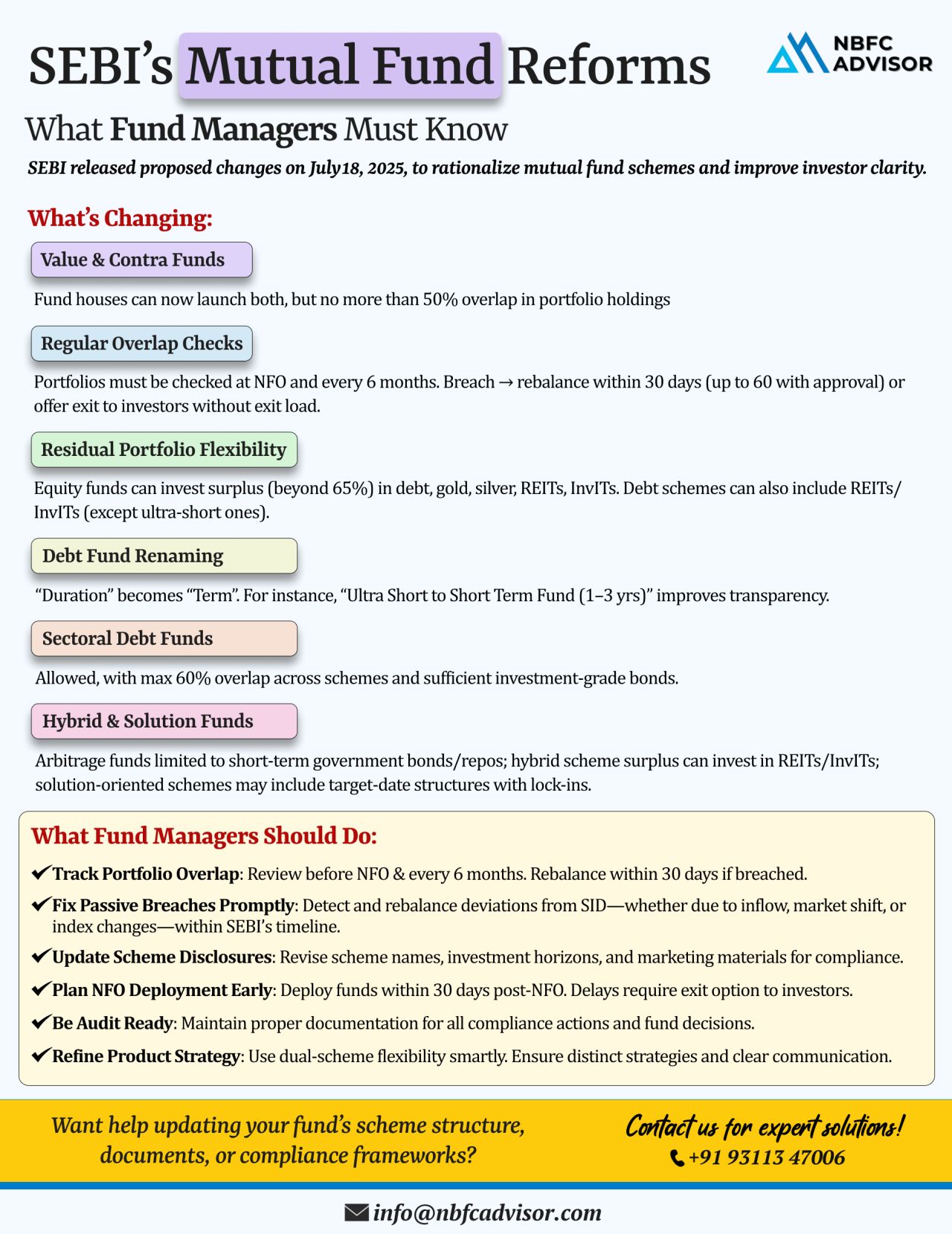

🔍 Enhancing Clarity, Transparency & Flexibility: SEBI’s Strategic Overhaul of Mutual Funds

SEBI, India’s capital markets regulator, has unveiled a progressive set of reforms for the mutual fund industry, aimed at simplifying struc...

📰 SEBI’s Latest Mutual Fund Reforms: A Step Towards Clarity and Better Risk Management

The Securities and Exchange Board of India (SEBI) has introduced a series of proposed reforms to bring greater transparency, clarity, and structure to mu...

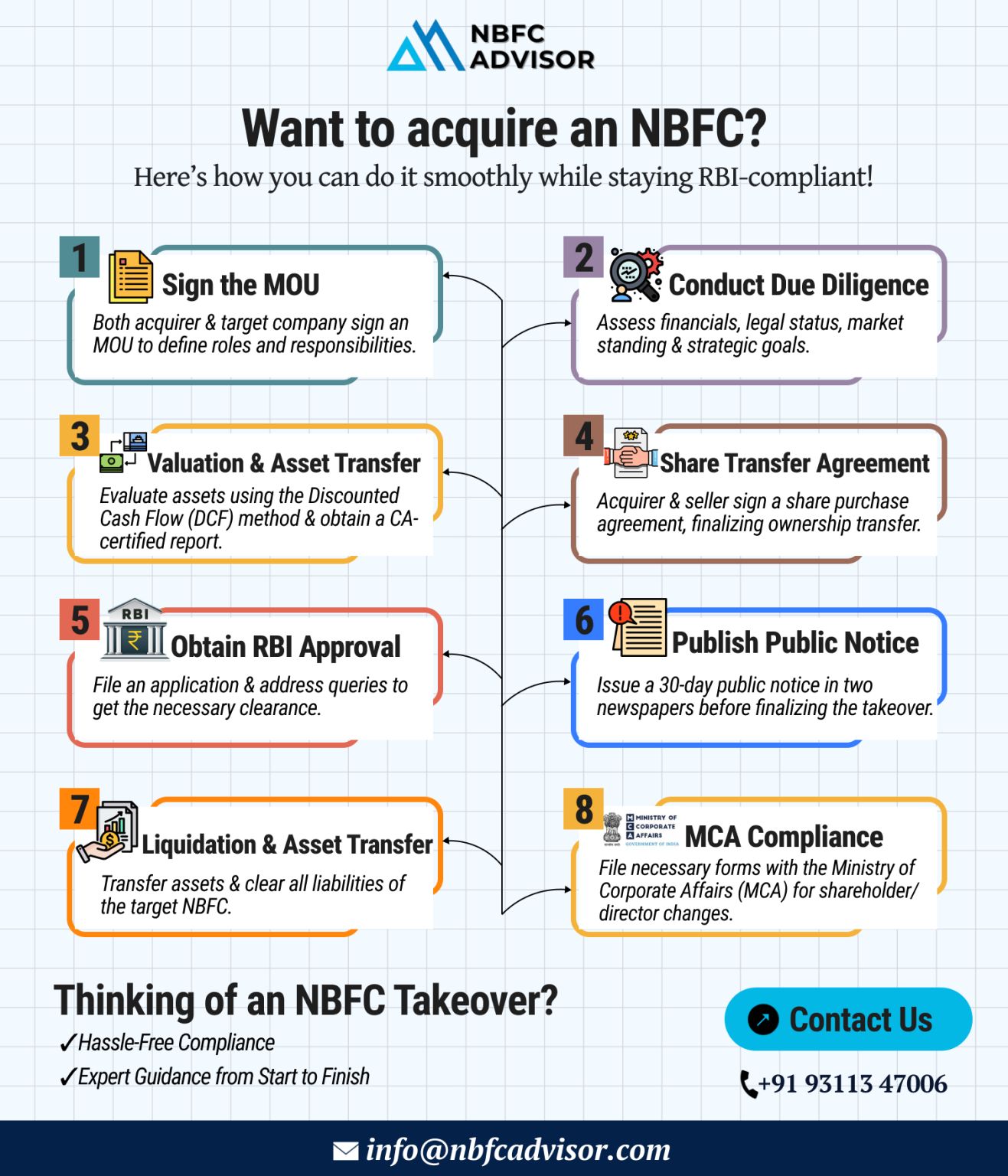

Planning to Acquire an NBFC? Here’s What You Need to Know

Acquiring a Non-Banking Financial Company (NBFC) can be a powerful growth strategy — giving you access to lending licenses, financial markets, and a wider customer base. However...

𝘙𝘦𝘨𝘪𝘴𝘵𝘦𝘳𝘦𝘥 𝘠𝘰𝘶𝘳 𝘕𝘉𝘍𝘊? 𝘛𝘩𝘢𝘵’𝘴 𝘑𝘶𝘴𝘵 𝘵𝘩𝘦 𝘉𝘦𝘨𝘪𝘯𝘯𝘪𝘯𝘨.

Getting your NBFC license is a big milestone — but don’t relax just yet. Receiving RBI approval is only the first step in setting up your fin...